Stay Informed and Stay Ahead: Market Watch, September 23rd, 2024.

Investor Guide: Treasury Bond ETFs

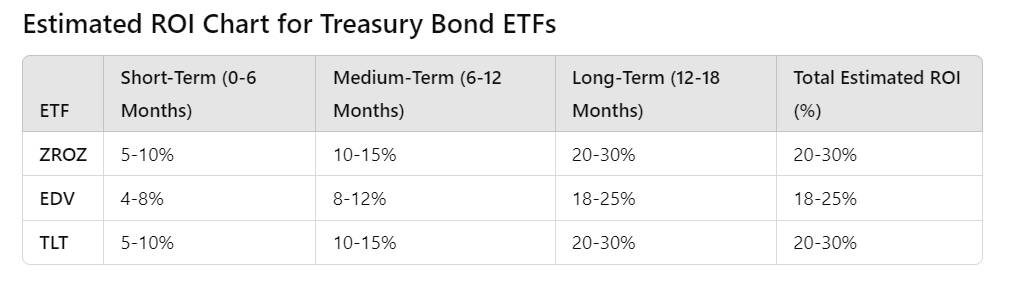

As investors navigate the complexities of today’s financial landscape, understanding the potential of various asset classes is essential. Based on internal client fund recommendations, we present a comprehensive guide focusing on three prominent Treasury bond ETFs: ZROZ, EDV, and TLT. This forecast aims to equip investors with insights into potential returns and market dynamics over the next 18 months, particularly in a scenario where persistent inflation is not a concern.

The Context: Current Economic Landscape

With the Federal Reserve signaling possible rate cuts, the environment for long-duration Treasury bonds has become increasingly favorable. In this context, long-term bonds are poised to benefit as investors seek safety amid economic uncertainties. Our analysis reflects insights from client fund recommendations, providing a solid foundation for investment strategies.

ETF Overviews and Forecasts

1. ZROZ (PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF)

- Short-Term (0-6 Months): Expected price appreciation of 5-10% as ZROZ reacts positively to Fed rate cuts.

- Medium-Term (6-12 Months): Anticipated growth of 10-15%, driven by stable economic conditions and demand for long-duration assets.

- Long-Term (12-18 Months): Cumulative returns could reach 20-30%, supported by continued investor interest and minimal inflation concerns.

2. EDV (Vanguard Extended Duration Treasury ETF)

- Short-Term (0-6 Months): Initial gains projected at 4-8% as market sentiment remains bullish.

- Medium-Term (6-12 Months): Potential for an additional 8-12% return, reflecting ongoing favorable conditions.

- Long-Term (12-18 Months): Total returns may accumulate to 18-25%, as the demand for long-duration bonds persists.

3. TLT (iShares 20+ Year Treasury Bond ETF)

- Short-Term (0-6 Months): Anticipated gains of 5-10% in response to favorable market conditions.

- Medium-Term (6-12 Months): Additional returns of 10-15% expected, assuming stability in economic indicators.

- Long-Term (12-18 Months): Cumulative total returns could reach 20-30%, benefiting from sustained demand for Treasury bonds.

Notes:

- The percentages represent estimated returns based on current market conditions and internal client fund recommendations.

- Each time frame indicates the anticipated ROI for that specific period.

Technical Analysis Support

Each of these ETFs exhibits positive technical indicators, suggesting potential for upward momentum. Key metrics, including moving averages, relative strength index (RSI), and MACD, all point toward bullish trends. As investors consider their options, monitoring these technical signals will be crucial for making informed decisions.

Conclusion: A Strategic Opportunity

In conclusion, based on internal client fund recommendations, this guide serves as a valuable resource for investors looking to capitalize on the potential of Treasury bond ETFs in the coming months. With estimated returns ranging from 18% to 30%, ZROZ, EDV, and TLT represent strategic opportunities in a stable economic environment. While the market often looks ahead, it’s important to remember that immediate returns may disappoint; patience is key for long-term gains.

Investors are encouraged to stay informed on economic indicators and market sentiment as they evaluate their portfolios. As always, consulting with a financial advisor can help tailor investment strategies to individual risk tolerance and financial goals.

By leveraging insights from our internal analysis, we hope to empower investors to navigate the evolving market landscape effectively.