Inside the Mechanics of the

- Matthew Krumholz

- 09 February 2026

Equities Remain Firm as Volatility Resets Summary: Global risk assets remain resilient despite mixed index performance. U.S. equities are holding

Measuring Monetary Transmission in a

- Matthew Krumholz

- 06 February 2026

Procedural Framework for Policy Assessment in Modern Capital Markets Abstract Traditional monetary policy assessment frameworks rely heavily on realized macroeconomic

Latest

Inside the Mechanics of the Market

Week Ahead: March 9, 2026 Executive Takeaway: Markets are repricing

Inside the Mechanics of the Market (Week Ahead: February 9, 2026)

Equities Remain Firm as Volatility Resets Summary: Global risk assets

Measuring Monetary Transmission in a Reflexive, Market-Driven System

Procedural Framework for Policy Assessment in Modern Capital Markets Abstract

Inside the Mechanics of the Market (Week Ahead: February 1, 2026)

Week Ahead – Resilient Growth, Policy Pause, and Volatility in

Supply and demand is the primary factor driving the price of stocks. Other factors, such as major financial news, natural disasters, investor reaction to company financials, or pricing speculation, can cause large price fluctuations.

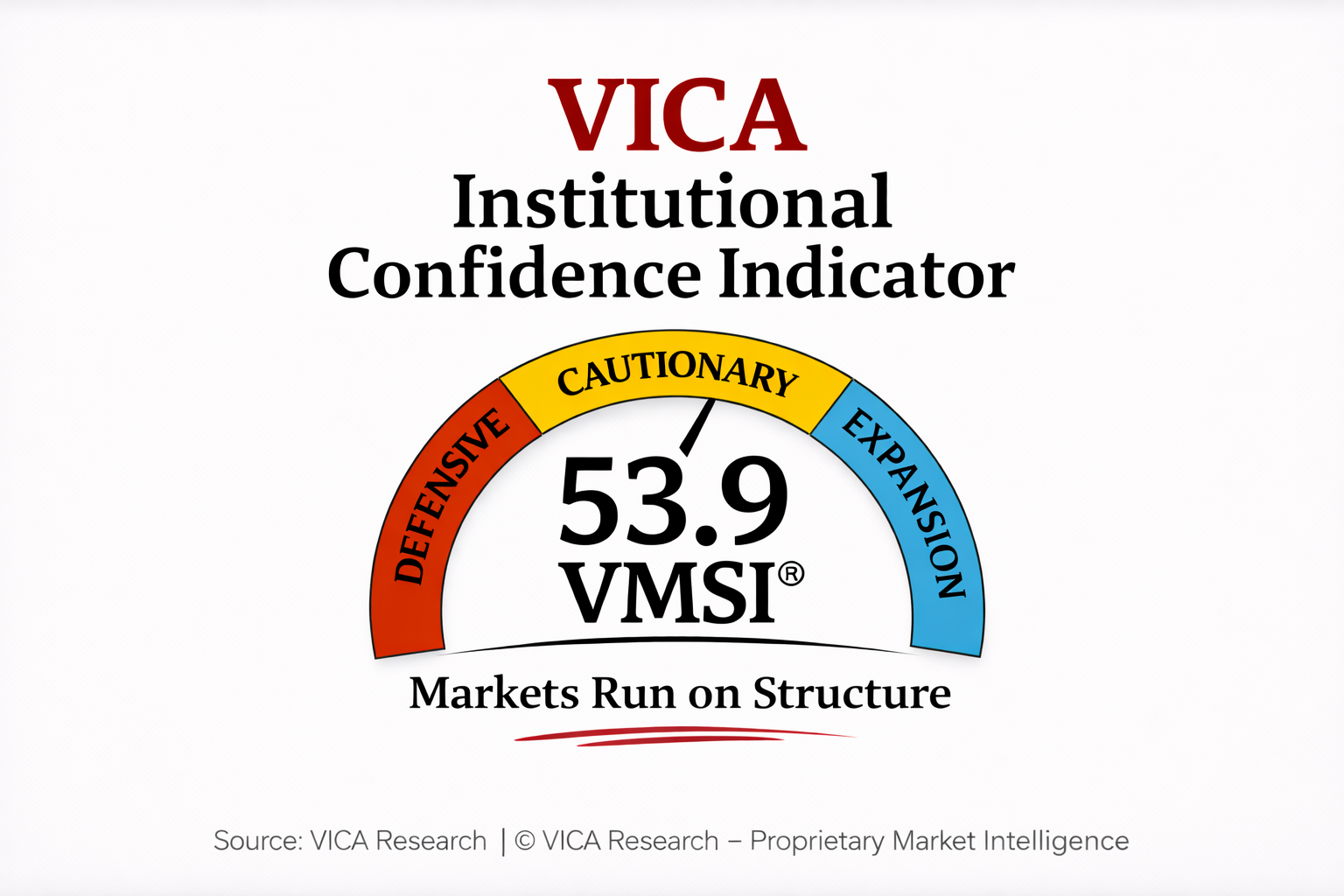

Vica is a leader in identifying patterns that’s others can’t see

Vica Metrics Matter

Hedge Fund Ranking

Investment Company

Industry Trends

Press, Headlines and PR

Newsletter Services

Public Sentiment

Ratings

Government Reports

Geopolitical Events

Education and Resources

Company Earnings and Guidance

Technicals Analyst Observations

About Vica

We are enterprise software and consulting company that specializes in systematic trading using quantitative models derived from mathematical and statistical analysis.

Vica Advantage

Our Teams are made up of computer scientists, mathematicians, physicists, signal processing experts and statisticians.

Scalable technological architectures for computation and execution

Petabyte-scale data warehouse to assess statistical probabilities for the direction of securities prices in any given market.

Most Popular

Inside the Mechanics of the Market

Week Ahead: March 9, 2026 Executive Takeaway: Markets are repricing

Inside the Mechanics of the Market (Week Ahead: February 9, 2026)

Equities Remain Firm as Volatility Resets Summary: Global risk assets

Measuring Monetary Transmission in a Reflexive, Market-Driven System

Procedural Framework for Policy Assessment in Modern Capital Markets Abstract

Inside the Mechanics of the Market (Week Ahead: February 1, 2026)

Week Ahead – Resilient Growth, Policy Pause, and Volatility in

Inverse ETFs Are Analog Hedges in a Digital Market

VICA Partners | Institutional Market Structure Commentary, January 2026 Inverse

The Next Market Shock Won’t Announce Itself in VIX

Why volatility is a tradable price — not a structural

Journal

Wall Street 3 Day Panic over Fed Rate Hikes Continue

This Week’s Ending 9-2 U.S. Economic Reports

No Market Surprise Today as the Federal Reserve Remains Tough on Inflation

Funds Successfully Invested in Weekly Market Rally

Investors

Sign up to receive our latest research on the forces shaping global economies and markets.

Journal

Inside the Mechanics of the Market

Week Ahead: March 9, 2026 Executive Takeaway: Markets are repricing

Inside the Mechanics of the Market (Week Ahead: February 9, 2026)

Equities Remain Firm as Volatility Resets Summary: Global risk assets

Measuring Monetary Transmission in a Reflexive, Market-Driven System

Procedural Framework for Policy Assessment in Modern Capital Markets Abstract

Inside the Mechanics of the Market (Week Ahead: February 1, 2026)

Week Ahead – Resilient Growth, Policy Pause, and Volatility in