Stay Informed and Stay Ahead: Market Watch, May 10th, 2024.

Wall Street Late Week Market Recap Edition

Market Highlights & Analysis: Indices, Sectors, and More…

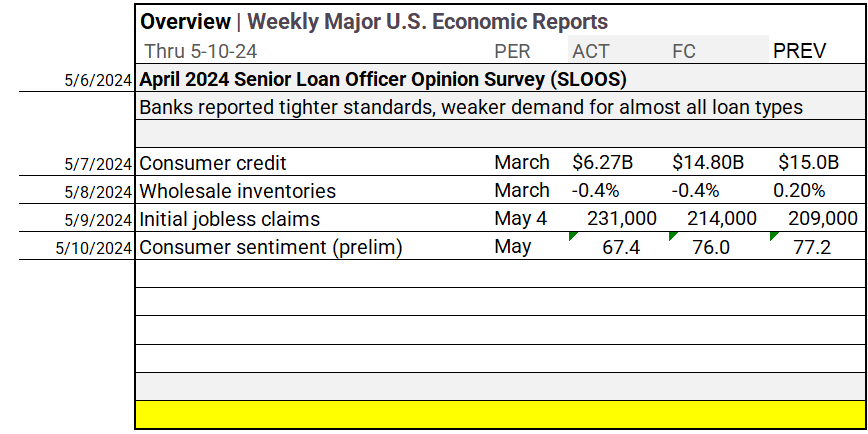

- Economic Data: Prelim May Consumer Sentiment took a notable dip, falling to 67.4 from the prior 77.2. This decline can largely be attributed to the rise in Initial Jobless Claims Last Week.

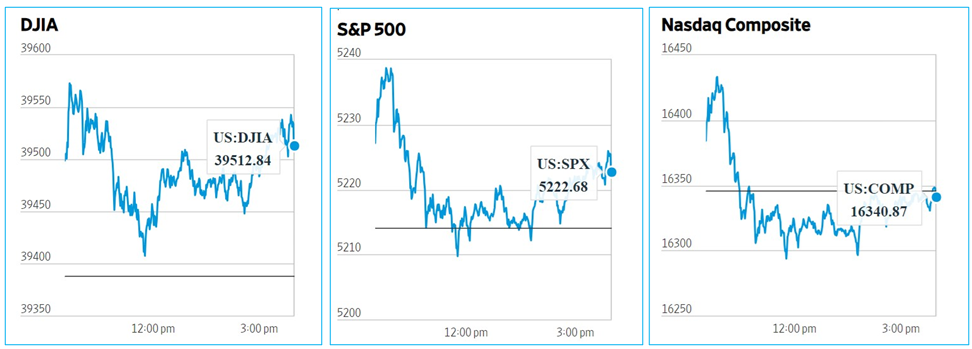

- Market Indices: DJIA (+0.32%), S&P 500 (+0.16%), Nasdaq Composite (-0.03%).

