VICA Partners | Institutional Market Structure Commentary, January 2026

Inverse ETFs Are Analog Hedges in a Digital MarketThey trade direction. They don’t model structure — and structure is what breaks first.

Abstract

Inverse ETFs are widely treated as practical hedges because they are liquid, accessible, and mechanically “simple”: when the index falls, the inverse product should rise. That logic works in a textbook world where markets move cleanly, trends persist, and risk can be expressed as direction.

But modern markets do not behave that way. Today’s equity system is dominated by index-embedded concentration, passive flows, systematic rebalancing, dealer convexity dynamics, and cross-asset correlation compression. In that environment, the primary risk is not “down.” It is structural instability—the probability that the regime changes abruptly, even if headline index levels remain deceptively stable.

This is why inverse ETFs increasingly function like analog tools in a digital system: they hedge a linear outcome in a non-linear market. They can reduce exposure to direction, but they cannot reliably hedge the mechanics that govern whether the market holds together.

The implication is not that inverse ETFs are “bad.” It is that they are incomplete. They are a hedge for movement—not a hedge for structure.

The Core Mistake: Treating Direction as Risk

Most investors are trained to think about hedging as a directional problem:

-

If the market goes down, protect the portfolio.

-

If volatility rises, reduce risk.

-

If macro stress increases, buy a hedge product.

But the market’s dominant failure mode is no longer slow decline. It is regime transition: a shift from stable absorption into discontinuous repricing.

In that sequence, the system often looks calm right until it isn’t. Index levels can remain supported by concentration and liquidity density, while internal fragility increases beneath the surface. When the break arrives, it is not gradual. It is mechanical.

This is why “direction-only” hedges often disappoint. They are built to respond to price movement, not to the hidden variables that determine whether stability is being earned or manufactured.

Why Inverse ETFs Mislead: The Reset Problem

Inverse ETFs are not designed to hedge a destination. They are designed to hedge a path.

Most inverse products reset daily. That reset creates a structural reality that is easy to miss:

Even if an index ends up flat over time, an inverse ETF can lose money if the path to “flat” contains volatility and whipsaw.

This is not a flaw in the product. It is the product behaving exactly as engineered.

In a trending decline, inverse ETFs can work well. In a choppy, mechanically supported, index-embedded market, they often decay.

That decay is not a market opinion. It is math.

The Real Regime: Digital Markets Are Non-Linear

In modern markets, the biggest drivers of stability are increasingly structural:

-

Index concentration compresses outcomes while widening opinion dispersion

-

Passive and benchmark flows stabilize leadership even as breadth deteriorates

-

Dealer positioning can dampen movement until convexity is forced to reprice

-

Correlation structure tightens, reducing shock distribution capacity

-

Liquidity density becomes the stabilizer—and eventually the constraint

These forces do not move in straight lines. They create regimes where prices can remain anchored while stress accumulates in hidden layers.

That is exactly where inverse ETFs underperform as “hedges.” They do not fail because the market is irrational. They fail because the hedge is linear and the market is not.

Proof Point: Same Market, Two Paths — and the Hedge Breaks

This is where most traditional analysis stops too early. Investors see an inverse product and assume it is a mirror image.

But the real test is not whether the inverse ETF rises on a down day. The real test is whether it delivers reliable protection across the path the market actually takes.

Modern markets do not travel in clean arcs. They travel through:

-

short volatility compressions

-

sudden repricing windows

-

rapid mean reversion

-

mechanically supported rallies

-

correlation spikes that change the geometry of risk

Inverse ETFs hedge direction. They do not hedge that geometry.

