Defensive Positioning Holds as Volatility Rises

May 22, 2025 | VICA Research

Weekly Snapshot

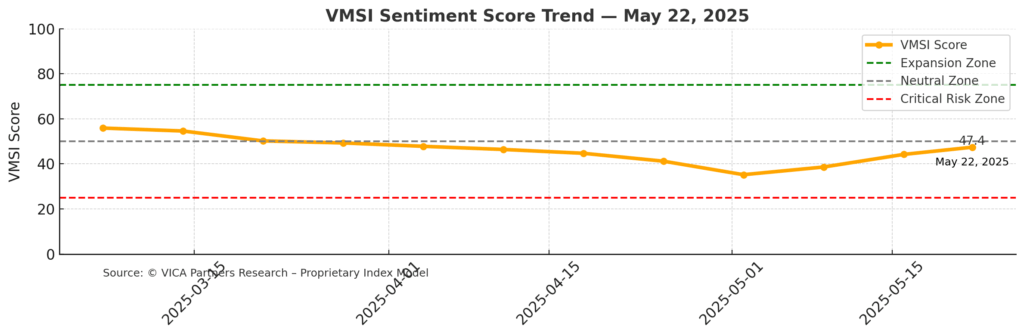

VMSI Score: 47.4 (Defensive Zone)

S&P 500: –0.04% | Nasdaq: +0.28% | Dow: –0.00% | VIX: 20.28

Momentum: 41.6 | Liquidity: 33.7 | Volatility: 66.2 | Safe Haven Demand: 74.0

Markets displayed bifurcated action across key indices, with tech-heavy names lifting the Nasdaq while the Dow and S&P wavered. Despite improving momentum and resilient leadership from semiconductors, institutional sentiment remains defensive as volatility re-accelerates and capital flows stay concentrated. The VMSI advanced to 47.4 — nearing the Cautionary Optimism zone — but broader conviction is not yet visible.

What is VMSI?

The VICA Market Sentiment Index (VMSI)© tracks institutional capital flows, risk posture, and macro volatility weekly. Built for tactical allocation — not behavioral shifts.

