Stay Informed and Stay Ahead: Market Watch, January 18th, 2024.

Market Highlights & Analysis: Indices, Sectors, and More…

- Economic Data: In January, jobless claims were 187,000, below the 208,000 forecast; Philly Fed Survey declined. December housing starts slightly missed at 1.46 million, while building permits exceeded at 1.5 million.

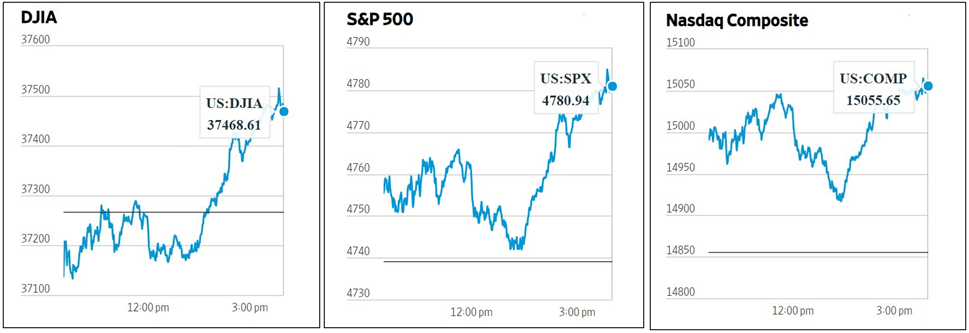

- Market Indices: DJIA (+0.54%), S&P 500 (+0.88%), Nasdaq Composite (+1.35%).

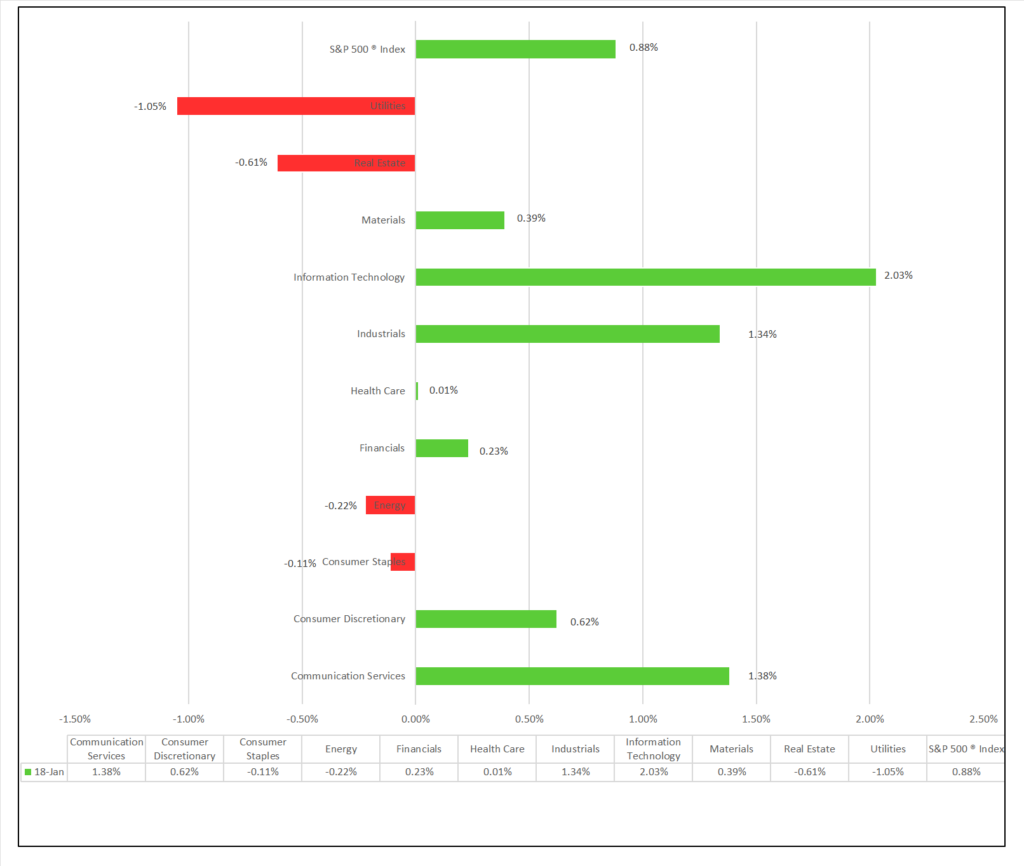

- Sector Performance: 7 of 11 sectors higher; Information Technology (+2.03%) leading, Utilities (-1.05%) lagging. Top industry: Passenger Airlines (+4.80%).

