MARKETS TODAY August 30th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished mixed, Japan’s Nikkei 225 was up 0.18%, China’s Shanghai Composite up 0.04%, Hong Kong’s Hang Seng 0.00%. S&P futures opened trading at 0.06% above fair value.

European markets finished mixed, London’s FTSE 100 up 0.12%, Germany’s DAX down 0.24% and France’s CAC 40 down 0.12%.

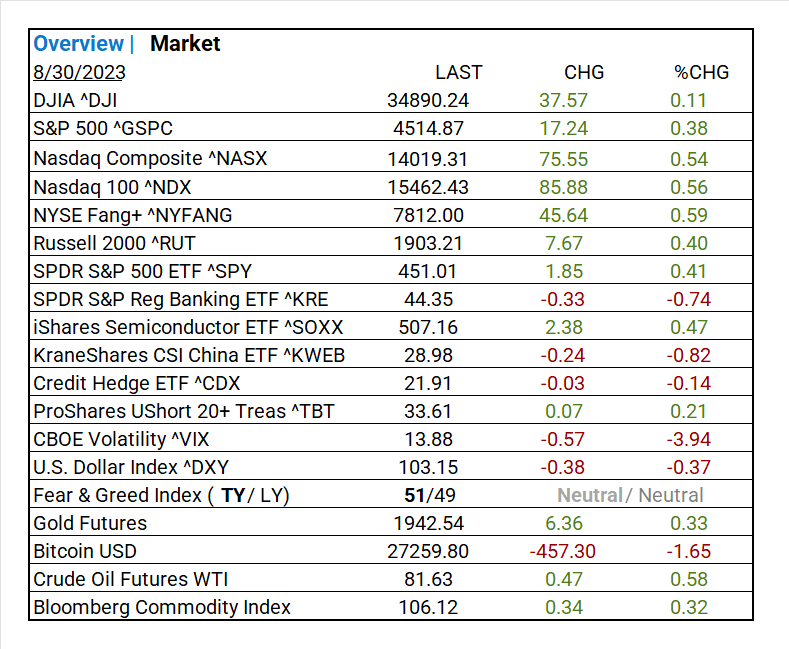

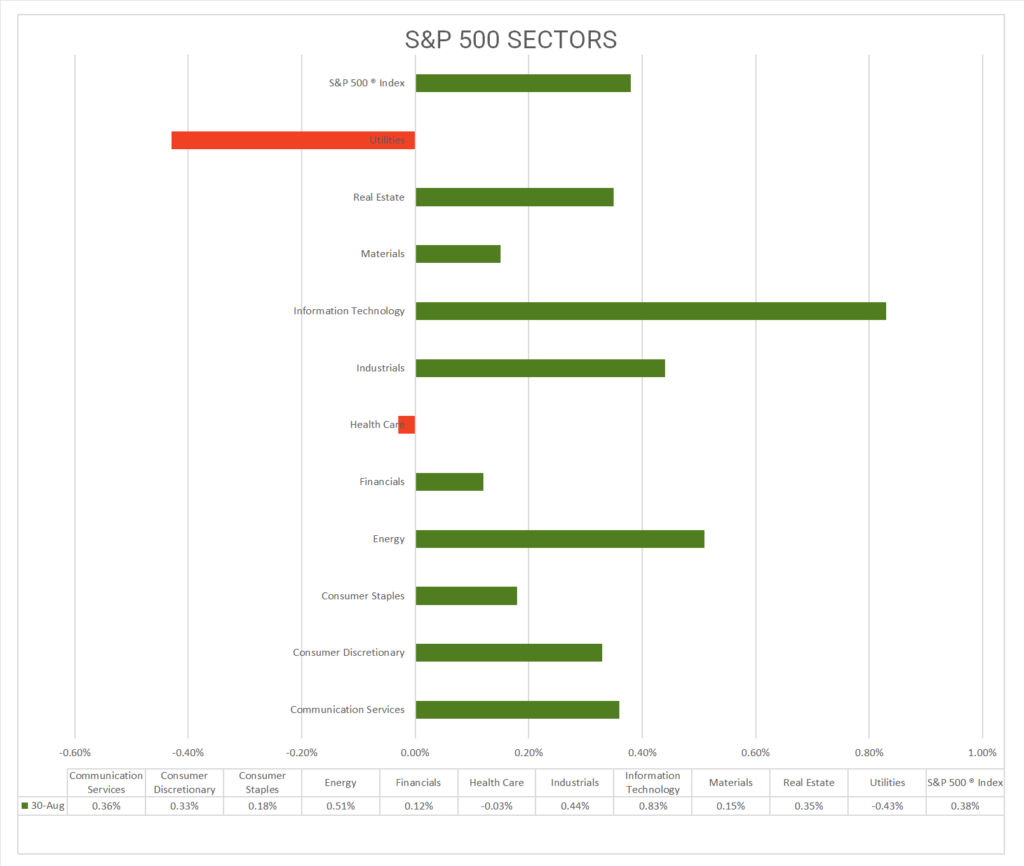

Today US Markets finished higher, NASDAQ up 0.54%, S&P 500 up 0.38% and the DOW up 0.11%. 9 of 11 S&P 500 Sectors advancing: Information Technology +0.83% outperforms/ Utilities -0.43% lags. Trending Industries: Technology Hardware, Storage & Peripherals, Personal Care Products, Household Durables.

In US economic news, Q2 GDP 2nd missed estimates. Retail inventories were up and Wholesale Inventories down in July. ADP Employment Change was lower than expected and missed estimates. Pending home sales in July with a surprise beat. U.S. crude oil stockpiles fell by 10.6 million barrels last week, a third straight week of inventory declines.