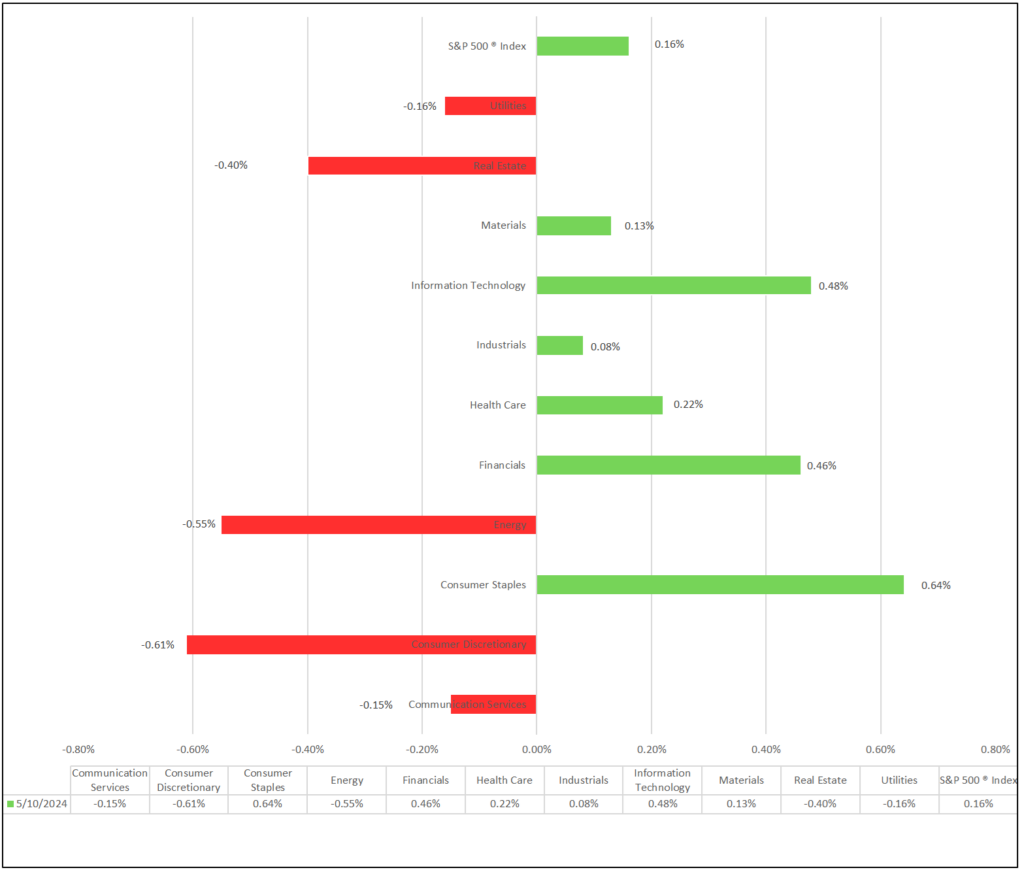

- Sector Performance: 6 of 11 sectors higher; Consumer Staples (+0.64%) leading, Consumer Discretionary (-0.61%) lagging. Top industry: Life Sciences Tools & Services (+2.46%).

- Factors: Mega Cap Value and High Div lead.

- Treasury Markets: Bond yields mostly gain, with notable longer-term strength.

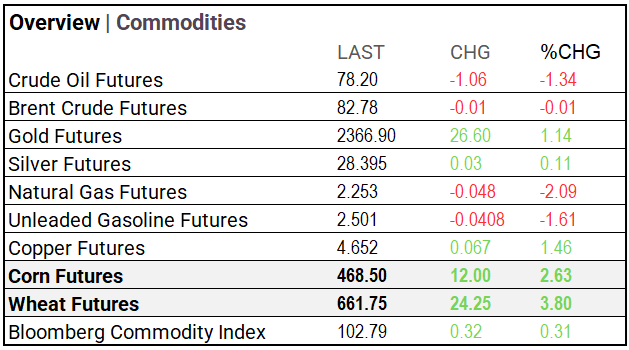

- Commodities: Wheat, Corn, and Copper outperform.

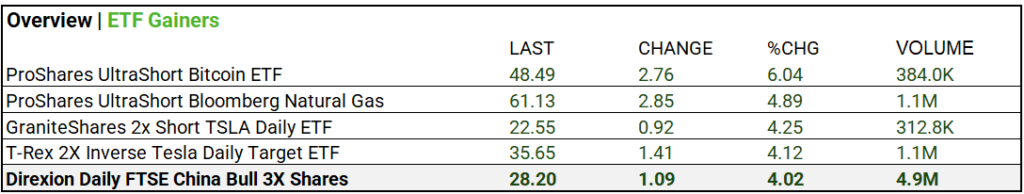

- ETFs: Direxion Daily FTSE China Bull 3X Shares (+4.02%) on 4.9M volume.

