(VICA Research | April 27, 2025)

Capital moves before narratives confirm.

April’s early market fractures point to a liquidity-driven regime transition — a structural realignment that capital allocators must recognize before sentiment data validates the shift.

Executive Summary

The most consequential shift in global finance is unfolding silently: a liquidity cycle inflection, not captured by sentiment surveys or surface-level data.

April’s behavior across credit markets, volatility hedging, sector rotation, and fund flows signals a structural regime change.

Capital strategy now demands a liquidity-first framework, not a narrative-driven response.

- Liquidity Over Narrative

Liquidity precedes solvency, sentiment, and macro statistics.

In April:

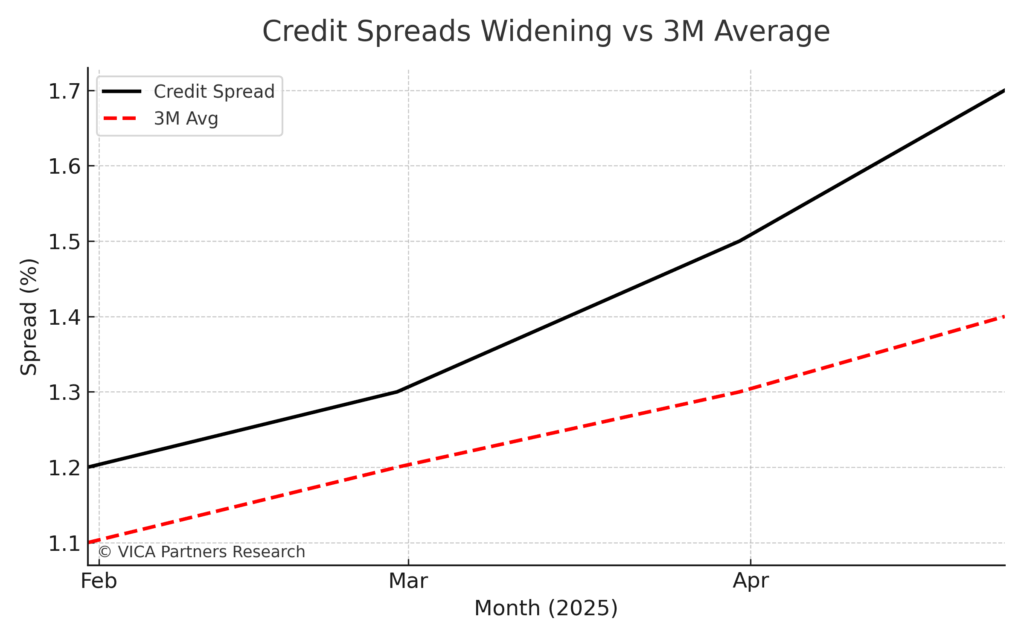

- Credit spreads widened from 1.5% in March to 1.7% by April 24, reaching a 12-month high.

- 3-month moving average rose sharply to 1.4%.

- Money market fund balances continued to rise.

- Volatility surfaces steepened, reflecting mounting liquidity pressure.

Key Takeaway: Credit spread widening reflects a foundational tightening in liquidity, preceding visible economic stress. Continued ETF redemptions in broad equity trackers and increased Treasury bill inflows confirm a preemptive defensive posture.

