Stay Informed and Stay Ahead: Market Watch, April 25th, 2024.

Wall Street Late Week Market Recap Edition

Market Highlights & Analysis: Indices, Sectors, and More…

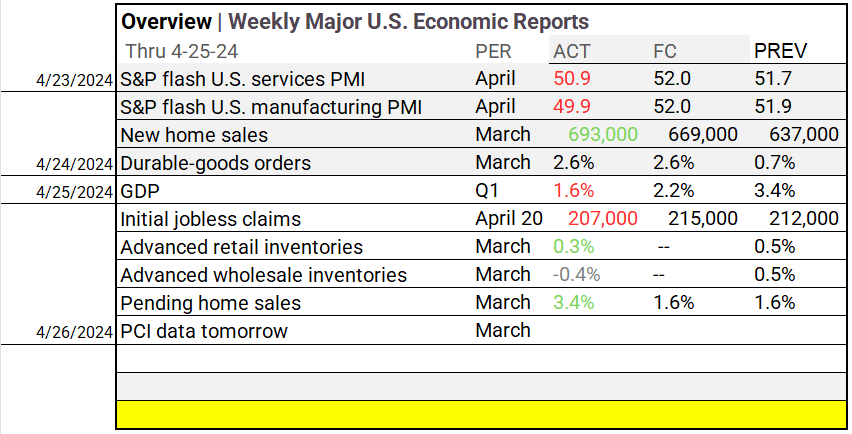

- Economic Data: Jobless claims for the week ending April 20th at 207K, missing the forecast of 215K. Anticipating a significant CPI release tomorrow!