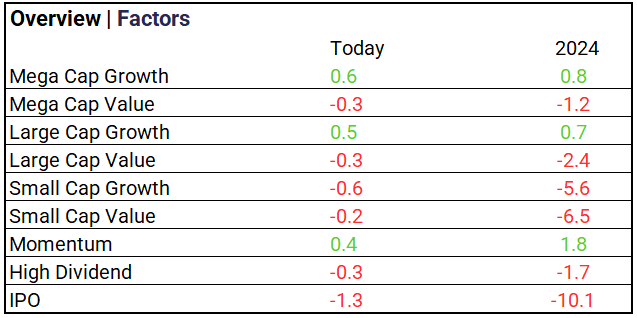

- Factors: Mega and Large Cap Growth outperform, while IPO lags

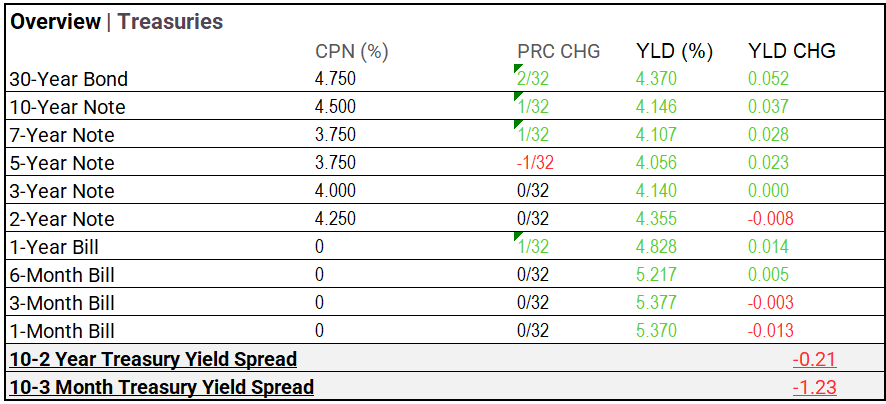

- Treasury Markets: The 30-Year Bond and 10-Year Note experienced the highest gains, while the 3-Month and 1-Month Bills saw declines.

- Commodities: Gold futures increased, Bitcoin declined, WTI Crude saw a slight drop, and the Bloomberg Commodity Index rose.

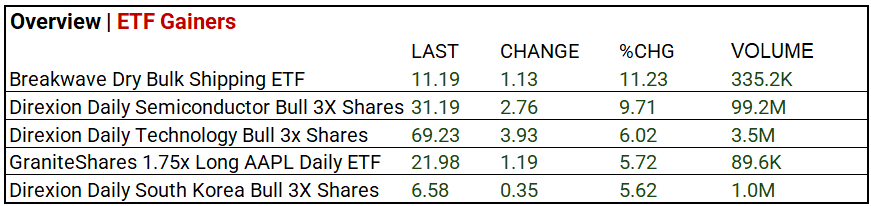

- ETFs: Direxion Daily Semiconductor Bull 3X Shares surged by 9.71%, backed by significant trading volume of 99.2 million.

