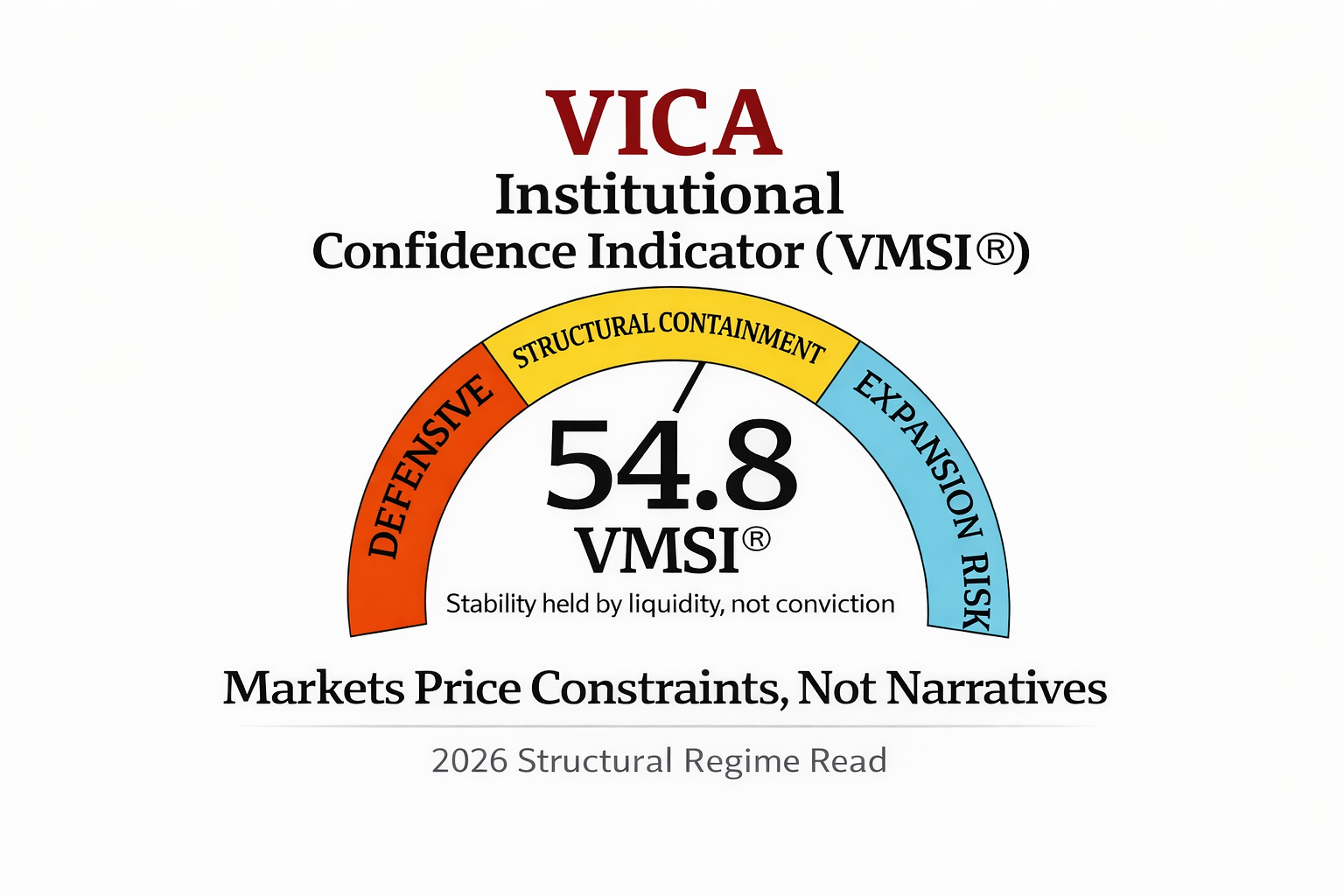

CAPM Explains Risk. It Doesn’t

- Matthew Krumholz

- 12 January 2026

Why modern markets require a structural model — and what VMSI adds that traditional analysis cannot VICA Partners | Institutional