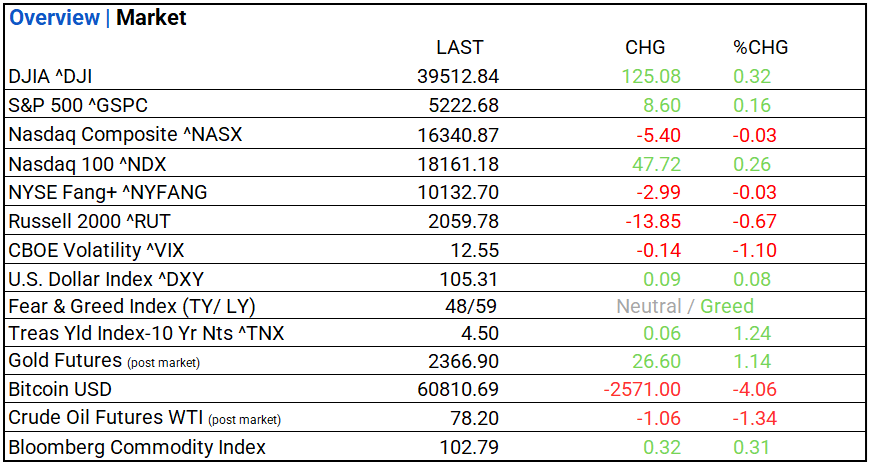

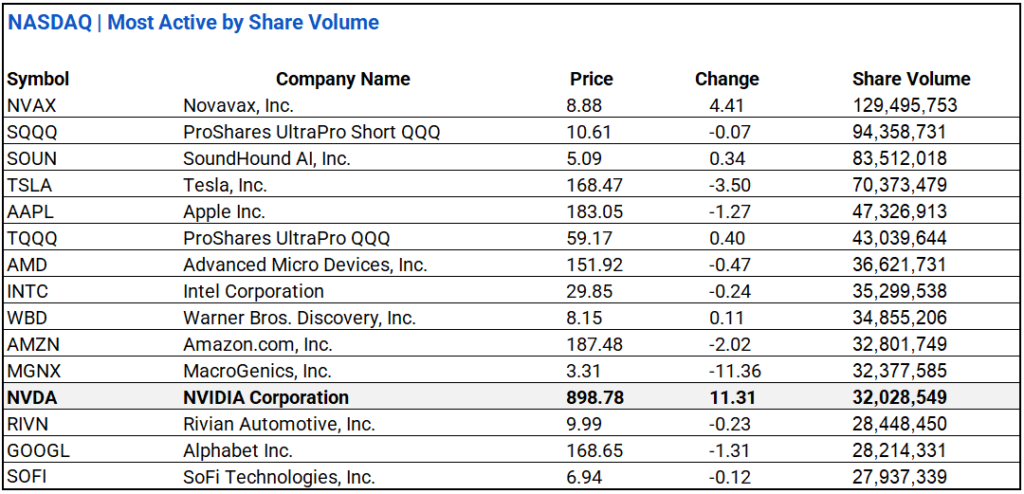

US Market Snapshot: Key Metrics:

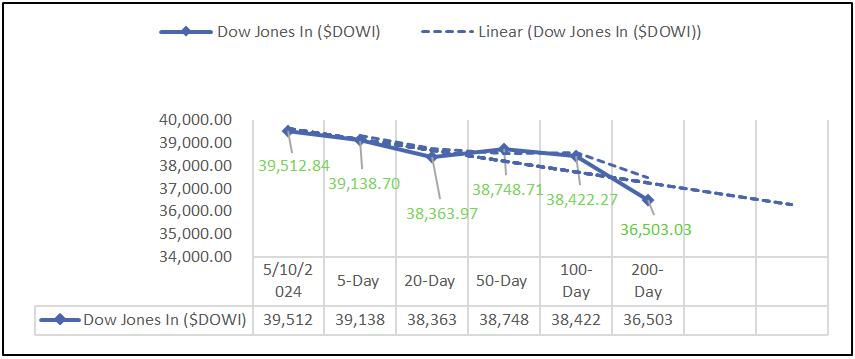

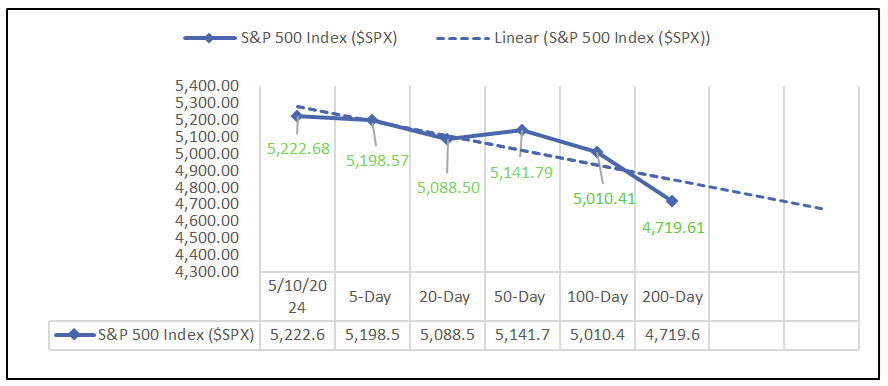

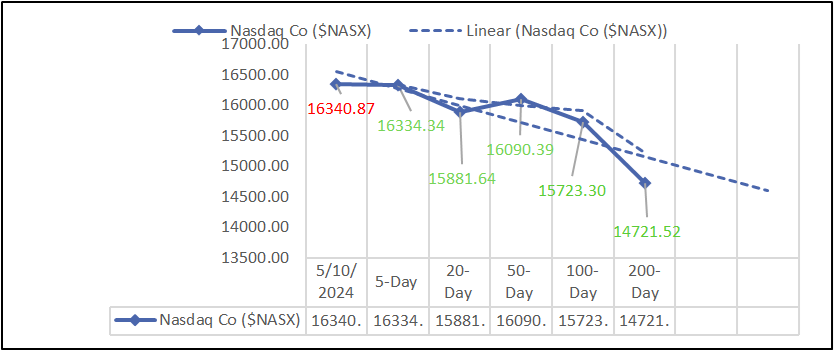

Moving Averages: DOW, S&P 500, NASDAQ:

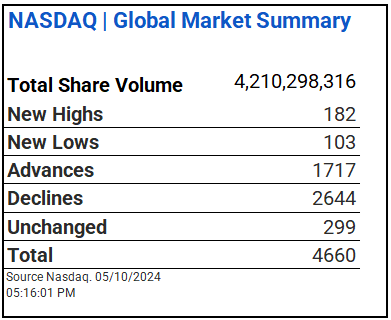

NASDAQ Global Market Summary:

Sectors:

- 6 of 11 sectors higher; Consumer Staples (+0.64%) leading, Consumer Discretionary (-0.61%) lagging. Top industries: Life Sciences Tools & Services (+2.46%), Media (+1.81%), and Communications Equipment (+1.77%).

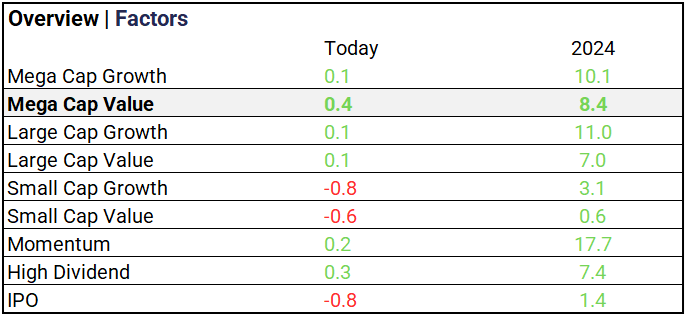

Factors:

- Mega Cap Value and High Div leading. Momentum stocks up 17.7% year-to-date.

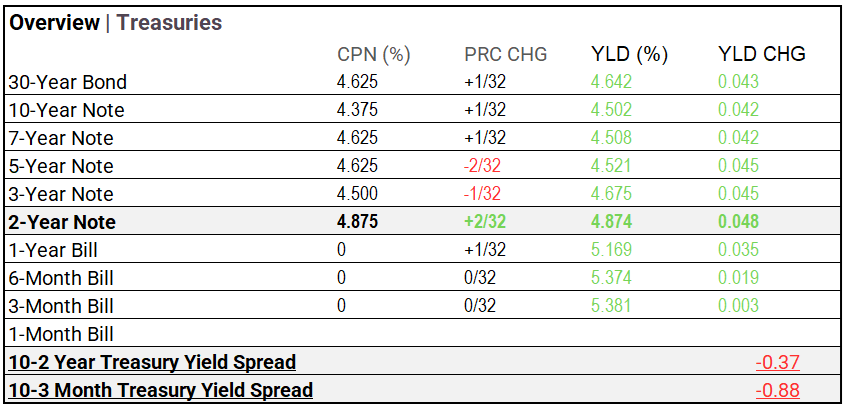

Treasury Markets:

- Bond yields mostly gain, with notable longer-term strength, the 2-year Note outperforming.

