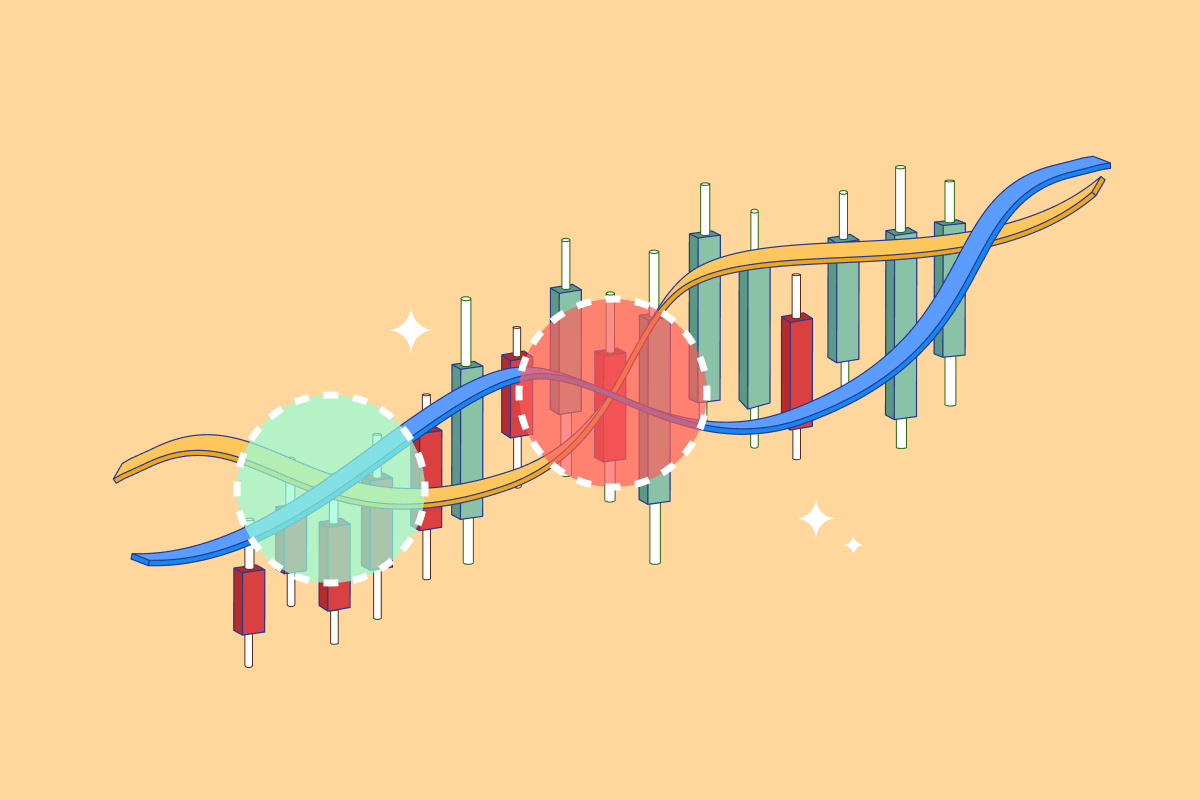

In technical analysis, a death cross is a term used to describe a bearish signal that occurs on a price chart when a shorter-term moving average crosses below a longer-term moving average. The interpretation of a death cross depends on the specific moving averages being used and the context in which it occurs.

Here’s a general interpretation of a technical death cross:

- Moving Averages: A death cross typically involves the 50-day moving average (shorter-term) crossing below the 200-day moving average (longer-term). However, the specific time periods can vary depending on the analyst or trader.

- Bearish Signal: A death cross is considered a bearish signal because it suggests a potential shift in the market’s trend from bullish to bearish. It indicates that the stock or asset’s recent price decline has accelerated, and the longer-term trend may be weakening.

- Confirmation: Traders and analysts often wait for confirmation before acting on a death cross. They may look for additional bearish indicators such as increased selling volume or a break below key support levels to validate the signal.

- Time Frame: The significance of a death cross can vary depending on the time frame being analyzed. In shorter time frames like daily charts, it may indicate a more immediate reversal. In longer time frames like weekly or monthly charts, it could suggest a broader and potentially more prolonged trend change.