MARKETS TODAY August 2nd, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished lower, %. Hong Kong’s Hang Seng down 2.46%, Japan’s Nikkei 225 off 2.30 and China’s Shanghai Composite down 0.89%.

European markets finished lower, and Germany’s DAX lost 1.28%, France’s CAC 40 down 1.04% and London’s FTSE 100 off by 0.85%. S&P futures opened trading at 0.56% below fair value.

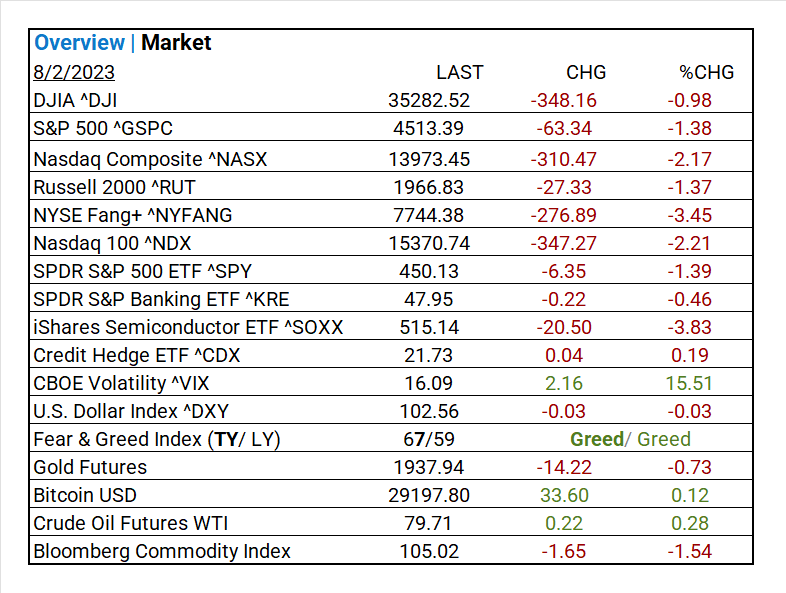

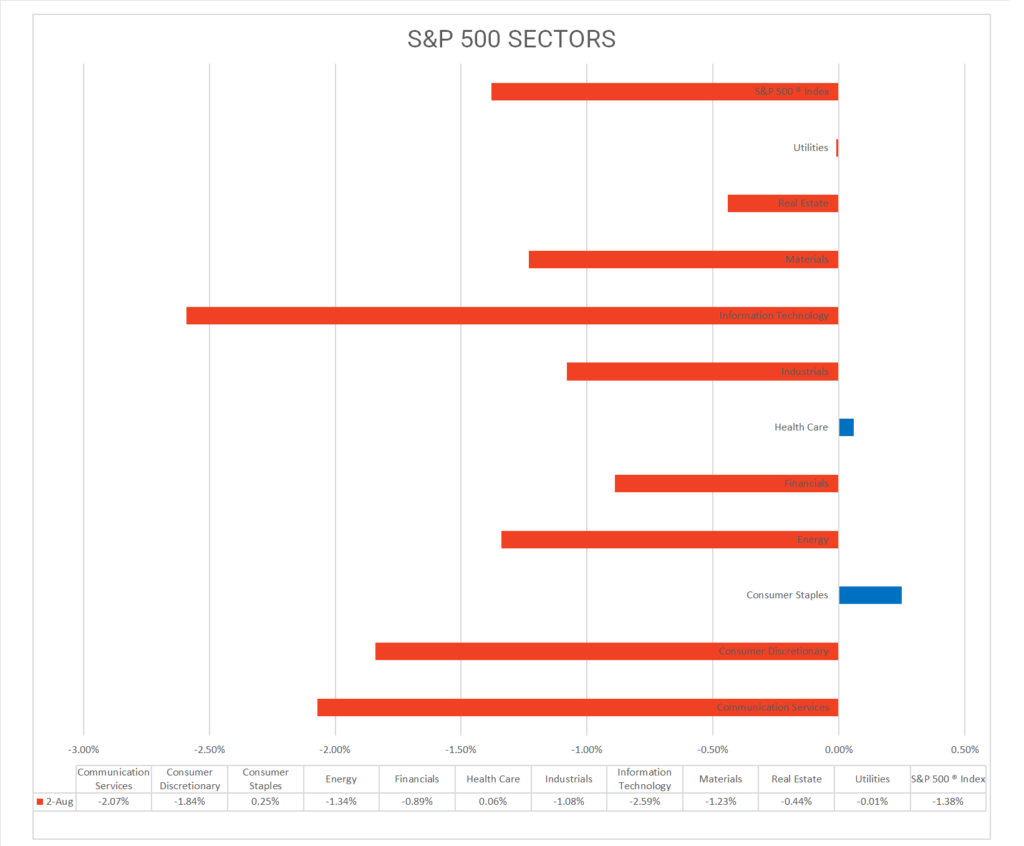

Today US Markets finished sharply lower, the NASDAQ lost 2.17%, S&P 500 down 1.38% and DOW down 0.98%. 9 of 11 S&P 500 sectors declining: Consumer Staples +0.25% outperforms/ Information Technology -2.59% lags. On the upside, Trending Industries: Life Sciences Tools & Services +1.27%, Office REITs +1.26%, Food Products +1.05%, Water Utilities +0.84%, longer term US Treasuries, Bitcoin, Oil.

