Equities Remain Firm as Volatility Resets

Summary: Global risk assets remain resilient despite mixed index performance. U.S. equities are holding near highs, credit remains stable, and volatility continues to compress — a combination that signals controlled risk-on positioning rather than euphoric risk chasing. The key message heading into the week: institutions are staying invested, but hedging remains active beneath the surface.

Market Snapshot (Week Ending Feb 6, 2026)

The tape remains constructive, but leadership is uneven:

-

S&P 500 ($SPX): 6,932.30 (+0.23% past 5 days)

-

Nasdaq Composite ($NASX): 23,031.21 (-1.45% past 5 days)

-

Dow Jones ($DOWI): 50,115.67 (+2.74% past 5 days)

Volatility and institutional sentiment remain more revealing than index headlines:

-

VIX: 17.76 (-3.16% past 5 days)

-

VMSI Composite: 54.8 (Cautionary Optimism / controlled risk-on)

Cross-asset confirmation remains supportive:

-

High Yield Credit (HYG): 80.81 (+0.35% past 5 days)

-

Investment Grade Credit (LQD): 110.56 (+0.05% past 5 days)

-

U.S. Dollar (UUP): 27.01 (-0.30% past 5 days)

-

Gold Miners (GDX): 97.39 (+5.35% past 5 days)

Interpretation: equities are holding firm, credit markets remain cooperative, the dollar is easing, and gold exposure is rising — suggesting institutions are adding risk while quietly increasing defensive hedges.

VMSI Signal (Institutional Sentiment Check)

The VICA Institutional Market Sentiment Index remains stable in moderately elevated territory, reinforcing a controlled risk-on regime:

-

Composite: 54.8

-

Momentum: 52.7

-

Liquidity: 54.5

-

Volatility & Hedging: 56.8

-

Safe Haven Demand: 59.1

This is not an “all-clear” signal — it reflects a measured allocation environment. Institutions appear willing to stay long, but not willing to abandon defense.

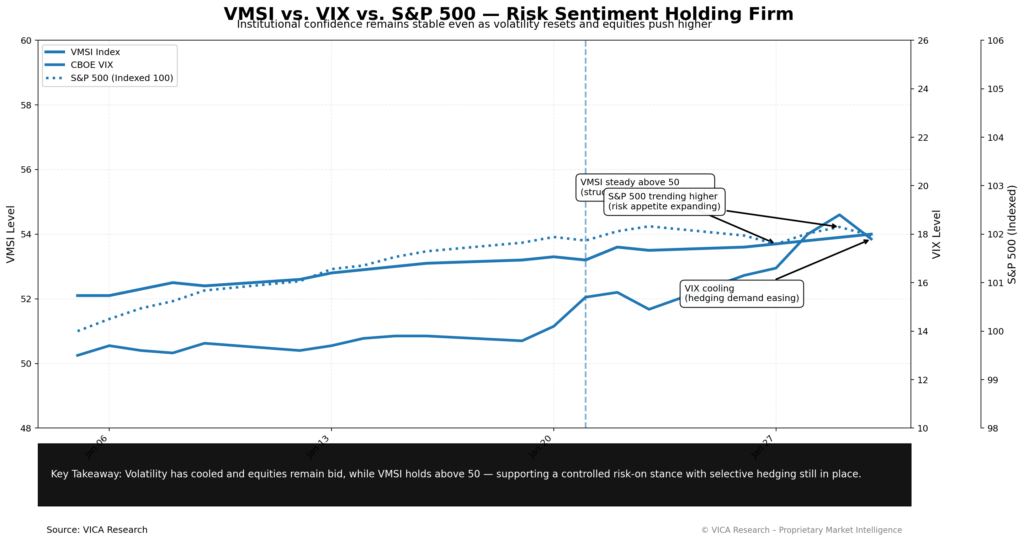

VMSI vs. VIX vs. S&P 500

Equities remain firm as the volatility complex continues to unwind. The VIX compression suggests reduced near-term fear pricing, yet VMSI remains elevated — implying risk appetite is present, but still disciplined.

The divergence matters: volatility is falling faster than institutional caution is easing. That combination often supports continued upside — but it also signals that the market is not fully pricing future shocks.

This Week’s Catalysts (Event Risk Map)

This week’s calendar carries enough weight to reprice rates quickly:

-

Tue, Feb 10: Retail Sales + NFIB Optimism + Employment Cost Index

-

Wed, Feb 11: U.S. Employment Report + Unemployment Rate + Wage Growth

-

Thu, Feb 12: Jobless Claims + Existing Home Sales

-

Fri, Feb 13: CPI Inflation (Core + Headline)

Market sensitivity is highest around CPI. With volatility compressed, any inflation surprise could trigger rapid repositioning.

Forward Positioning (Institutional Guidance)

We remain moderately risk-on, but this is a market that rewards discipline.

Equities — Overweight (Selective): The S&P remains firm near highs, and breadth is stabilizing. Maintain equity exposure, but avoid concentration risk. Cyclical strength is improving, though leadership remains uneven beneath the surface.

Credit — Neutral to Overweight (Carry Focus): HYG and LQD stability confirms credit stress is not building. This remains a carry-driven environment, not a duration-driven environment.

Gold — Maintain Hedge: The sharp move in gold miners (GDX +5.35% weekly) is a real signal: institutions are buying insurance even as equities hold. Maintain exposure as a geopolitical and inflation hedge.

USD — Watch for further softness: A weaker dollar supports emerging markets and global risk allocation. If the dollar continues drifting lower, it becomes an additional tailwind for risk assets.

Key Risk (The One That Matters Most)

The dominant risk this week is simple: inflation data forcing a re-pricing of rates.

With volatility compressed and equity multiples elevated, a CPI upside surprise would be enough to trigger a fast volatility reset — even if growth remains intact.

Bottom Line

Markets are not euphoric — they are positioned. The data supports a controlled risk-on posture, but hedging activity is quietly rising. This is a market that can continue higher, but one that will punish complacency quickly if inflation reaccelerates.

This is a market built on stability — and stability is a fragile asset.

Disclaimer

This report is for informational purposes only and does not constitute investment advice. All investments carry risk of loss. Past performance is not indicative of future results. Consider your own objectives and consult a professional before making any investment decisions.

VMSI Index Access

Track real-time market sentiment with the VICA Market Sentiment Index (VMSI) — a quant-backed gauge of capital flow and risk pricing. Designed for institutional investors. Full relaunch coming March 2026.