“Empowering Your Financial Success” Daily Market Insights: December 6th, 2023.

Market Insights: Performance, Indices, Sectors, and Trends:

- Economic Data: ADP employment showed a slowdown in job gains and eased wage pressures.

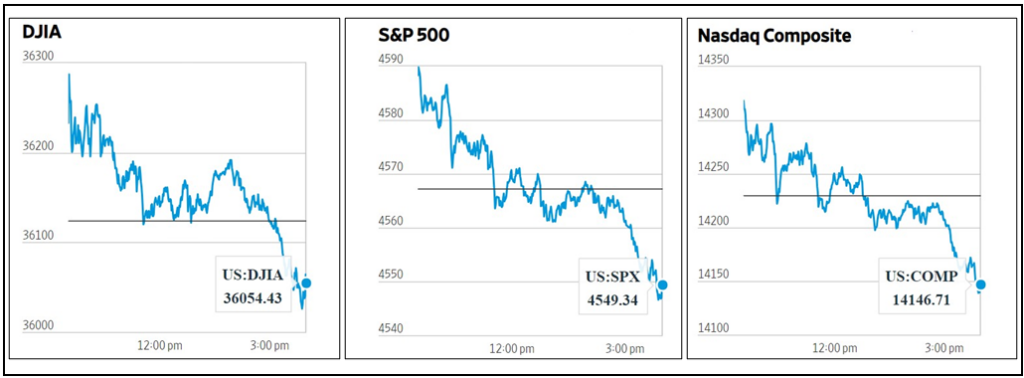

- Market Indices: DJIA (-0.19%), S&P 500 (-0.39%), Nasdaq Composite (-0.58%).

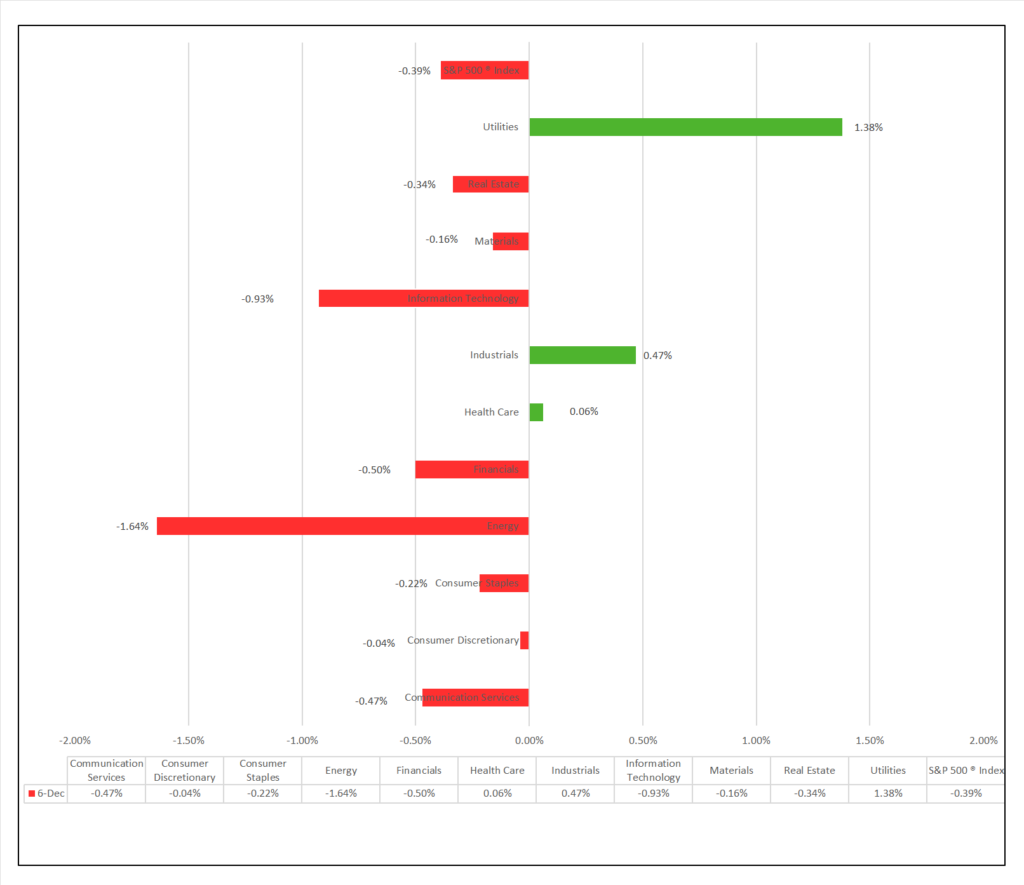

- Sector Performance: 8 of 11 sectors lower; Utilities (+1.38%) leading, Energy (-1.64%) lagging. Top industry: Passenger Airlines (+3.05%).

