VMSI Institutional Market Intelligence Report — August 14, 2025

Source: VICA Partners VMSI © — Data: Proprietary models & public sources

Summary — Week Ending Aug 14, 2025

Institutional capital remains fully engaged at structural highs, with macro tailwinds — stable rates, tight credit spreads, steady USD — reinforcing risk deployment. Allocation pacing is disciplined, hedging is easing, and growth sectors lead. Historically, this configuration has delivered positive 3-month forward returns in 8 of the last 10 comparable periods, keeping the probability of sustained upside into Q4 firmly elevated barring volatility or macro shocks.

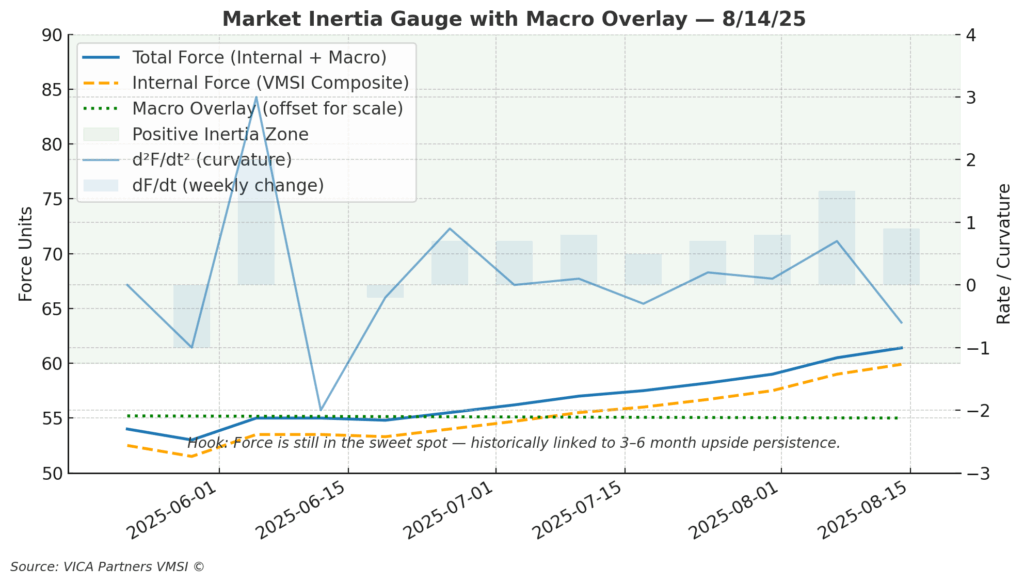

1) Lead Insight — Market Inertia Gauge

Model: Fₜ = φₜ × (Mₜ × aₜ) + Bₜ × uₜ

- Mₜ (Mass): Institutional base (regime-adjusted)

- aₜ (Acceleration): Allocation velocity — strongest in mid-cap growth, industrials, cyclicals

- uₜ (Macro Vector): Policy rate, FCI, credit spreads, USD, inflation expectations, term premium

- Bₜ (Loadings): Regime/crowding-adjusted macro sensitivity

- φₜ (Time Friction): Urgency; elevated when near-term convexity dominates

This Week:

- Positioning: Conviction-weighted exposure at structural highs

- Macro Overlay: Positive — stable rates, tight credit spreads, steady USD

- Time Friction: Stable — allocations paced to avoid overextension

Takeaway: Institutional capital is firmly engaged, macro levers are supportive, and execution remains disciplined. Historically, this force–stability–timing alignment sustains advances over 3–6 months.