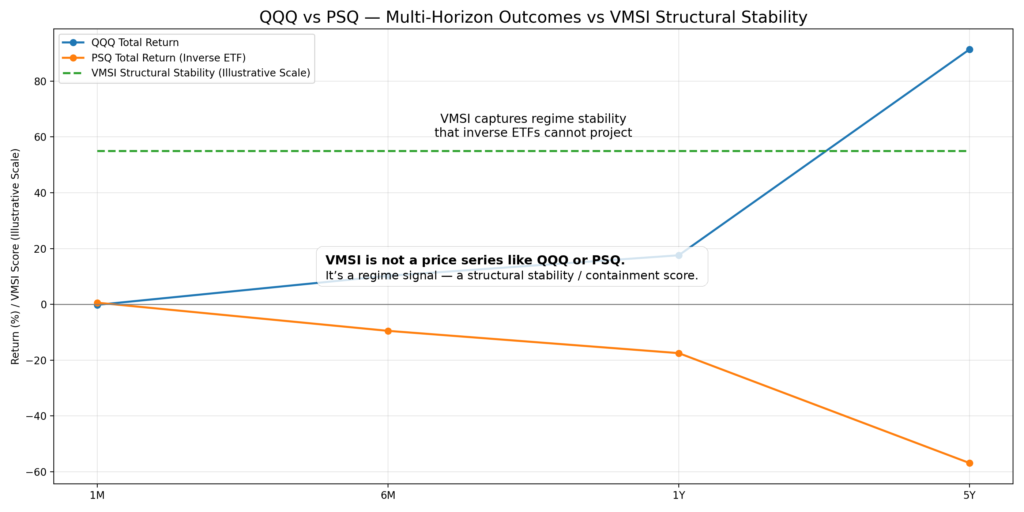

QQQ vs PSQ — Path Decay vs Structural Regime Signal (Illustrative) (QQQ vs PSQ with VMSI regime overlay / containment-to-fragility transition markers) Source: VICA Partners Research

How to read it: The chart illustrates a modern reality: QQQ can remain structurally supported even through volatility and whipsaw, while PSQ—despite being “inverse”—decays because the path contains churn. The VMSI overlay highlights that the real signal is not direction. It is whether the regime is in containment (stable) or drifting toward fragility (unstable).

What the Chart Is Actually Proving

This is not simply a “daily reset” story. That’s the surface explanation.

The deeper point is structural:

Inverse ETFs are designed to trade price direction. Markets increasingly move through regime containment.

Containment is the environment where:

-

prices hold despite disagreement

-

stability persists despite stress

-

volatility can compress even as fragility rises

-

the system continues functioning, but at a higher internal cost

In that regime, the most common investor mistake is to hedge the headline instead of the structure.

The chart makes that visible. It shows why the hedge can decay even when the investor’s narrative feels correct.

What Professional Risk Actually Requires Now

Modern hedging is not about “being bearish.” It’s about recognizing what kind of market you are inside.

The critical question is no longer:

“Will the market go down?”

It is:

“Is the regime stable, or is stability being manufactured?”

Those are not the same question.

In a stable regime, protection should be measured, systematic, and cost-aware. In a manufactured regime, protection must be convex, adaptive, and timing-sensitive—because the break, when it arrives, is discontinuous.

This is why inverse ETFs often feel comforting but behave poorly. They provide the illusion of control in a system where the risk is not linear.

Where VMSI Fits: Hedging Structure Instead of Headlines

The VICA Market Sentiment Index (VMSI) was built around a different objective than traditional sentiment or volatility tools.

It does not attempt to predict a price target. It does not treat fear as a signal and greed as a forecast. It measures whether the system is operating in:

-

stability through absorption

-

stability through suppression

-

or instability through regime transition

In other words:

Inverse ETFs hedge direction. VMSI models regime.

That distinction is why structural modeling narrows uncertainty without pretending to eliminate it. It doesn’t claim to forecast the next tick. It identifies whether the market is operating inside a coherent architecture—or approaching the limits of that architecture.

Conclusion

Inverse ETFs remain useful instruments. But they are increasingly misunderstood.

They are not regime hedges. They are path-dependent direction tools.

In modern markets, the most important risk is not the next down day. It is the probability of a structural transition—when stability stops being absorbed and starts being forced.

That is why inverse ETFs are analog hedges in a digital market.

They trade direction. They don’t model structure. And structure is what breaks first.

VICA Research Disclaimer This commentary is for informational purposes only and does not constitute investment advice. Views reflect market-structure analysis as of publication and may change without notice. Investing involves risk, including possible loss of principal. Unauthorized reproduction or redistribution is strictly prohibited. © 2026 VICA Partners — VMSI™ Proprietary Framework

Research Note: VMSI will be reintroduced in Q1 2026 in an index-grade format supported by institutional partners and built for systematic regime interpretation.