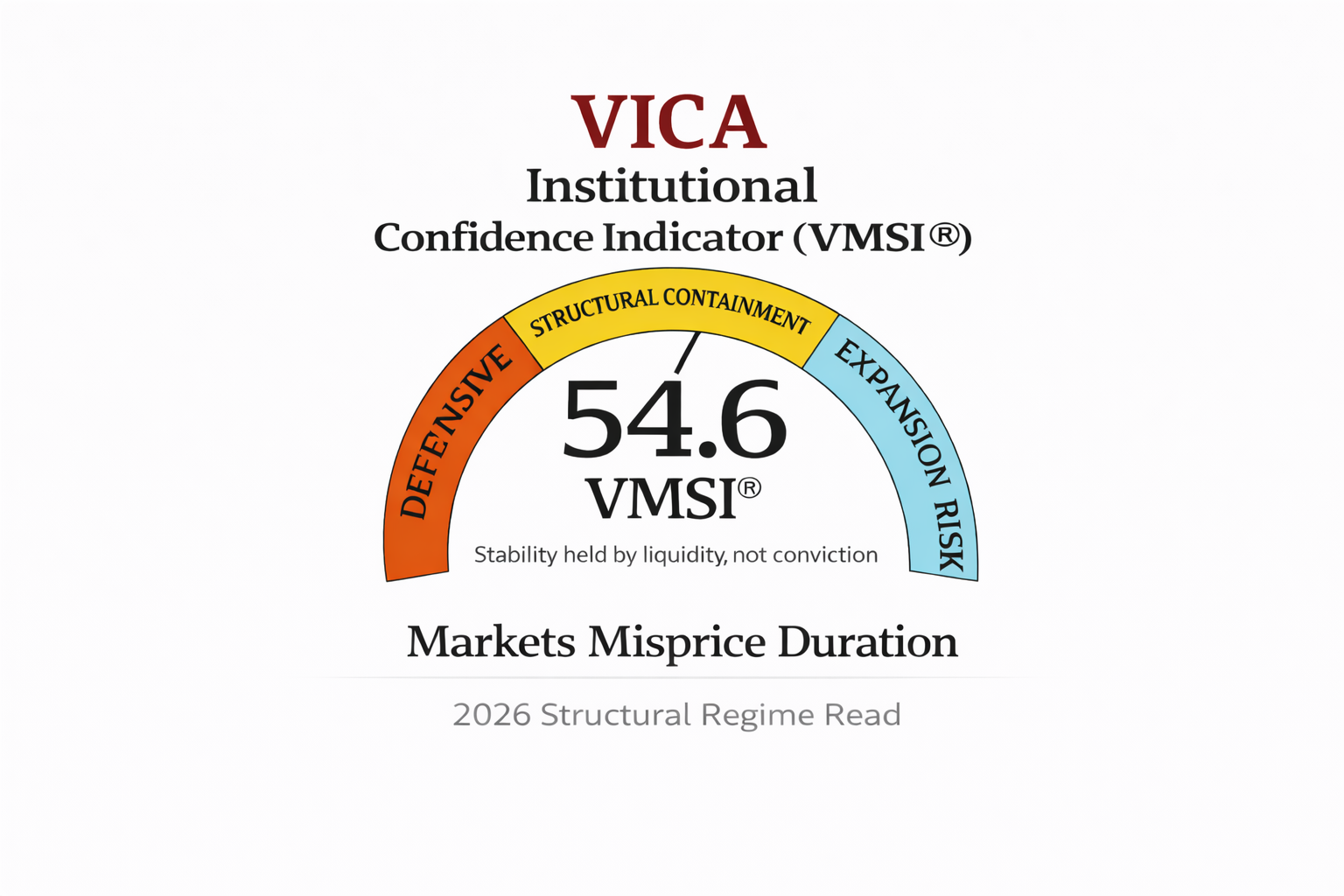

Markets Misprice Duration

- Matthew Krumholz

- 03 January 2026

What Venezuela Reveals About Risk, Oil, and Duration Mispricing VICA Partners | Institutional Market Structure Commentary Abstract Geopolitical shocks consistently

Latest

The Next Market Shock Won’t Announce Itself in VIX

Why volatility is a tradable price — not a structural

CAPM Explains Risk. It Doesn’t Explain Why Prices Hold.

Why modern markets require a structural model — and what

Markets Misprice Duration

What Venezuela Reveals About Risk, Oil, and Duration Mispricing VICA

China’s Growth Model Is Externally Anchored. Capital Still Prices the Constraint.

VICA Partners | Institutional Market Structure Commentary Abstract Markets are

Supply and demand is the primary factor driving the price of stocks. Other factors, such as major financial news, natural disasters, investor reaction to company financials, or pricing speculation, can cause large price fluctuations.

Vica is a leader in identifying patterns that’s others can’t see

Vica Metrics Matter

Hedge Fund Ranking

Investment Company

Industry Trends

Press, Headlines and PR

Newsletter Services

Public Sentiment

Ratings

Government Reports

Geopolitical Events

Education and Resources

Company Earnings and Guidance

Technicals Analyst Observations

About Vica

We are enterprise software and consulting company that specializes in systematic trading using quantitative models derived from mathematical and statistical analysis.

Vica Advantage

Our Teams are made up of computer scientists, mathematicians, physicists, signal processing experts and statisticians.

Scalable technological architectures for computation and execution

Petabyte-scale data warehouse to assess statistical probabilities for the direction of securities prices in any given market.

Most Popular

The Next Market Shock Won’t Announce Itself in VIX

Why volatility is a tradable price — not a structural

CAPM Explains Risk. It Doesn’t Explain Why Prices Hold.

Why modern markets require a structural model — and what

Markets Misprice Duration

What Venezuela Reveals About Risk, Oil, and Duration Mispricing VICA

China’s Growth Model Is Externally Anchored. Capital Still Prices the Constraint.

VICA Partners | Institutional Market Structure Commentary Abstract Markets are

Stocks Are Rising — But Fewer and Fewer Stocks Are Doing the Work

VICA Institutional Confidence Indicator (VMSI®) Report | December 19, 2025

Markets Are Stable — But Only Because Structure Is Carrying the Load

VICA Market Sentiment Index (VMSI) Report | December 12, 2025,

Journal

Jedi Mastery of Bear Markets

Insider Trading Hedge Funds Facts

Earn A+ Grade in Mathematical Finance

Get-it-on with Quantitative Funds

Investors

Sign up to receive our latest research on the forces shaping global economies and markets.

Journal

The Next Market Shock Won’t Announce Itself in VIX

Why volatility is a tradable price — not a structural

CAPM Explains Risk. It Doesn’t Explain Why Prices Hold.

Why modern markets require a structural model — and what

Markets Misprice Duration

What Venezuela Reveals About Risk, Oil, and Duration Mispricing VICA

China’s Growth Model Is Externally Anchored. Capital Still Prices the Constraint.

VICA Partners | Institutional Market Structure Commentary Abstract Markets are