Stay Informed and Stay Ahead: Market Watch, May 31st, 2024.

Late-Week Wall Street Market Digest

Three Key Takeaways

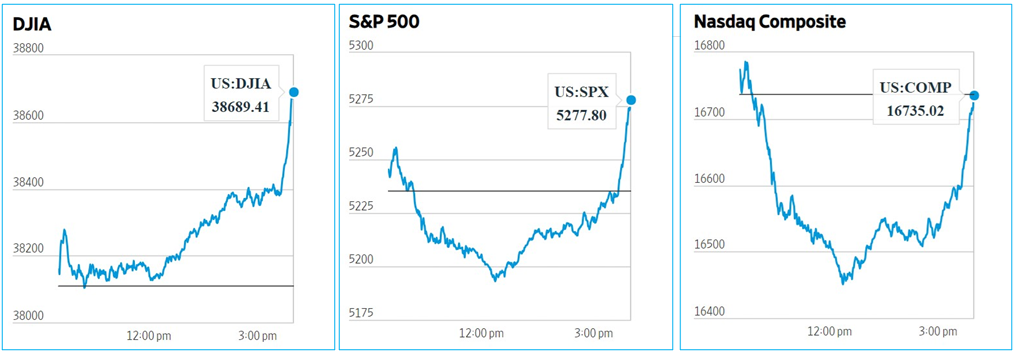

+ DJIA and S&P 500 rose; NASDAQ fell. Sectors: Energy led, Information Technology lagged.

+ PCE index remained stable, while Core PCE decreased slightly with inflation continuing to cool, supporting Q3 rate cuts.

+ NASDAQ shows mixed sentiments with new highs and lows, yet more advances than declines highlight market resilience.

