The Persistence Premium

- Matthew Krumholz

- 25 October 2025

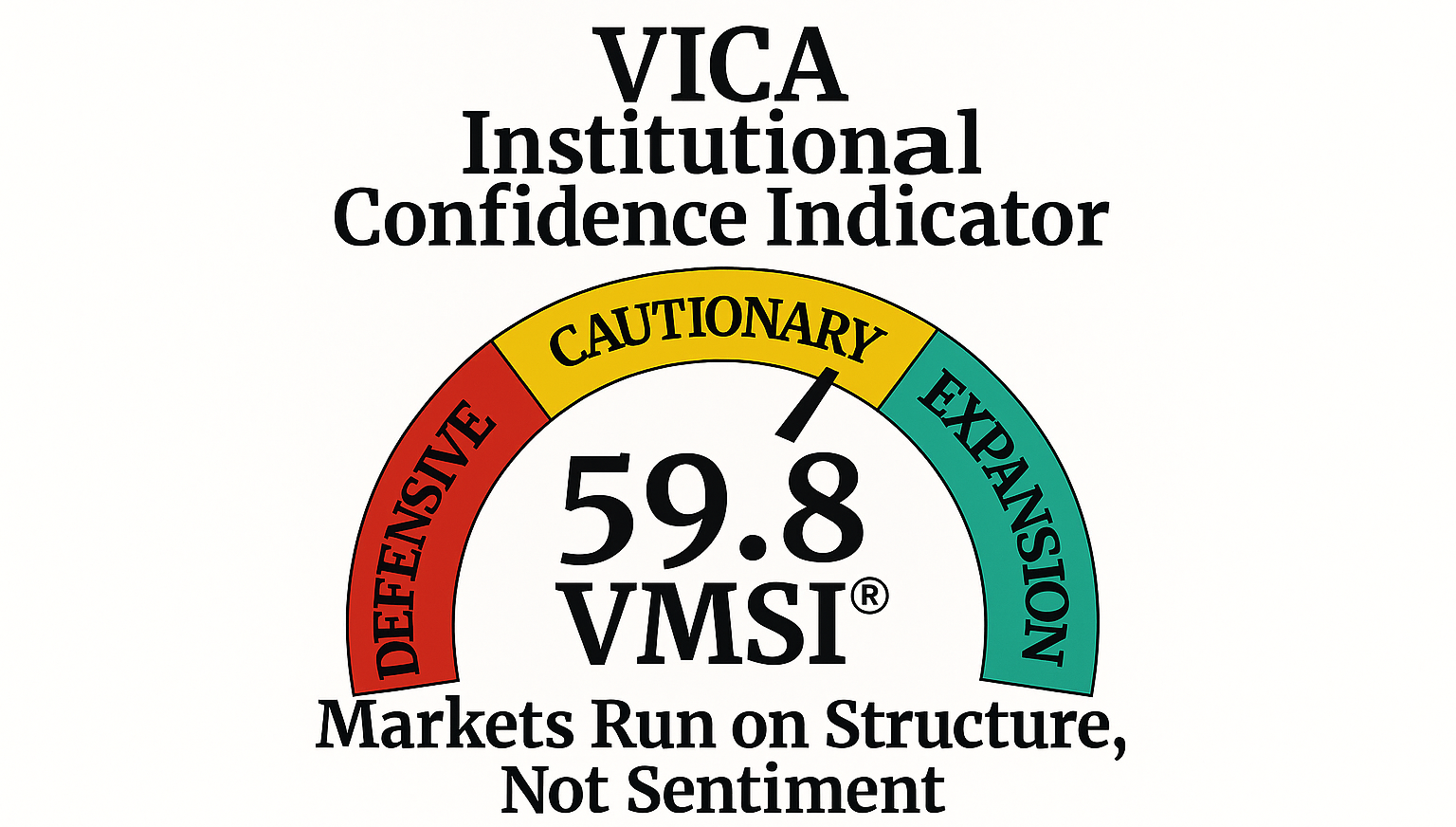

VMSI™ Institutional Market Intelligence Report — FORCE-12.2 Institutional Edition Week Ending October 23, 2025 The Persistence Premium Liquidity Buys Time

