Stay Informed and Stay Ahead: Market Watch, January 26th, 2024.

Market Highlights & Analysis: Indices, Sectors, and More…

- Economic Data: Inflation cools, December economic indicators showed modest gains in personal income and spending, with a big beat in home sales.

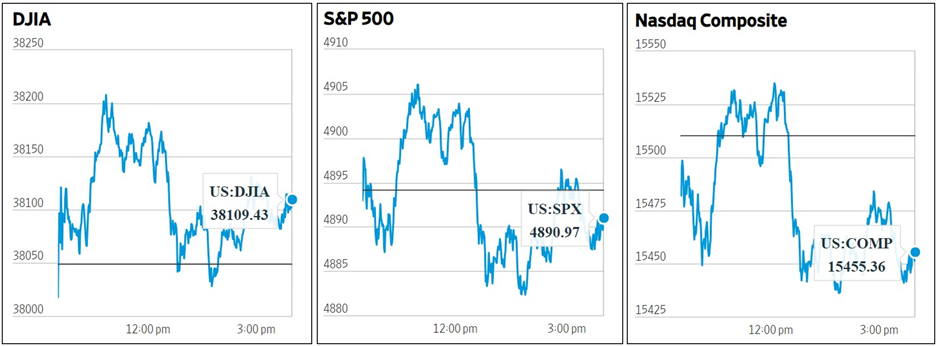

- Market Indices: DJIA (+0.16%), S&P 500 (-0.07%), Nasdaq Composite (-0.36%).

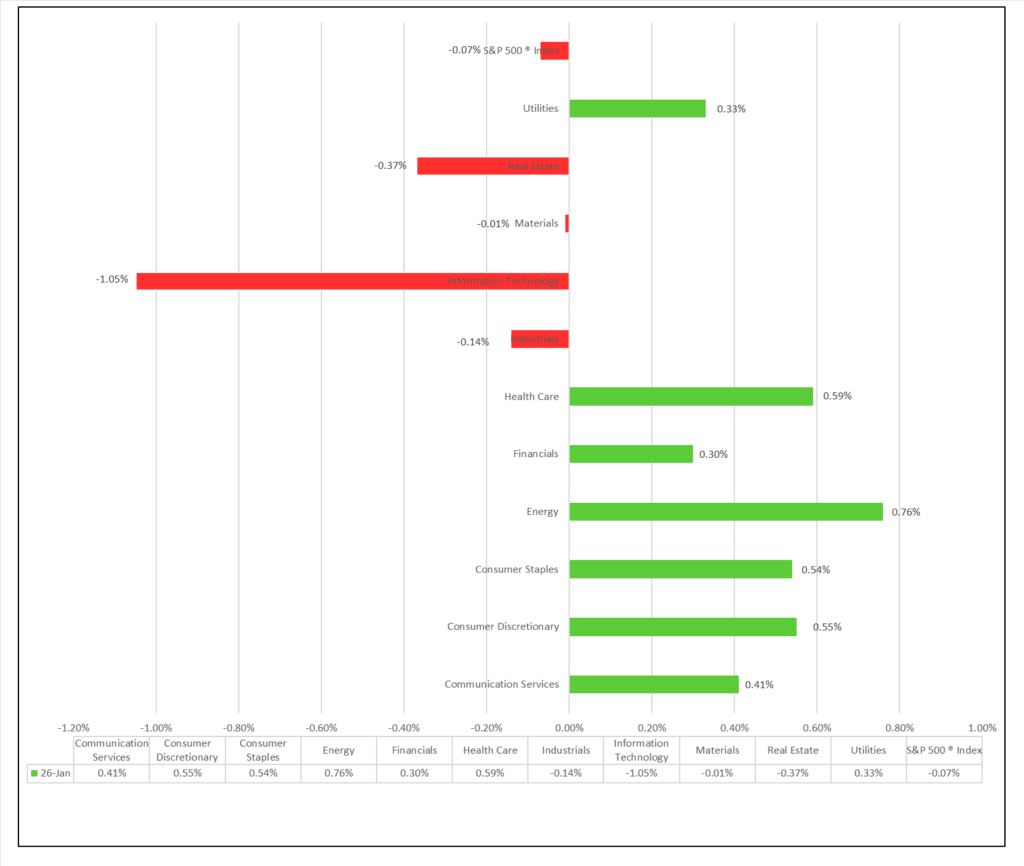

- Sector Performance: 6 of 11 sectors higher; Energy (+0.76%) leading, Information Technology (-1.05%) lagging. Top industry: Consumer Finance (+5.62%) w/ American Express ^AXP (+7.1%).