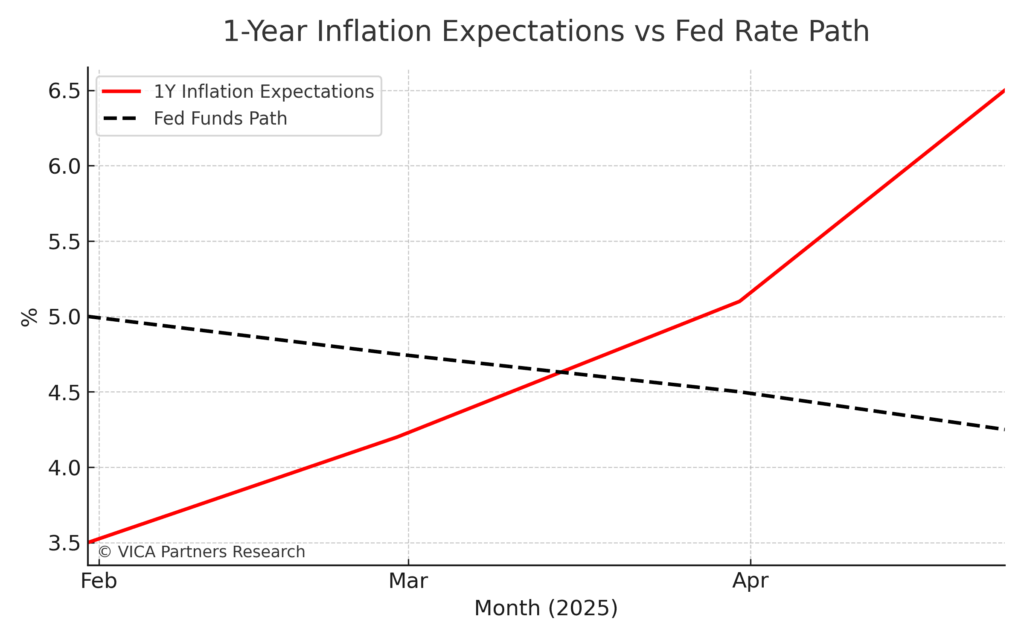

- Inflation Expectations Reanchor Capital Costs

Consumer inflation expectations accelerated sharply in April:

- 1-year forward inflation expectations rose to 6.5% by April 24, up from 5.1% in March.

- Fed funds path assumptions declined modestly to 4.25%, showing a decoupling from inflation expectations.

Key Takeaway: Forward inflation expectations are forcing capital markets to reprice risk ahead of central bank actions. Credit curves have steepened, and real yields are drifting higher despite softer nominal CPI prints.

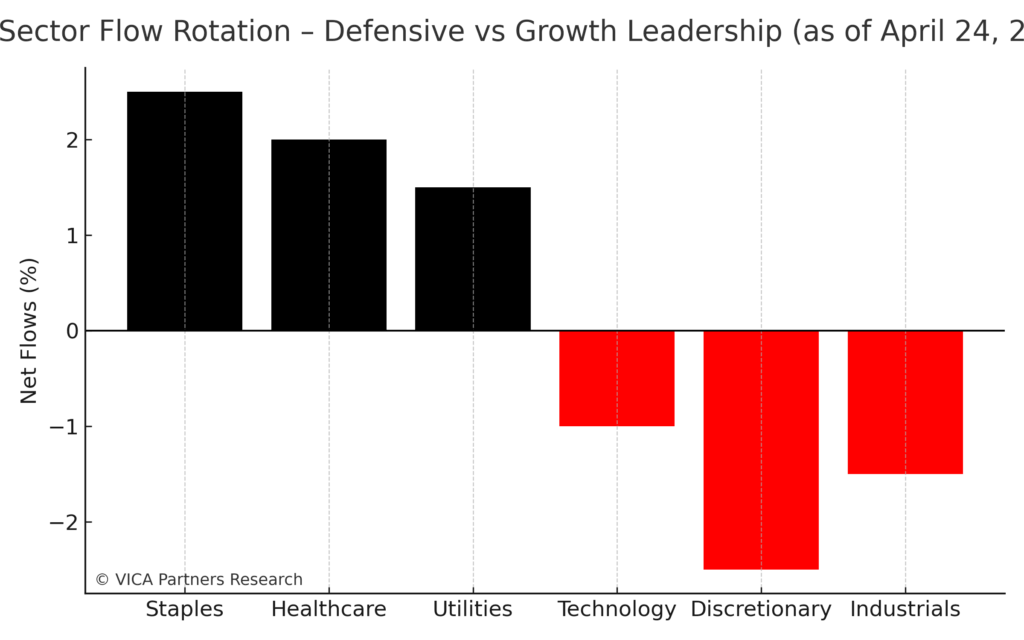

- Defensive Sector Rotation: Smart Capital Moves First

Rotation patterns in April show clear capital repositioning toward resilience:

- Defensive sectors — Staples, Healthcare, Utilities — saw strong net inflows of 1.5% to 2.5%.

- Growth sectors — Technology, Discretionary — posted net outflows up to -2.5%.

- Net flows overwhelmingly favored defensive allocations.

Key Takeaway: Sector rotation is a strategic reallocation toward cash flow resilience. ETF flow data confirms institutions are overweighting stability sectors while underweighting cyclicals and discretionary plays.

