“Empowering Your Financial Success”

Daily Market Insights: December 4th, 2023.

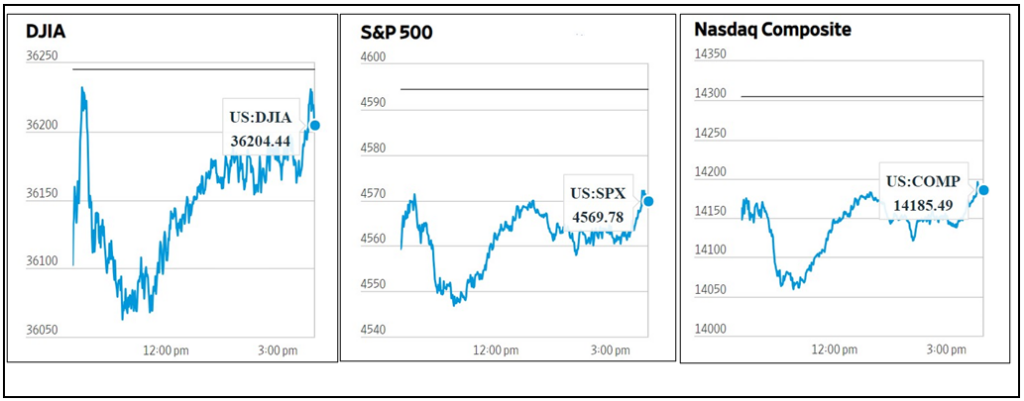

US Market Snapshot: Key Stock Market Indices:

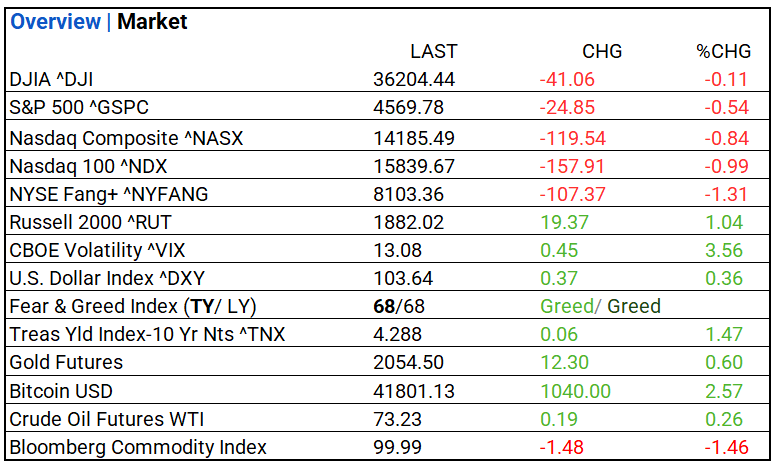

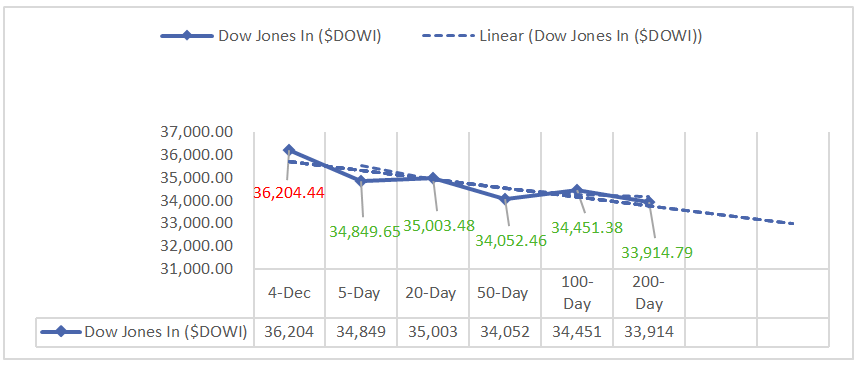

- DJIA ^DJI: 36,204.44 (-41.06, -0.11%)

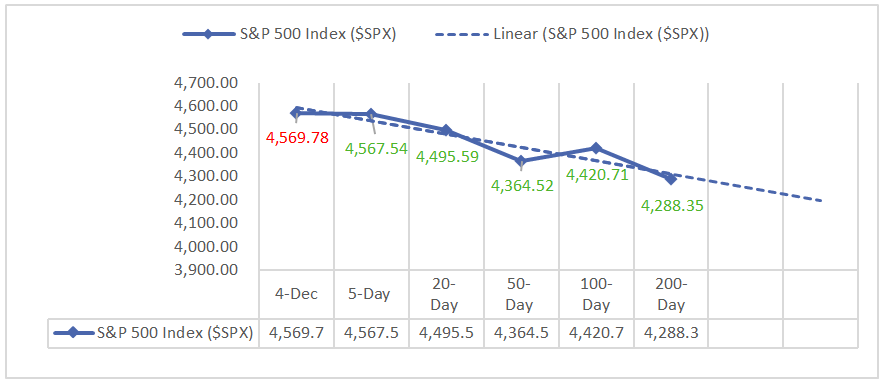

- S&P 500 ^GSPC: 4,569.78 (-24.85, -0.54%)