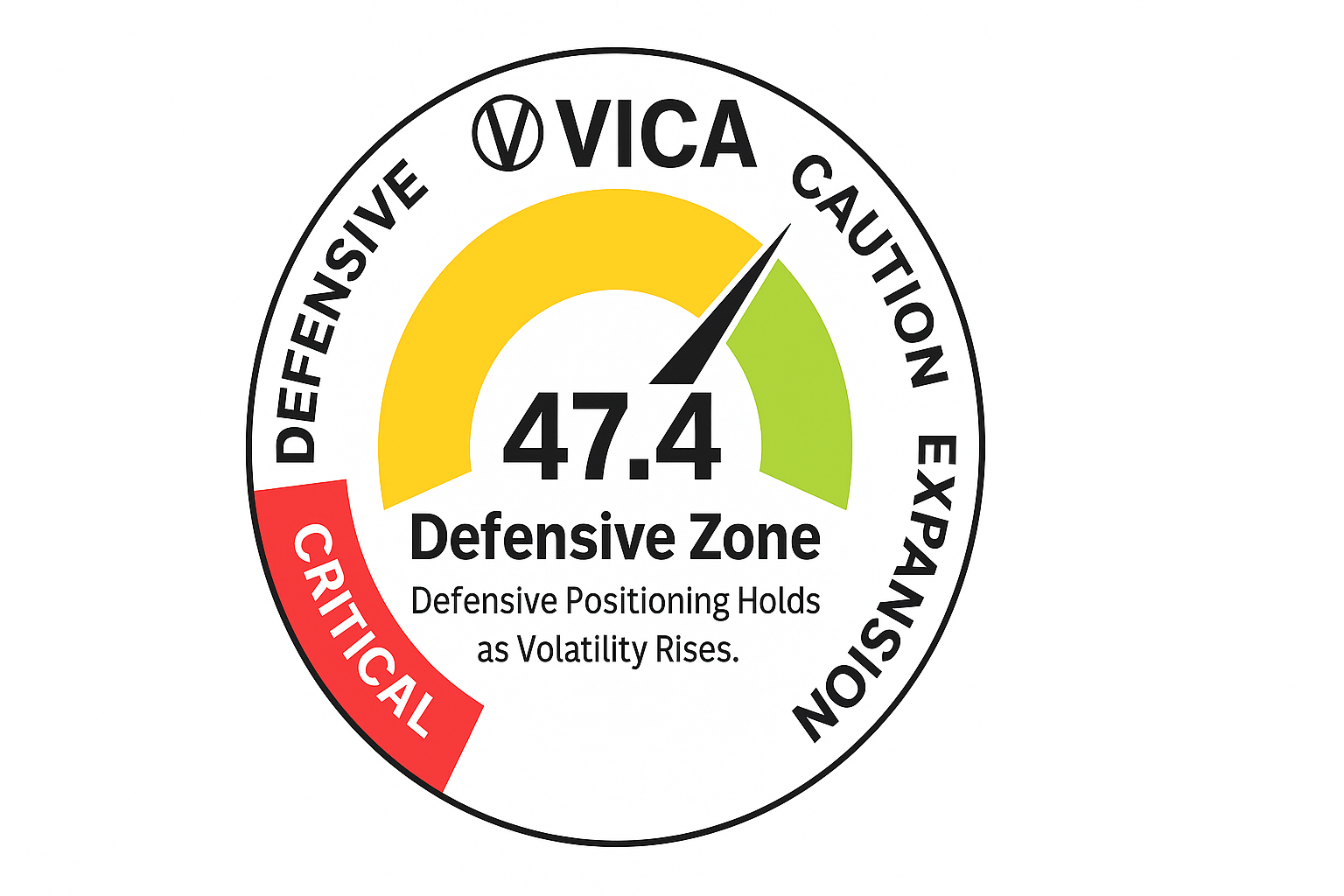

VMSI Gauge — Current Sentiment & Risk Level

VMSI Score – May 22, 2025: 47.4

The gauge shows a fourth straight week of upward movement. Still, sentiment remains defensive, signaling cautious re-engagement without full exposure.

Key Insight: Institutions are beginning to lean in, but caution still prevails.

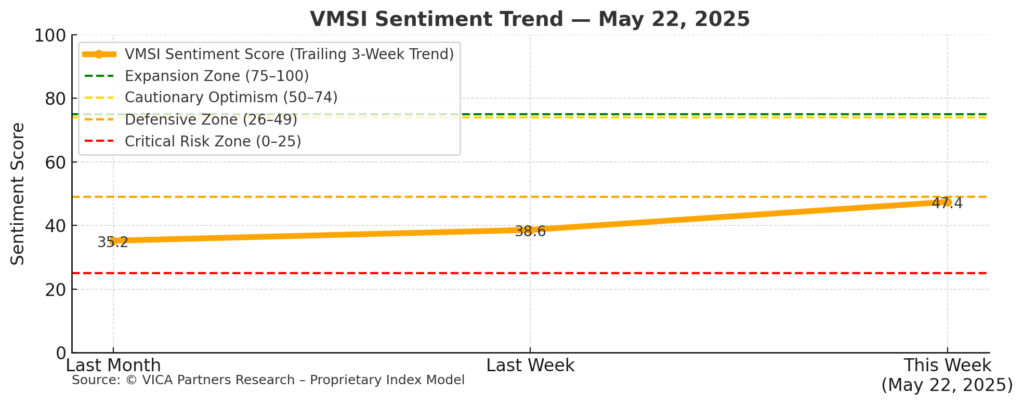

VMSI Timeline — Sentiment Shifts Over Time

The timeline continues its steady ascent from late-April lows. While the directional trend is constructive, sentiment has yet to break into optimistic territory.

Key Insight: Momentum builds, but confidence remains tethered by volatility and credit caution.

