Stay Informed and Stay Ahead: Market Watch, July 19th, 2024.

Late-Week Wall Street Markets

Key Takeaways

+ DOW, S&P 500, and NASDAQ were down; Health Care led, with Health Care Equipment & Supplies as the top industry.

+ July 13th jobless claims exceeded forecasts, Philadelphia Fed manufacturing steadily beat expectations, and retail sales and housing rose.

+ Long-term yields rose, indicating higher borrowing costs. Small caps outperformed, corn and wheat increased, while oil and gas fell. Bitcoin USD climbed to 66,436.42 (+4.23%). ETFs and Serve Robotics saw significant gains. American Express and Travelers missed earnings.

Summary of Market Performance

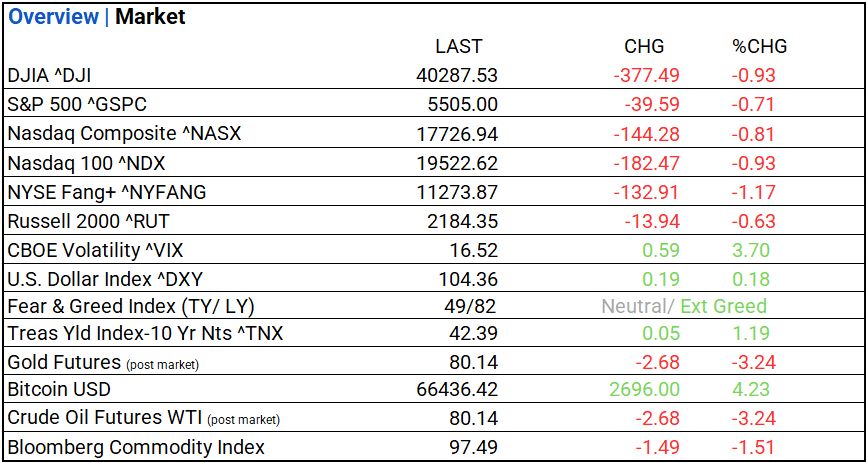

Indices & Sectors Performance:

- Today, major US stock indices—DOW, S&P 500, NASDAQ—down. Among eleven sectors, nine declined. Health Care and Utilities led, Energy AND Information Tech trailed. Top industries: Health Care Equipment & Supplies Industry (+1.94%), Passenger Airlines Industry (+1.00%), and Industrial REITs (+0.92%).