In US economic news, ADP job survey came in above the estimates, leisure and hospitality accounted for the gains.

Takeaways

- Fitch Downgrade first 1% pullback since May

- ADP job survey came in above the estimates

- 9 of 11 S&P 500 sectors declining: Consumer Staples +0.25% outperforms/ Information Technology -2.59% lags.

- Trending Industries: Life Sciences Tools & Services +1.27%, Office REITs +1.26%, Food Products +1.05%, Water Utilities +0.84%

- Bitcoins and Oil with moderate gains

- CVS Health Corp (CVS), Humana (HUM) w/ solid earnings beats

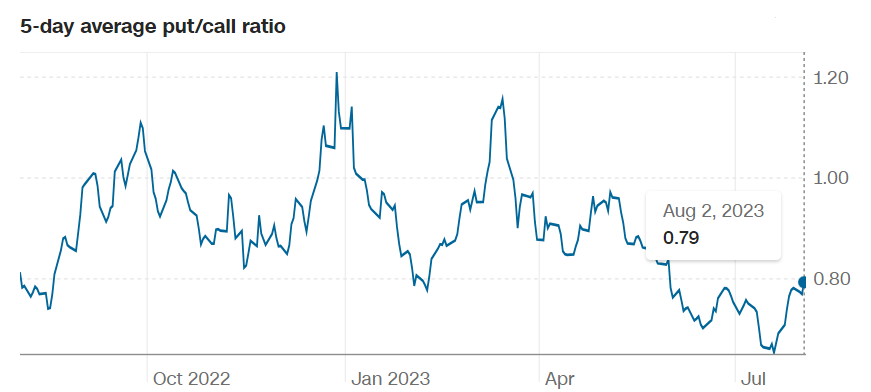

Pro Tip: When the ratio of puts to calls is rising, it is bear market metric for A ratio below 1 is considered bullish.