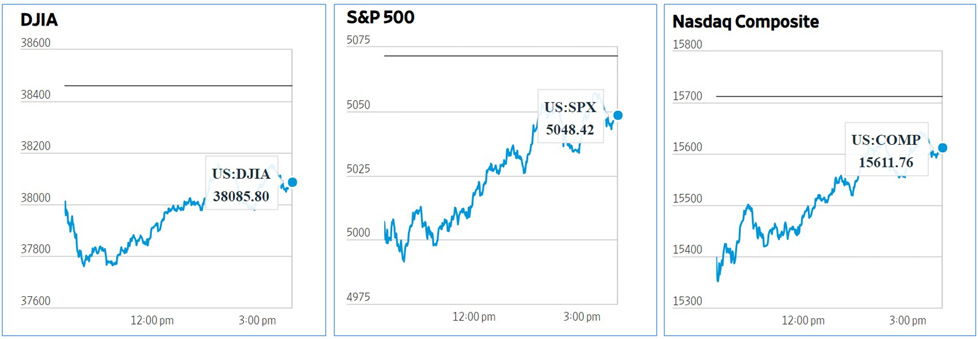

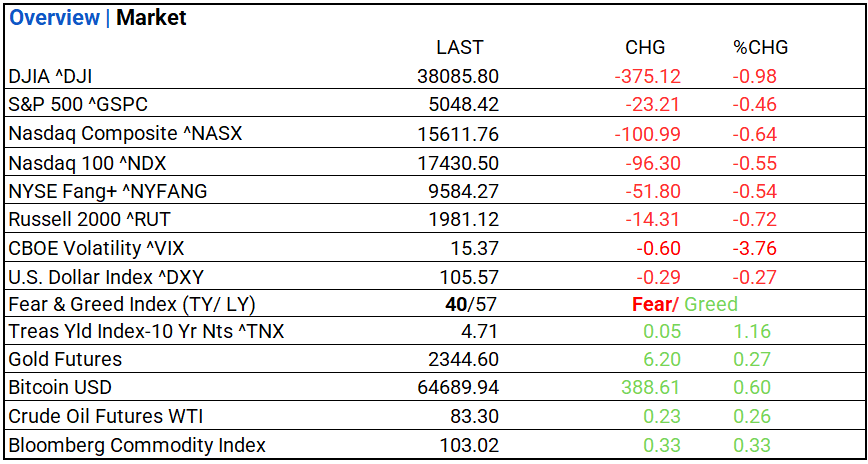

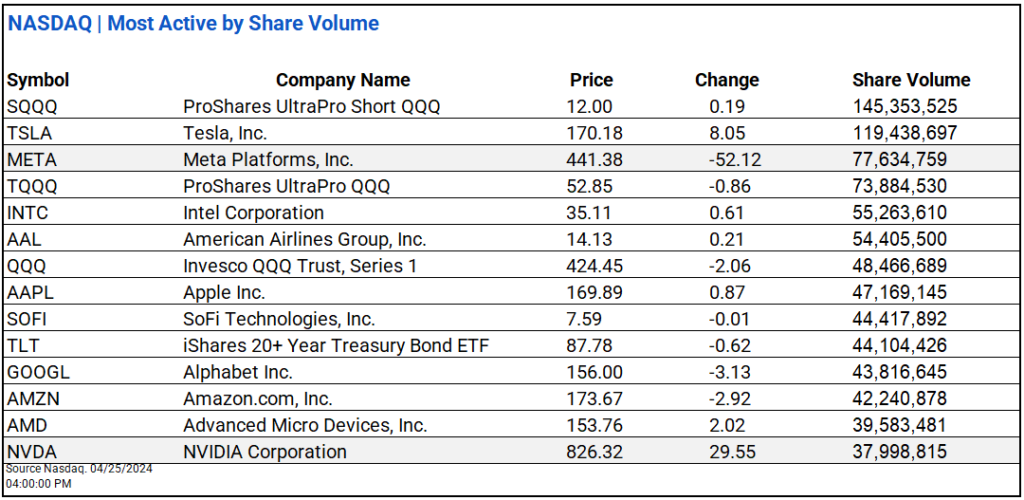

- Market Indices: DJIA (-0.98%), S&P 500 (-0.46%), Nasdaq Composite (-0.64%).