Summary of Market Performance

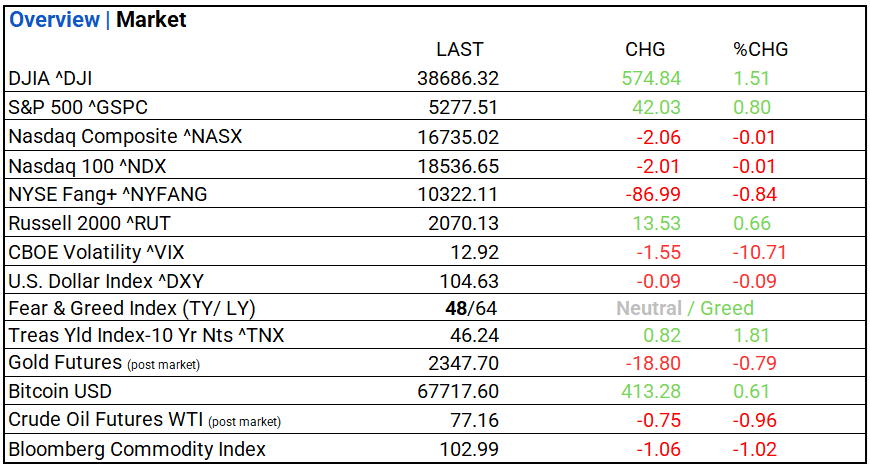

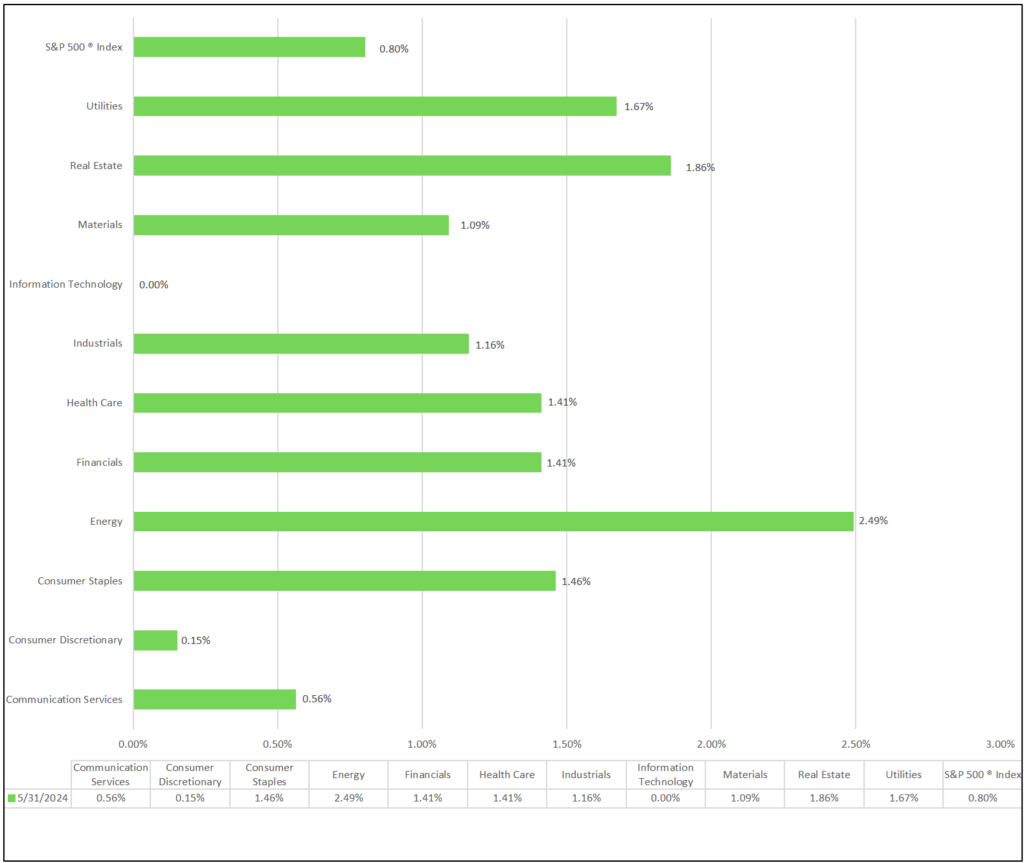

Indices & Sectors Performance:

- Major indices, DJIA and S&P 500 up, NASDAQ declined.

- 10 of 11 sectors increased, Energy leading and Information Technology lagging. Leading Water Utilities (+3.55%), Health Care Providers & Services (+3.28%), and Gas Utilities (+2.96%).