The Calm Holds — Credit

- Matthew Krumholz

- 21 October 2025

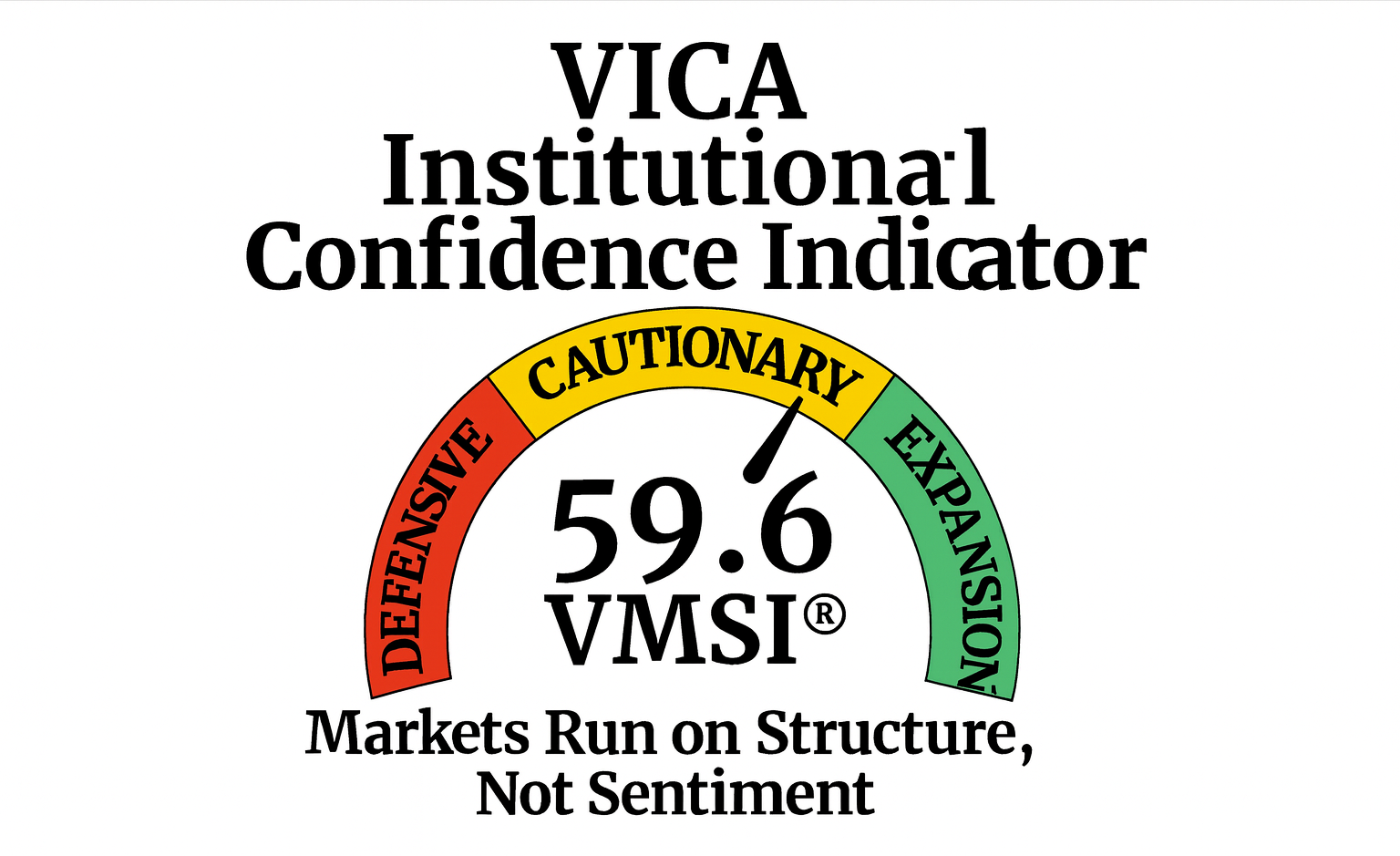

VMSI™ Institutional Market Intelligence Report — FORCE-12.2 Institutional Edition. Week Ending October 16 2025 The Calm Holds — Credit Is

Latest

The Market That Trades Itself

Liquidity Holds — AI Amplifies — Credit Decides. Markets are

The Persistence Premium

VMSI™ Institutional Market Intelligence Report — FORCE-12.2 Institutional Edition Week

The Calm Holds — Credit Is the Fuse

VMSI™ Institutional Market Intelligence Report — FORCE-12.2 Institutional Edition. Week

Liquidity Rules, Credit Waits — The Calm Before Convexity

VMSI™ Institutional Market Intelligence Report — FORCE-12 Institutional Edition Week

Supply and demand is the primary factor driving the price of stocks. Other factors, such as major financial news, natural disasters, investor reaction to company financials, or pricing speculation, can cause large price fluctuations.

Vica is a leader in identifying patterns that’s others can’t see

Vica Metrics Matter

Hedge Fund Ranking

Investment Company

Industry Trends

Press, Headlines and PR

Newsletter Services

Public Sentiment

Ratings

Government Reports

Geopolitical Events

Education and Resources

Company Earnings and Guidance

Technicals Analyst Observations

About Vica

We are enterprise software and consulting company that specializes in systematic trading using quantitative models derived from mathematical and statistical analysis.

Vica Advantage

Our Teams are made up of computer scientists, mathematicians, physicists, signal processing experts and statisticians.

Scalable technological architectures for computation and execution

Petabyte-scale data warehouse to assess statistical probabilities for the direction of securities prices in any given market.

Most Popular

The Market That Trades Itself

Liquidity Holds — AI Amplifies — Credit Decides. Markets are

The Persistence Premium

VMSI™ Institutional Market Intelligence Report — FORCE-12.2 Institutional Edition Week

The Calm Holds — Credit Is the Fuse

VMSI™ Institutional Market Intelligence Report — FORCE-12.2 Institutional Edition. Week

Liquidity Rules, Credit Waits — The Calm Before Convexity

VMSI™ Institutional Market Intelligence Report — FORCE-12 Institutional Edition Week

Continuation Until Credit Breaks

VMSI: Continuation Until Credit Breaks — Credit/CRE now the hinge

Liquidity vs. Credit: The Fracture Line of 2025

VMSI Institutional Market Intelligence Report – Week Ending September 25,

Journal

Stock rise today as investors begin to embrace that bad can look good

Stocks head conservatively higher as markets bet the Fed will slow rate hikes

Stocks open lower and recover, all three major U.S. indexes are on track for weekly gains

Indexes lose early gains, net long positions in U.S. equity futures is near the lowest level since 2006

Investors

Sign up to receive our latest research on the forces shaping global economies and markets.

Journal

The Market That Trades Itself

Liquidity Holds — AI Amplifies — Credit Decides. Markets are

The Persistence Premium

VMSI™ Institutional Market Intelligence Report — FORCE-12.2 Institutional Edition Week

The Calm Holds — Credit Is the Fuse

VMSI™ Institutional Market Intelligence Report — FORCE-12.2 Institutional Edition. Week

Liquidity Rules, Credit Waits — The Calm Before Convexity

VMSI™ Institutional Market Intelligence Report — FORCE-12 Institutional Edition Week