Stay Informed and Stay Ahead: Market Watch, August 16th, 2024.

Late-Week Wall Street Markets

Key Takeaways

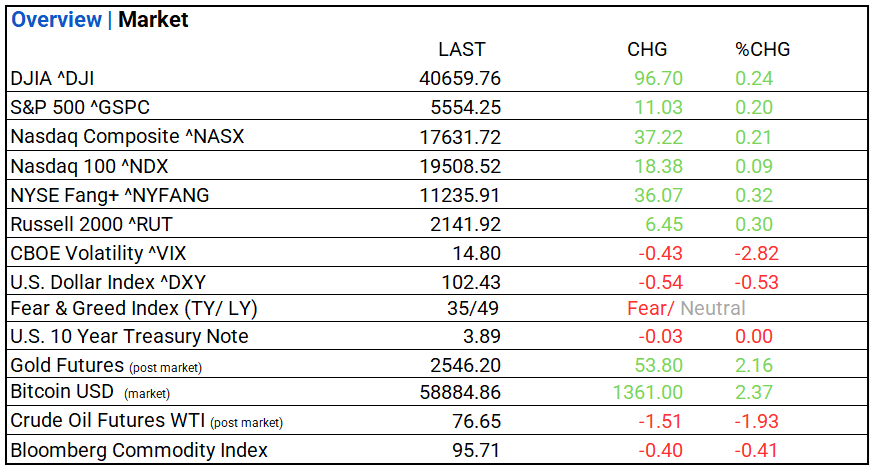

- Markets: DOW, S&P 500, and NASDAQ gain; VIX less volatile. Financials lead, Industrials lag. Top industry: Diversified Telecommunication Services.

- Inflation: Sentiment rose to 67.8; housing starts, permits, and builder confidence declined, signaling a weakening housing market.

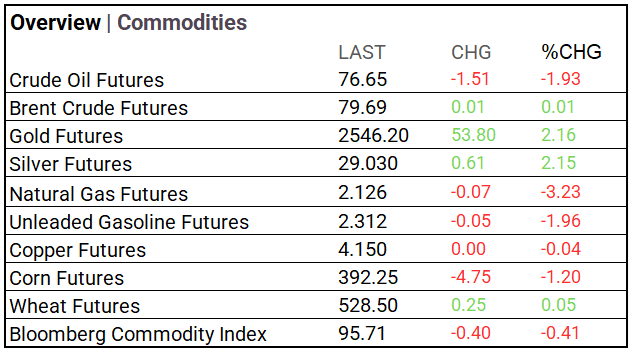

- Yields & Commodities: Yields fell across most maturities, with short-term notes seeing the largest declines, particularly the 3-Year Note. Commodities were mostly lower, except gold, silver, and wheat. Gold futures rose 2.16% to $2,546.20, leading to gains.

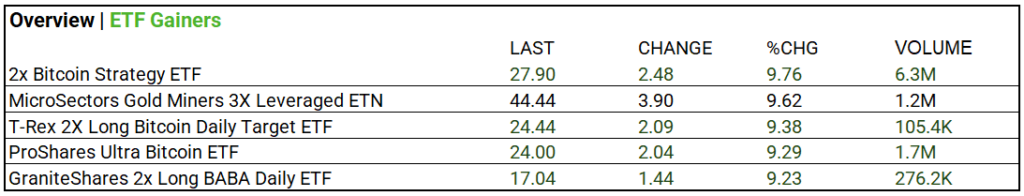

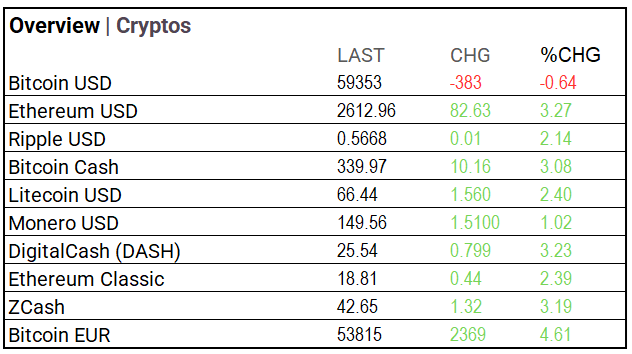

- Crypto & ETFs: Bitcoin settles at $59,353. And Ethereum went up $82.63 to $2612.96. ETF’s 2x Bitcoin Strategy ETF rose 9.76% on 6.3M volume.