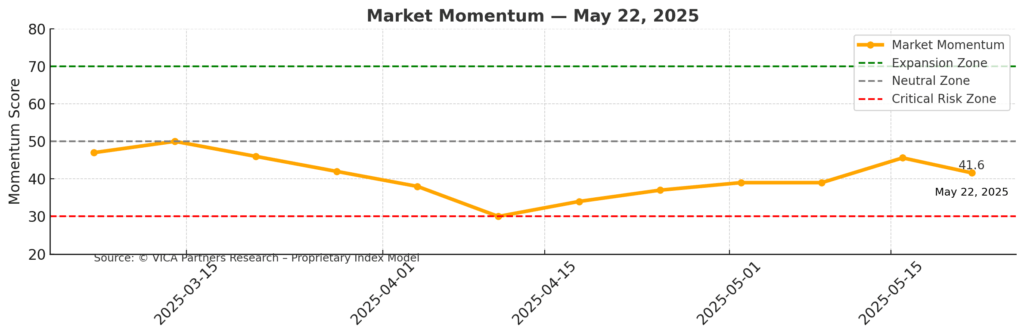

Market Momentum — Institutional Accumulation

Momentum improved to 41.6 as Nasdaq extended leadership. Still, weak Dow performance and uneven S&P internals show participation remains selective.

Key Insight: Leadership is narrow, but improving breadth is encouraging.

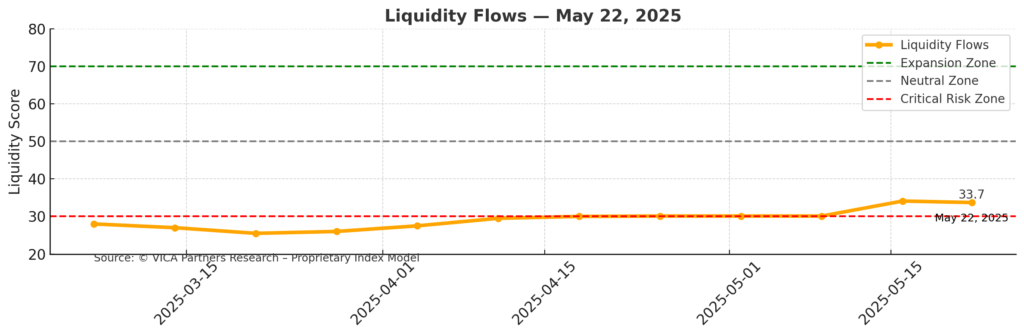

Liquidity Flows — Capital Movement Patterns

Liquidity ticked up to 33.7. Although outflows from small caps and credit persist, redemptions have slowed. Institutions are still deploying capital cautiously.

Key Insight: Stabilization is forming, but risk-on flows remain limited.

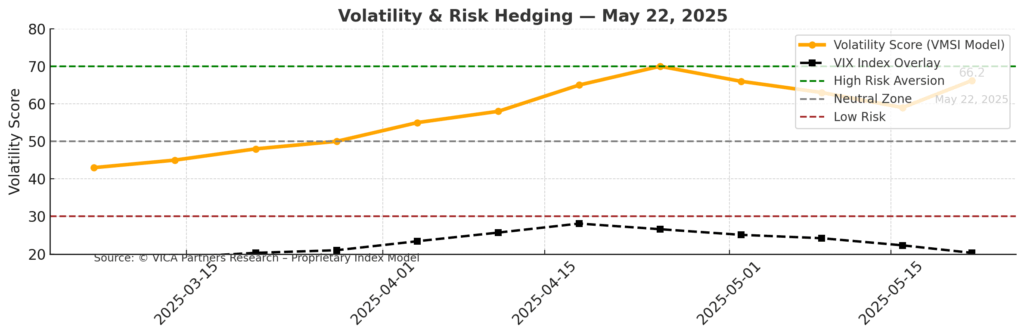

Volatility & Risk Hedging — Uncertainty Barometer

Volatility rose again earlier in the week, with the VIX closing at 20.28. While off intraday highs, the risk hedging index remains elevated at 66.2, as institutions maintain downside coverage.

Key Insight: Risk appetite is returning, but fear is not fully unwound.