Sectors/ Commodities/ Treasuries

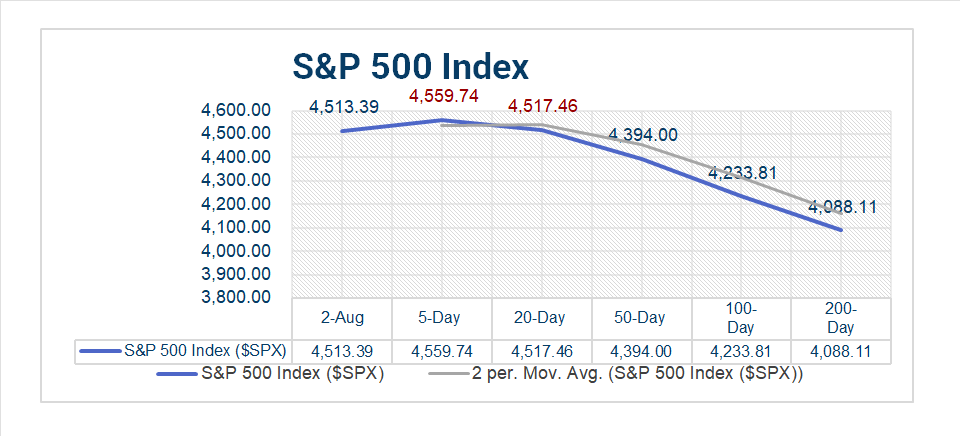

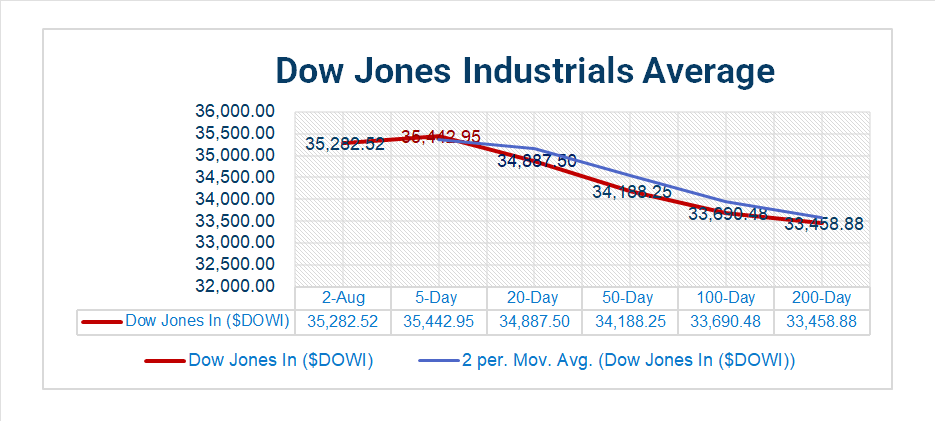

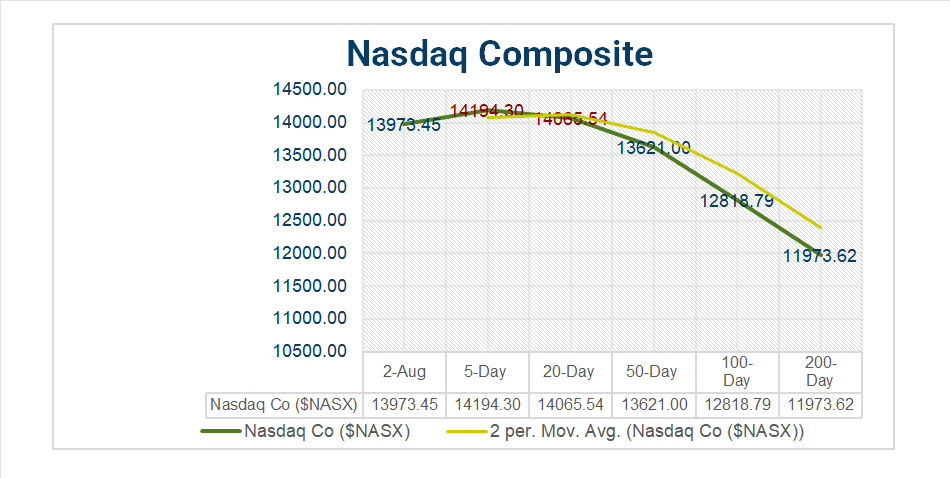

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 9 of 11 S&P 500 sectors declining: Consumer Staples +0.25% outperforms/ Information Technology -2.59% lags.

- Industries: Life Sciences Tools & Services +1.27%, Office REITs +1.26%, Food Products +1.05%, Water Utilities +0.84%

- YTD Leaders: Information Technology +45.93%, Communication Services +44.30%, Consumer Discretionary +33.95%.

