Stay Informed and Stay Ahead: Market Watch, May 29th, 2024.

Wall Street Mid-Week Market Recap Edition

Market Highlights & Analysis: Indices, Sectors, and More…

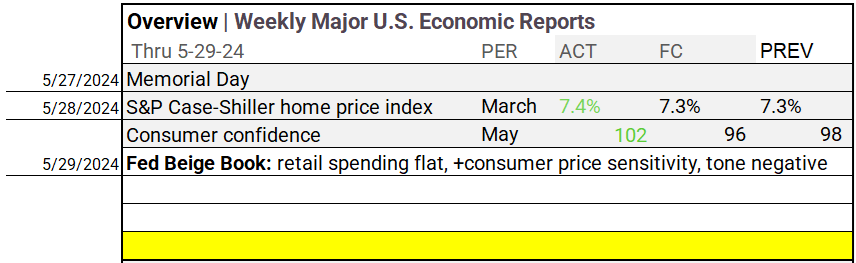

- Economic Data: Home prices up, consumer confidence rose, retail flat.

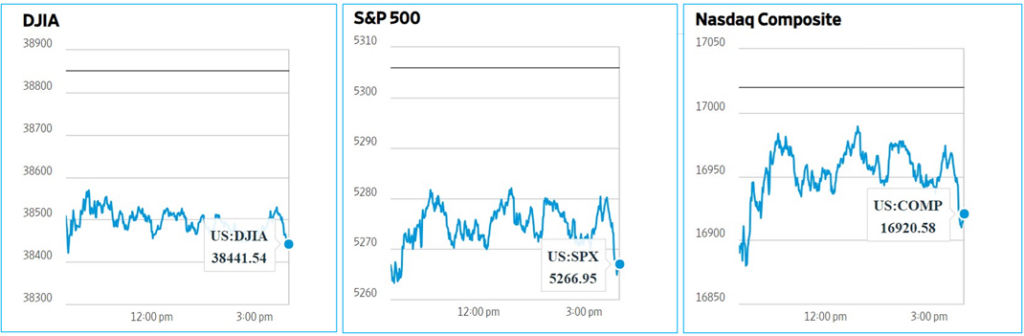

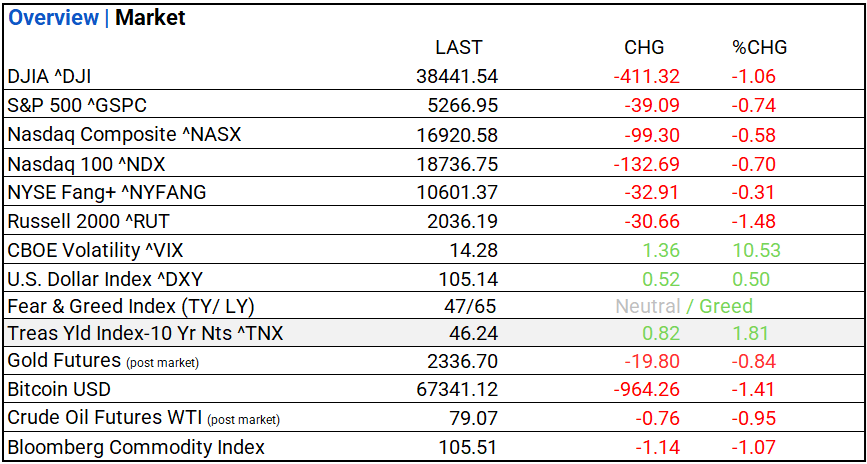

- Market Indices: Major indices declined: DJIA, S&P 500.

- Sector Performance: All sectors fell; tech led; energy lagged most.

- Factors: Mega Cap Growth slightly down; momentum stocks lead YTD.

- Treasury Markets: Yields rose except short-term; 30-year bond highest.

- Commodities: Commodities mostly fell; oil, gold, and gas declined.

- ETFs: Inverse leveraged ETFs surged; ProShares Natural Gas up.