- VICA VMSI Data Captures Structural Break

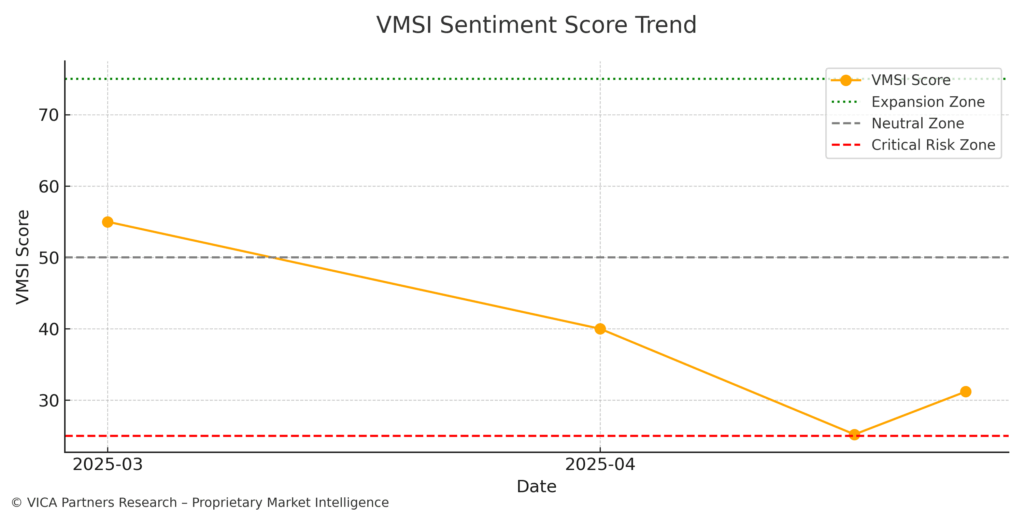

The VICA Market Sentiment Index (VMSI) declined materially in late April:

- VMSI fell from 55 in early March to 40 in early April, dipped further to 25.2 by mid-April, and rebounded to 31.2 by April 24, 2025.

- April marked the most significant single-month volatility and sentiment reset since early 2020.

Key Takeaway: VMSI captured capital behavior fractures ahead of broader survey recognition, validating liquidity-first monitoring. Volatility hedging remains elevated despite headline index rebounds. This trend visualization highlights the sharp April dip to 25.2 and the modest recovery to 31.2, aligning with flow data and risk appetite measures.

VMSI Institutional Risk Update | April 24, 2025

VMSI Score: 31.2 — Defensive Zone

VMSI Score: 31.2 — Defensive Zone

S&P 500: +2.03% | Nasdaq: +2.74% | Dow: +1.23% | VIX: 26.49

The VICA Market Sentiment Index (VMSI) rose modestly to 31.2, remaining firmly in the Defensive Zone. Despite a sharp equity rebound, institutional capital behavior remains defined by caution, liquidity stress, and volatility management.

VMSI Key Metrics:

| Metric | Reading |

| Momentum | 37 |

| Liquidity | 29.4 |

| Volatility | 59 |

| Safe Haven Demand | 78 |

Interpretation:

- Defensive positioning dominates.

- Liquidity pressures remain unresolved.

- Volatility hedging demand signals continued risk aversion.

- Institutional conviction for a sustained rally remains absent.

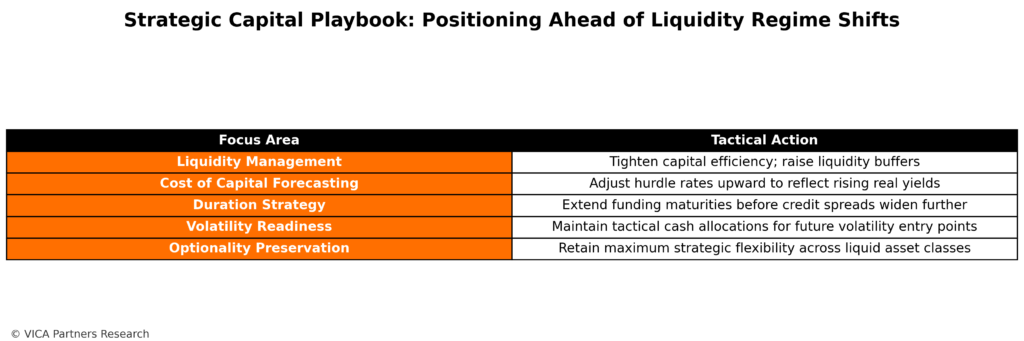

Strategic Capital Playbook: Positioning Ahead of Liquidity Regime Shifts

Key Takeaway: Preparing liquidity structures, sector rotations, and volatility defenses now will define capital leadership in the in the next cycle.

Conclusion: Liquidity Mastery Defines Cycle Winners

April 2025 marks the start of a liquidity-driven capital regime change.

Smart capital is repositioning ahead of headlines.

Liquidity’s silent repricing is the true signal — and those who recognize it early will define the next cycle’s leadership.

Sources Referenced

University of Michigan Sentiment Data, Bloomberg Credit Markets, Federal Reserve Liquidity Reports, ETF.com Flow Analytics, CFTC Commitment of Traders Reports, Nasdaq and NYSE Market Statistics.

About the VICA Market Sentiment Index (VMSI)

© VICA Partners Research — Proprietary Multi-Factor Model. The VMSI measures institutional capital posture, liquidity trends, sector rotation, and volatility structuring. Public datasets are selectively integrated; full index construction and calibration remain proprietary to VICA.

Intellectual Property Notice

© VICA Partners Research. Unauthorized use, reproduction, or redistribution of VMSI models or derived content is strictly prohibited and monitored.