Takeaways

- Q2 GDP and ADP jobs lower, miss estimates

- S. crude oil suffers a third straight week of inventory declines

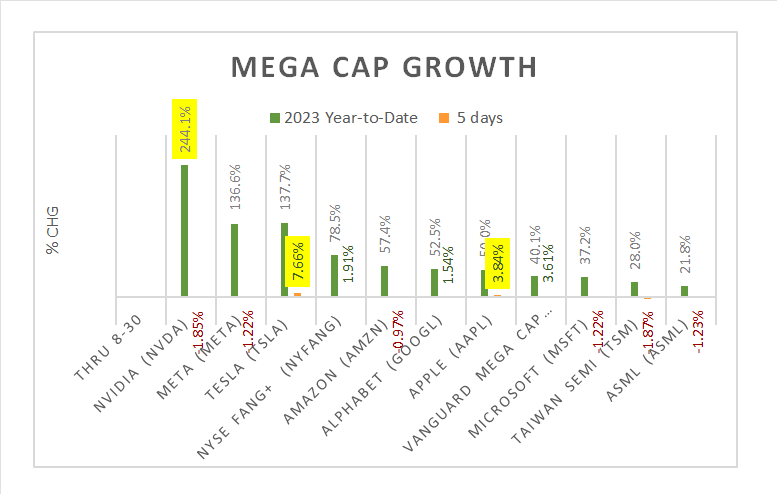

- NYSE Fang+ ^NYFANG +0.59%

- Growth Stocks outperform 2nd consecutive day

- Semiconductor ETF ^SOXX +0.47%

- Trending “on the Day” Tech Hardware +1.84%, Personal Care Products+1.78%

- Oil Futures, Bloomberg Commodity Index rise

- Noteworthy 90 day/ Energy Equipment & Services Industry +30%

- Gold up/ Options Market betting bullish move for SPDR Gold Trust ^GLD

- CBOE Volatility ^VIX drops 4% today as market expecting Fed to pause hikes in Sept

- Salesforce Inc (CRM), Okta (OKTA) with solid earnings beats

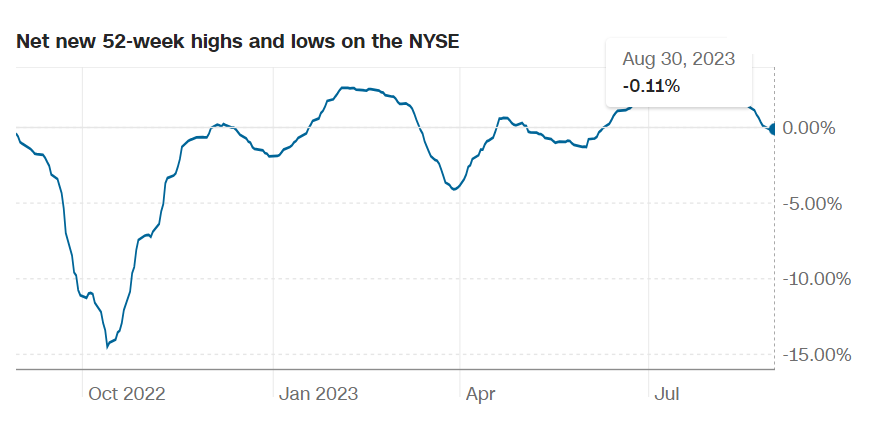

Pro Tip: Stock Price Strength shows the number of stocks on the NYSE at 52-week highs compared to those at 52-week lows.