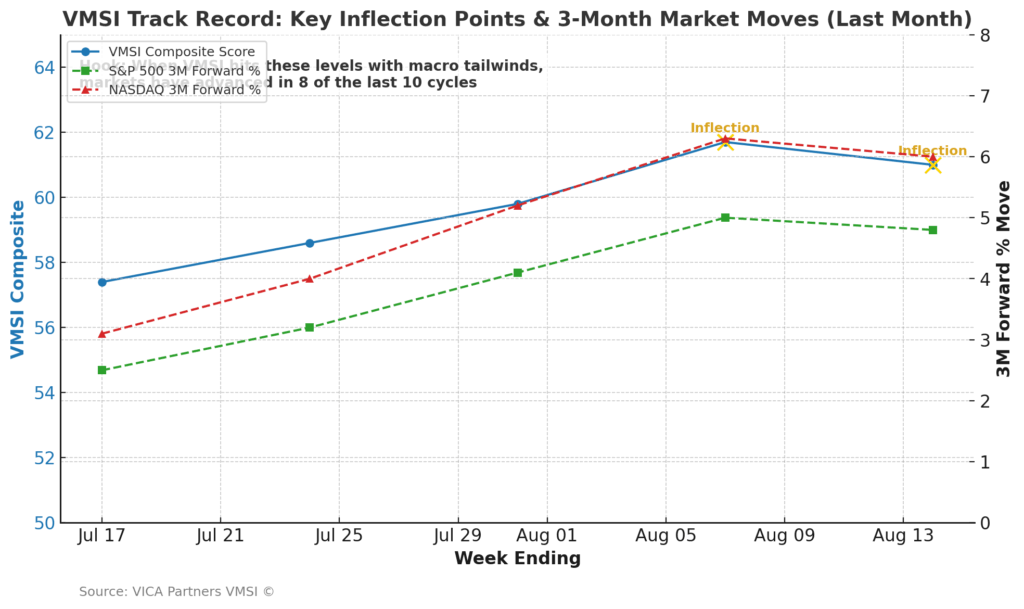

2) VMSI Track Record — Inflection Points

This Week: Composite levels remain near cycle highs, matching prior setups that preceded strong equity gains.

History: In 8 of the last 10 comparable periods, 3-month forward returns for S&P 500 and Nasdaq were positive.

Takeaway: Sustained scores above the structural threshold, paired with macro tailwinds, have a high hit rate for continued upside.

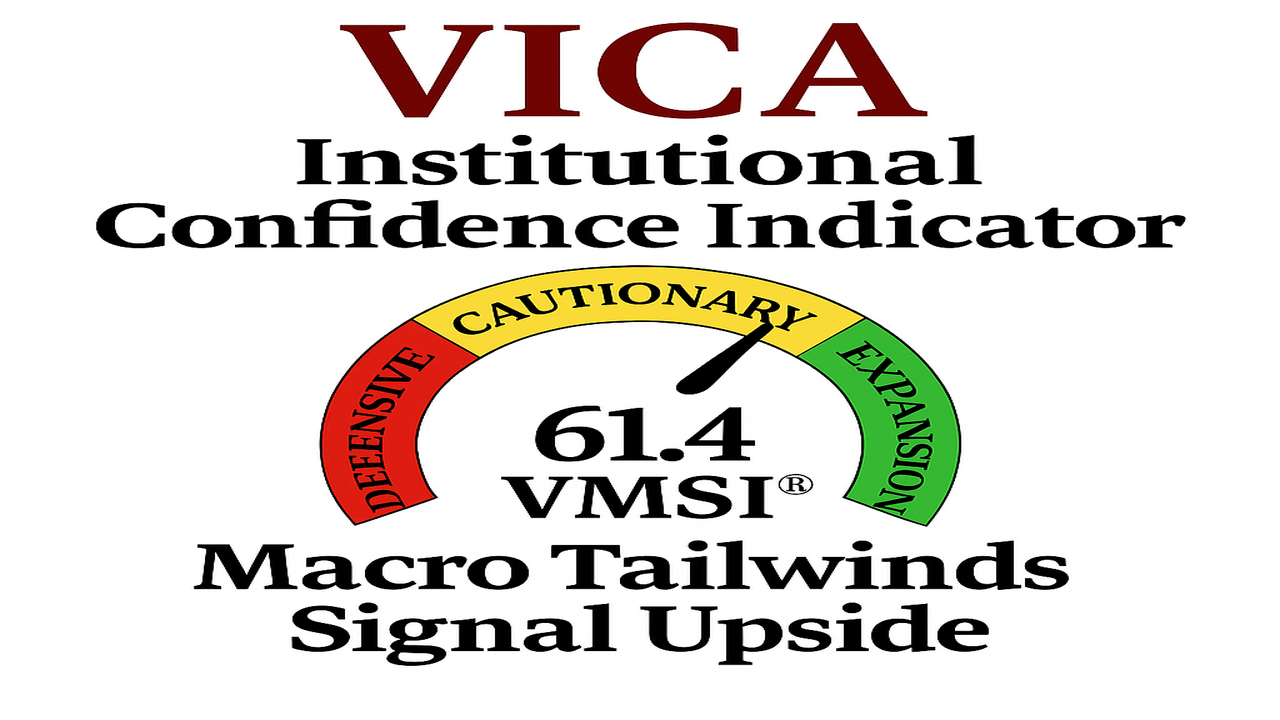

3) Headline Metric — Composite Score: 61.4

This Week: The VMSI Composite Score rose to 61.4, signaling cautionary optimism as conviction-weighted flows align with volatility compression and credit stability. The +2-point gain over the past three weeks reinforces the broader Q2–Q3 2025 advance sequence.

