Stay Informed and Stay Ahead: Research – December 9th, 2024

Japan-focused ETFs: Strategic Performance Insights & 180-Day Growth Forecast

Executive Summary

This report offers a comprehensive analysis of key Japan-focused Exchange Traded Funds (ETFs), examining performance over various timeframes to help institutional investors understand return trends. Special focus is placed on the 180-day growth forecast, providing actionable insights for strategic decision-making in line with Japan’s evolving economic landscape.

ETF Performance Breakdown

iShares MSCI Japan ETF (EWJ)

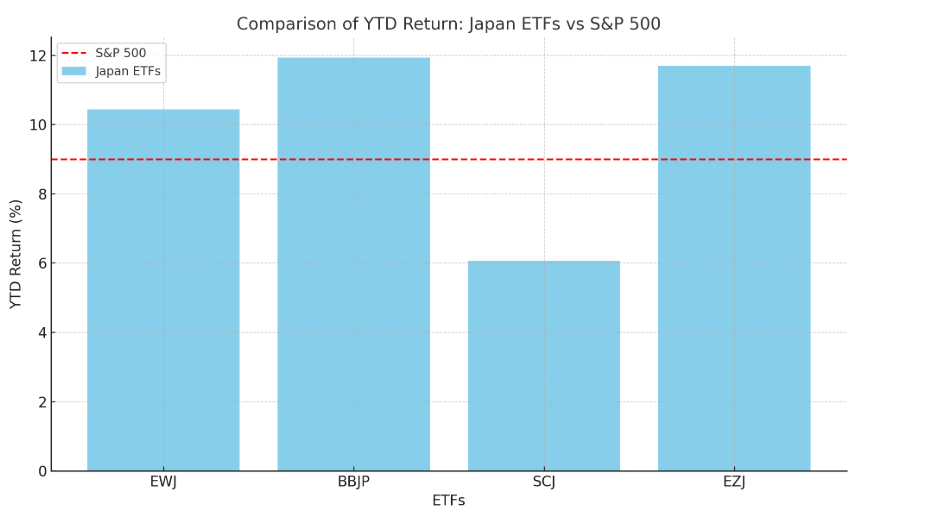

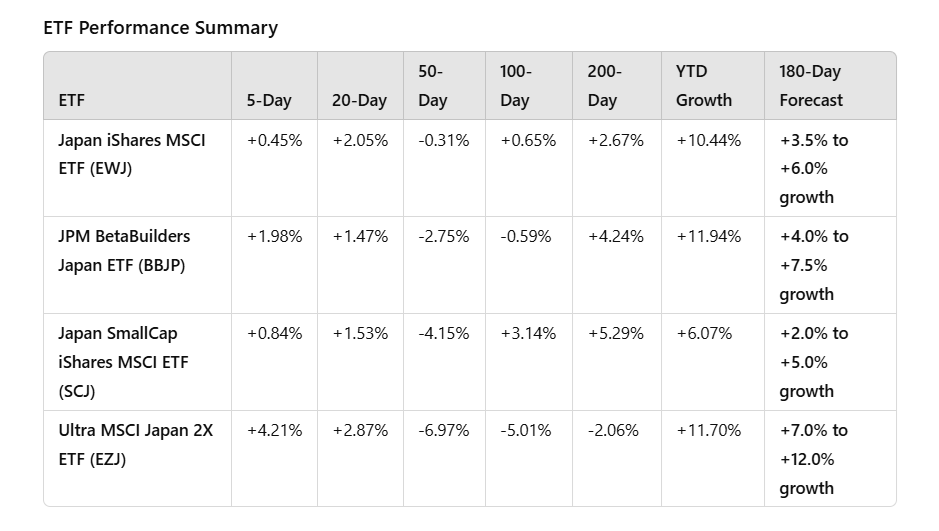

Overview: The iShares MSCI Japan ETF (EWJ) provides broad exposure to large- and mid-cap Japanese companies. Its growth trajectory reflects Japan’s recovery dynamics, with a year-to-date (YTD) return of +10.44%. The ETF shows volatility in its 50-day return period but remains a solid choice for stable long-term growth.

180-Day Forecast: +3.5% to +6.0% growth.

JPM BetaBuilders Japan ETF (BBJP)

Overview: The JPM BetaBuilders Japan ETF (BBJP) offers diversified exposure to Japan’s large-cap stocks. Its YTD growth of +11.94% reflects strong fundamentals, despite brief volatility across the 50- and 100-day periods. The ETF is positioned for continued strength in the coming months.

180-Day Forecast: +4.0% to +7.5% growth.

iShares MSCI Japan SmallCap ETF (SCJ)

Overview: Focused on small-cap stocks, the iShares MSCI Japan SmallCap ETF (SCJ) presents higher reward potential but comes with increased risk. While its shorter-term performance has been volatile, it offers promising long-term growth.

180-Day Forecast: +2.0% to +5.0% growth.

Ultra MSCI Japan 2X ETF (EZJ)

Overview: The Ultra MSCI Japan 2X ETF (EZJ) provides leveraged exposure to Japan’s MSCI index, ideal for short-term traders with a higher risk appetite. Despite recent fluctuations, the ETF has delivered strong YTD performance of +11.70%.

180-Day Forecast: +7.0% to +12.0% growth.

Conclusion

The Japan-focused ETFs analyzed in this report offer diverse investment strategies suited to various risk tolerances and investment horizons. For those seeking broad exposure to Japan’s large-cap sector, EWJ and BBJP stand out as stable options with promising long-term growth prospects. Conversely, investors looking for higher-risk, higher-reward opportunities may consider SCJ, which targets small-cap stocks, or the EZJ, which delivers leveraged exposure for those willing to accept greater volatility.

Each of these ETFs presents unique opportunities for growth, making them highly relevant for institutional investors looking to align their portfolios with Japan’s evolving economic recovery. The 180-day growth forecasts provide a crucial lens through which to assess their near-term potential. By understanding these trends, institutional decision-makers can position their portfolios for success in the coming months.