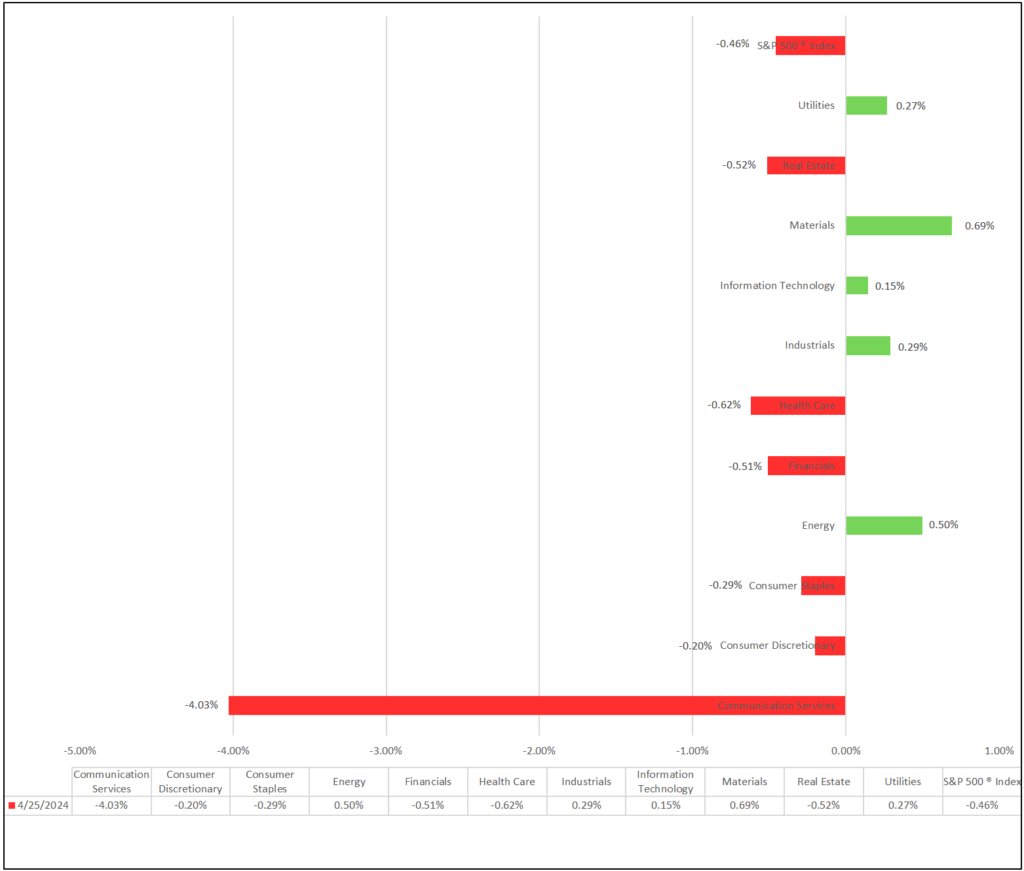

- Sector Performance: 6 of 11 sectors lower; Materials (+0.69%) leading, Communication Services (-4.03%) lagging. Top industry: Metals & Mining (+4.80%).

