Week Ahead – Resilient Growth, Policy Pause, and Volatility in Check

Summary: The global economy’s resilience and easing inflation have kept central banks on a cautious pause, supporting a moderately risk-on stance going into the week. We highlight our allocation guidance (favoring equities) and key risks to watch – including upcoming central bank moves and geopolitical flare-ups – as we launch our VMSI index for institutional-grade insight.

Macro Outlook

Global growth is proving more robust than anticipated, with recession fears still unrealized as we enter 2026. Inflation pressures continue to moderate, giving major central banks room to hold steady or even consider easing. The U.S. Federal Reserve, for instance, left rates unchanged at a 3.50–3.75% range last week, as Chair Powell noted the economy’s “solid” performance and diminished risks to inflation – signaling a high bar for any further rate moves in the near term. In Europe, the ECB is likewise expected to hold its policy rate at 2.0% at this Thursday’s meeting now that Eurozone inflation has basically returned to target. Equity markets have responded positively: year-to-date gains are broadening beyond the once-narrow mega-cap tech rally, with leadership extending into emerging markets and other sectors. Volatility persists in pockets, but so far it reflects isolated risk events rather than a fundamental change in trend.

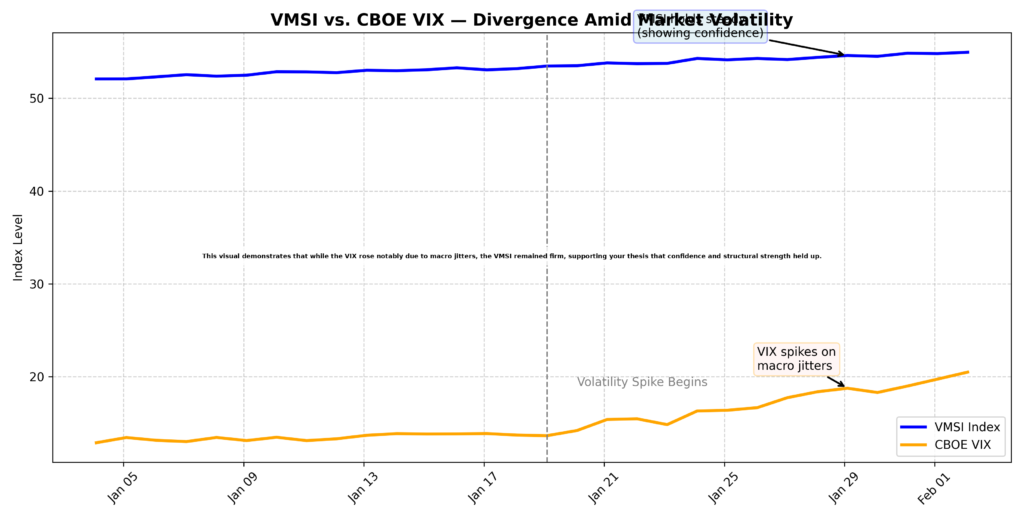

(VMSI) vs. CBOE VIX. The VMSI – a comprehensive gauge of market psychology integrating liquidity, institutional flows, and leverage – has stayed relatively elevated even as the VIX spiked on recent market jitters. This positive divergence suggests that underlying investor confidence and stability remained intact despite a short-term rise in hedging activity. In other words, the uptick in volatility was not fully corroborated by a deterioration in fundamentals or risk appetite, which aligns with our continued moderately risk-on stance. (If VMSI were to roll over sharply, that would signal a more cautious outlook ahead.)

Forward-Looking Allocation

-

Equities – Overweight: We maintain a tilt toward equities over bonds, given resilient growth and a potentially more accommodative policy backdrop. Market breadth is improving, and risk appetite is expanding across regions. We favor selective cyclicals (e.g. Industrials, Healthcare) and emerging market stocks benefiting from a weaker USD and policy support, while remaining cautious on overstretched consumer sectors.

-

Fixed Income – Neutral (Prefer Yield): Within fixed income we prioritize income (“carry”) over price appreciation. With central bank actions largely priced in, long-duration developed market government bonds remain less attractive (vulnerable to yield curve steepening). We prefer high-quality credit and EM hard-currency bonds where yield premiums and improving fundamentals offer better risk-reward. Active selection is key, as tight spreads mean credit markets are punishing idiosyncratic risks.

-

Gold – Maintain Hedge: We continue to hold gold as a strategic hedge. Ongoing geopolitical tensions and policy uncertainties are supporting gold’s appeal as a safe-haven asset. A modest allocation to gold helps diversify the portfolio and protect against tail-risk events (especially with real yields off highs and central banks steady or easing).

Top Macro Risks

-

Sticky Inflation or Policy Error: Inflation has been easing, but any upside surprise in prices or wages could rattle markets. The Fed itself warns that inflation risks, though reduced, “still exist”. If price pressures don’t fall as expected (or if central banks misjudge the situation), we could see a hawkish pivot or a delay in the anticipated rate cuts.

-

Policy & Political Uncertainty: Unpredictable economic policies can quickly change the market tone. For example, the current U.S. administration’s volatile policy moves and central bank leadership transitions (the Fed and other institutions face key appointments in 2026) inject uncertainty. Any aggressive fiscal maneuvers, regulatory shocks, or political conflicts (e.g. debt ceiling standoffs) could spur volatility and risk-off swings.

-

Geopolitical Flashpoints: Geopolitical tensions remain a wild card. Escalation of conflicts or new flashpoints – whether in energy-producing regions, great-power relations, or other hotspots – could drive a flight to safety overnight. Such events can spike volatility and disrupt the otherwise positive market narrative (as seen when hedging demand surges on headlines). We stay alert to geopolitical news and hedge exposures accordingly.

-

Growth Downturn Scenario: Our base case is continued modest growth, but a shock downturn is a key risk to monitor. Some analysts caution that a mild U.S. recession in the first half of 2026, while not likely, is possible under certain conditions (e.g. if consumer spending suddenly pulls back or global demand falters). Should growth unexpectedly contract, corporate earnings would weaken and risk assets would likely retreat – underscoring the importance of diversification and nimble risk management.

Disclaimer

This report is for informational purposes only and does not constitute investment advice. All investments carry risk of loss. Past performance is not indicative of future results. Consider your own objectives and consult a professional before making any investment decisions.

VMSI Index Access

For deeper insights and real-time market sentiment analysis, access the VICA Market Sentiment Index (VMSI) on our platform. The VMSI gives you an institutional edge by quantifying where capital is flowing and how risk is being priced – invaluable for fund managers navigating today’s markets.