Sectors/ Commodities/ Treasuries

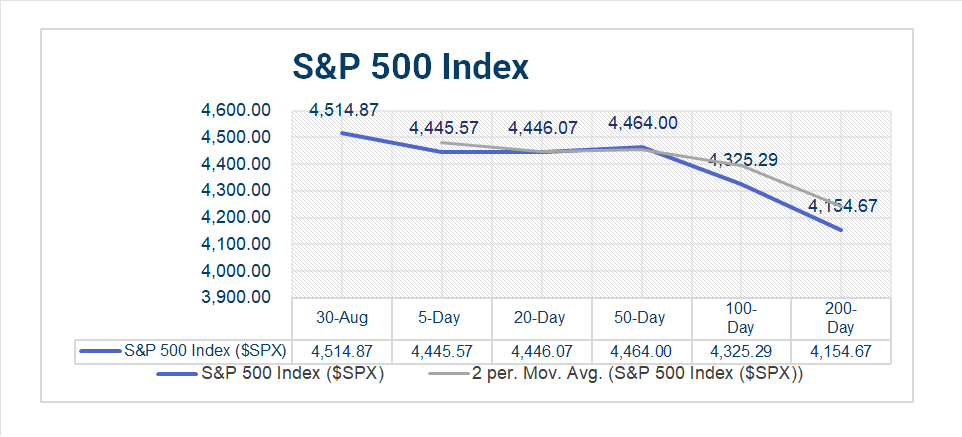

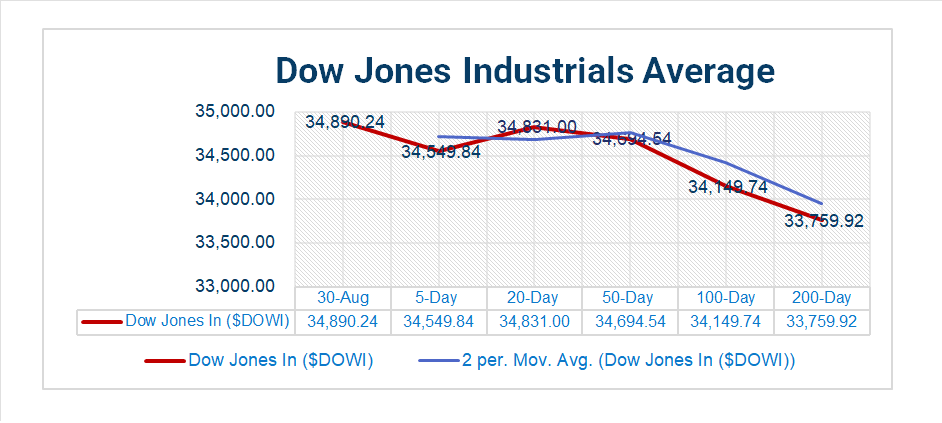

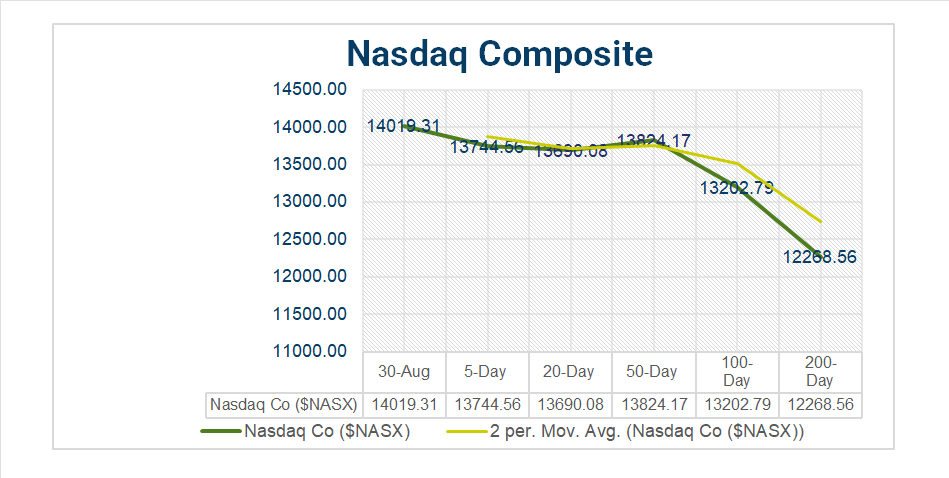

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 9 of 11 S&P 500 sectors advancing: Information Technology +0.83% outperforms/ Utilities -0.43% lags.

