Stay Informed and Stay Ahead: Economic Information, March 1st, 2024.

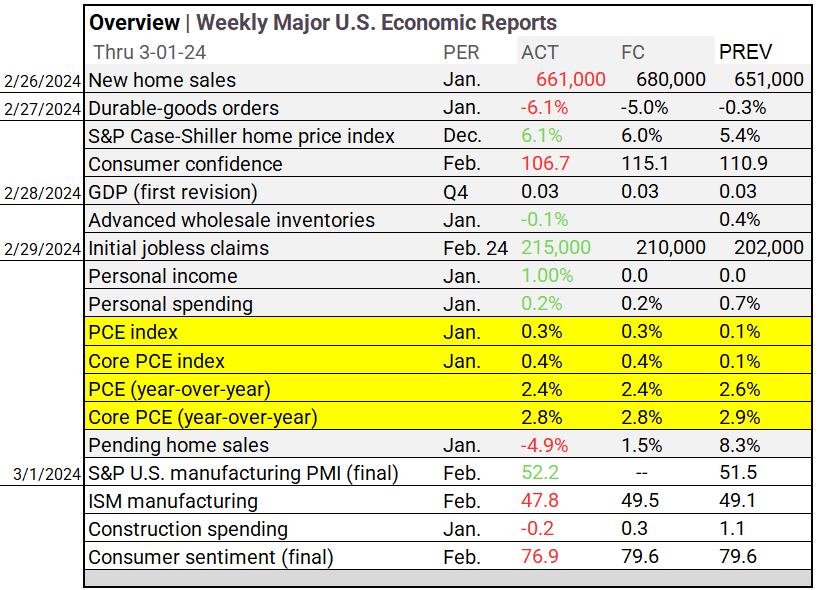

Overview | Weekly Major U.S. Economic Reports

Weekly Major U.S. Economic Reports Week Ending 3-1-24

Market Data: Economic Reports

-

Key Economic PCE Data: In January, the Personal Consumption Expenditure (PCE) index, a key measure of inflation based on what consumers spend, showed a 0.3% increase, consistent with analyst expecations. The Core PCE index, which excludes volatile food and energy prices, also rose by 0.4%, mirroring market consensus. Looking at the year-over-year figures, the PCE index rose by 2.4%, improving on the level as the previous period. While Core PCE index, which is considered a more stable measure of inflation, showed a slight improvement, reaching 2.8%, compared to the previous year’s 2.9%. This suggests a modest easing in underlying inflationary pressures when excluding volatile components.

-

Other Economic Data: Housing fluctuates and late week sales reports soft; Consumer Confidence dips; Manufacturing shows modest growth; Personal Income and Spending remain stable.

Overall: Inflationary pressures ease, PCE data relieve Fed stress, hinting at summer rate cuts