Stay Informed and Stay Ahead: Market Watch, February 15th, 2024.

Market Highlights & Analysis: Indices, Sectors, and More…

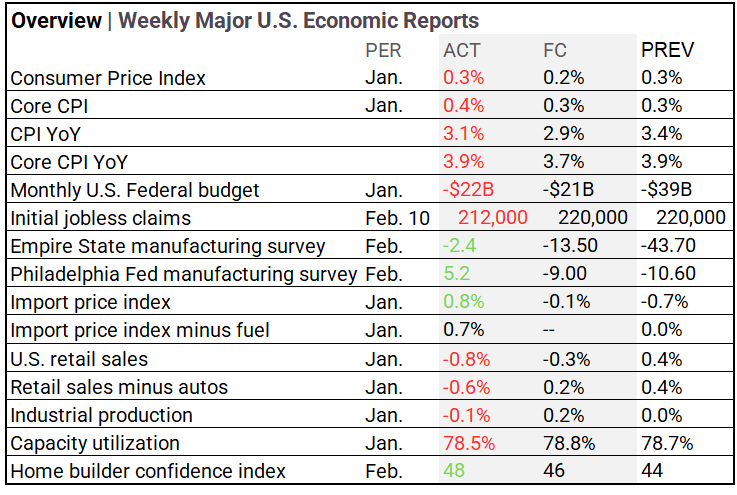

- Economic Data: Initial jobless claims fell to 212,000, below the forecasted 220,000, while US retails sales in Jan. came up soft and Mfg. surveys beat.

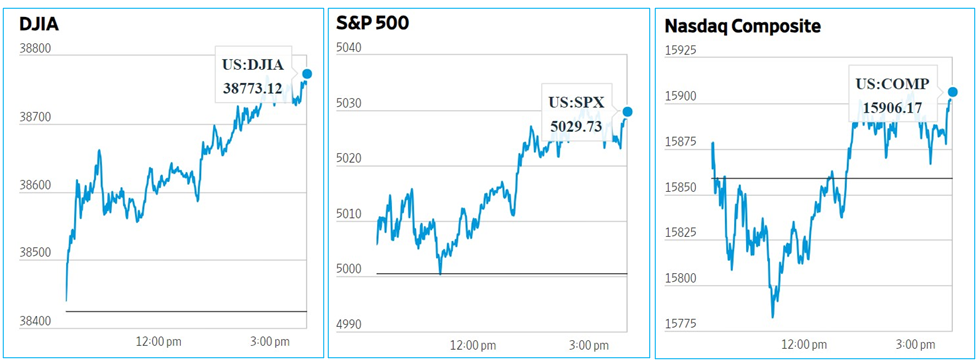

- Market Indices: DJIA (+0.91%), S&P 500 (+0.58%), Nasdaq Composite (+0.30%).

