VICA Partners Intelligence | April 2025

A regime transition in capital allocation is underway—and the smartest money is leading the shift.

Executive Summary

Market stress has returned—policy fragility, terminal rate confusion, cross-asset volatility, and margin degradation across risk assets are all colliding. But while passive capital seeks narrative comfort, strategic capital is executing a controlled reallocation regime.

This piece outlines how America’s largest allocators are repositioning across liquidity tiers, yield curves, credit duration, and sectoral convexity to preserve optionality and build forward return asymmetry.

Liquidity as Optionality: Cash Levels Are a Signal

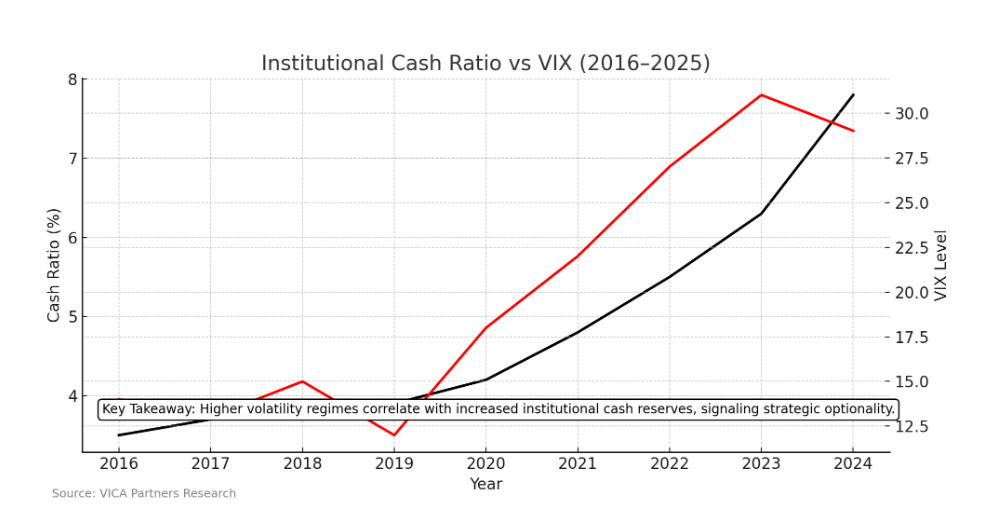

Institutional portfolios have tactically raised cash allocations to a 5-year high, not as a risk-off hedge, but as a volatility harvesting weapon.

Technical Insight:

- 3M Treasury yield remains above 5%, providing risk-free convexity.

- Volatility-adjusted Sharpe ratio on short-duration cash equivalents exceeds most equity beta since Q1.

- Implied correlation among S&P constituents has widened >0.65, creating dislocation entry windows for pair traders.

Institutional Cash Ratio vs VIX (2016–2025)

Key Takeaway: Higher volatility regimes correlate with increased institutional cash reserves, signaling strategic optionality.

“When market participants fear cash drag, we see reentry optionality priced at a discount.”

— CIO, $120B diversified allocator

Regime-Based Sector Rotation: From Duration to Defensibility

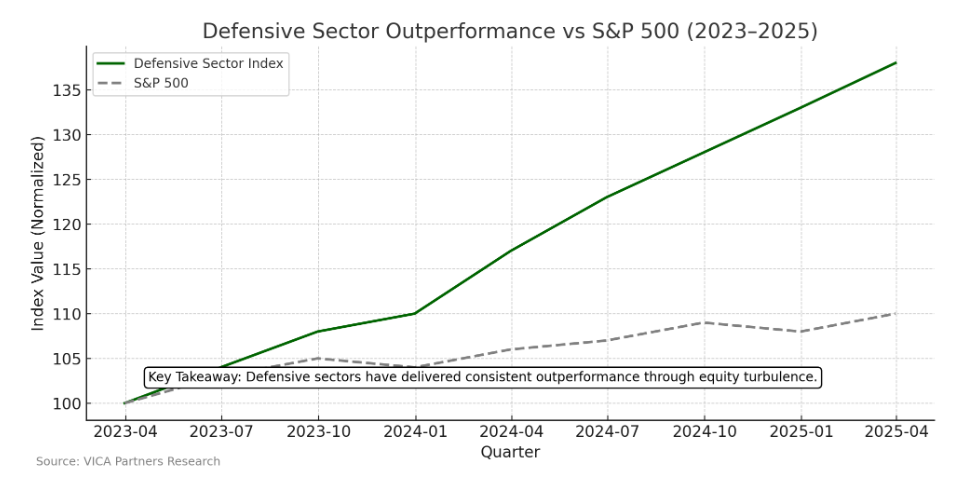

Institutional flows are rotating out of long-duration, high-multiple names and into capital-efficient, earnings-stable sectors. This is not a growth-to-value rotation—it’s a regime correction centered on margin reliability and non-correlation.