Market Summary

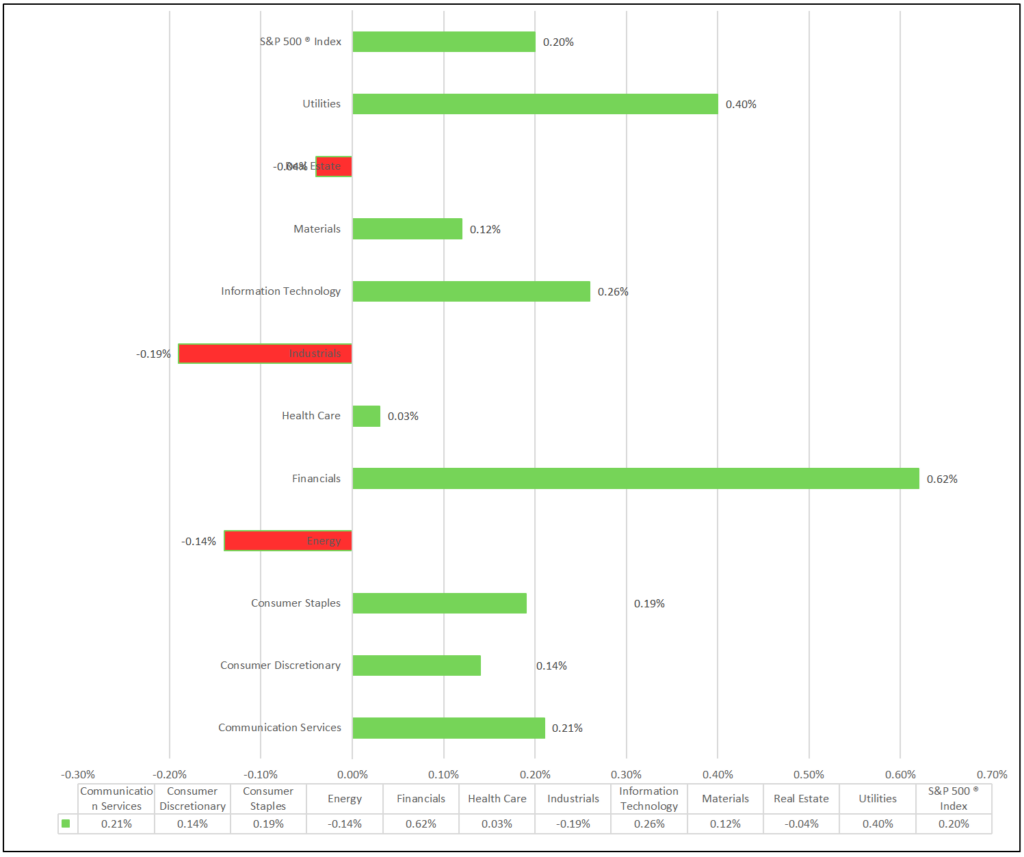

Indices & Sectors Performance:

- DOW, S&P 500, and NASDAQ rose. 8 of 11 sectors advanced, Financials leads, Industrials lags. Diversified Telecommunication Services (+1.37%), Consumer Finance (+1.33%), and Entertainment (+1.30%) leading.