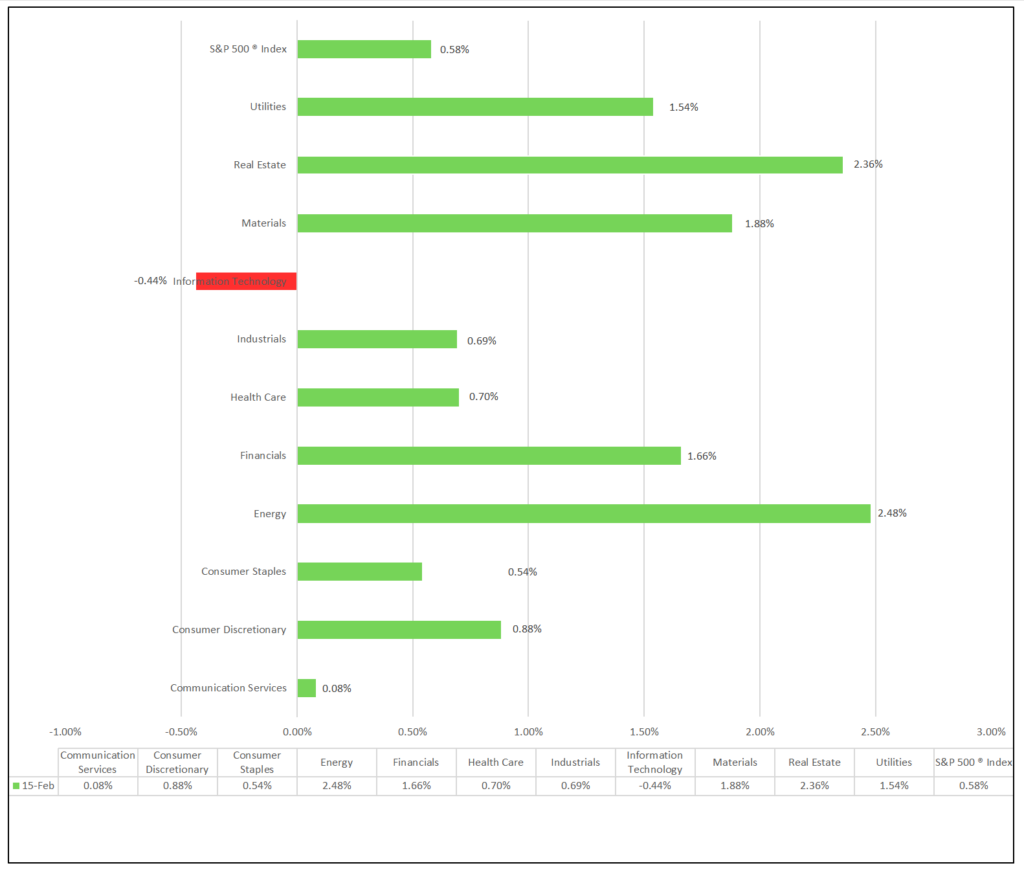

- Sector Performance: 10 of 11 sectors higher; Energy (+2.48%) leading, Information Technology (-0.44%) lagging. Top industry: Office REITs (+5.39%).

- Factors: Small Caps lead on the day.

- Treasury Markets: Yields rising across the curve, 10-year note led gainers.

- Commodities: Gold futures dipped slightly to $2,014.30, Bitcoin hold $52K rallied to $45,349.36, while crude oil had moderate gains.

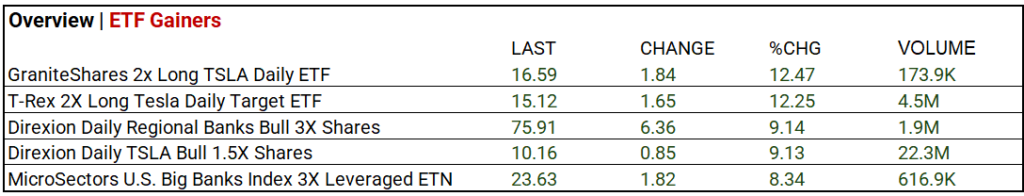

- ETFs: Tesla Day! Direxion Daily TSLA Bull 1.5X Shares, (+9.13%), on robust 22.3m volume.

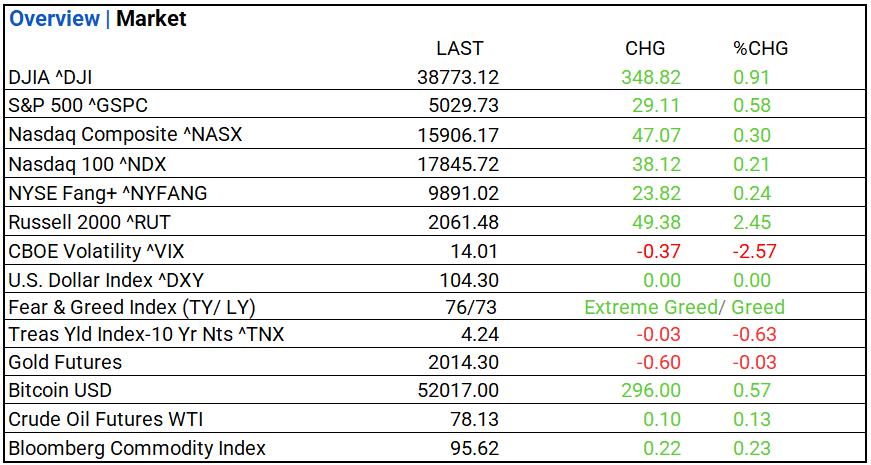

US Market Snapshot: Key Stock Market Indices:

- DJIA ^DJI: 38,773.12, 348.82, 0.91%

- S&P 500 ^GSPC: 5,029.73, 29.11, 0.58%

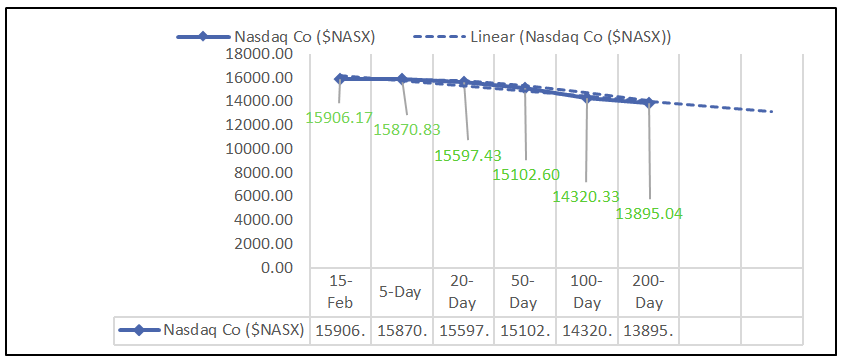

- Nasdaq Composite ^NASX: 15,906.17, 47.07, 0.30%

- Nasdaq 100 ^NDX: 17,845.72, 38.12, 0.21%

- NYSE Fang+ ^NYFANG: 9,891.02, 23.82, 0.24%

- Russell 2000 ^RUT: 2,061.48, 49.38, 2.45%

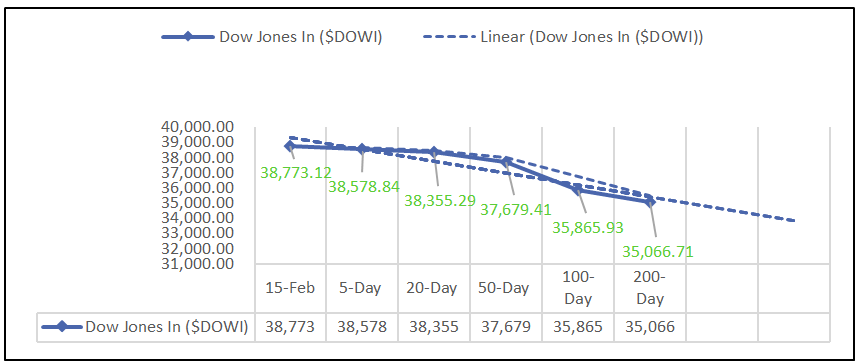

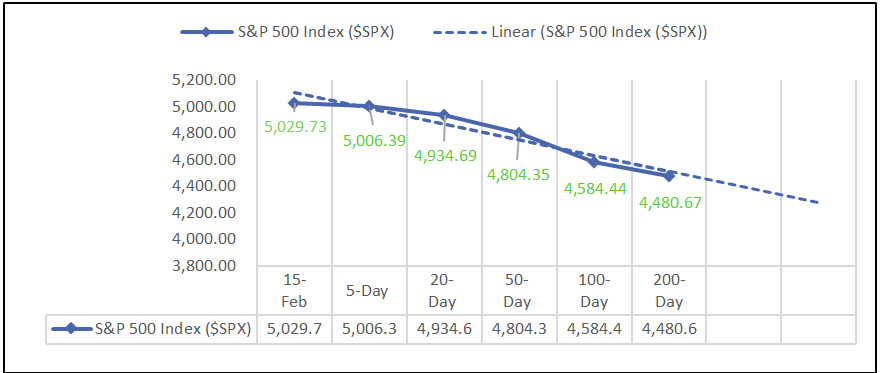

Moving Averages: DOW, S&P 500, NASDAQ:

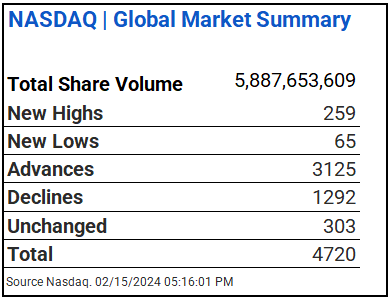

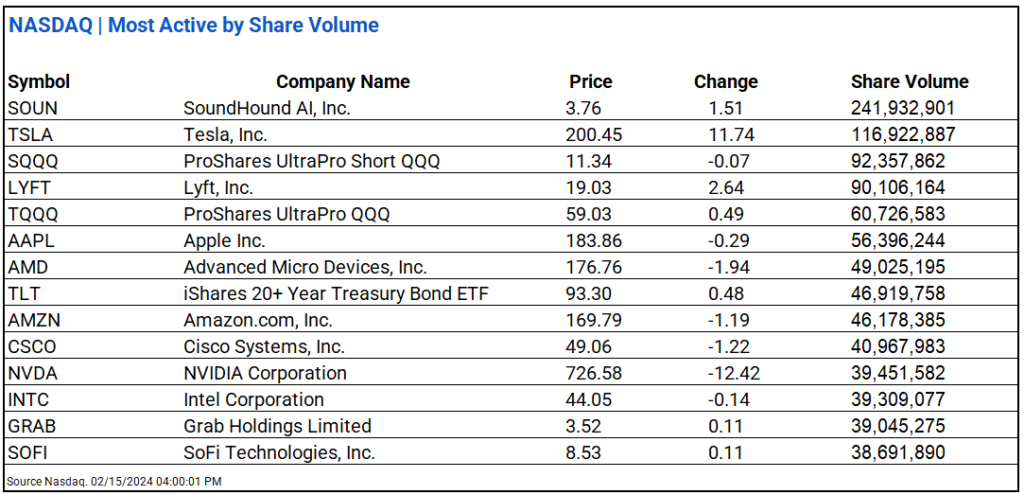

NASDAQ Global Market Summary:

Sectors:

- 10 of 11 sectors higher; Energy (+2.48%) leading, Information Technology (-0.44%) lagging. Top industries: Office REITs (+5.39%), Automobiles (+5.32%), Real Estate Management & Development (+4.19%), and Independent Power and Renewable Electricity Producers (+3.97%).

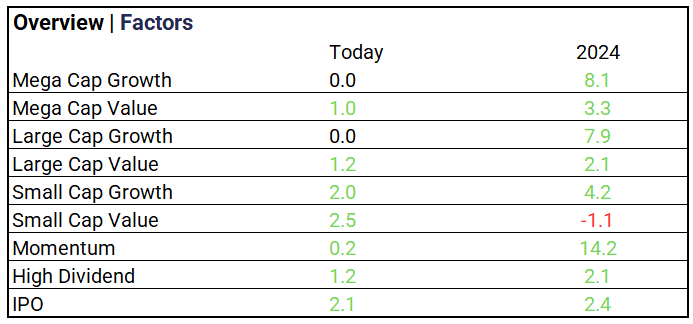

Factors:

- Small Caps lead on the day, Momentum +14.2% YTD.

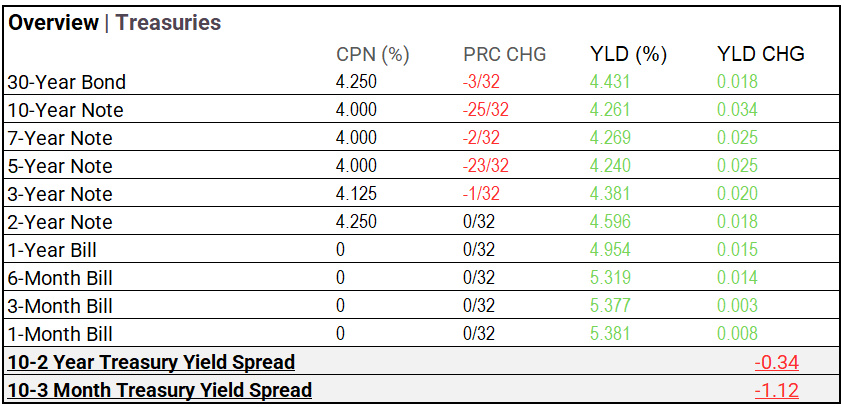

Treasury Markets:

- Yields rising across the curve, 10-year note led gainers.

Currency and Volatility:

- U.S. Dollar Index ^DXY: 104.30 (+0.00, +0.00%)

- CBOE Volatility ^VIX: 14.01 (-0.37%, -2.57%)

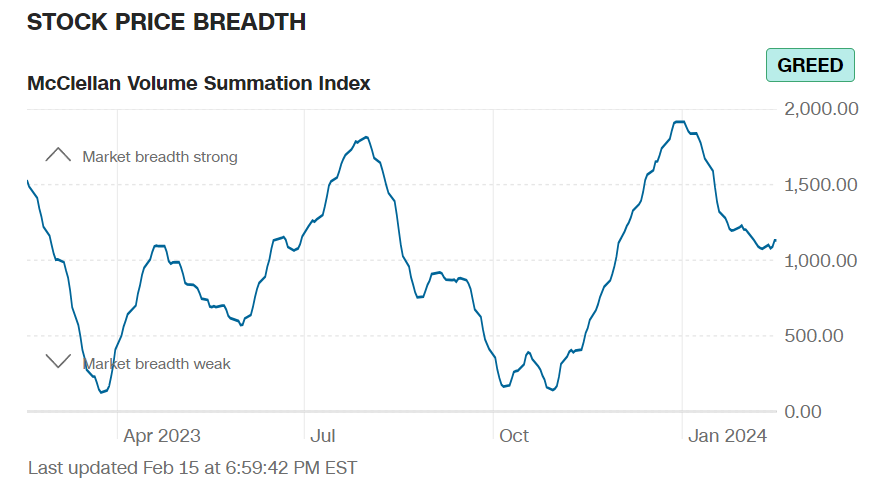

- Fear & Greed Index: 76/LY 73 (Extreme Greed/ Greed)

