“Empowering Your Financial Success”

Daily Market Insights: September 18th, 2023

Global Markets Summary:

Asian Markets and US Futures:

- Japan’s Nikkei 225: +1.10%

- China’s Shanghai Composite: +0.26%

- Hong Kong’s Hang Seng: -1.39%

- S&P Futures: -0.12%

European Markets:

- London’s FTSE 100: -1.05%

- Germany’s DAX: -0.56%

- France’s CAC 40: -1.39%

US Market Snapshot: Today’s Key Highlights and Trends:

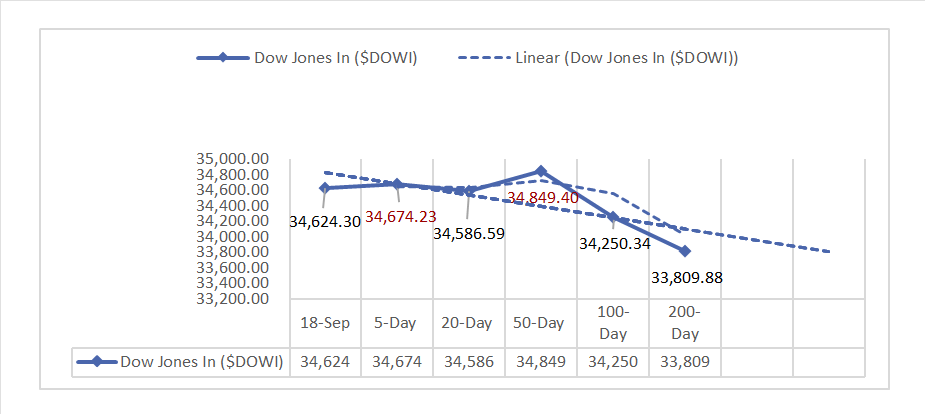

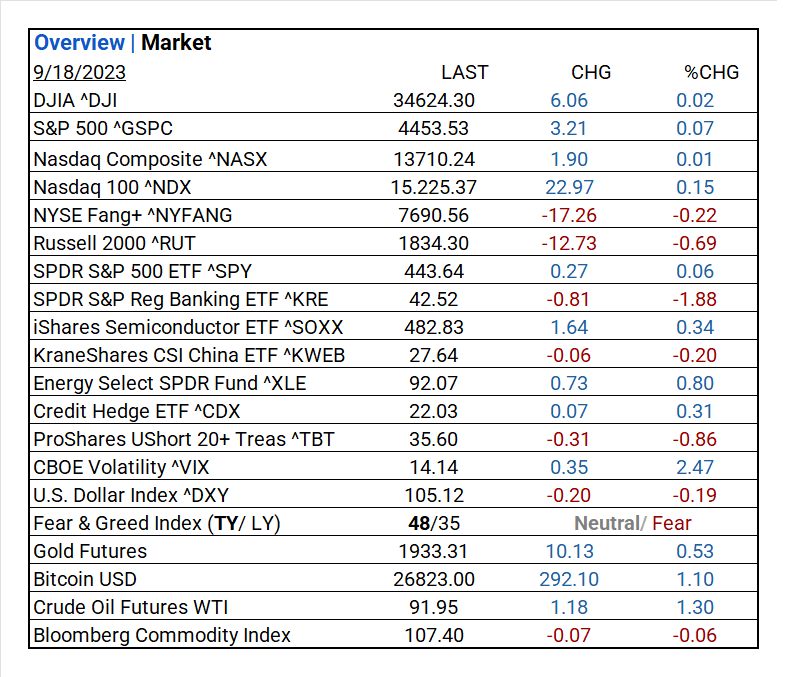

- DJIA (^DJI): 34,624.30 (+0.02%)