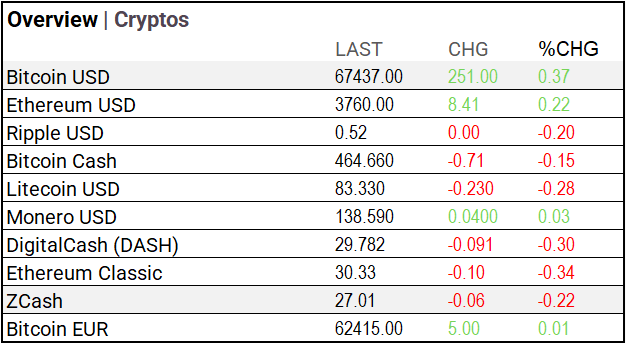

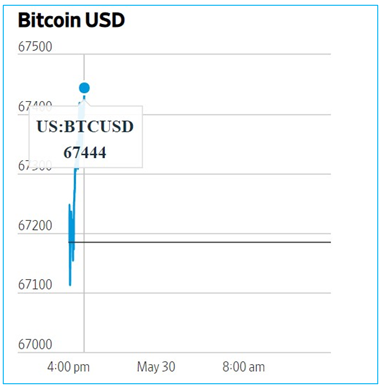

- Cryptos: Cryptocurrencies stable; Bitcoin, Ethereum rose, Ripple declined.

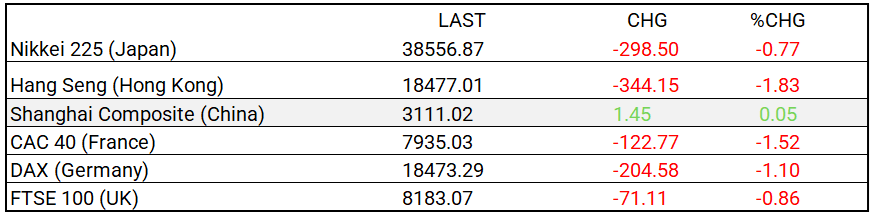

- Asia/ Europe: Global fell; Shanghai slightly up, Hang Seng down.

US Market Snapshot: Key Metrics:

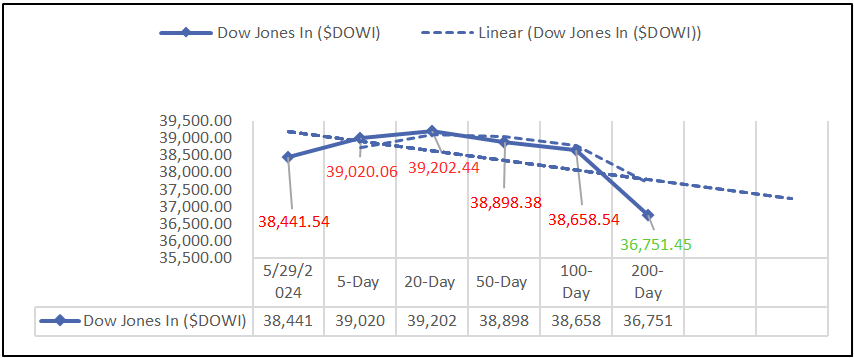

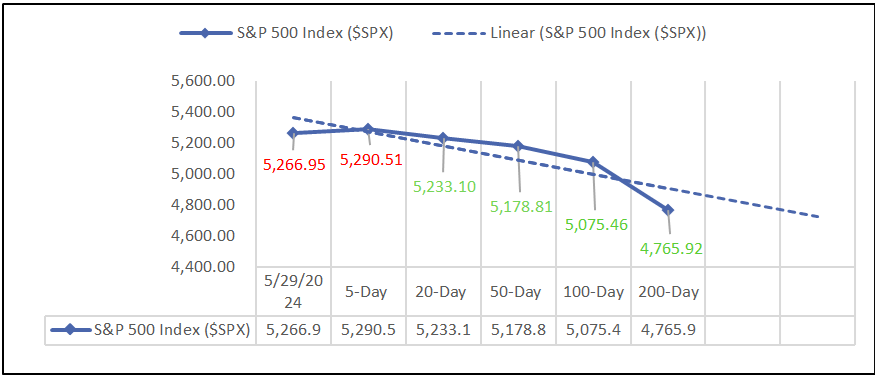

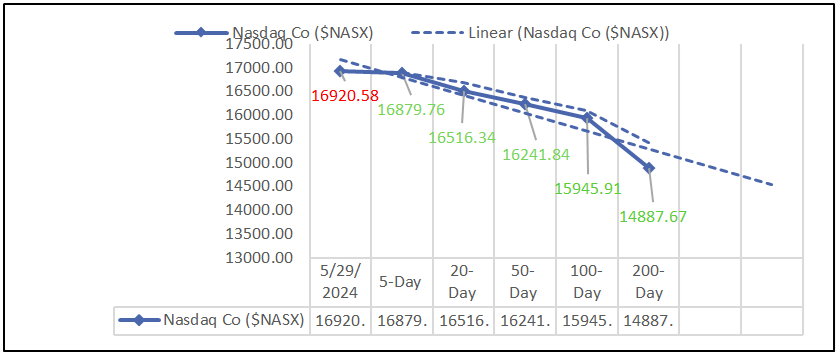

Moving Averages: DOW, S&P 500, NASDAQ:

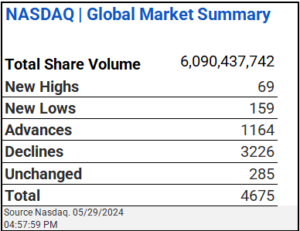

NASDAQ Global Market Summary:

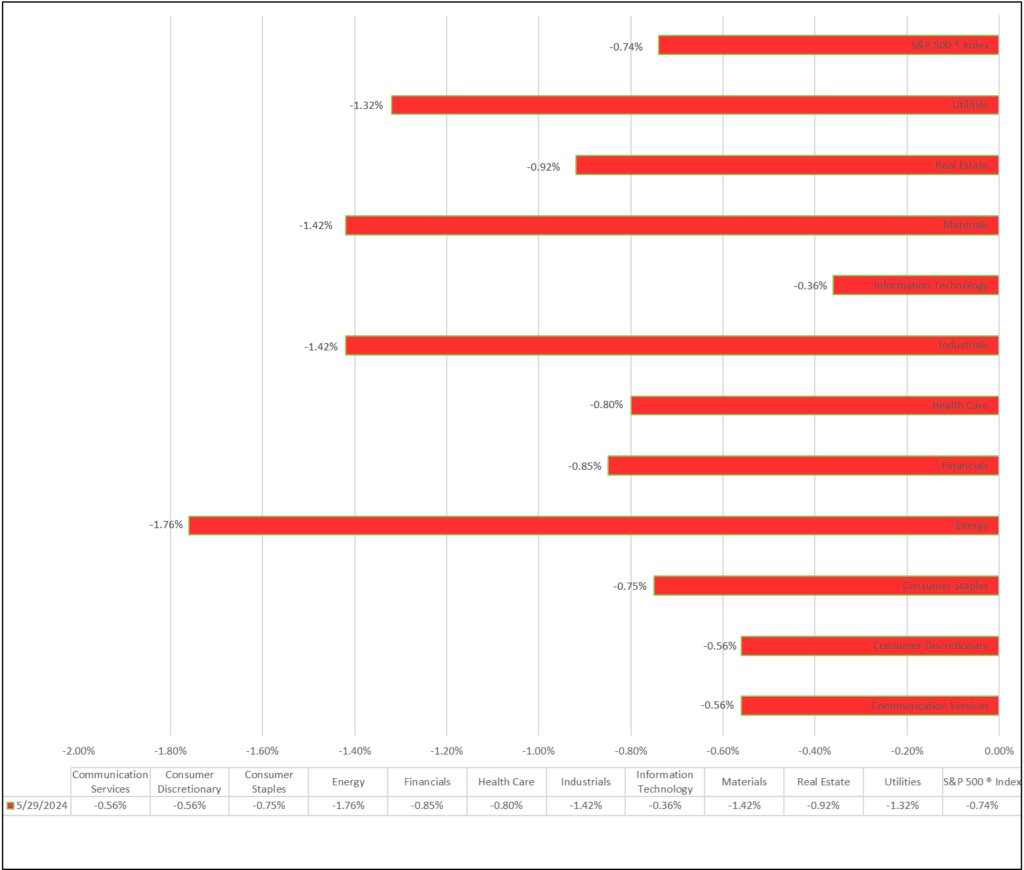

Sectors:

- All 11 sectors lower; Information Technology (-0.36%) leading, Energy (-1.76%) lagging. Top industries: Technology Hardware, Storage & Peripherals (+0.06%), Health Care REITs (+0.03%), and Industrial REITs (0.00%).