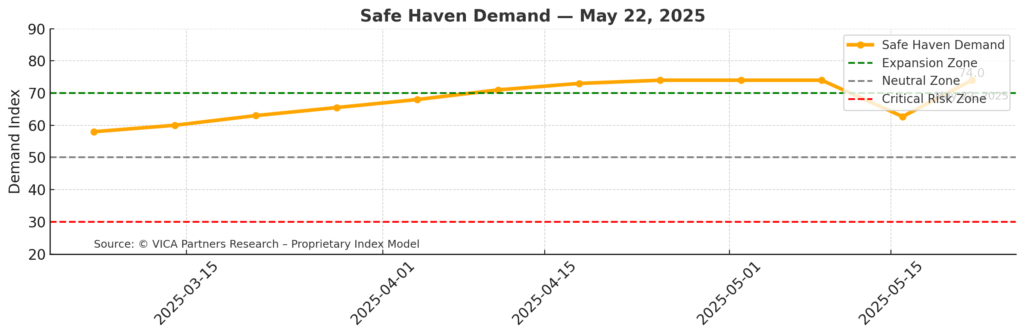

Safe Haven Demand — Flight to Quality

Safe haven demand held firm at 74.0. Despite modest Treasury yield pullback to 4.55%, institutions continue allocating toward lower-volatility assets.

Key Insight: Institutions are still favoring safety as a hedge.

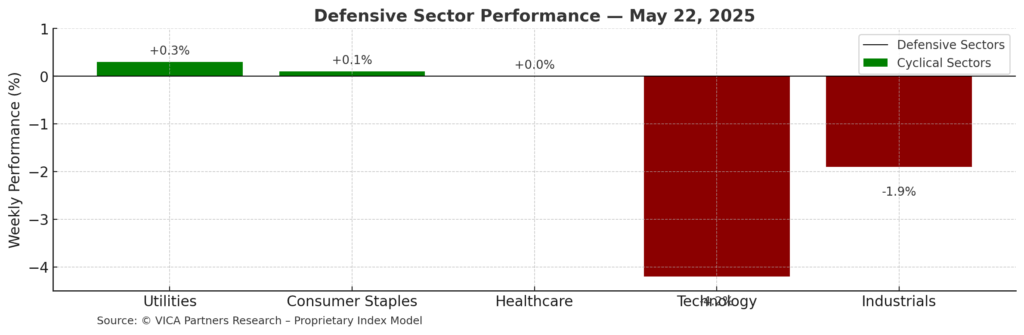

Defensive Sector Rotation — Equity Preference

Utilities and Staples showed mild gains, while Tech leadership persisted. Sector flows remain focused on large-cap defensives and quality growth.

Key Insight: Positioning favors defense, not speculative beta.

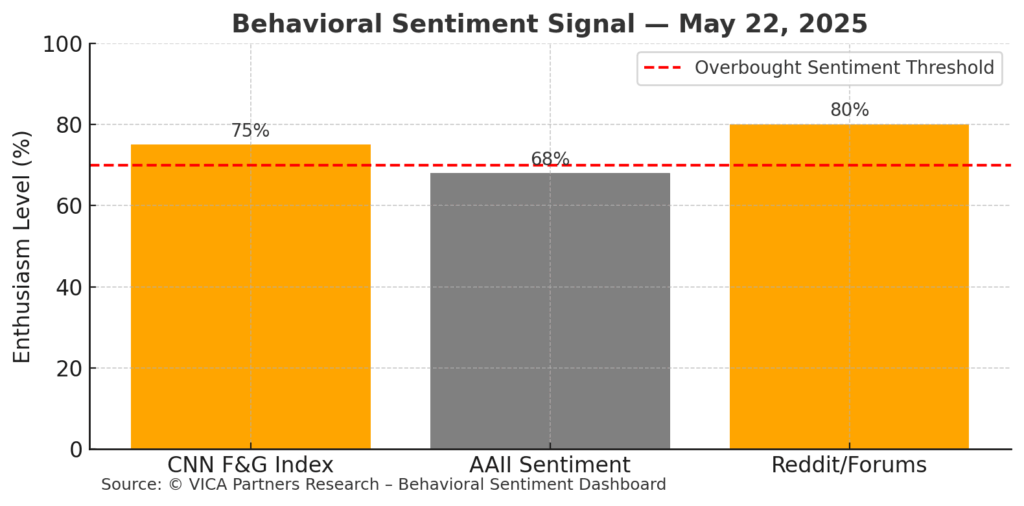

Investor Sentiment Caution Note

Retail sentiment is rising sharply across multiple surveys, despite deteriorating breadth and elevated VIX levels.