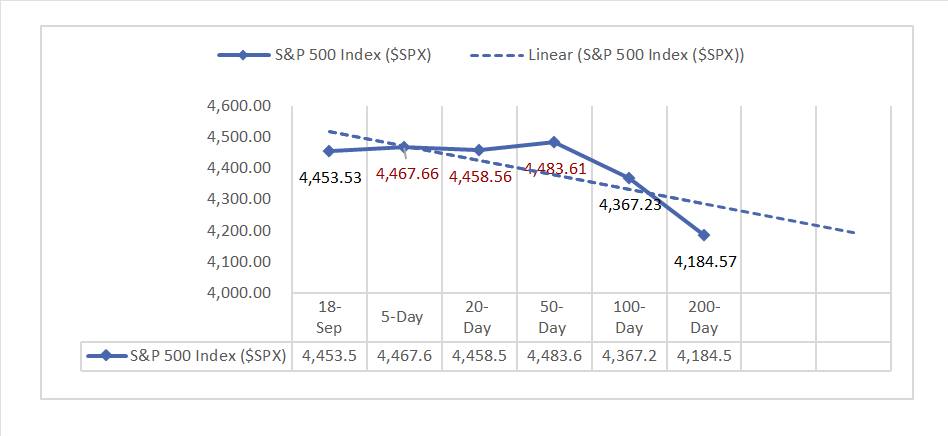

- S&P 500 (^GSPC): 4,453.53 (+0.07%)

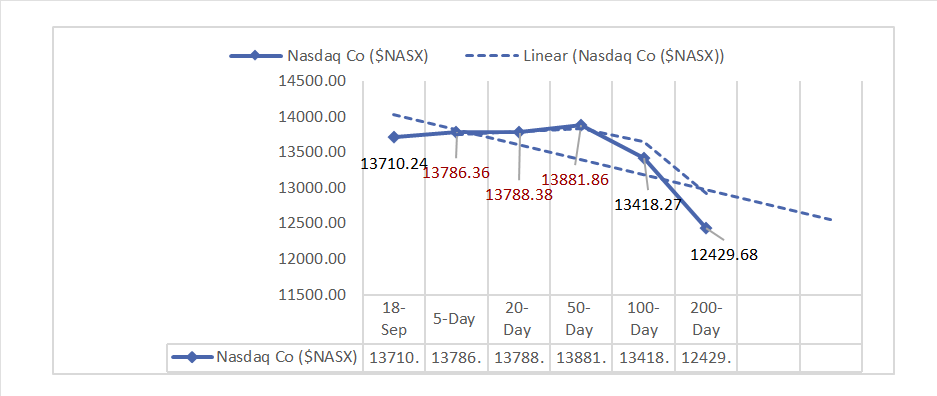

- Nasdaq Composite (^NASX): 13,710.24 (+0.01%)

- NYSE Fang+ (^NYFANG): 7,690.56 (-0.22%)

- Russell 2000 (^RUT): 1,834.30 (-0.69%)

Highlights:

- Index Performance: Major indices gained; NYSE Fang+ and Russell 2000 declined slightly.