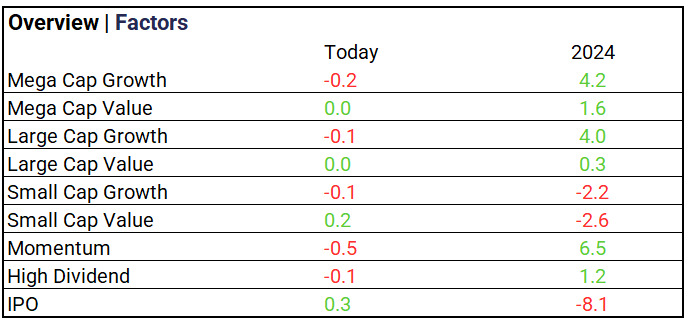

- Factors: IPOs and Small Cap Value gain while Momentum lags.

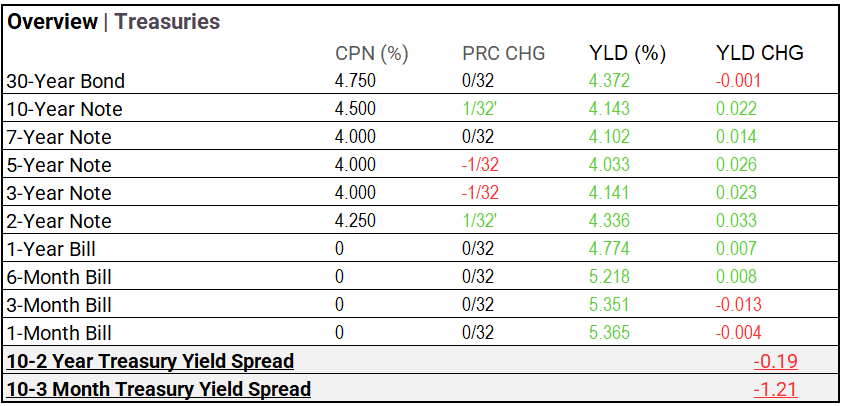

- Treasury Markets: 2-Year Note lead gainers, 30-Year Bond retraced, and Bills mostly declined.

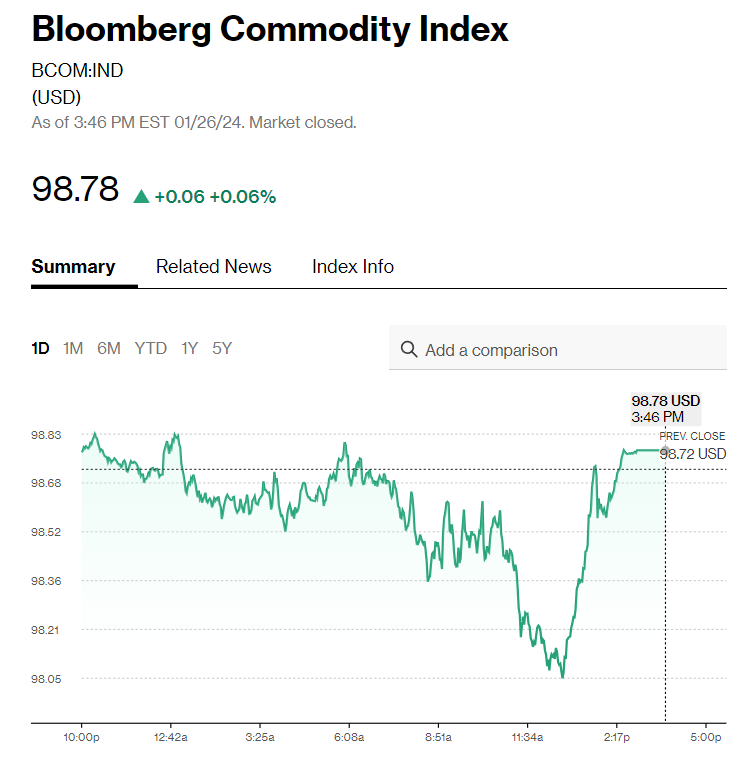

- Commodities: Bitcoin gains nearly 2k; Gold, Bitcoin, Crude Oil Futures, and Bloomberg Commodity Index also rise.