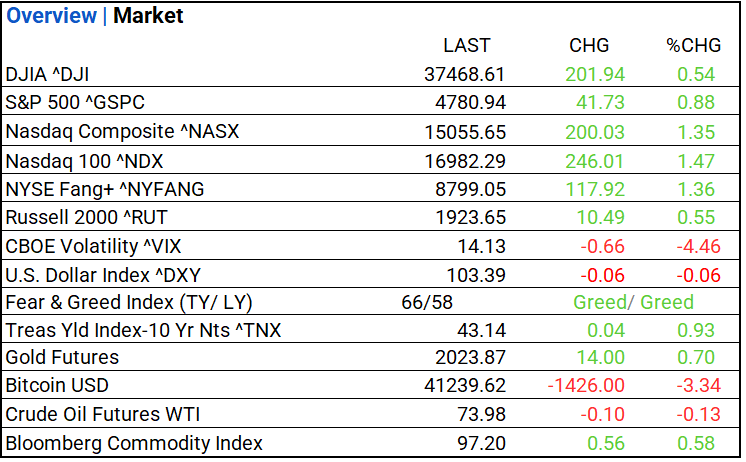

US Market Snapshot: Key Stock Market Indices:

- DJIA ^DJI: 37,468.61, 201.94, 0.54%

- S&P 500 ^GSPC: 4,780.94, 41.73, 0.88%

- Nasdaq Composite ^NASX: 15,055.65, 200.03, 1.35%

- Nasdaq 100 ^NDX: 16,982.29, 246.01, 1.47%

- NYSE Fang+ ^NYFANG: 8,799.05, 117.92, 1.36%

- Russell 2000 ^RUT: 1,923.65, 10.49, 0.55%

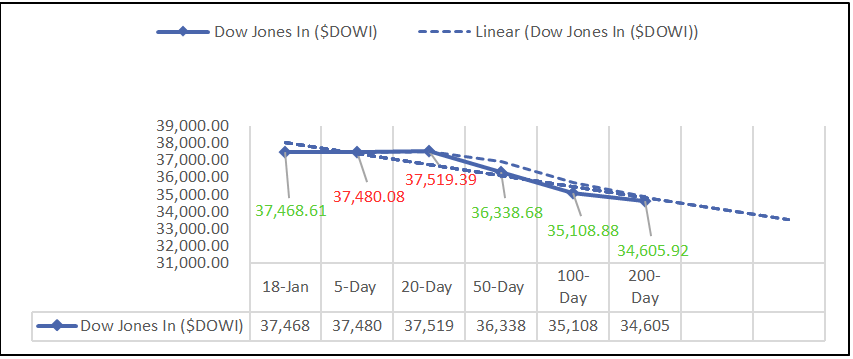

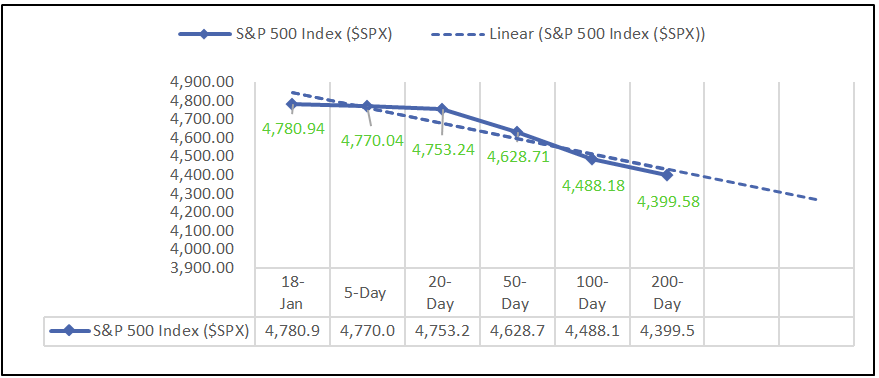

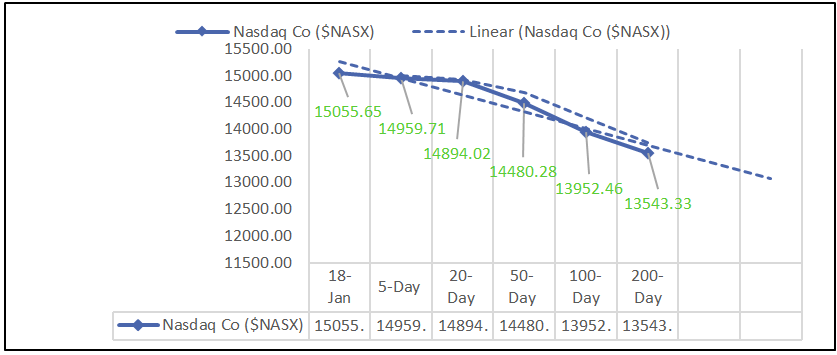

Moving Averages: DOW, S&P 500, NASDAQ:

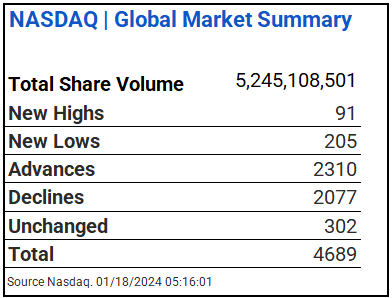

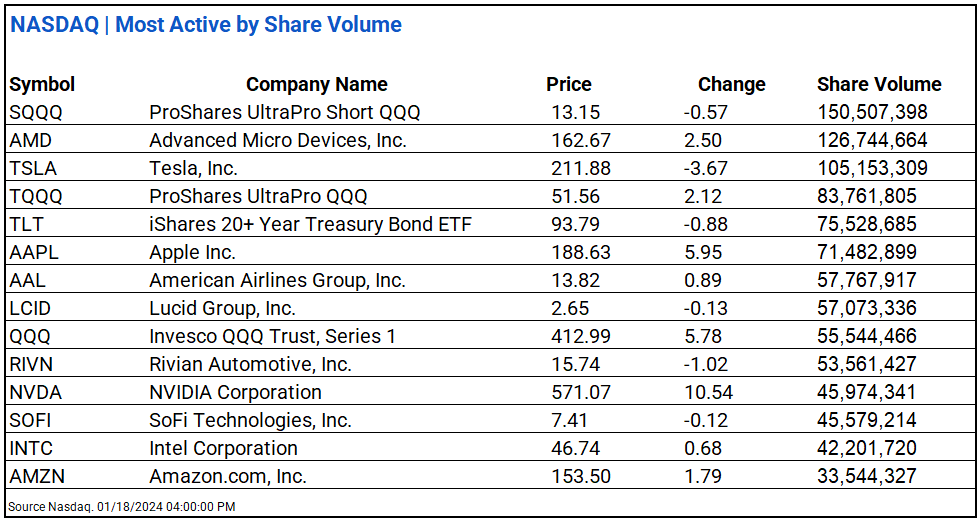

NASDAQ Global Market Summary:

Sectors:

- 7 of 11 sectors higher; Information Technology (+2.03%) leading, Utilities (-1.05%) lagging. Top industries: Passenger Airlines (+4.80%), Trading Companies & Distributors (+4.47%), Technology Hardware, Storage & Peripherals (+3.17%), and Semiconductor & Semiconductor Equipment (+2.56%).

Factors:

- Mega and Large Cap Growth outperform, while IPO lags.

Treasury Markets:

- The 30-Year Bond and 10-Year Note experienced the highest gains, while the 3-Month and 1-Month Bills saw declines.

Currency and Volatility:

- U.S. Dollar Index ^DXY: 103.39 (-0.06, -0.06%)

- CBOE Volatility ^VIX: 14.13 (-0.66, -4.46%)