- Factors: Small Caps and IPOs excelled.

- Treasury Markets: Yields generally fell; the 3-Year and 2-Year Treasury gained 0.20 and 0.41, respectively.

- Commodities: Gold edged up; Bitcoin slightly declined. Bloomberg Commodity Index and Crude Oil Futures dropped sharply.

- Other/Earnings: Analysts significantly lowered S&P 500 companies’ Q4 EPS estimates in October and November, with a 5.0% decline in the bottom-up EPS estimate.

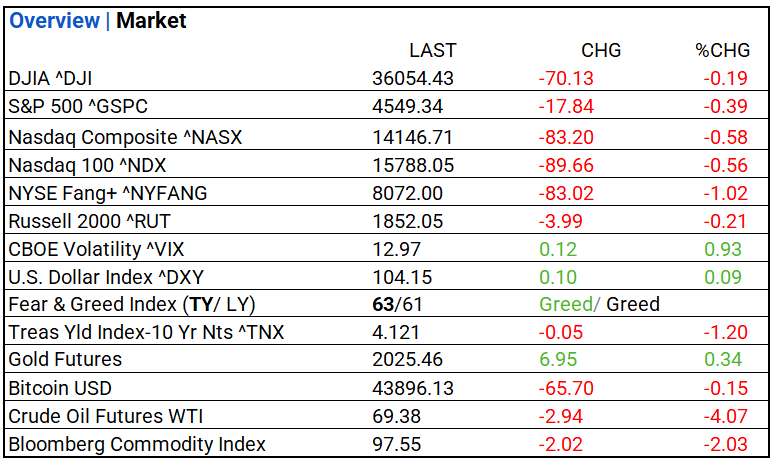

US Market Snapshot: Key Stock Market Indices:

- DJIA ^DJI: 36,054.43 (-70.13, -0.19%)

- S&P 500 ^GSPC: 4,549.34 (-17.84, -0.39%)

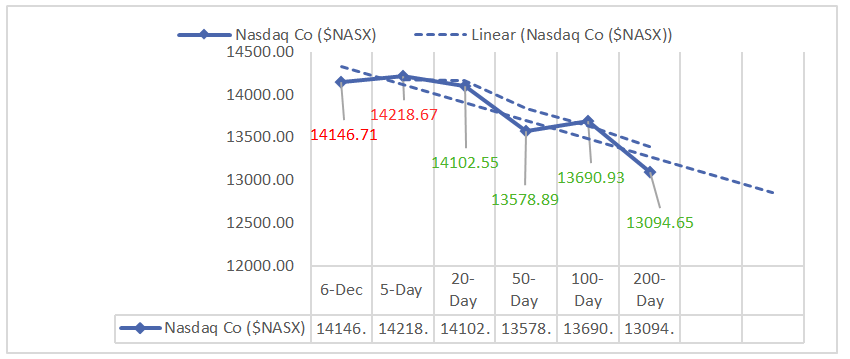

- Nasdaq Composite ^NASX: 14,146.71 (-83.20, -0.58%)

- Nasdaq 100 ^NDX: 15,788.05 (-89.66, -0.56%)

- NYSE Fang+ ^NYFANG: 8,072.00 (-83.02, -1.02%)

- Russell 2000 ^RUT: 1,852.05 (-3.99, -0.21%)