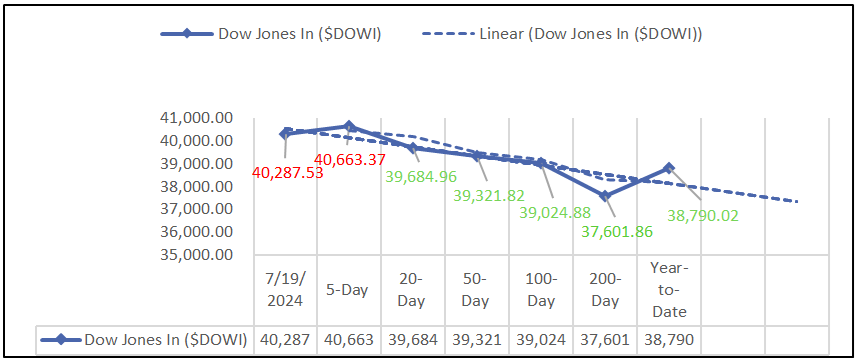

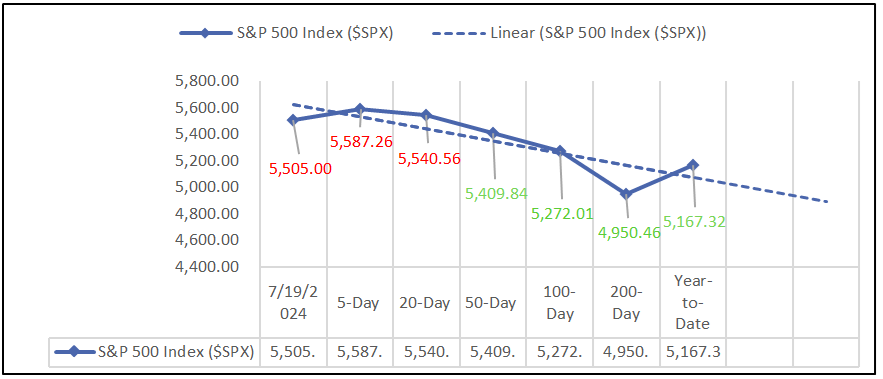

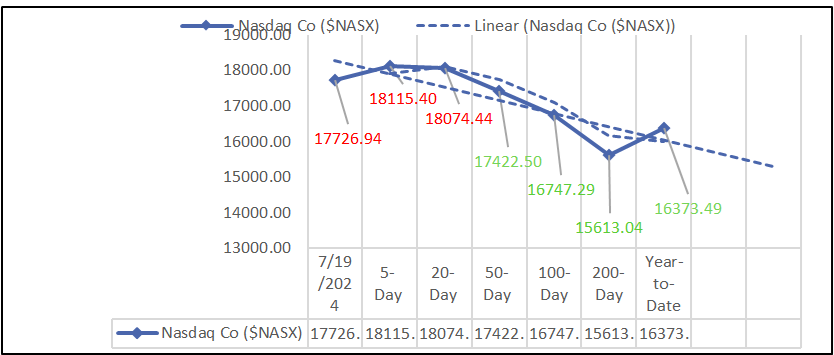

Chart: Performance of Major Indices

Moving Average Analysis:

S&P 500 Sectors:

- Among eleven sectors, nine fell. Health Care led; Energy trailed.

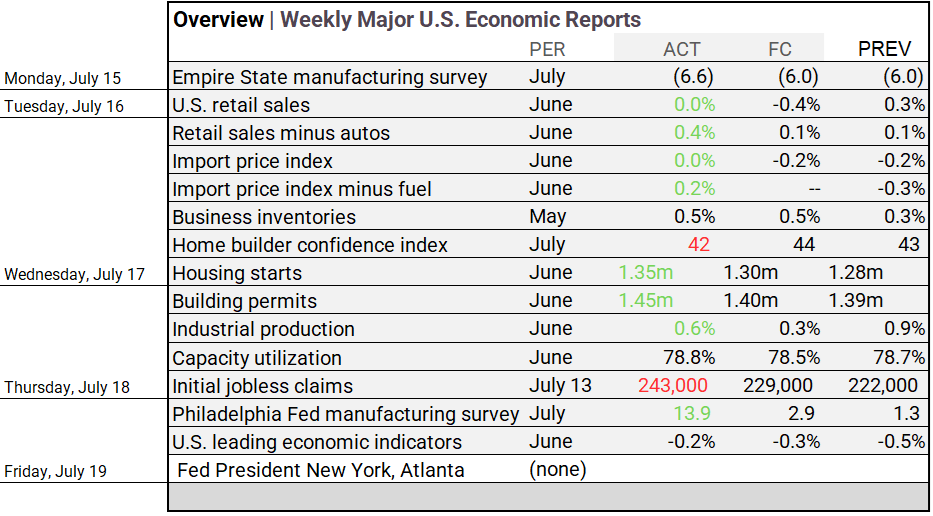

Economic Highlights:

- July 13th weekly Jobless claims edged higher than forecast, with the July Philadelphia Fed manufacturing survey handily beating. Retail and Housing both saw better than consensus growth for the week.