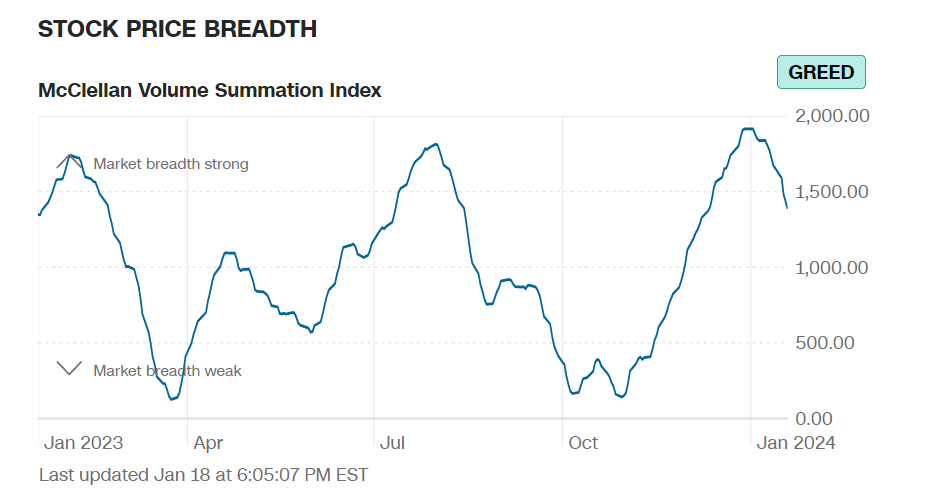

- Fear & Greed Index: 66/LY 58 ( Greed/ Greed)

Commodity Markets:

- Gold Futures: $2,023.87, +$14.00, +0.70%

- Bitcoin USD: $41,239.62, -$1,426.00, -3.34%

- Crude Oil Futures WTI: $73.98, -$0.10, -0.13%

- Bloomberg Commodity Index: 97.20, +$0.56, +0.58%

ETF’s:

- Direxion Daily Semiconductor Bull 3X Shares surged by 9.71%, backed by significant trading volume of 99.2 million.

US Economic Data:

- Initial Jobless Claims (Jan. 13): 187,000 (Forecast: 208,000, Previous: 203,000)

- Philadelphia Fed Manufacturing Survey (Jan.): -10.6 (-8.0, -12.8)

- Housing Starts (Dec.): 1.46 million (Forecast: 1.43 million, Previous: 1.53 million)

- Building Permits (Dec.): 1.5 million (Forecast: 1.48 million, Previous: 1.47 million)

Earnings:

- Q4 Forecast: Analysts significantly lowered S&P 500 companies’ Q4 earnings per share (EPS) estimates during October and November, with a 5.0% decline in the bottom-up EPS estimate. This drop surpasses the average declines over the past 5, 10, 15, and 20 years, marking the most substantial decrease since Q1 2023. Among sectors, Health Care experienced the largest decline (-19.9%), while Information Technology saw a modest increase (+1.5%) in their Q4 2023 bottom-up EPS estimates.

Notable Earnings Today:

- BEAT: Taiwan Semiconductor (TSM), Truist Financial Corp (TFC), Fastenal (FAST), PPG Industries (PPG), KeyCorp (KEY), First Horizon National (FHN).

- MISSED: M&T Bank (MTB), JB Hunt (JBHT), Northern Trust (NTRS).

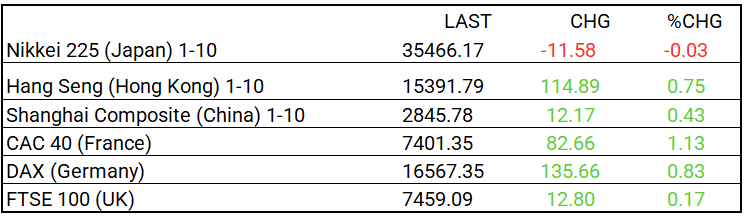

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): 35,466.17, -11.58, -0.03%

- Hang Seng (Hong Kong): 15,391.79, 114.89, 0.75%

- Shanghai Composite (China): 2,845.78, 12.17, 0.43%

- CAC 40 (France): 7,401.35, 82.66, 1.13%

- DAX (Germany): 16,567.35, 135.66, 0.83%

- FTSE 100 (UK): 7,459.09, 12.80, 0.17%

Central Banking and Monetary Policy, Noteworthy:

- Consumers Start 2024 on Strong Footing After a Jolly Holiday – WSJ

- Companies Are Snapping Up New Clean-Energy Tax Credits – WSJ

- ECB Officials Converge Around June to Start Cutting Rates – Bloomberg

- Wall Street’s Davos Crew Brims With Optimism – Bloomberg

Energy:

- U.S. Crude-Oil Stocks Fall, Products Rise in Week – WSJ

- EU Set to Seek Ambitious Goal of 90% Emissions Cut by 2040 – Bloomberg

China:

- China’s top city economies set 2024 GDP growth targets above 5%, signalling road ahead despite headwinds – SCMP