Chart: Performance of Major Indices and Sectors

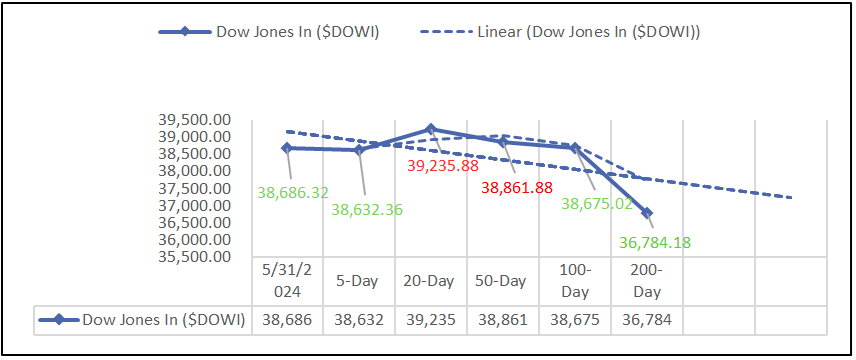

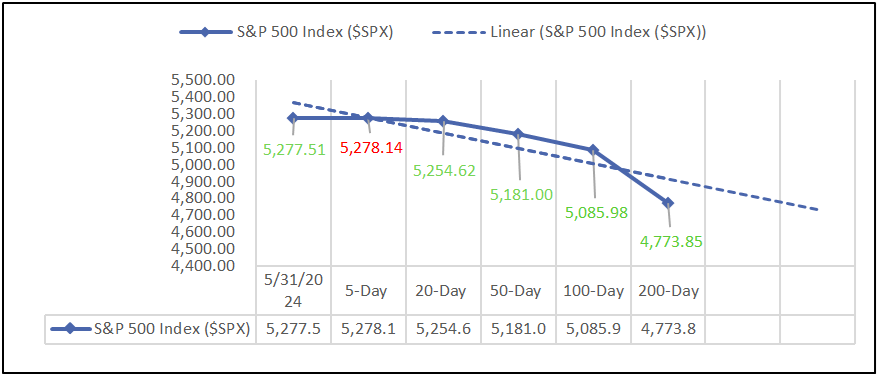

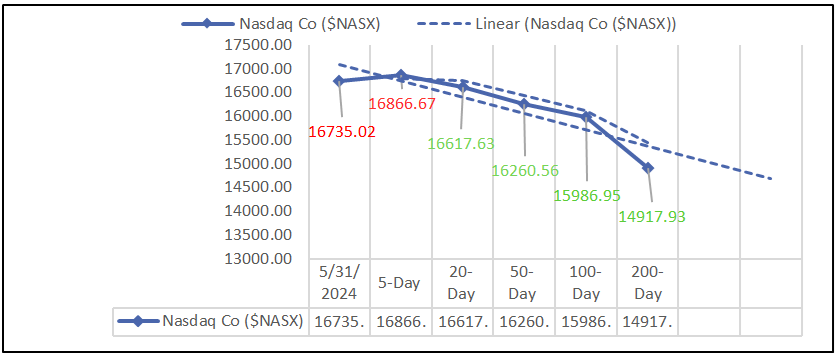

Moving Average Analysis:

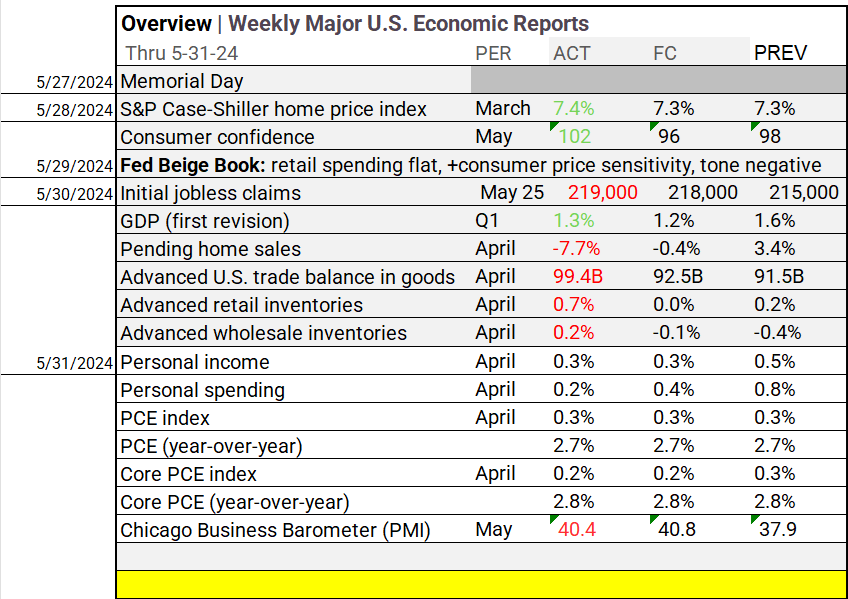

Economic Highlights:

- April saw modest growth in personal income and spending. PCE index remained stable, while Core PCE decreased slightly. Chicago PMI declined.

NASDAQ Global Market Update:

- A mix of new highs and lows suggests both bullish and bearish sentiments. More advances than declines signal market resilience.

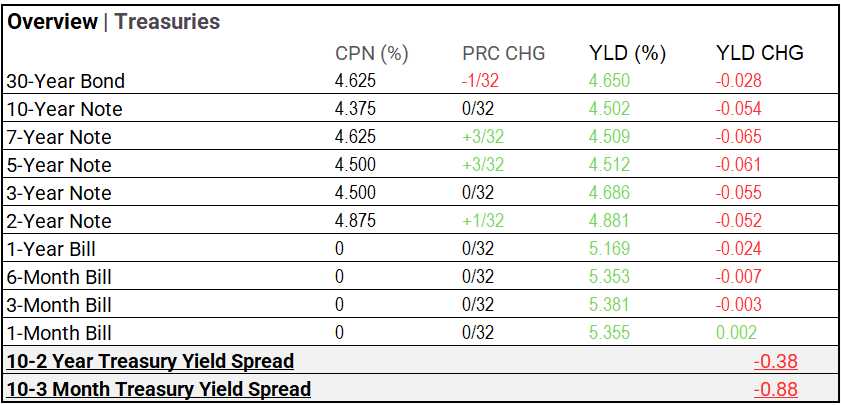

Treasury Markets:

- US Treasury securities showed varied yields and prices: 30-year bond at 4.650%, 10-year note at 4.502%, with yield spreads indicating market shifts.