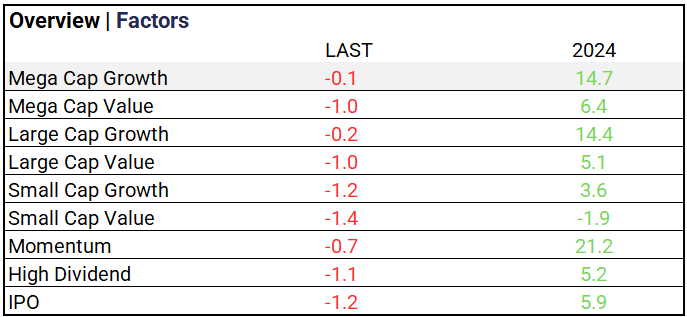

Factors:

- Broad-based losses with Mega Cap Growth off only -0.1%. Momentum stocks up 21.2% year-to-date.

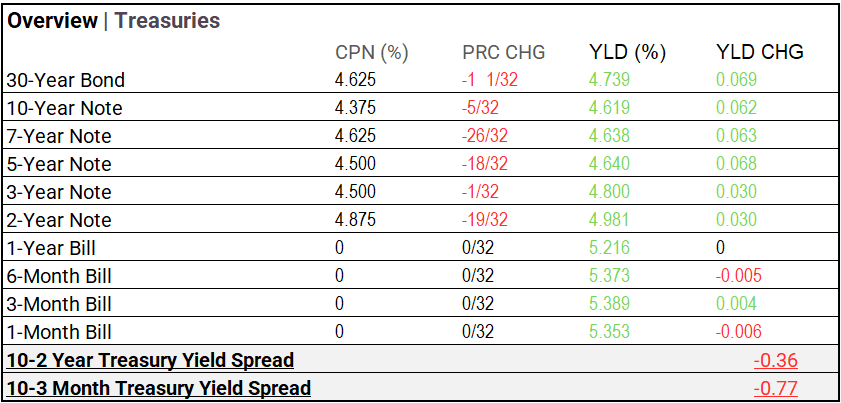

Treasury Markets:

-

- Treasury yields rose, except short-term bills; 30-year bond yield highest at 4.739%, 10-year at 4.619%.

Currency and Volatility:

- U.S. Dollar Index ^DXY: 105.14 (+0.52, +0.50%)

- CBOE Volatility ^VIX: 14.28 (+1.36, +10.53%)