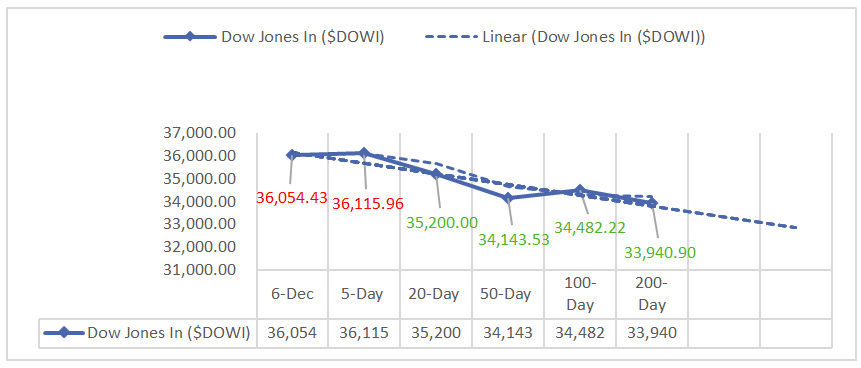

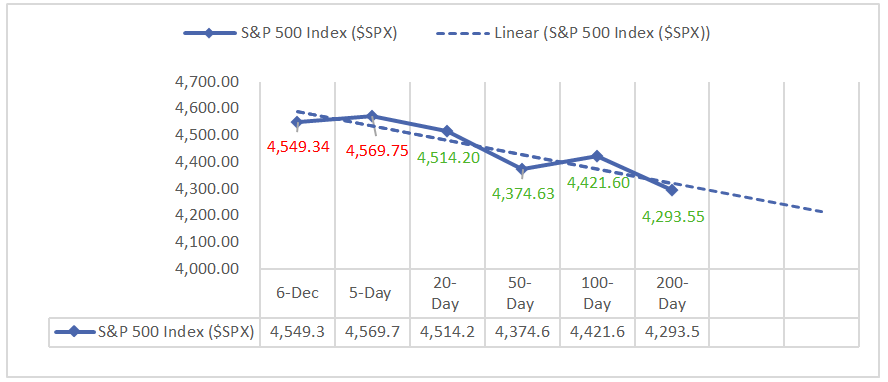

Moving Averages: DOW, S&P 500, NASDAQ:

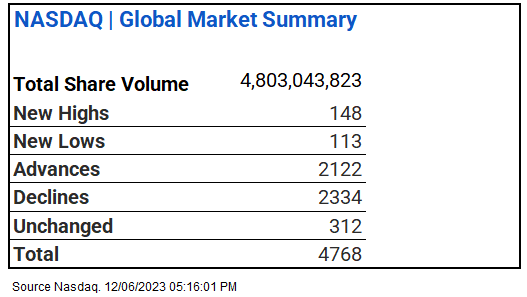

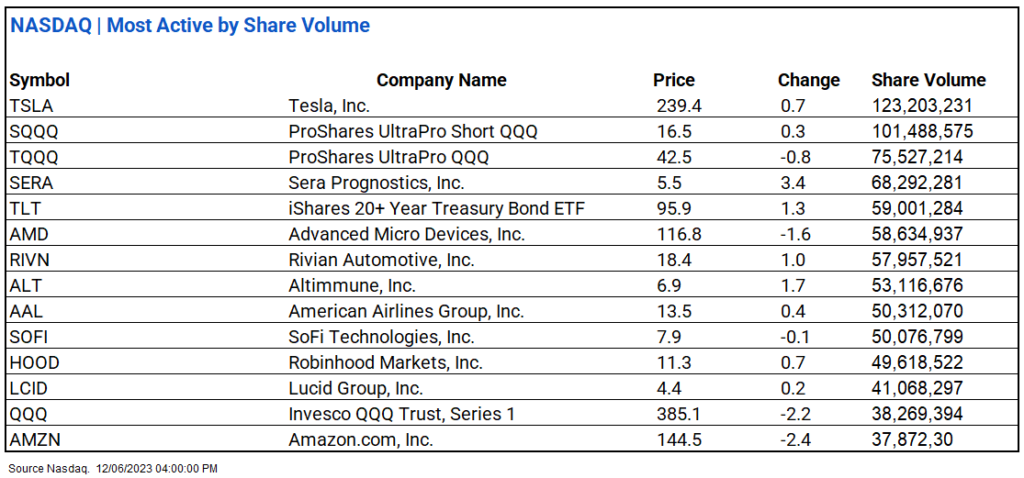

NASDAQ Global Market Summary:

Sectors:

- 8 of 11 sectors lower; Utilities (+1.38%) leading, Energy (-1.64%) lagging. Top industries: Passenger Airlines (+3.05%), Distributors (+1.97%), and Office REITs (+1.87%).

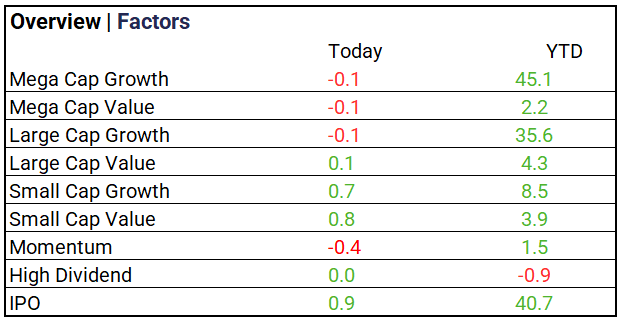

Factors:

- Small caps and IPOs excel.

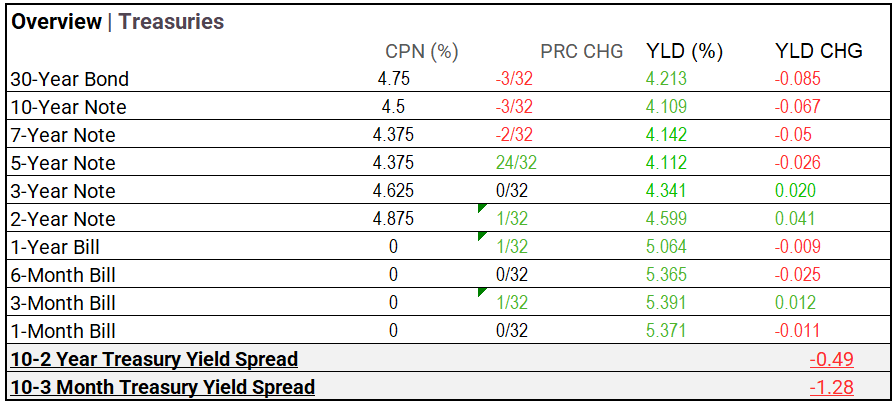

Treasury Markets:

- Treasury yields generally fell, with the 3-Year and 2-Year Treasury Notes leading with gains of 0.20 and 0.41, respectively.