- CNN Fear & Greed Index turned bullish

- AAII Bulls outpace Bears 2-to-1

- Reddit and retail platforms show return of speculative optimism

Key Insight: Emotional optimism is disconnected from capital structure. Use caution chasing rallies.

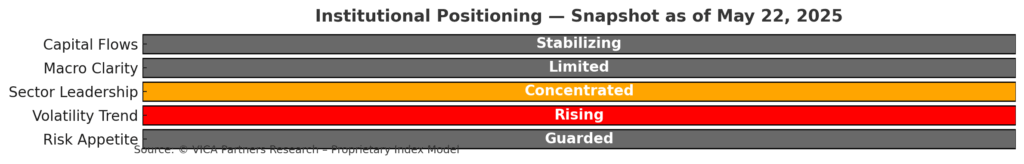

Institutional Positioning Snapshot

Key Insight: Tactical posture remains risk-aware and narrow.

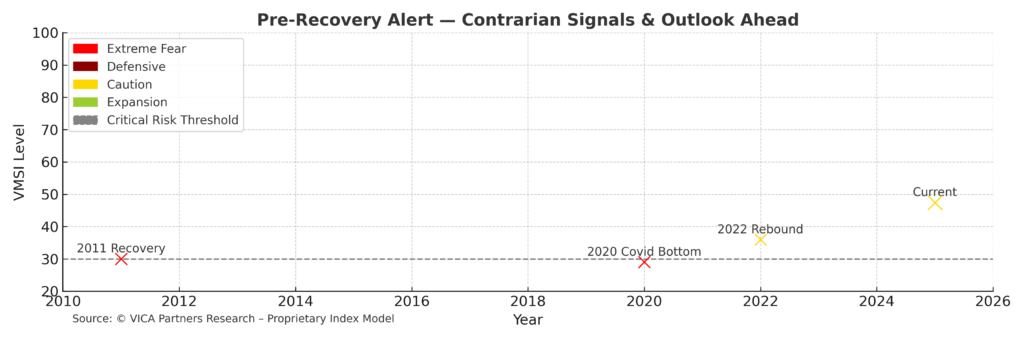

Pre-Recovery Alert — Historical Recovery Zones

Insert: Historical VMSI Recovery Zones – 2011, 2020, 2025

VMSI at 47.4 is now brushing up against levels seen just before inflection points in 2011 and 2020. These pivots require stronger liquidity and conviction.

Key Insight: Recovery possible — but not confirmed.

About the VICA Market Sentiment Index (VMSI)©

The VMSI is VICA Research’s proprietary sentiment gauge designed to track shifts in institutional risk behavior, capital flow posture, and macro-driven volatility signals.

Each weekly score reflects a multi-factor model that blends market structure, flow dynamics, defensive rotation, and volatility hedging — calibrated against technical and behavioral thresholds.

Index Scale:

🟥 0–25: Critical Risk Zone

🟧 26–49: Defensive

🟨 50–74: Cautionary Optimism

🟩 75–100: Expansion / High Confidence

The VMSI updates weekly following Thursday’s market close.

Disclaimer

This report and the proprietary VICA Market Sentiment Index (VMSI)© are confidential works of authorship protected by intellectual property laws. Unauthorized reproduction, copying, redistribution, or use without express permission from VICA Research is strictly prohibited and monitored.

A portion of future VMSI-related proceeds will support global literacy, vocational education, and the advancement of scholars in critical fields like engineering — with a commitment to measurable impact and long-term social return.