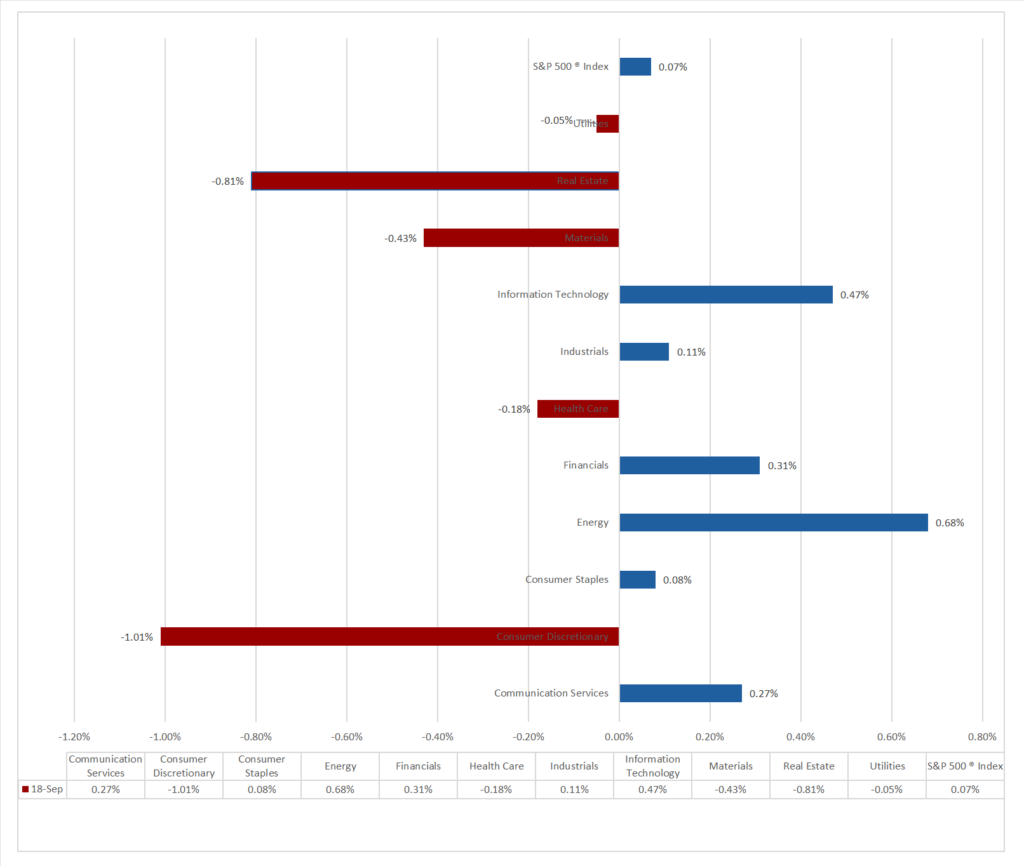

- Sector Spotlight: S&P 500 sectors: Six rose; Energy led with +0.68%, while Consumer Discretionary fell -1.01%.

- Notable Sectors: Notable sectors showing strength included Technology Hardware, Energy Equipment, Insurance, and Household Durables.

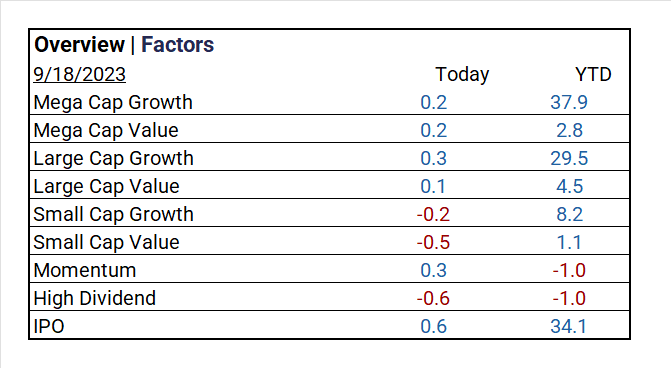

- Stock Categories: IPO stocks surged 0.6%, Large Cap Growth and Momentum stocks rose 0.3%, High Dividend stocks fell -0.6%.

- ETFs: Gain-Energy Select SPDR Fund (^XLE), Direxion Daily Semi Bull 3x Shares (^SOXL). Loss – US Global Jets ^JETS, SPDR S&P Reg Banking ETF ^KRE.

- Market Volatility: CBOE Volatility (^VIX) saw a substantial 2.47% increase.

- Sentiment Check: Market sentiment, Fear & Greed Index (TY/LY), stood at 48/35, showing a neutral to slightly fearful stance.

Treasury and Currency:

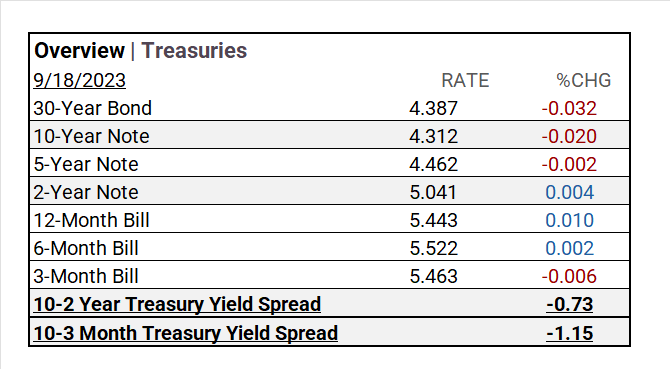

- Yield Moves: US Treasuries showed mixed movements; 30-Year Bond decreased; Year Note slightly increased.