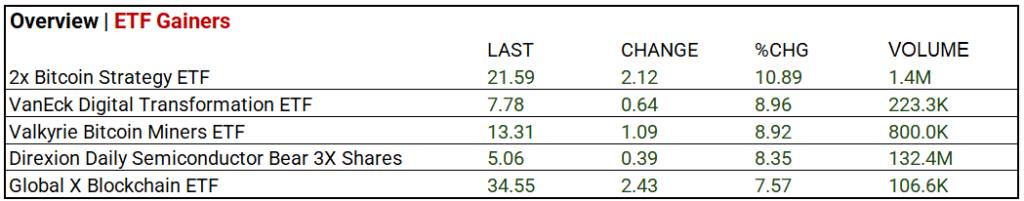

- ETFs: 2x Bitcoin Strategy ETF jumps 10.89% with good 1.4m volume.

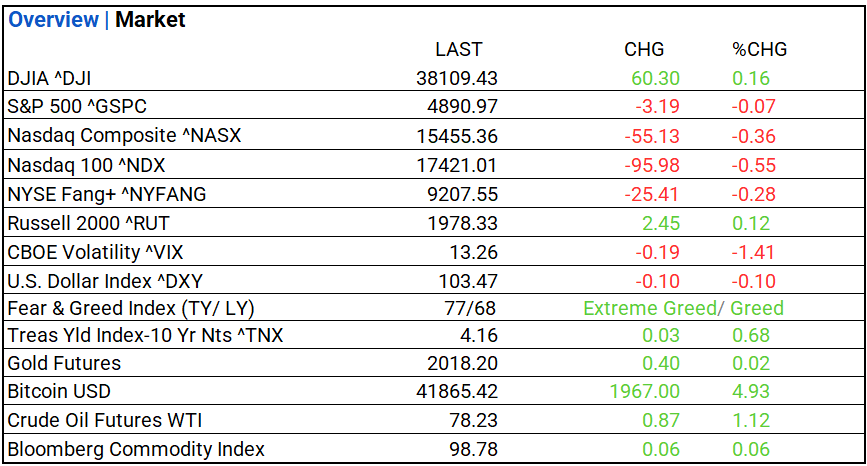

US Market Snapshot: Key Stock Market Indices:

- DJIA ^DJI: 38,109.43, 60.30, 0.16%

- S&P 500 ^GSPC: 4,890.97, -3.19, -0.07%

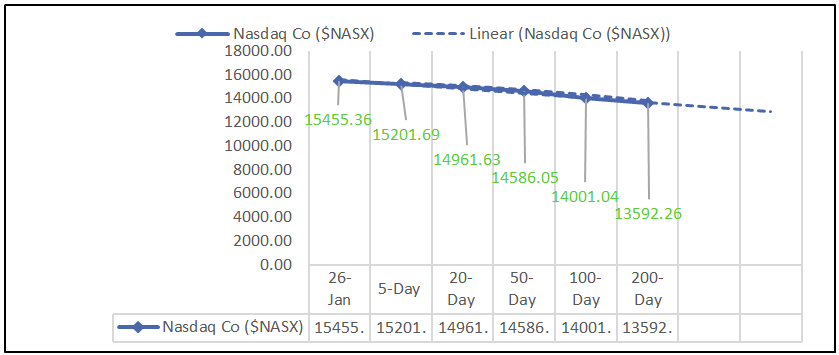

- Nasdaq Composite ^NASX: 15,455.36, -55.13, -0.36%

- Nasdaq 100 ^NDX: 17,421.01, -95.98, -0.55%

- NYSE Fang+ ^NYFANG: 9,207.55, -25.41, -0.28%

- Russell 2000 ^RUT: 1,978.33, 2.45, 0.12%

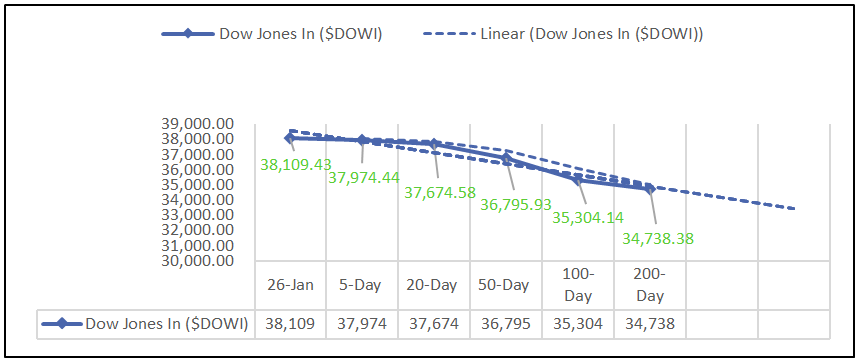

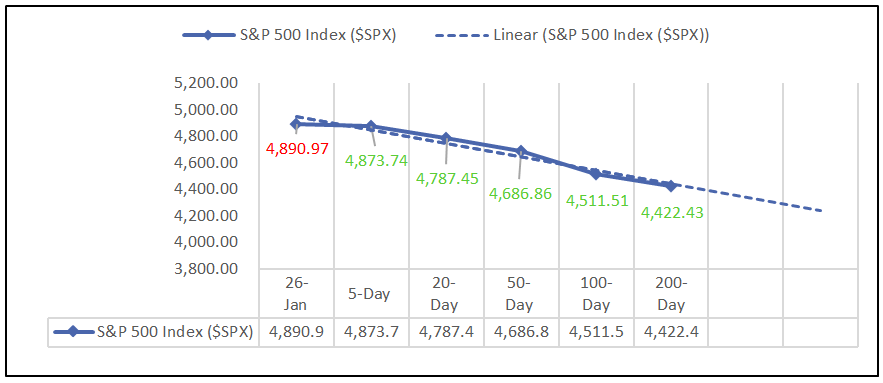

Moving Averages: DOW, S&P 500, NASDAQ:

NASDAQ Global Market Summary:

Sectors:

- 6 of 11 sectors higher; Energy (+0.76%) leading, Information Technology (-1.05%) lagging. Top industries: Consumer Finance (+5.62%), Leisure Products (+2.06%), Media (+1.70%), and Textiles, Apparel & Luxury Goods (+1.62%).

Factors:

- IPOs and Small Cap Value lead, Mega Cap Growth starts ’24 strong, up 4.2% YTD.

Treasury Markets:

- 2-Year Note lead gainers, 30-Year Bond retraced, and Bills mostly declined.

Currency and Volatility:

- U.S. Dollar Index ^DXY: 103.47 (-0.10, -0.10%)

- CBOE Volatility ^VIX: 13.26 (-0.19, -1.41%)

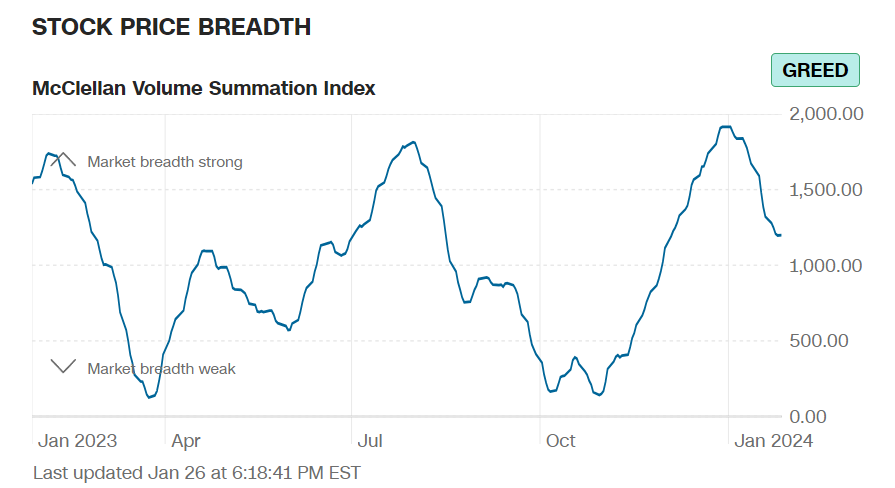

- Fear & Greed Index: 77/LY 68 (Extreme Greed/ Greed)