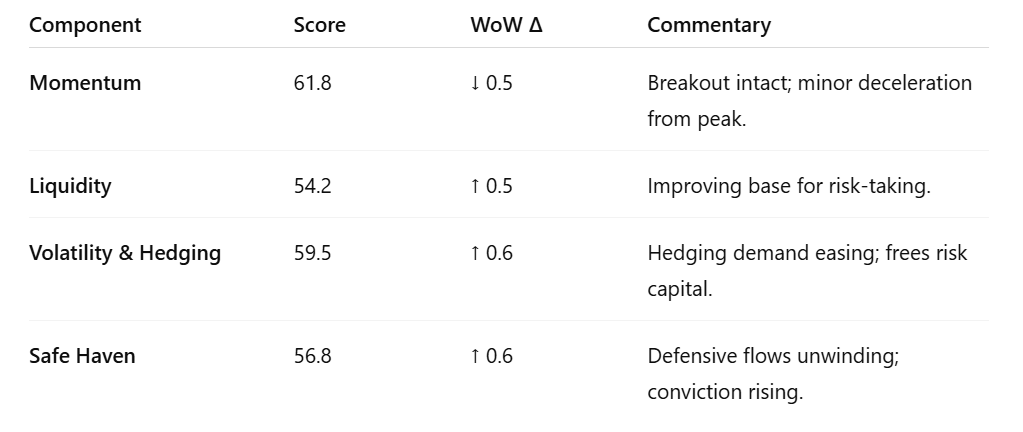

4) Component Deep Dive — WoW Changes

Takeaway: Broad subcomponent gains + easing hedging = durable institutional positioning, historically consistent with multi-month advances.

(Charts available upon request for each subcomponent.)

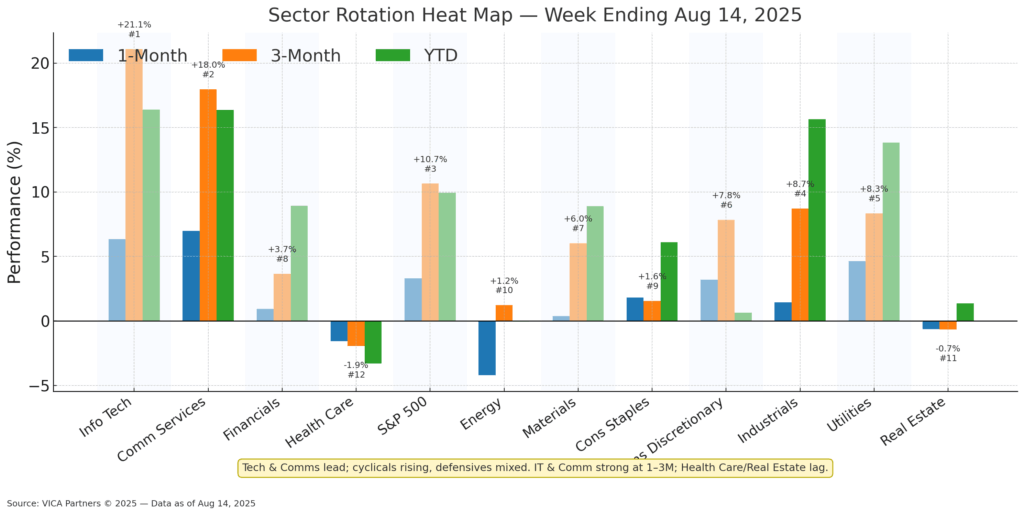

5) Sector Rotation & Positioning

This Week: Leadership in Technology & Communication Services; cyclicals (Consumer Discretionary, Industrials) show steady follow-through. Financials strengthen on credit stability. Utilities steady; Energy & Health Care lag; Real Estate range-bound.

Takeaway: Rotation favors growth and cyclicals, not defensive or value-heavy sectors — a constructive risk-on profile.