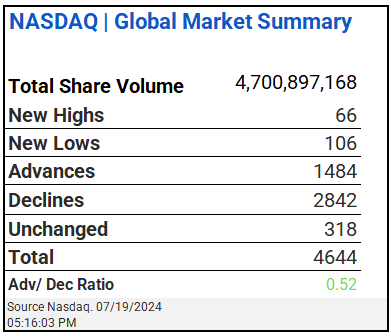

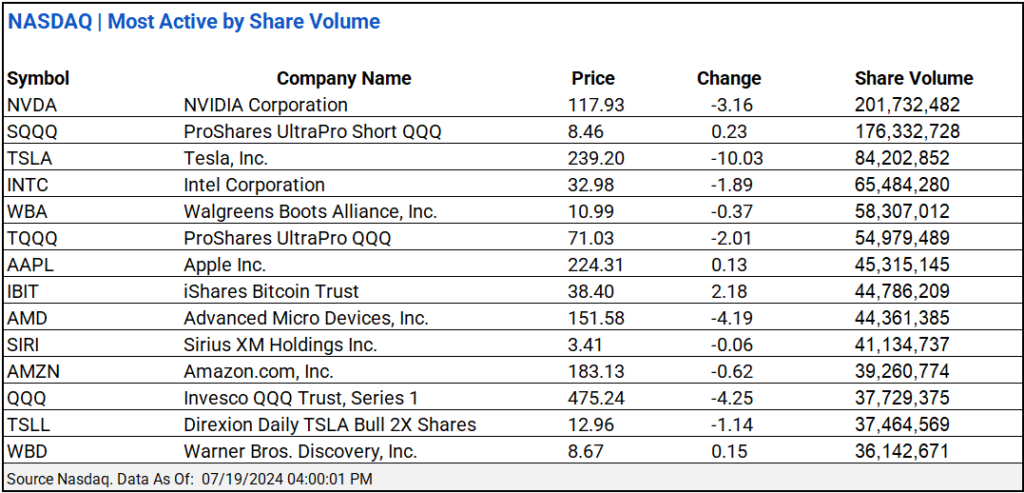

NASDAQ Global Market Update:

- NASDAQ showed mixed sentiment with a total share volume of 4.70 billion, 66 new highs, 106 new lows, and an advance/decline ratio of 0.52. NVIDIA Corporation and ProShares UltraPro Short QQQ led active company trading.

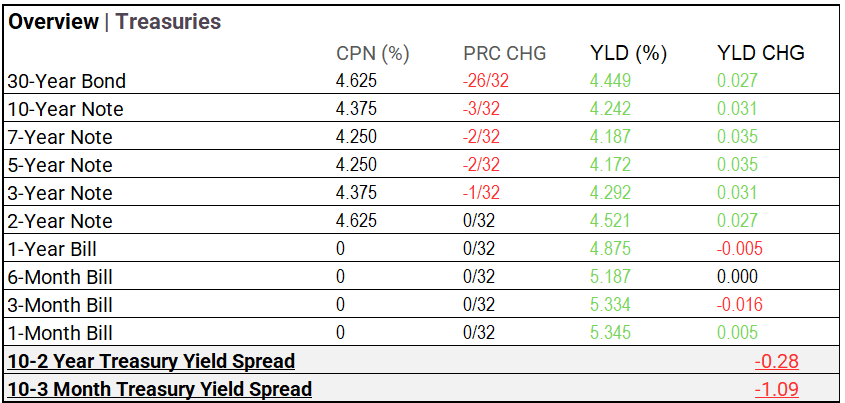

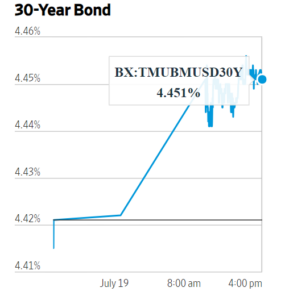

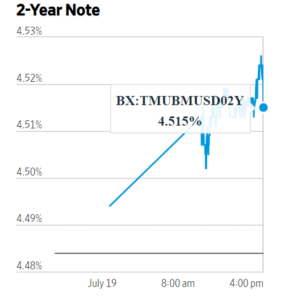

Treasury Markets:

- The long-term 30-year bond yield increased by 0.027%, indicating a rise in long-term borrowing costs. Medium-term notes, including the 10-year, 7-year, 5-year, and 3-year notes, saw yield increases of 0.031%, 0.035%, 0.035%, and 0.031% respectively, suggesting a similar upward trend in medium-term borrowing costs.

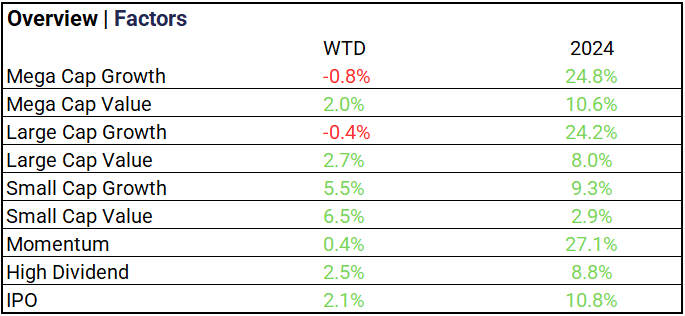

Market Factors:

- For the week Small-cap value stocks rose 6.5%, Small-cap growth 5.5%, while mega-cap growth declined <0.8%>.