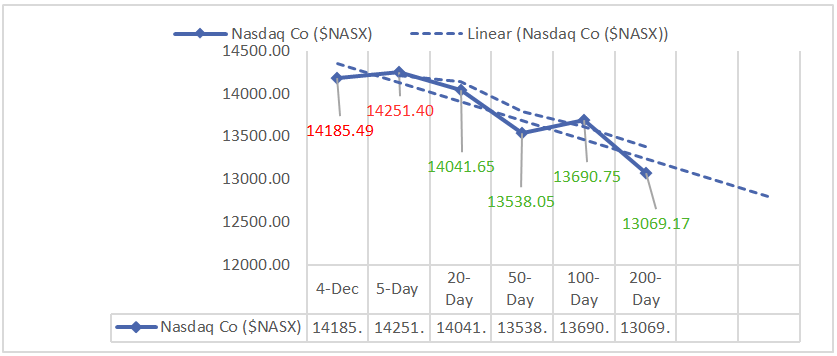

- Nasdaq Composite ^NASX: 14,185.49 (-119.54, -0.84%)

- Nasdaq 100 ^NDX: 15,839.67 (-157.91, -0.99%)

- NYSE Fang+ ^NYFANG: 8,103.36 (-107.37, -1.31%)

- Russell 2000 ^RUT: 1,882.02 (19.37, 1.04%)

Moving Averages: DOW, S&P 500, NASDAQ:

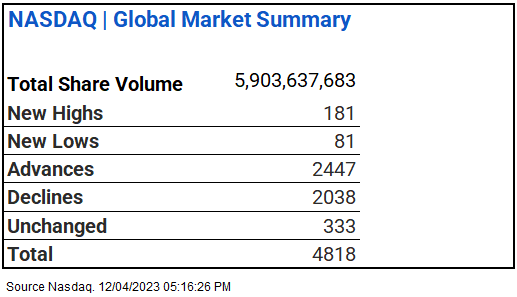

NASDAQ Global Market Summary:

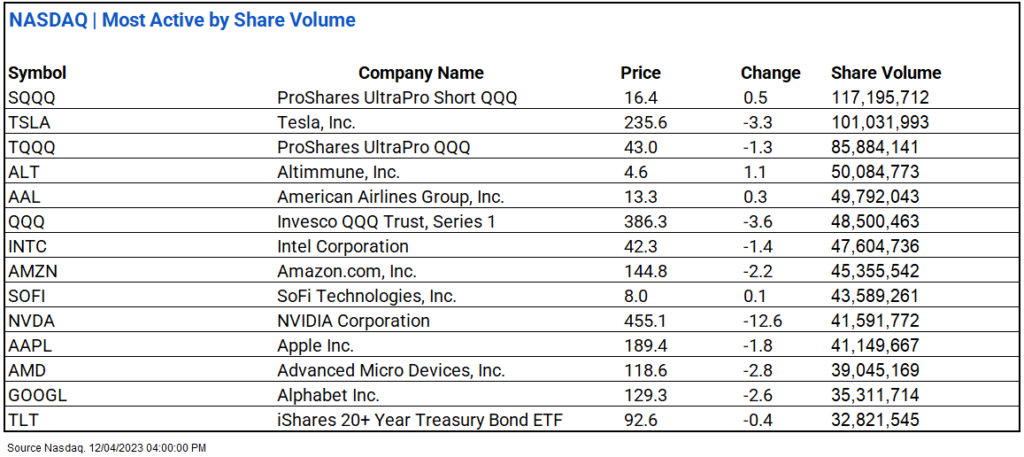

Market Insights: Performance, Sectors, and Trends:

- Economic Data: Factory orders for October declined by 3.6%, deviating from the previous month’s positive trend of 2.8%, and falling slightly below the forecasted -3.5%.

- Market Indices: DJIA (-0.11%), S&P 500 (-0.54%), Nasdaq Composite (-0.84%).