- Factors: Mega cap value stocks led, remaining flat. Momentum stocks up 13.4% year-to-date.

- Treasury Markets: Bond yields rise, with the 10-year thru 2-year yields gaining most.

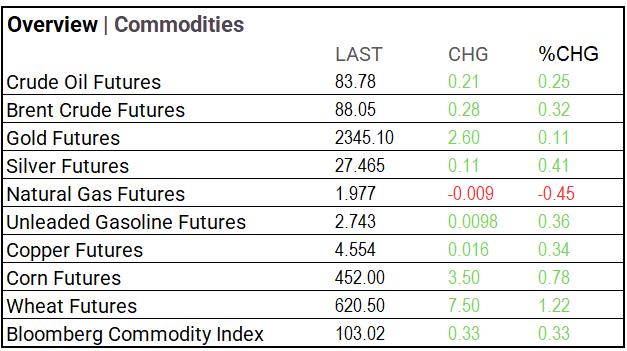

- Commodities: Corn, Wheat, and Silver outperform.

- ETFs: T-Rex 2X Long Tesla Daily Target ETF (+4.58%) on 5.8M in volume.

US Market Snapshot: Key Metrics:

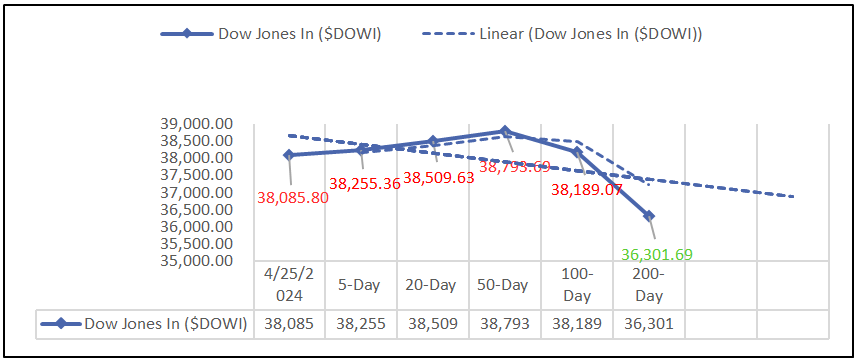

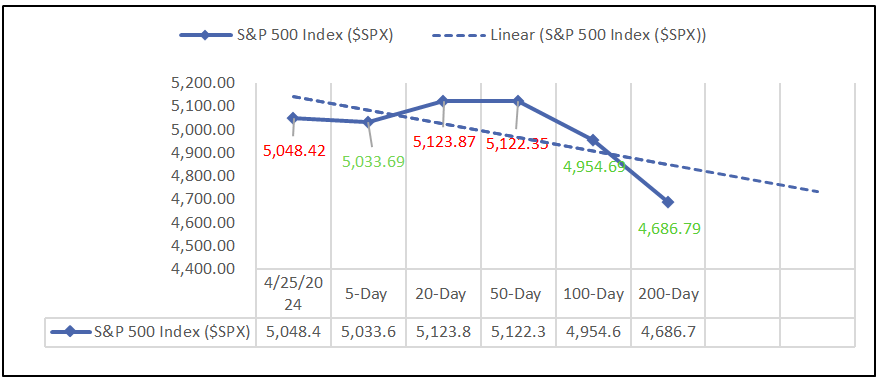

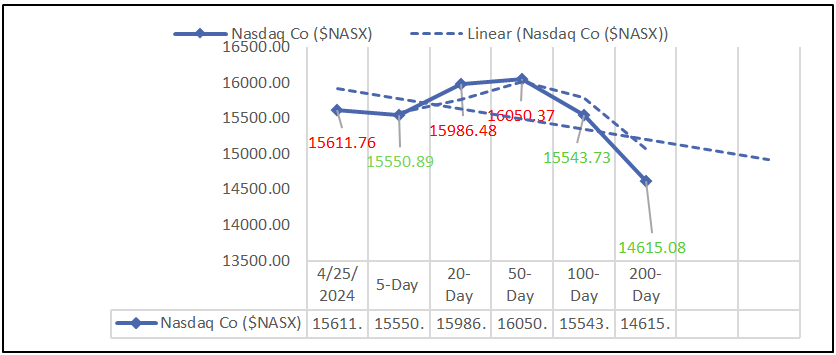

Moving Averages: DOW, S&P 500, NASDAQ:

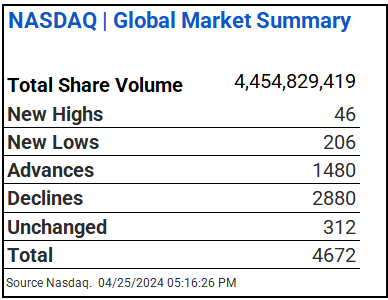

NASDAQ Global Market Summary:

Sectors:

- 6 of 11 sectors lower; Materials (+0.69%) leading, Communication Services (-4.03%) lagging. Top industries: Metals & Mining (+4.80%), Automobiles (+4.22%), and Semiconductor & Semiconductor Equipment (+2.59%).

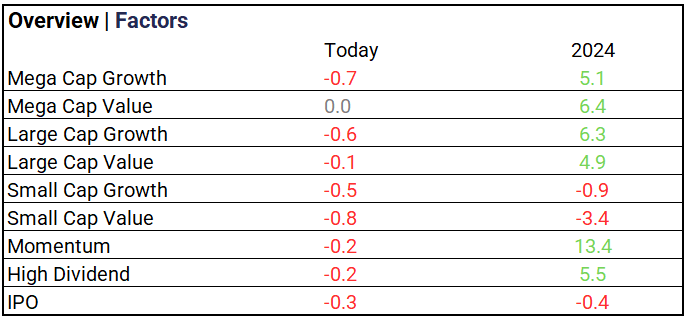

Factors:

- Mega cap value stocks led, remaining flat. Momentum stocks up 13.4% year-to-date.

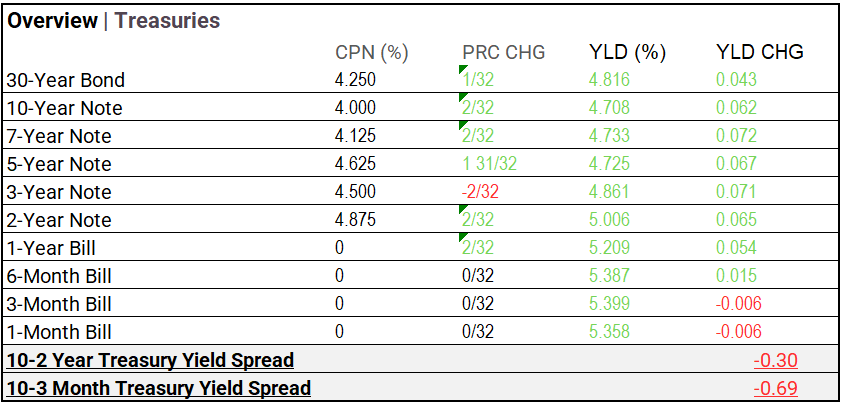

Treasury Markets:

- Bond yields rise, with the 10-year thru 2-year.”Bond yields outperforming.