Allocator Positioning Patterns:

- Overweight: Healthcare, Utilities, Consumer Staples

- Neutral to Underweight: Tech Platforms, Unprofitable Growth, Long-Cycle Industrials

- Factor Tilt: Quality + Dividend Stability over Momentum

Economic Thesis:

In a rising real-rate, declining liquidity regime, valuation multiple expansion compresses, and price leadership shifts to cash-flow resilient entities with operational leverage.

Defensive Sector Outperformance vs S&P 500 (2023–2025)

Key Takeaway: Defensive sectors have delivered consistent outperformance through equity turbulence.

Volatility Isn’t a Threat—It’s an Asset Class

The most sophisticated desks now treat volatility as a deployable instrument, not merely a hedge.

What We’re Seeing:

- Index collars and synthetic puts are being layered into core positions.

- Long volatility relative value trades are returning in macro funds.

- Structured downside protection with skew exploitation is central to beta preservation.

“Hedging isn’t about fear—it’s about enabling risk-on with downside asymmetry,”

— Head of Quant Strategy, Global Macro Fund

Private Markets: Cycle Reset ≠ Cycle Exit

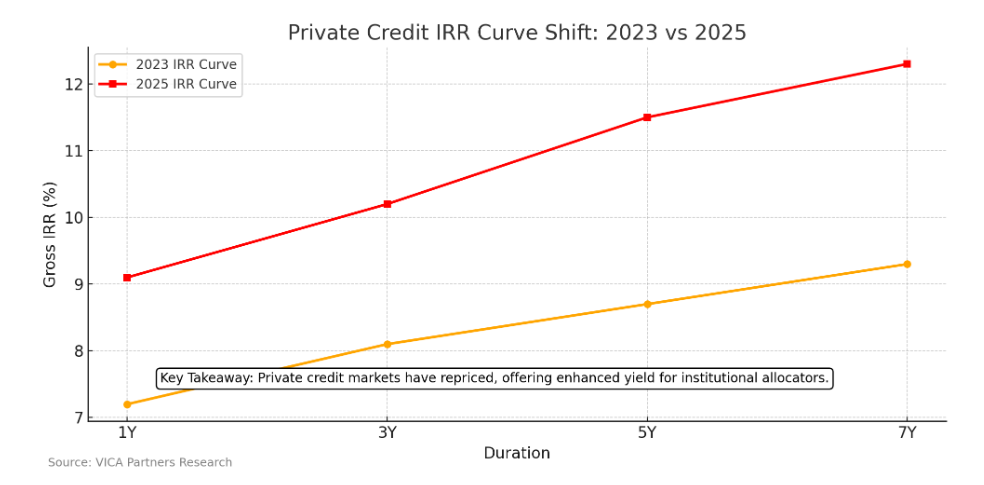

Institutions are not exiting alternatives. They’re demanding repricing, duration anchoring, and control premiums.

Technical Allocator Activity:

- Private credit is commanding 11–13% gross IRRs with low default risk due to covenant strength.

- Real estate is bifurcating: core urban office is repricing down 25–30%, while logistics and medical are being bid up.

- PE Secondaries: LP-led transactions are booming, pricing 10–18% below NAV—true alpha for patient capital.

Private Credit IRR Curve Shift – 2023 vs 2025

Key Takeaway: Private credit markets have repriced, offering enhanced yield for institutional allocators.

The denominator effect is temporary. Discounted access to long-dated IRR is permanent—if sized properly.

FX, Commodities, and Cross-Border Macro Rebalancing

Multi-asset allocators are reintroducing macro overlays to hedge geopolitical instability and FX volatility.

Strategic Hedging Trends:

- Commodities: Select exposure to oil, uranium, and agricultural futures for inflation beta.

- FX: Hedging dollar dominance against CHF, SGD, NOK to avoid real rate mismatch.

- Gold and Bitcoin: Being re-evaluated as cross-cycle geopolitical hedges (modestly, but methodically).

This isn’t a return to 2007-style exoticism—it’s controlled asymmetry construction.

Conclusion: The Buffett Principle in a Volatility Regime

“Be fearful when others are greedy, and greedy when others are fearful.”

— Warren Buffett

Institutional capital isn’t just quoting it—they’re engineering it.

They are:

- Repricing risk, not retreating from it

- Resizing allocations, not abandoning mandates

- Rebuilding forward asymmetry, not chasing backward benchmarks

This is not reactive capital. This is designed capital.

The real money isn’t watching the shift. It is the shift.

Upcoming VICA Visual Intelligence Drops

- Institutional Cash Ratio vs VIX

- Defensive Sector Divergence Tracker

- Private Credit IRR Curve Shift

- Macro Overlay Allocation Map (FX + Commodities)

© 2025 VICA Partners | All rights reserved.

This report is for professional and institutional audiences only. It does not constitute investment advice.