- Trending “on the Day”: Technology Hardware, Storage & Peripherals +1.84%, Personal Care Products+1.78%, Household Durables +1.38%, Aerospace & Defense +0.94%, Machinery+0.94%, Specialty Retail +0.84%.

- *1 Month Leaders: Energy +2.62%, Health Care -0.36%

- *YTD Leaders: Communication Services +43.47%, Information Technology +41.98%, Consumer Discretionary +32.64%

- *S&P 500 +17.14% *as of Aug-29-2023

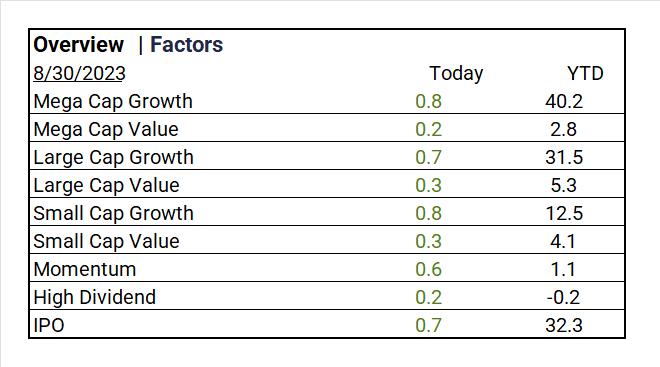

Factors

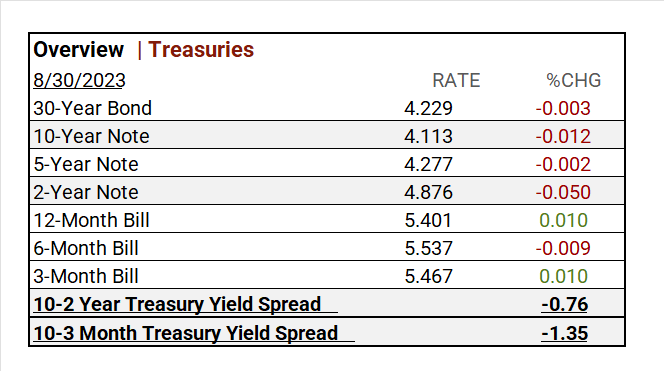

US Treasuries

Earnings

Q2 ’23 Top Line Top Line

- Q1 ’23 Actual: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 Forecast: S&P 500 EPS was expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

Q2 Seasonal Actual (TBA)

Notable Earnings Today

- +Beat: Salesforce Inc (CRM), Bank China ADR (BACHY), Crowdstrike Holdings (CRWD), Veeva Systems A (VEEV), Cooper (COO), Okta (OKTA), Chewy (CHWY), Pure Storage Inc (PSTG)

- – Miss: Industrial Commercial Bank of China (IDCBY), Brown Forman A (BFa), National Bank of Canada (NTIOF), Air China ADR (AIRYY), Five Below (FIVE)