Currency and Volatility:

- U.S. Dollar Index ^DXY: 105.57 (-0.29, -0.27%)

- CBOE Volatility ^VIX: 15.37 (-0.60, -3.76%)

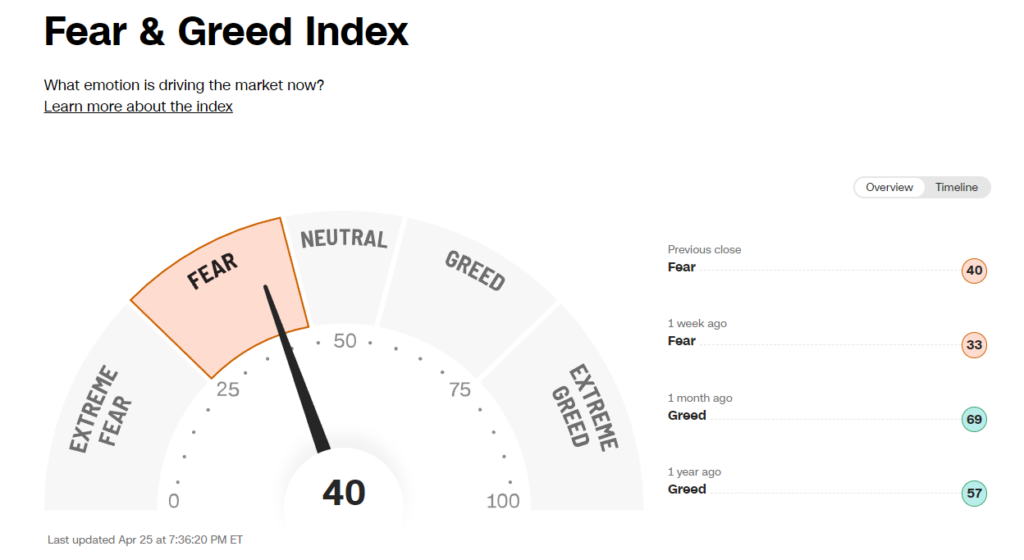

- Fear & Greed Index: 40/TY 57/LY (Fear/Greed)

Commodity Markets:

Note: differences in chart due to post market activity

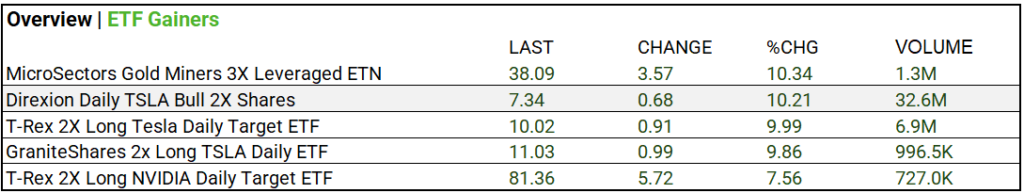

ETF’s:

- Biggest volume gainer: Direxion Daily TSLA Bull 2X Shares (+10.21%) volume of 32.6M.

US Economic Data:

- Initial jobless claims falls short week of April 20th @207K with FC 215k. Big CPI Day tomorrow!

Notable Earnings Today:

- BEAT: Microsoft (MSFT), Alphabet C (GOOG), Merck&Co (MRK), AstraZeneca ADR (AZN), Union Pacific (UNP), Honeywell (HON).

- MISSED: Nestle ADR (NSRGY), T-Mobile US (TMUS), Caterpillar (CAT), Comcast (CMCSA), Intel (INTC), Airbus Group NV (EADSY).

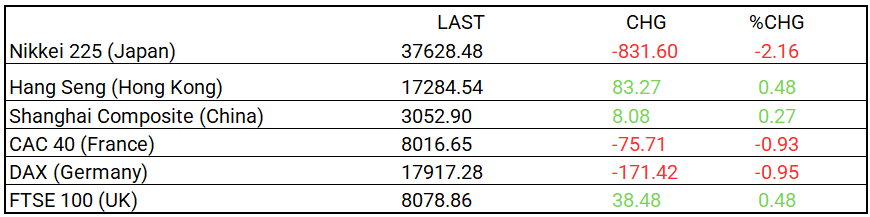

Global Markets Summary: Asian & European Markets:

Central Banking and Monetary Policy, Noteworthy:

- The Dream of Fed Rate Cuts Is Slipping Away – WSJ

- US Economy Slows and Inflation Jumps, Damping Soft-Landing Hopes – Bloomberg

Energy:

- New EPA Emissions Rules Squeeze Coal Plants – WSJ

- On Lithium’s Frontier, Miners Are Betting on a Greener Second Act – Bloomberg

China:

- China’s beefed up statistics and accounting laws under review, robust fines to increase cost of fraud – SCMP