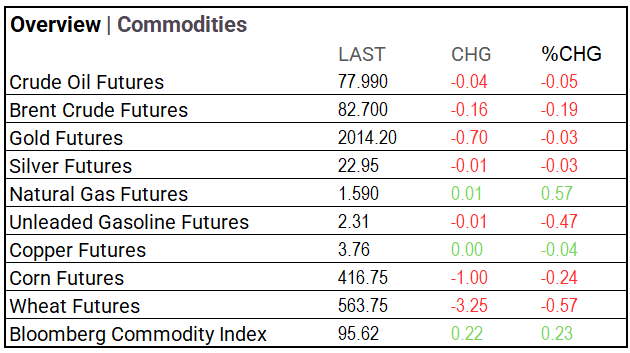

Commodity Markets:

- Gold Futures: $2,014.30, -$0.60, -0.03%

- Bitcoin USD: $52,017.00, +$296.00, +0.57%

- Crude Oil Futures WTI: $78.13, +$0.10, +0.13%

- Bloomberg Commodity Index: 95.62, +$0.22, +0.23%

Note: differences in chart due to post market pricing

ETF’s:

- Tesla Day! T-Rex 2X Long Tesla Daily Target ETF (+12.25%), on 4.5m volume and Direxion Daily TSLA Bull 1.5X Shares, (+9.13%), on robust 22.3m volume.

US Economic Data:

- Initial jobless claims this week and US retails sales in Jan. came up soft while Mfg. surveys beat.

Earnings:

- Q4 Forecast: Analysts significantly lowered S&P 500 companies’ Q4 earnings per share (EPS) estimates during October and November, with a 5.0% decline in the bottom-up EPS estimate. This drop surpasses the average declines over the past 5, 10, 15, and 20 years, marking the most substantial decrease since Q1 2023. Among sectors, Health Care experienced the largest decline (-19.9%), while Information Technology saw a modest increase (+1.5%) in their Q4 2023 bottom-up EPS estimates.

Notable Earnings Today:

- BEAT: Applied Materials (AMAT), Airbus Group NV (EADSY), Deere&Company (DE), Coinbase Global (COIN), The Trade Desk (TTD), Ingersoll Rand (IR), Cenovus Energy Inc (CVE), Agnico Eagle Mines (AEM), Roku (ROKU), Dropbox (DBX)

- MISSED Schneider Electric (SBGSF), Stellantis NV (STLA), Southern (SO), DoorDash (DASH), Digital (DLR), Orange ADR (ORAN), Consolidated Edison (ED),DraftKings (DKNG), Toast (TOST).

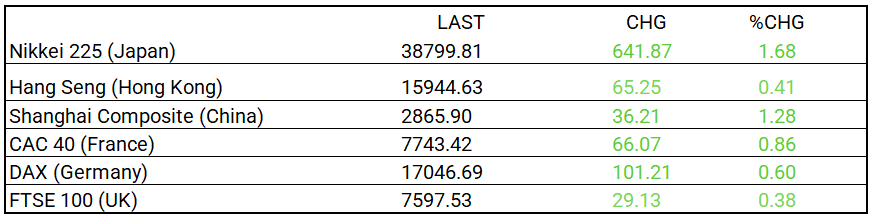

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): 38,799.81, +641.87, +1.68%

- Hang Seng (Hong Kong): 15,944.63, +65.25, +0.41%

- Shanghai Composite (China): 2,865.90, +36.21, +1.28%

- CAC 40 (France): 7,743.42, +66.07, +0.86%

- DAX (Germany): 17,046.69, +101.21, +0.60%

- FTSE 100 (UK): 7,597.53, +29.13, +0.38%

Central Banking and Monetary Policy, Noteworthy:

- U.S. Shoppers Cut Back in January – WSJ

- Biden Adviser Says Soft Landing Helped by Public-Spending Boost – WSJ

- Fed’s Bostic Says May Take ‘Some Time’ to Hit Rate-Cut Threshold – Bloomberg

- ECB’s Lagarde Warns Against Hasty Decision on Rate Cuts – Bloomberg

Energy:

- Higher Global Oil Supply Set to Satisfy Demand Increase, IEA Says – WSJ

- Donald Trump Is the Oil and Gas Industry’s Top Choice for President – Bloomberg

China:

- ‘Just the beginning’: Chinese EVs face uphill path as US, EU put down roadblocks – SCMP