Economic Data

US

- ADP employment Aug: act 177,000, fc 200,000, prior 371,000

- GDP (revision) Q2: act 2.1%, fc 2.4%, prior 2.4%

- Advanced U.S. trade balance in goods July: act -$91.2B, prior -$88.8B

- Advanced retail inventories July: act 0.3%, prior 0.7%

- Advanced wholesale inventories July: act -0.1%, prior 0.5%

- Pending home sales July: act 0.9%, fc -0.5%, prior 0.3%

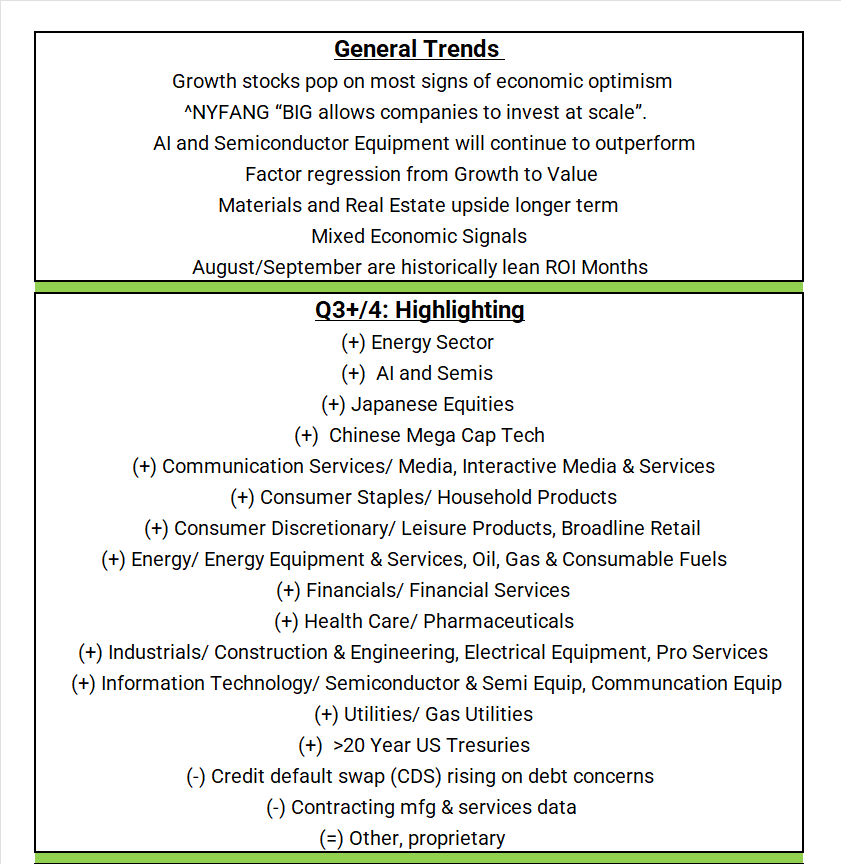

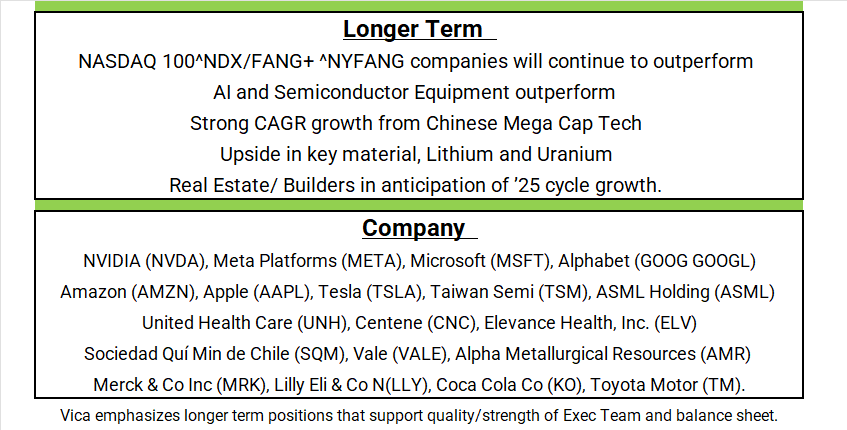

Vica Partners Guidance

Vica Partners Economic Forecast

The Federal Reserve as of August 2023 was no longer predicting Recession; to quote Investor Jeremy Grantham “the Federal Reserve record on predicting recessionary cycles is guaranteed to be wrong! Pundits can all agree that the Fed has never called any recession in-kind.

So why don’t we support the soft-landing scenario…

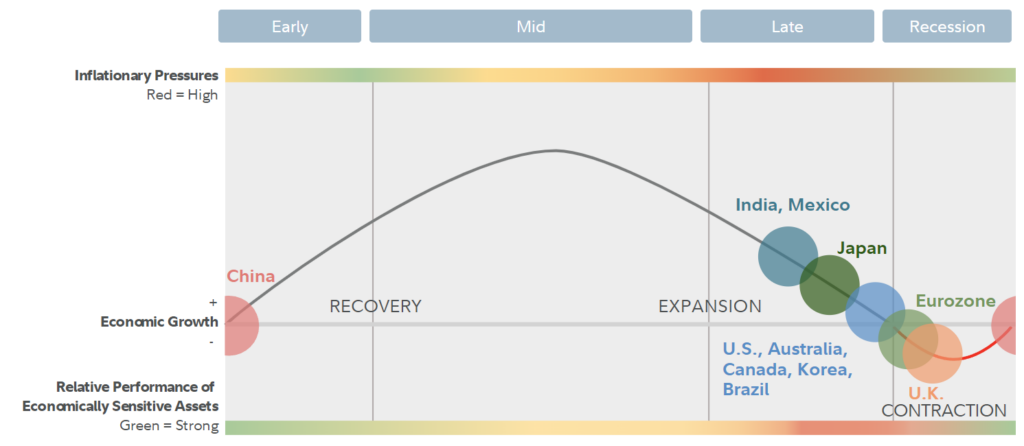

- Vica forecasts that the US will have a Recession, starting as early as Q4 ’23 and deep into ’24: the combination to date of Fed tightening, surging oil prices, stock market overvaluations and a strong dollar will shortly give us our bottom.