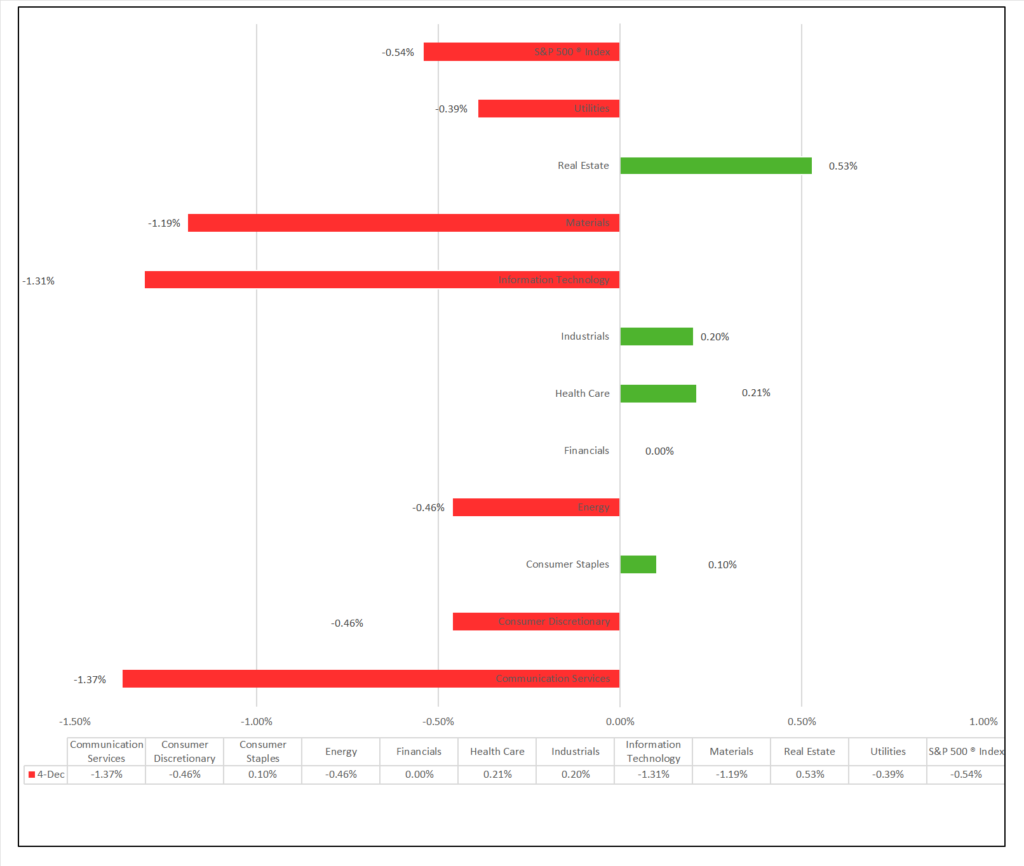

- Sector Performance: 6 of 11 sectors lower; Real Estate (+0.53%) leading, Communication Services (-1.37%) lagging. Top industry: Personal Care Products (+2.27%).

- Factors: Small Caps outperform Mega Cap Growth lags.

- Treasury Markets: 3-Year and 2-Year Treasury Notes lead with gains of 0.105 and 0.103, respectively.

-

Commodities: Bitcoin continues to rally, Gold and Crude Oil Futures rose modestly, whereas the Bloomberg Commodity Index saw declines.

- Other/ Earnings: Analysts significantly lowered S&P 500 companies’ Q4 earnings per share (EPS) estimates during October and November, with a 5.0% decline in the bottom-up EPS estimate.

Sectors:

- 6 of 11 sectors lower; Real Estate (+0.53%) leading, Communication Services (-1.37%) lagging. Top industries: Personal Care Products (+2.27%), Hotel & Resort REITs (+2.09%), and Retail REITs (+1.78%).

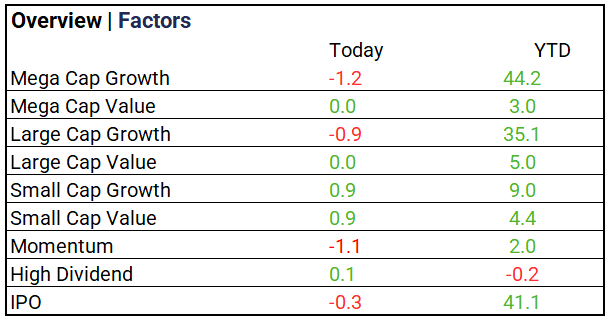

Factors:

- Small Caps outperform Mega Cap Growth lags.