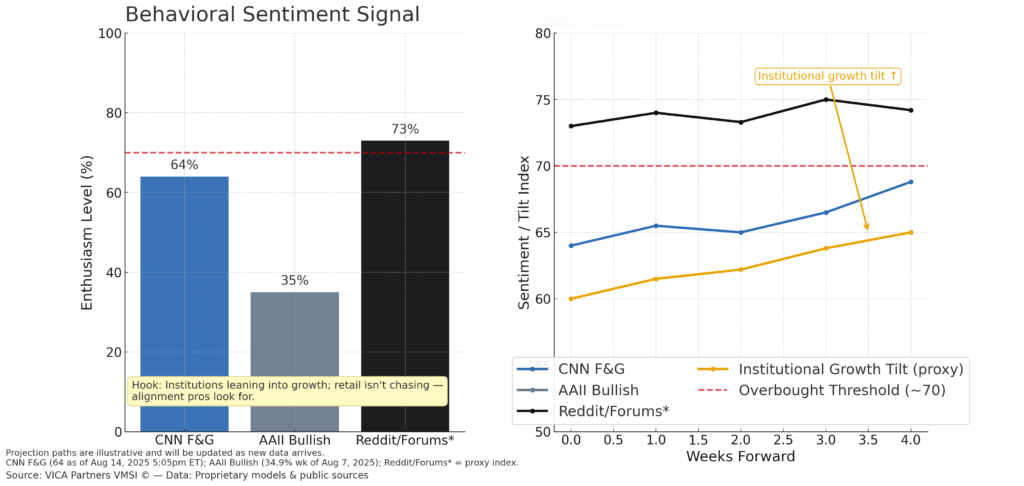

6) Sentiment Overview

This Week: Institutions are adding to growth exposure; retail flows have leveled.

Context: Institutions often counter retail — current divergence has historically preceded sustained upside.

Takeaway: Cautious retail + engaged institutional growth positioning = supportive risk environment.

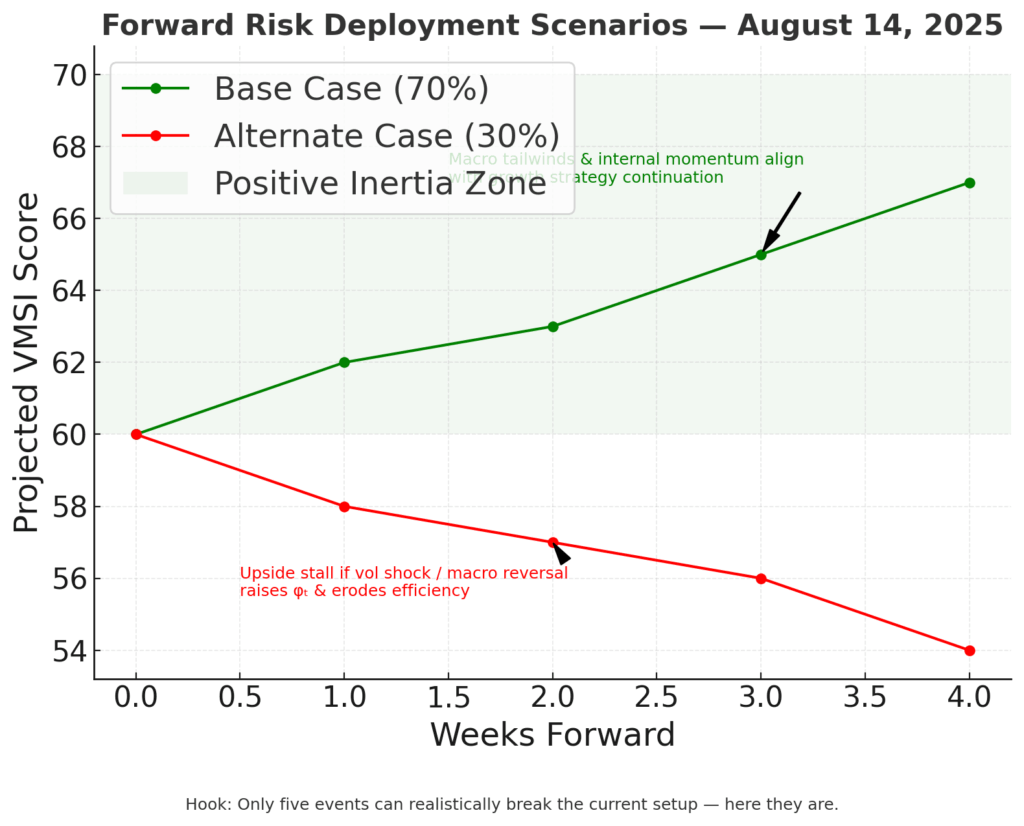

7) Predictive Outlook

- Base Case (70%): Measured upside continuation as macro tailwinds align with momentum.