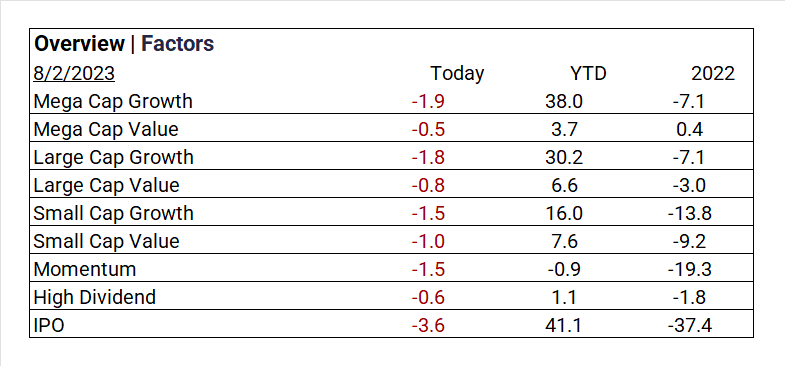

Factors

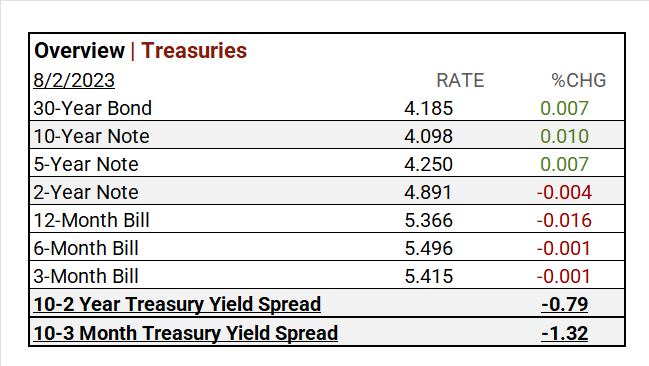

US Treasuries

Q2 ’23 Top Line Top Line

- Q1 ’23 Actual: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 Forecast: S&P 500 EPS was expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

- Q2 Actual (thru 7/28): a) 51% of S&P 500 companies reporting actual results, 80% of S&P 500 b) the blended earnings decline for the S&P 500 is -7.3%, c) for Q3 2023, 27 S&P 500 companies have issued negative EPS guidance and 18 S&P 500 companies have issued positive EPS guidance d) the forward 12-month P/E ratio for the S&P 500 is 19.4. This P/E ratio is above the 5-year average (18.6) and above the 10-year average (17.4).

Notable Earnings Today

- +Beat: CVS Health Corp (CVS), PayPal Holdings Inc (PYPL), Shopify Inc (SHOP), Siemens Healthineers ADR (SMMNY), Humana (HUM), MercadoLibre (MELI), McKesson (MCK), Trane Technologies (TT), Simon Property (SPG), Exelon (EXC), DuPont De Nemours (DD), Verisk (VRSK), HubSpot Inc (HUBS)

- – Miss: Qualcomm (QCOM), Ferrari NV (RACE), Occidental (OXY), Emerson (EMR), Phillips 66 (PSX), MetLife (MET), Kraft Heinz (KHC), Energy Transfer (ET), Williams (WMB), Yum! Brands (YUM), DoorDash (DASH), Nutrien (NTR)

Economic Data

US

- ADP employment: period July, act 324,000, fc 175,000, prior 455,000

Vica Partner Guidance July ’23, (updated 8-01)

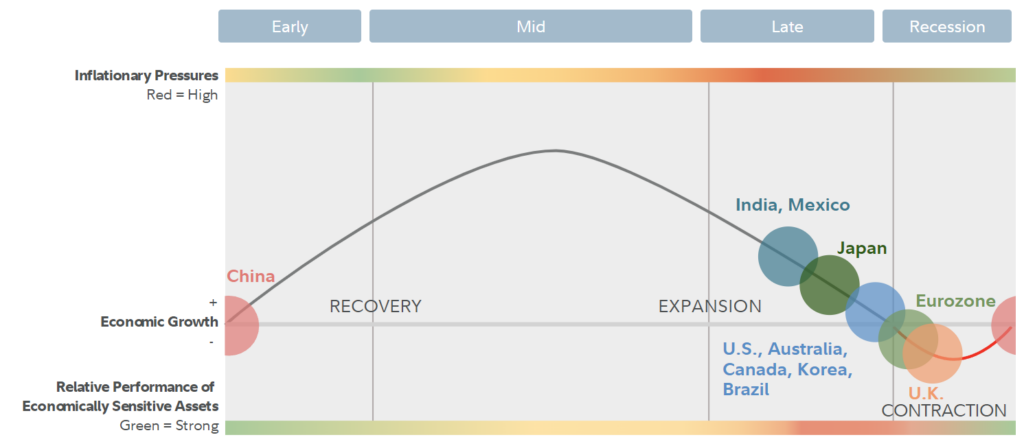

- Q3/4 highlighting, Industries: Interactive Media & Services, Household Durables, Broadline Retail, Consumer Finance, Automobiles, Construction & Engineering, Semiconductor & Semiconductor Equipment, Construction Materials, Specialized REITs, Gas Utilities. Other: Undervaluation for Chinese Mega Cap Tech. Japan equities still a better value than US. Look for continued strength in Mega and Large Cap Growth “the new defensives” Expect Energy Sector rally!