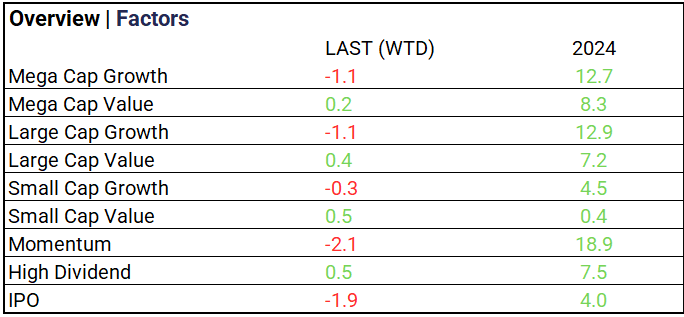

Market Trends:

- Value saw significant weekly gains, led by small caps. Momentum stocks maintained a strong YTD increase of 18.9%.

Currency & Volatility:

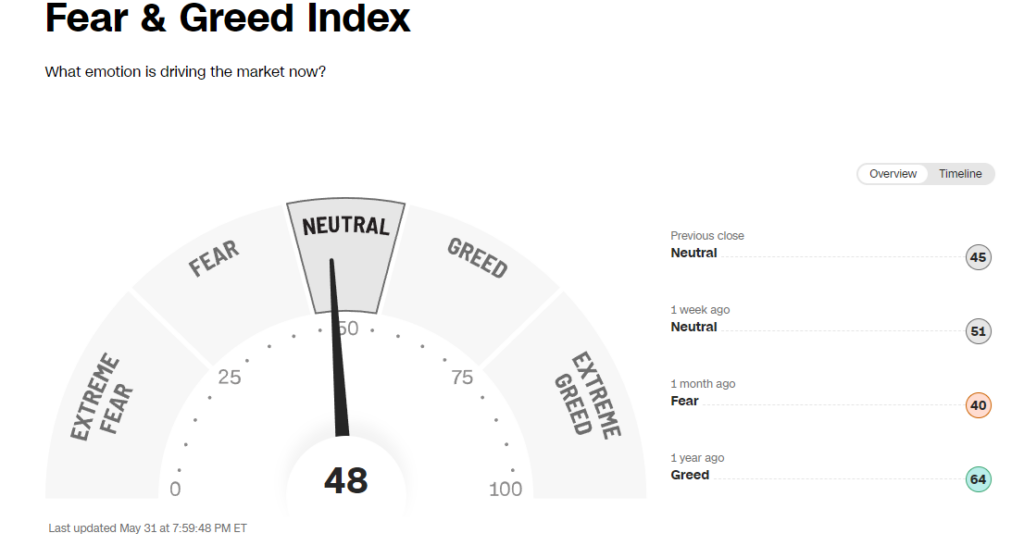

- The US Dollar Index dipped slightly, while CBOE Volatility pulled back to 12.92. The Fear & Greed Index remains neutral.