- Alternate Case (30%): Upside stall if volatility shock or macro reversal raises φₜ.

Top Five Risk Triggers:

- Hawkish central bank pivot / rate hike acceleration

- Macro data shock (employment, GDP, inflation)

- Geopolitical escalation

- Liquidity crunch / credit stress

- Volatility breakout above key thresholds

Takeaway: Growth strategy intact; risk clustered in a few identifiable catalysts.

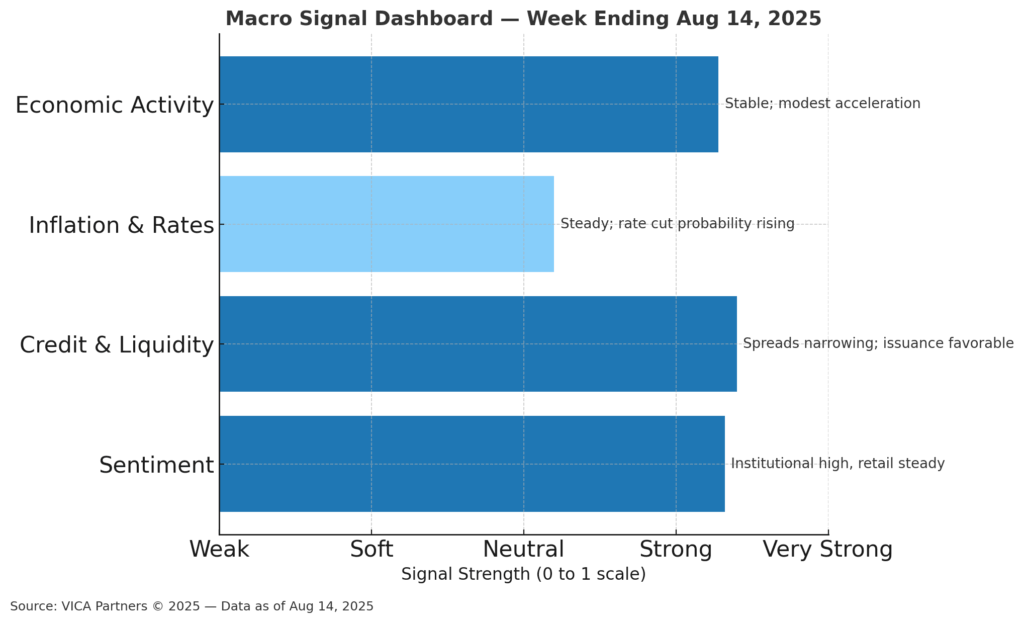

8) Macro Signals Snapshot

This Week: Macro backdrop supportive — steady policy tone, tight credit spreads, contained inflation expectations, modest USD strength, neutral term premium.

Takeaway: No deterioration in key levers; credit stability + policy clarity reinforce institutional risk deployment.

9) Final Word

The advance is driven by structure, not sentiment. Institutional capital remains fully engaged, calibrated to liquidity depth, macro stability, and growth exposure. Defensive positioning continues to unwind, momentum holds in breakout territory, and sector rotation favors risk-on leadership. Historically, this exact macro–positioning profile has delivered positive 3-month forward returns in 8 of the last 10 comparable periods — reinforcing the probability of continued upside into Q4.

About VMSI & Disclaimer

The Volatility & Market Sentiment Index (VMSI©) is VICA’s proprietary multi-factor framework tracking conviction-weighted institutional positioning across volatility, momentum, liquidity, and sentiment. Updated weekly, it integrates market microstructure signals with macro context to monitor shifts in institutional risk deployment.

This report is provided for informational purposes only and does not constitute investment advice, an offer, or a solicitation to buy or sell any security or financial instrument. Views reflect conditions at the time of publication and may change without notice. While based on sources believed to be reliable, VICA Partners makes no representation as to accuracy or completeness and assumes no liability for losses arising from reliance on this material. Past performance is not indicative of future results.

© 2025 VICA Partners VMSI Economic Physics Model — All Rights Reserved.