- Cautionary, Banks shortly may be overpricing. Current indicators are mixed. Credit default swap (CDS) to pick-up through Q4/Q1.

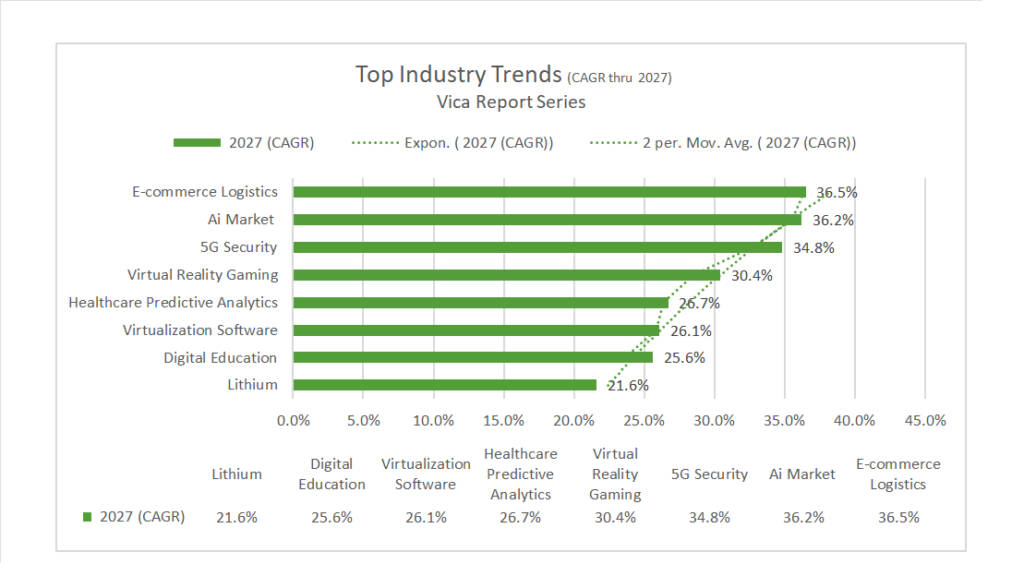

- Longer Term, NASDAQ 100^NDX/FANG+ ^NYFANG companies will continue to outperform “BIG allows you to invest at scale”. TOP Sector outperform includes AI and Semiconductor Equipment, Key Material like Lithium. Forward looking CAGR growth below:

- Company, we continue to emphasize business *quality and strength of balance sheet for all investments. * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom (AVGO).

- BIG Picture: Market bottoms are made on bad news and with deflationary signals the current market rally should come as no surprise. The combination of current Fed tightening, higher oil prices and a strong dollar should have given us a final bottom in ’23?

- Our biggest concern with the current rally is that the Government is not as effective as Free Markets in managing capital. Stock repurchases are just another way to deploy Capital. Consider that about 63% of the typical business cost is labor. I wholeheartedly trust the Free Market to better spend on CAPEX, R&D, and other.

- As for Bonds as an alternative investment for Stocks, a 10-year bond should have a return that is equal to or exceeds nominal GDP, and that is not the case today.

- The argument for Fed further tightening has its pundits. Raising rates to counter jobs (1.6 jobs available for every job seeker) in a rapidly changing economy will NOT moderate on demands.

- The Fed would benefit by rethinking its 2% target inflation number. A little extra pad like 3% today, protects the economy from Deflation.

News

Company News/ Other

- Qualcomm, Stung by Sluggish Smartphone Market, Plans Layoffs – WSJ

- CVS Reports Stronger Demand Amid Cost-Cutting Push – WSJ

- Chip Czar Sees Japan Funding One-Third of Second TSMC Plant – Bloomberg

Energy/ Materials

- Ford Fears a World on Fire Will Throw Up Its Hands on Climate – Bloomberg

- Covid Taught Nations to Shut Down. Extreme Heat Is Borrowing the Playbook – Bloomberg

Central Banks/Inflation/Labor Market

- Fitch Downgrades U.S. Credit Rating – WSJ

Asia/ China

- China’s services activity expands at quicker pace in July, lifted by summer travel season – South China Morning Post