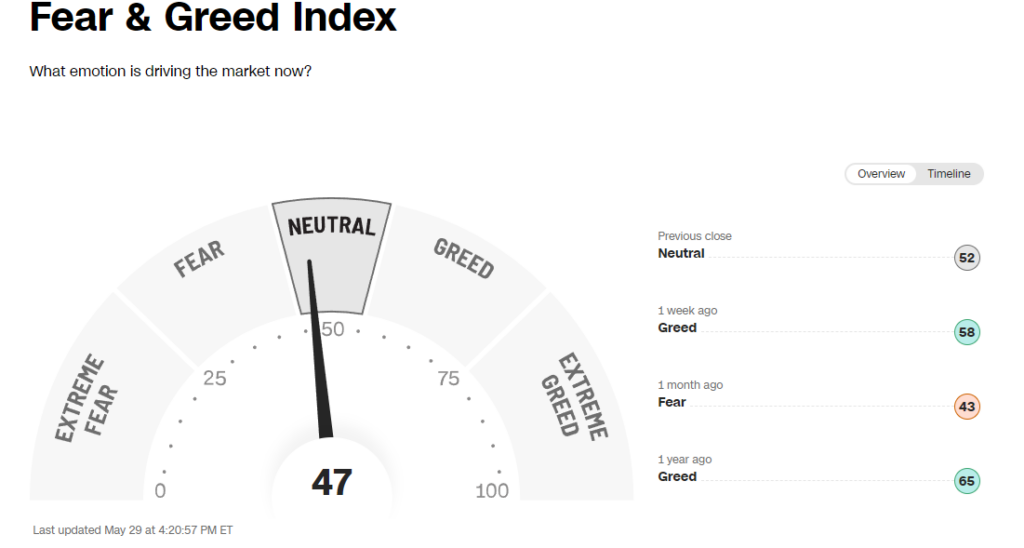

- Fear & Greed Index: 47/TY 65/LY (Neutral/ Greed)

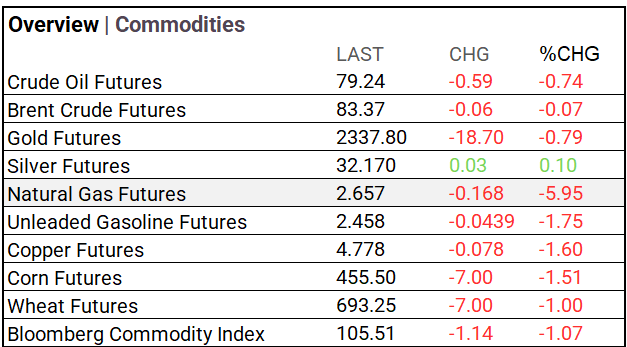

Commodity Markets:

- Commodities mostly fell; crude oil, gold, and natural gas declined. Silver slightly up, Bloomberg Index down.

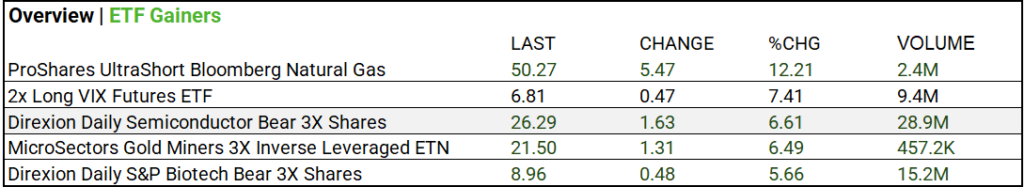

ETF’s:

- Inverse leveraged ETFs surged; ProShares UltraShort Natural Gas up 12.21%, 2x Long VIX Futures up 7.41%.

Cryptos:

- Cryptocurrencies were mostly stable; Bitcoin and Ethereum rose slightly. Ripple, Litecoin, and others saw minor declines.

US Economic Data:

- Home prices rose 7.4% in March. May consumer confidence increased to 102. Fed Beige Book reports flat retail spending.

Notable Earnings Today:

- BEAT: HP Inc (HPQ), Heico (HEI), National Bank of Canada (NTIOF), Okta (OKTA), Dick’s Sporting Goods (DKS), UiPath (PATH), Abercrombie&Fitch (ANF), Chewy (CHWY).

- MISSED: Salesforce Inc (CRM), Bank of Montreal (BMO), Agilent Technologies (A), Pure Storage Inc (PSTG)

Global Markets Summary: Asian & European Markets:

- Global markets mostly fell; Shanghai Composite up slightly, Hang Seng down 1.83%.

Central Banking and Monetary Policy, Noteworthy:

- IMF Raises China Economic Growth Forecasts – Wall Street Journal

- ‘Not Gonna Be Pretty:’ Covid-Era Homebuyers Face Huge Rate Jump – Bloomberg

Business:

- ConocoPhillips to Acquire Marathon Oil in $17.1 Billion All-Stock Deal – Wall Street Journal

- Abercrombie Soars as Return of ‘90s Fashion Boosts Outlook – Bloomberg

China:

- China’s EV sector could offset looming EU tariffs with detours via ‘friendly’ tracks, but be prepared for countermeasures – South China Morning Post