Currency and Volatility:

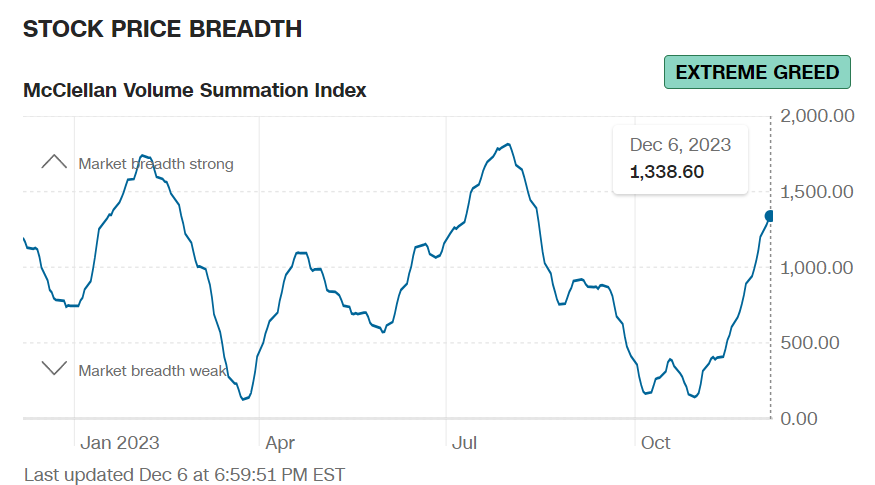

- U.S. Dollar Index and CBOE Volatility up, Fear & Greed indicates Greed.

- CBOE Volatility ^VIX: 12.97 (+0.12, +0.93%)

- Fear & Greed Index: 63/LY 61 (Greed/ Greed).

Commodity Markets:

- Gold Futures: $2,025.46 (6.95, 0.34%)

- Bitcoin USD: $43,896.13 (-65.70, -0.15%)

- Crude Oil Futures WTI: $69.38 (-2.94, -4.07%)

- Bloomberg Commodity Index: 97.55 (-2.02, -2.03%)

US Economic Data:

- ADP Employment (Nov): 103,000 (Previous: 128,000, Forecast: 106,000)

- U.S. Productivity (Q3, Revision): 5.2% (Previous: 4.9%, Forecast: 4.7%)

- U.S. Trade Deficit (Oct): -$64.3B (Previous: -$64.1B, Forecast: -$61.2B)

Earnings:

- Q4 Forecast: Analysts significantly lowered S&P 500 companies’ Q4 earnings per share (EPS) estimates during October and November, with a 5.0% decline in the bottom-up EPS estimate. This drop surpasses the average declines over the past 5, 10, 15, and 20 years, marking the most substantial decrease since Q1 2023. Among sectors, Health Care experienced the largest decline (-19.9%), while Information Technology saw a modest increase (+1.5%) in their Q4 2023 bottom-up EPS estimates.

Notable Earnings Today:

- BEAT: Veeva Systems A (VEEV), Campbell Soup (CPB), Braze (BRZE), Ollie’s Bargain Outlet (OLLI), Sprinklr (CXM), Korn Ferry (KFY).

- MISSED: Brown Forman A (BFa), Chewy (CHWY), Thor Industries (THO), GameStop Corp (GME), C3.ai (AI), Greif Bros (GEF).

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): 2.04%

- Hang Seng (Hong Kong): 0.83%

- Shanghai Composite (China): -0.11%

- CAC 40 (France): 0.66%

- DAX (Germany): 0.75%

- FTSE 100 (UK): 0.34%

Central Banking and Monetary Policy:

- Signs of a Weakening Job Market, in Five Charts – WSJ

- Shares in Asia Fall as Oil Touches Six-Month Low: Markets Wrap – Bloomberg

Energy:

- U.S. Crude Oil Inventories Fall by 4.6 Million Barrels in Week – WSJ

- Can China diversify iron ore imports from Australia, Brazil as mining giant Rio Tinto affirms 2025 Africa production? – SCMP

China:

- China advises state firms to keep eye on finances as risk becomes economic watchword – SCMP