- US. Dollar Index (^DXY): 105.12 (-0.19%)

Volatility and Market Sentiment:

- CBOE Volatility (^VIX): 14.14 (+2.47%)

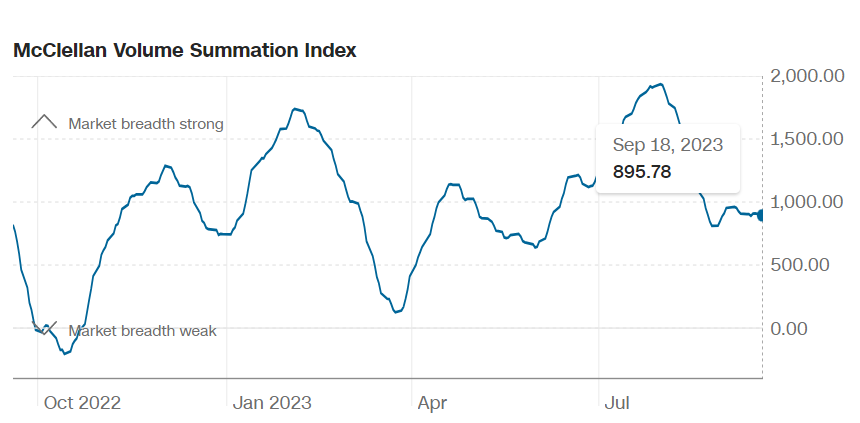

- McClellan Volume Summation Index: 895.78 (-1.64%)

- Fear & Greed Index (TY/LY): 48/35 (Neutral/Fear)

source: CNN Fear and Greed Index

Commodities:

- Gold Futures: $1,933.31 (+0.53%)

- Bitcoin USD: $26,823.00 (+1.10%)

- Crude Oil Futures WTI: $91.95 (+1.30%)

- Bloomberg Commodity Index: 107.40 (-0.06%)

Factor Charts:

- Gains: IPO stocks: +0.6%, Large Cap Growth: +0.3%, Momentum stocks: +0.3%

- Loss: Small Cap Value: -0.5%, High Dividend stocks: -0.6%

ETFs by Contract Volume:

- SPDR S&P 500 ETF (^SPY): +0.06%

- Invesco QQQ Trust (^QQQ): +0.25%

- iShares Russell 2000 (^IWM): -0.66%

- iShares iBoxx $High Yield Corp Bond (^HYG): +0.07%

- iShares MSCI Emerging Markets ETF ^EEM: -0.13%

- ProShares UltaPro QQQ (^TQQQ): +0.23%

Noteworthy:

- Energy Select SPDR Fund (^XLE): +0.85%

- Direxion Daily Semi Bull 3x Shares (^SOXL): +0.71%

- Credit Hedge ETF (^CDX): +0.31%

- iShares China Large-Cap (^FXI): -0.48%

- ProShares UltraShort 20+ Treas (^TBT): -0.86%

- US Global Jets ^JETS: -1.83%

- SPDR S&P Reg Banking ETF ^KRE: -1.88%

US Economic Data

- NAHB Housing Market Index September: 45 vs. consensus of 50, prior 50. Builder confidence in the single-family housing market has declined from the previous month, indicating that more builders adversely view conditions.

Earnings:

Q1 Insights:

- Q1 ’23: 79% of companies beat analyst estimates.

Q2 Insights:

- Q2 Forecast: Predicted decline of <7.2%> in S&P 500 EPS , Fiscal year 2023 EPS remained flat YoY.

Notable Earnings Today: n/a

Resources:

News

Company News/ Other

- Instacart Prices IPO at $30 a Share, at Top End of Expectation – WSJ

- Toyota Keeps Up the Push to Prove It Can Embrace New Technology – Bloomberg

Energy/ Materials

- Regulators Are Trying to Stop Greenwashing Before It Gets Worse – Bloomberg

Real Estate

- San Francisco Office Market Shows Signs of Life – WSJ

Central Banks/Inflation/Labor Market

- Why a Soft Landing Could Prove Elusive – WSJ

- US Core CPI Picks Up, Keeping Another Fed Hike in Play This Year – Bloomberg

Asia/ China

- China’s mixed bag: 4 takeaways from August as economic data tells complex tale – SCMP