Currency & Volatility:

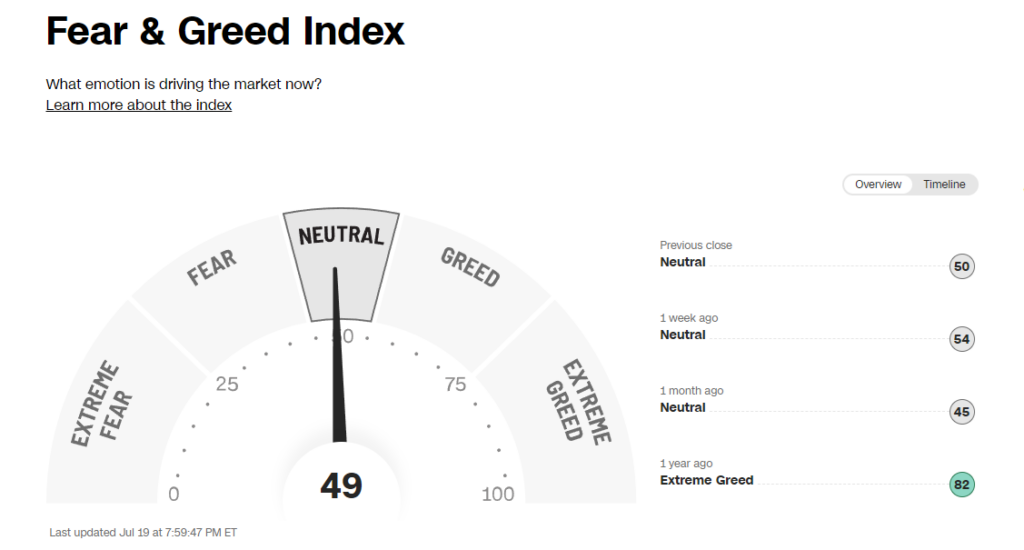

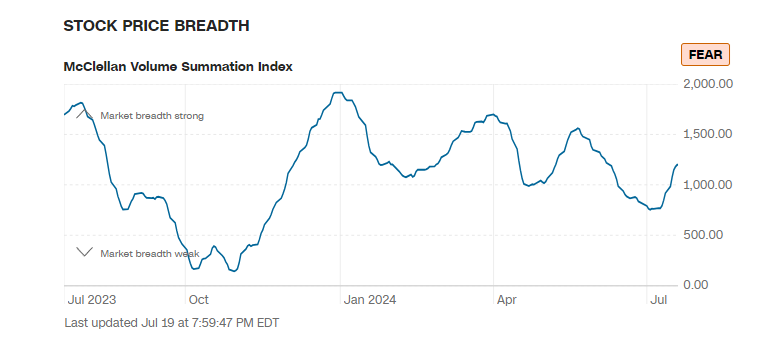

- The VIX increased to 16.52 (+3.70%), and the Fear & Greed Index shifted from Greed to 49 (Neutral).

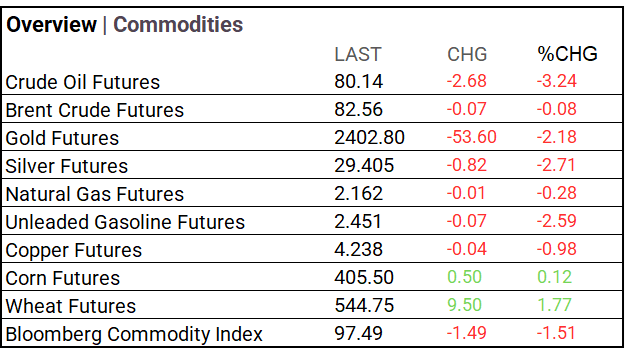

Commodities & ETFs:

- Commodity markets showed mixed movements: Crude oil, Brent crude, gold, silver, natural gas, unleaded gasoline, and copper were down, while corn and wheat rose. The Bloomberg Commodity Index decreased.

