By VICA Partners | July 2025

(Peer-reviewed by institutional market strategists and asset managers)

The Federal Reserve’s policy efficacy is increasingly entangled with its institutional sprawl. As the Fed has absorbed additional mandates—climate oversight, credit allocation, social equity filters—it has edged away from its core comparative advantage: controlling expectations through clear monetary signaling.

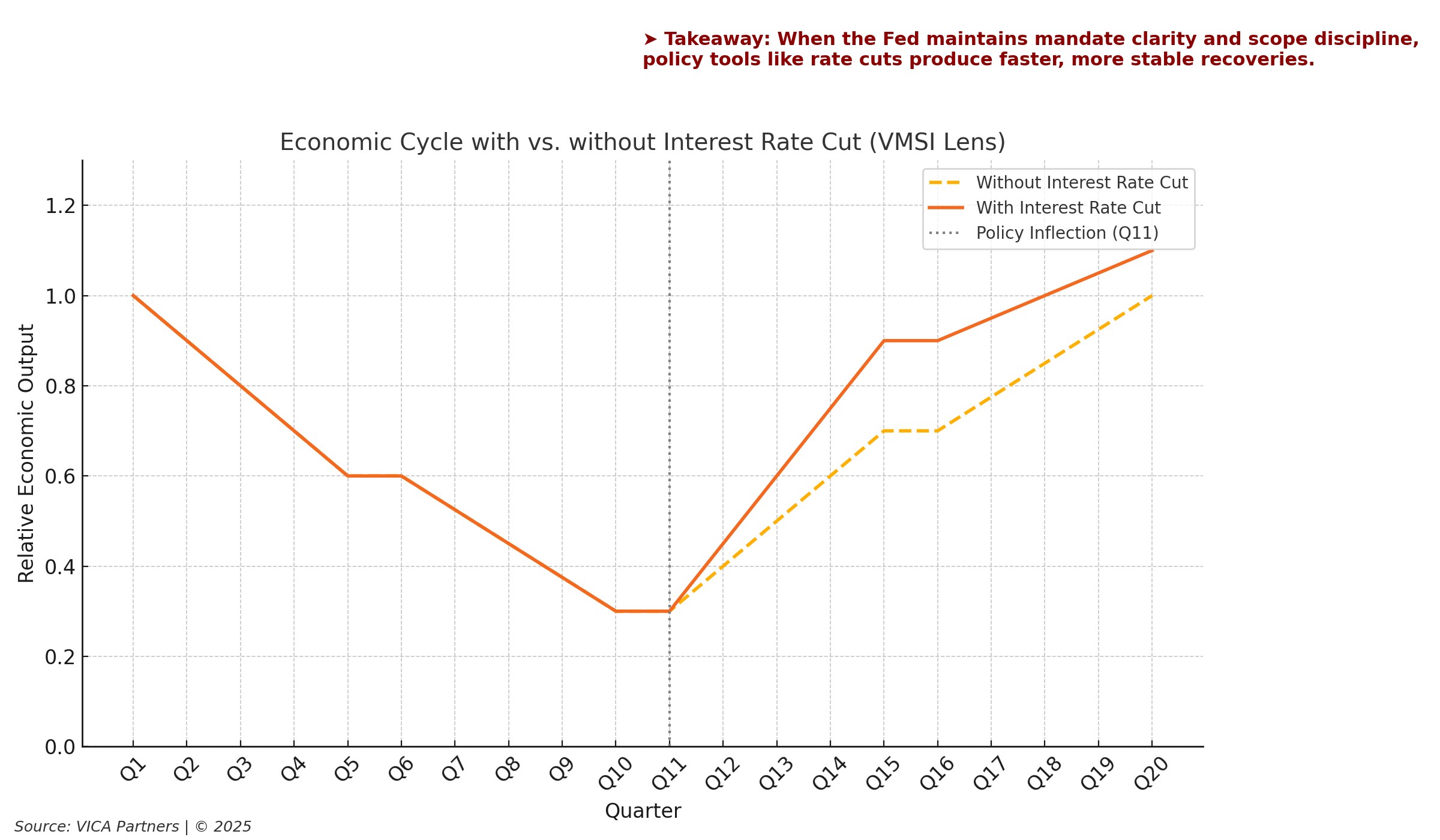

The accompanying chart illustrates a fundamental truth: When the Fed remains narrowly focused, interest rate adjustments deliver faster, more stable economic outcomes. Conversely, when institutional ambiguity rises, market volatility increases, and policy tools lose potency.

This logic is central to our VMSI framework—which measures the interaction between Volatility, Mandate clarity, Scope discipline, and Inflation anchoring. A central bank that loses focus invites noise into the signal. And in a regime where rate policy is the primary channel of macro stabilization, noise is inflationary.

As Treasury Secretary Bessent recently noted, a review of the Fed’s non-monetary footprint is warranted. Not to diminish its influence, but to sharpen it. Economic cycles require precision. Institutions should not be oversized relative to their signal-to-noise ratio.

In short: The Fed doesn’t need new tools. It needs fewer distractions.