Currency and Volatility:

- U.S. Dollar Index ^DXY: 105.31 (+0.09, +0.08%)

- CBOE Volatility ^VIX: 12.55 (-0.14, -1.10%)

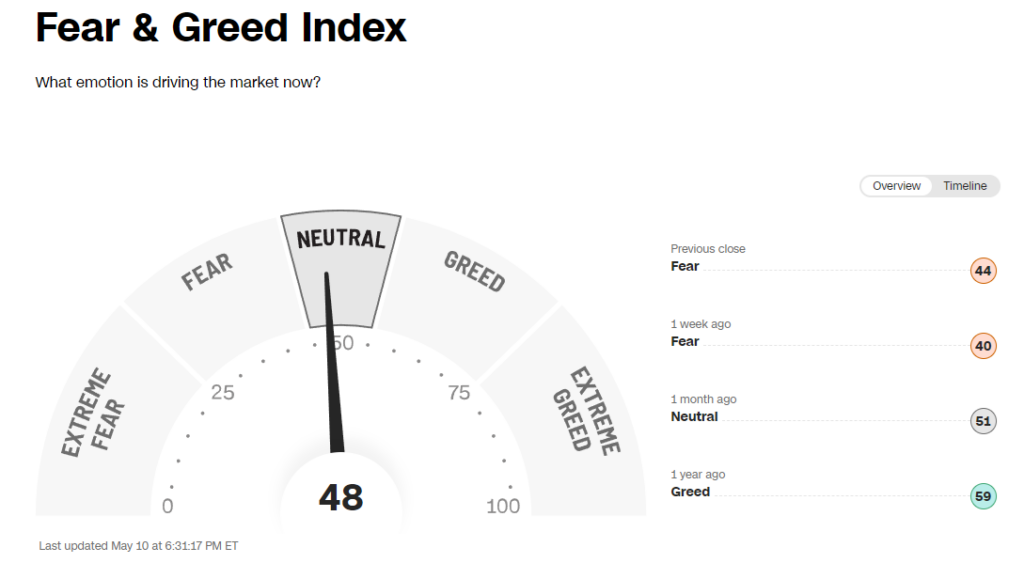

- Fear & Greed Index: 48/TY 59/LY (Neutral/ Greed)

Commodity Markets:

ETF’s:

- Top volume gainer: Direxion Daily FTSE China Bull 3X Shares (+4.02%) on 4.9M volume.

US Economic Data:

- May Consumer Sentiment (prelim) falls sharply to 67.4 from previous 77.2

Notable Earnings Today:

- BEAT/ MEETS: Constellation Software (CNSWF), CRH (CRH),Daiwa House ADR (DWAHY), Crescent Point Energy (CPG), DigitalOcean Holdings (DOCN), Construction Partners (ROAD), Sylvamo (SLVM).

- MISSED: Tokyo Electron Ltd PK (TOELY), Nippon ADR (NTTYY), Enbridge (ENB), KDDI Corp PK (KDDIY), Honda Motor ADR (HMC), Kubota ADR (KUBTY), Shiseido Company (SSDOY), Ubiquiti (UI)

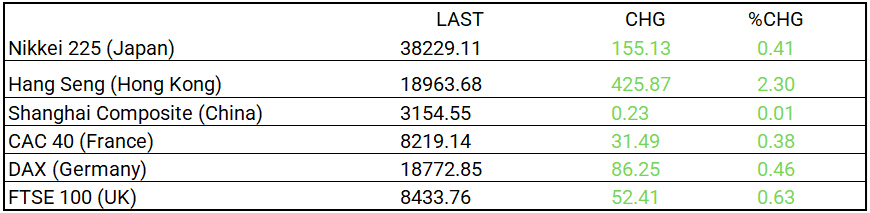

Global Markets Summary: Asian & European Markets:

Central Banking and Monetary Policy, Noteworthy:

- Bank of England Leaves Interest Rates Unchanged, Signals It’s Closer to Cutting – WSJ

- US April Budget Surplus Hits $210 Billion on Higher Tax Receipts – Bloomberg

Energy:

- Shell and Total Talk of Moving to New York. It’s No Cure-All. – WSJ

- Biden Set to Hit China EVs, Strategic Sectors With Tariffs – Bloomberg

China:

- Explainer | China trade: 5 takeaways from April as exports show ‘green shoots’ of recovery, but domestic demand key – South China Post