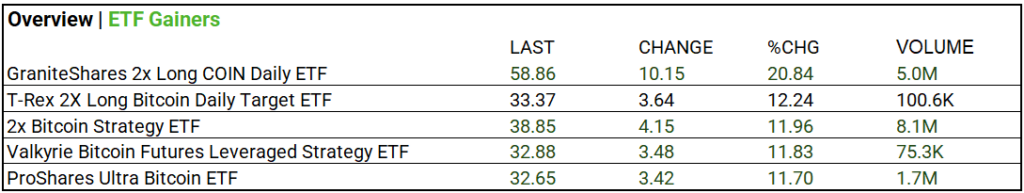

- ETFs: GraniteShares 2x Long COIN Daily ETF +20.84% on 5.0M volume; 2x Bitcoin Strategy ETF +11.96% on 8.1M volume.

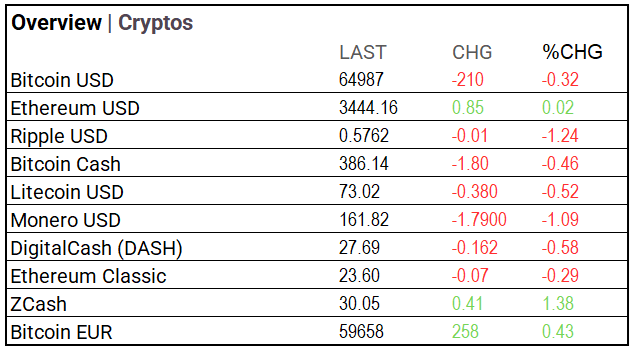

Cryptocurrency Update:

- Bitcoin USD rose to 66,436.42 (+4.23%) during the market session.

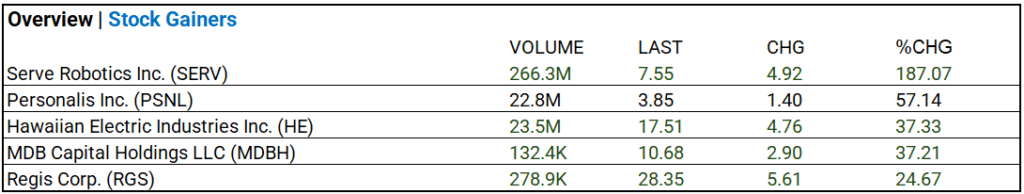

Stocks:

- Serve Robotics Inc. jumps 187.07% on 266.3M volume, Personalis Inc. gained 57.14% on 22.8M volume, and Hawaiian Electric Industries Inc. rose 37.33% on 23.5M volume.

Notable Earnings:

- American Express (AXP) and Travelers (TRV) missed, while Southern Copper (SCCO) and Schlumberger (SLB) beat.

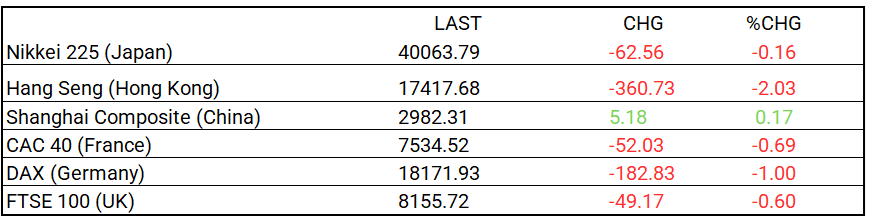

Global Markets Summary:

- Asia was mixed: Shanghai Composite up 0.17%, Hang Seng down 2.03%; Europe declined.

Strategic Investment Adjustments and Historical Market Trends

- Focus on long-duration bonds and hedge with smart economic principles to manage rates.

- Maintain investments in Information Technology, especially semiconductors, while rotating into value instruments for diversification.

- Historically, election years support market growth.

-mk

In the NEWS:

Central Banking, Monetary Policy & Economics:

- Eurozone Businesses Expect Wage Growth to Slow, ECB Survey Finds – WSJ

- White House Raises US Growth, Inflation Projections for 2024 – Bloomberg

Business:

- Gucci’s Owner Lost His Patience. What Came Next Was a Grand Reinvention. – WSJ

- How a Routine CrowdStrike Update Crashed the World’s Computers – Bloomberg

China:

- China seeks ‘unified market’ to surmount regional barriers, boost consumption – SCMP