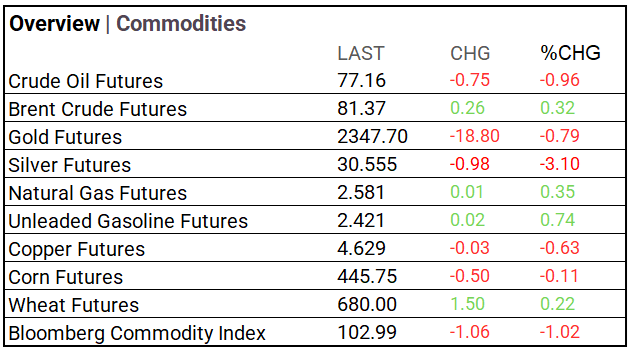

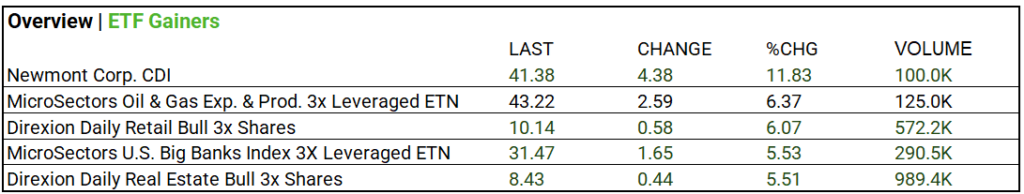

Commodities & ETFs:

- In commodity markets, Brent Crude rose, while Gold and Silver fell. Overall, the Bloomberg Commodity Index saw a decline.

- ETF’s, Newmont Corp. CDI surged by 11.83%, while leveraged oil, retail, and banking ETNs also experienced significant gains in volume.

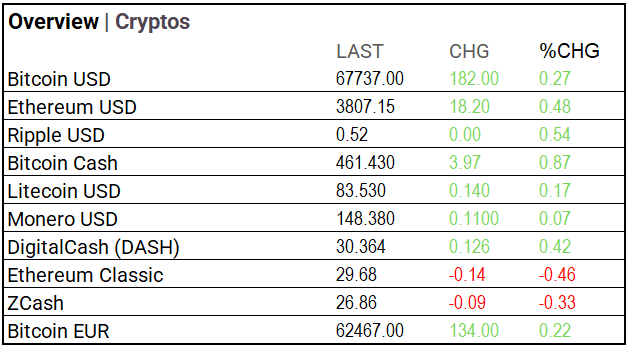

Cryptocurrency Update:

- Cryptocurrency market: Bitcoin rose to $67,737, Ethereum to $3,807. Ripple stable at $0.52.

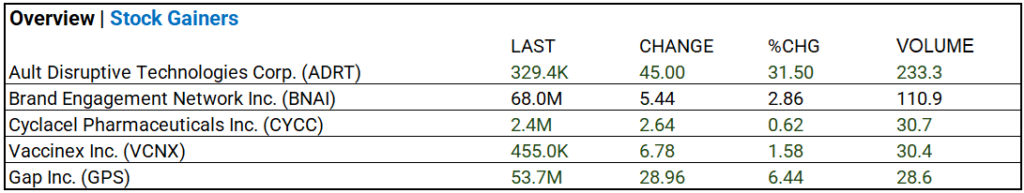

Stocks:

- Ault Disruptive Technologies soared by 31.50%, Brand Engagement Network rose by 2.86%, and Gap Inc. surged by 6.44%.

Notable Earnings Today:

- BRP Inc (DOOO) exceeded earnings expectations in an otherwise inactive day.

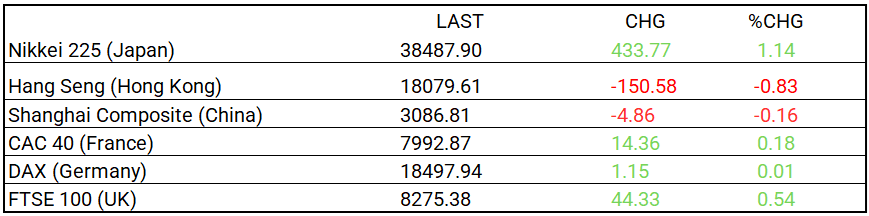

Global Markets Summary:

- Japan up while Hong Kong and China declined, with Europe modesty gaining.

In the NEWS:

Central Banking and Monetary Policy:

- The Fed Might Soon Have to Worry About More Than Just Inflation – Wall Street Journal

- Euro-Zone Inflation Up More Than Expected Before ECB Cut – Bloomberg

Business:

- Autodesk Won’t Restate Financial Results Following Accounting Probe – Wall Street Journal

- Gap’s Red Carpet Pivot Is a Hit With Shoppers and Wall Street – Bloomberg

China:

- China’s factory activity shrinks in May amid uneven economic recovery – South China Morning Post