- Market bottoms are made on bad news and with deflationary signals: economic reports are currently mixed and arguably too much focus placed on product prices and weekly jobs. Our biggest concern is rising interest rates and the depressing slow-moving effect it has on the Real Estate market. And… all with Consumer debt rising to historical highs.

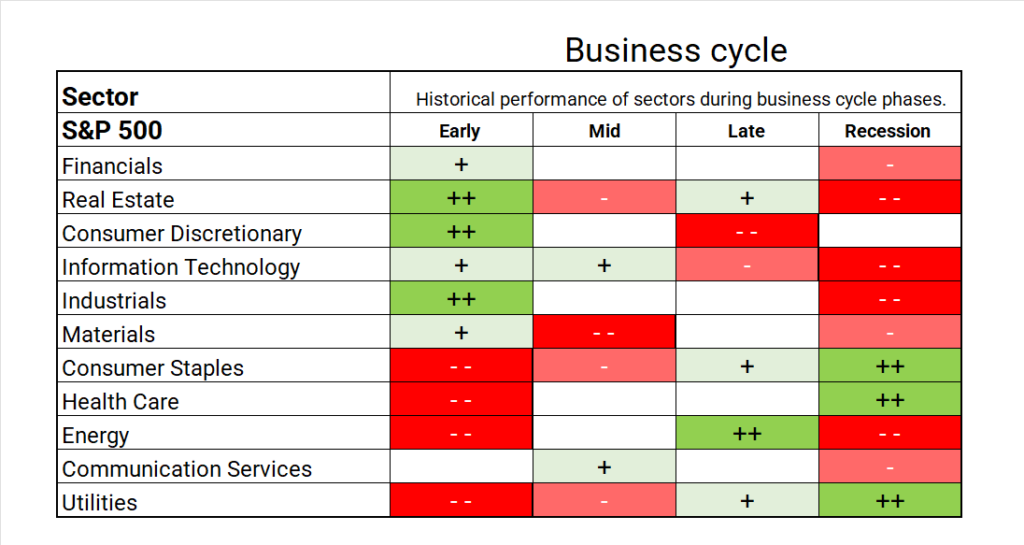

- Current S&P 500 Sector Metrics support contraction: strong trends in the Energy sector indicate the US is in a late business cycle (see chart below).

- A correction in excessive market asset valuations: the current shift from Growth to Value stocks and the Information Technology sector pullback are both underway.

And why…

- The Federal Reserve has limited power in controlling inflation: applying old school economic principles is ineffective in a highly automated and expanding global economy. By simply raising rates to counter jobs (1.6 jobs available for every job seeker) will NOT moderate on demands.

- A 2% inflation target is not realistic today: perhaps a >3% base rate could help fund a) appropriated wages for skilled workers and training b) an executable and efficient energy transition c) improving operational efficiencies across the economy d) and most importantly (look at China today) protection from deflation!

News

Company News/ Other

- EU regulators backs Pfizer’s updated vaccine for dominant Omicron subvariant – Reuters

- Huawei’s silence over its latest Mate smartphone’s advanced chip raises speculation on where and how it was made – SCMP

- What’s Behind $1 Trillion in Credit-Card Balances? – WSJ

- Chatbots Are Trying to Figure Out Where Your Shipments Are – WSJ

Energy/ Materials

- Orsted’s $2.3 Billion Charge Exposes US Offshore Wind Woes – Bloomberg

- France Extends Coal Plant Waiver Into 2024 to Back Power Supply – Bloomberg

Real Estate

- How to Play the Property Meltdown in Five Charts – WSJ

- Americans Are Bailing on Their Home Insurance – WSJ

Central Banks/Inflation/Labor Market

- US Pending Home Sales Unexpectedly Rise for a Second Month – Bloomberg

- Rising Stock Prices Threaten Progress on Powell Inflation Gauge – Bloomberg

Asia/ China

- Bank of China, ICBC profit growth tanks as property crisis takes a toll – SCMP