Commodity Markets:

- Gold Futures: $2,018.20, +$0.02, +0.40%

- Bitcoin USD: $41,865.42, +$1,967.00, +4.93%

- Crude Oil Futures WTI: $78.23, +$0.87, +1.12%

- Bloomberg Commodity Index: 98.78, +$0.06, +0.06%

ETF’s:

- 2x Bitcoin Strategy ETF jumps 10.89% with higher volume reaching 1.4 million.

US Economic Data:

- Personal Income Dec. 0.3% (fc: 0.3%, prior: 0.4%)

- Personal Spending Dec. 0.7% (fc: 0.5%, prior: 0.4%)

- PCE Index Dec. 0.2% (fc: –, prior: -0.1%)

- Core PCE Index Dec. 0.2% (fc: 0.2%, prior: 0.1%)

- PCE (Year-over-year) 2.6% (fc: –, prior: 2.6%)

- Core PCE (Year-over-year) 2.9% (fc: 3.0%, prior: 3.2%)

- Pending Home Sales Dec. 8.3% (fc: 2.0%, prior: -0.3%)

Earnings:

- Q4 Forecast: Analysts significantly lowered S&P 500 companies’ Q4 earnings per share (EPS) estimates during October and November, with a 5.0% decline in the bottom-up EPS estimate. This drop surpasses the average declines over the past 5, 10, 15, and 20 years, marking the most substantial decrease since Q1 2023. Among sectors, Health Care experienced the largest decline (-19.9%), while Information Technology saw a modest increase (+1.5%) in their Q4 2023 bottom-up EPS estimates.

Notable Earnings Today:

- BEAT: Colgate-Palmolive (CL), Fanuc Corporation (FANUY), Booz Allen Hamilton (BAH), Autoliv (ALV), Gentex (GNTX), Moog (MOGa), Badger Meter (BMI).,

- MISSED: American Express (AXP), Norfolk Southern (NSC), Volvo ADR (VLVLY), First Citizens BancShares (FCNCA), Nitto Denko Corp (NDEKY), United Bankshares (UBSI), First Hawaiian (FHB), BankUnited (BKU).

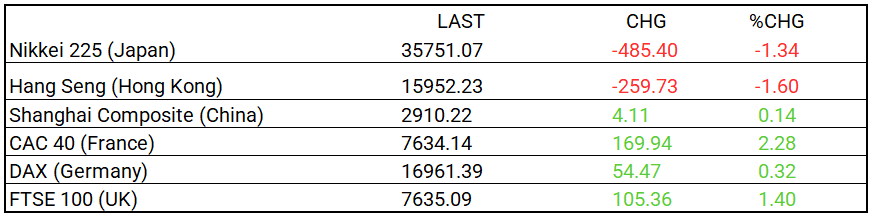

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): 35,751.07, -485.40, -1.34%

- Hang Seng (Hong Kong): 15,952.23, -259.73, -1.60%

- Shanghai Composite (China): 2,910.22, 4.11, 0.14%

- CAC 40 (France): 7,634.14, 169.94, 2.28%

- DAX (Germany): 16,961.39, 54.47, 0.32%

- FTSE 100 (UK): 7,635.09, 105.36, 1.40%

Central Banking and Monetary Policy, Noteworthy:

- Cooler Inflation Keeps Door Open for Rate Cuts This Year – WSJ

- The Fed Gets the Signal It Needs to Cut Rates, but It All Comes Down to the Job Market – WSJ

- Fed’s Preferred Inflation Gauge Cools on Robust Spending – Bloomberg

- Euro Zone Is Crawling Toward 2% Inflation With Shaky Landing – Bloomberg

Energy:

- Red Sea Attacks Push BHP to Divert Shipping – WSJ

- LNG Exports Shouldn’t Be the Next Keystone Campaign – Bloomberg

China:

- Has surprising US economic growth strengthened Washington’s hand in China negotiations? – SCMP