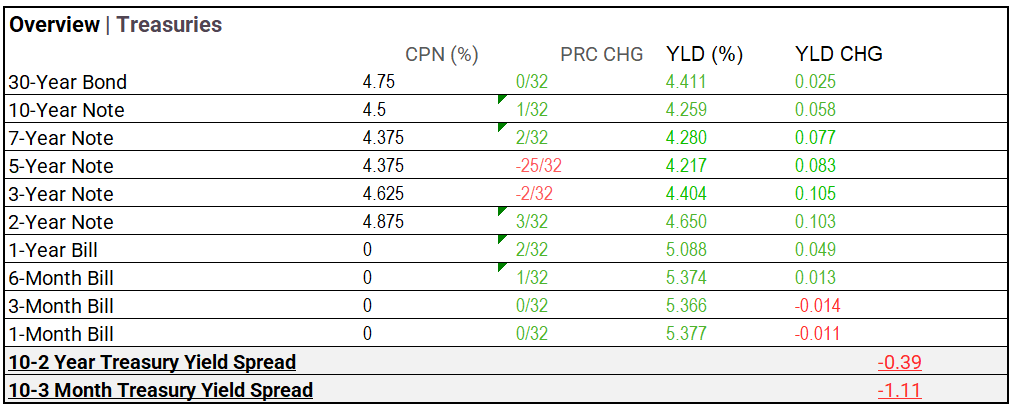

Treasury Markets:

- 3-Year and 2-Year Treasury Notes lead with gains of 0.105 and 0.103, respectively.

Currency and Volatility:

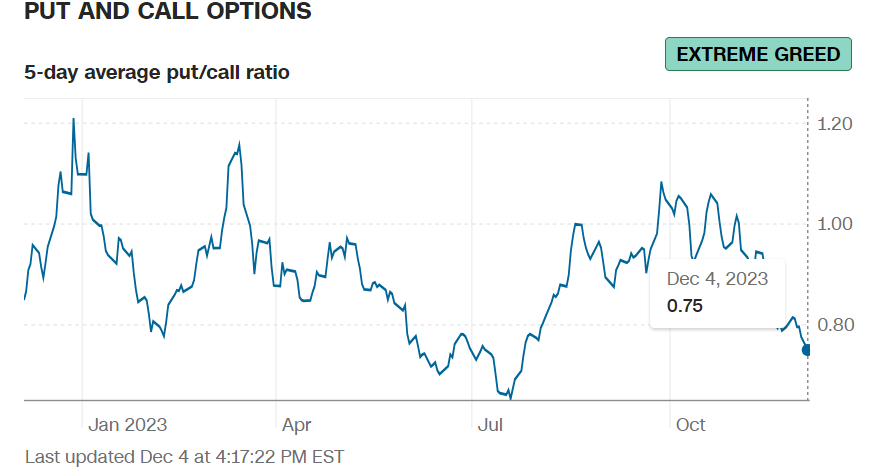

- U.S. Dollar Index and CBOE Volatility up, Fear & Greed indicates Greed.

- CBOE Volatility ^VIX: 13.08 (+0.45, +3.56%)

- Fear & Greed Index: 68/LY 68 (Greed/ Greed).

source: CNN Fear and Greed Index

Commodity Markets:

-

Bitcoin continues to rally, Gold and Crude Oil Futures rose modestly, whereas the Bloomberg Commodity Index saw declines.

-

Gold Futures: $2,054.50 (12.30, 0.60%)

-

Bitcoin USD: $41,801.13 (+1040.0, +2.57%)

-

Crude Oil Futures WTI: $73.23 (0.19, 0.26%)

-

Bloomberg Commodity Index: 99.99 (-1.48, -1.46%)

US Economic Data:

- Factory orders (Oct.): -3.6% (Previous: 2.8%, Forecast: -3.5%)

Earnings:

- Q4 Forecast: Analysts significantly lowered S&P 500 companies’ Q4 earnings per share (EPS) estimates during October and November, with a 5.0% decline in the bottom-up EPS estimate. This drop surpasses the average declines over the past 5, 10, 15, and 20 years, marking the most substantial decrease since Q1 2023. Among sectors, Health Care experienced the largest decline (-19.9%), while Information Technology saw a modest increase (+1.5%) in their Q4 2023 bottom-up EPS estimates.

Notable Earnings Today:

- BEAT: Gitlab (GTLB), Science Applications (SAIC), Culp (CULP), SAS ADR (SASBQ),

- MISSED: Nio A ADR (NIO), Joann (JOAN)

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): -0.53%

- Hang Seng (Hong Kong): -1.09%

- Shanghai Composite (China): -0.29%

- CAC 40 (France): -0.18%

- DAX (Germany): 0.04%

- FTSE 100 (UK): -0.22%

Central Banking and Monetary Policy:

- Goods Deflation Is Back. It Could Speed Inflation’s Return to 2% – WSJ

- Inflation Has Depleted Pandemic-Era Savings for Many Americans – Bloomberg

Energy:

- Commodity Traders’ Mega Profits Are Here to Stay – Bloomberg

- Elliott’s Push at Phillips 66 Looks Familiar – WSJ

China:

- China’s credit reshuffle aims to squelch risk, restore confidence as recovery lags – SCMP