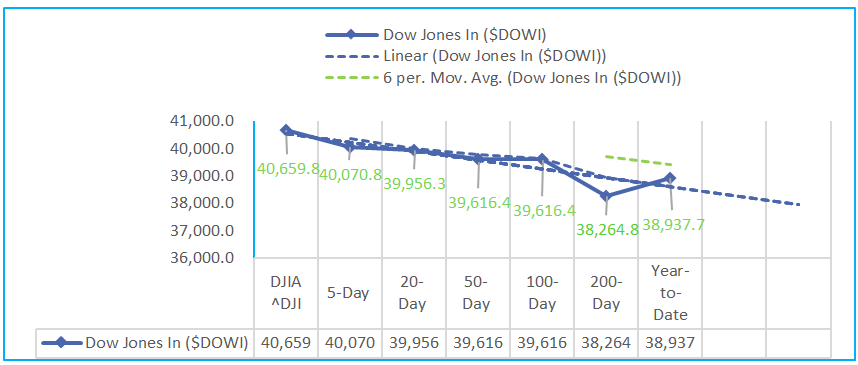

- DOW/ Volume Observations: DOW/Volume Observations: Average volume is declining. The 5-day volume is below the 20-day and 50-day averages, indicating reduced trading activity during the recent rally. The declining volume in the short term could suggest that the rally is happening with fewer participants, which might be something to watch.

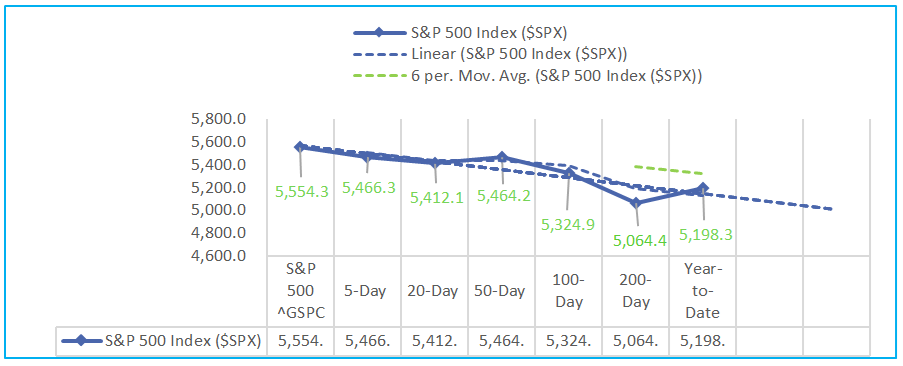

- S&P 500/ Shows consistent growth across all periods, with the +33.30% gain over the 200-day period standing out as the most striking data point, highlighting a strong long-term bullish trend. The short-term rally (+3.93% over 5 days) and steady medium-term growth also indicate a healthy market.

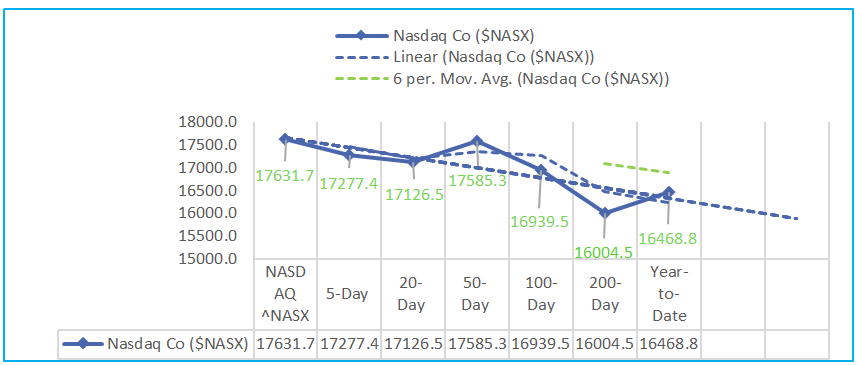

- NASDAQ/ 200-Day Performance: the most striking data point is the +37.86% increase over the 200-day period. This suggests a substantial long-term bullish trend and recovery from any earlier declines.

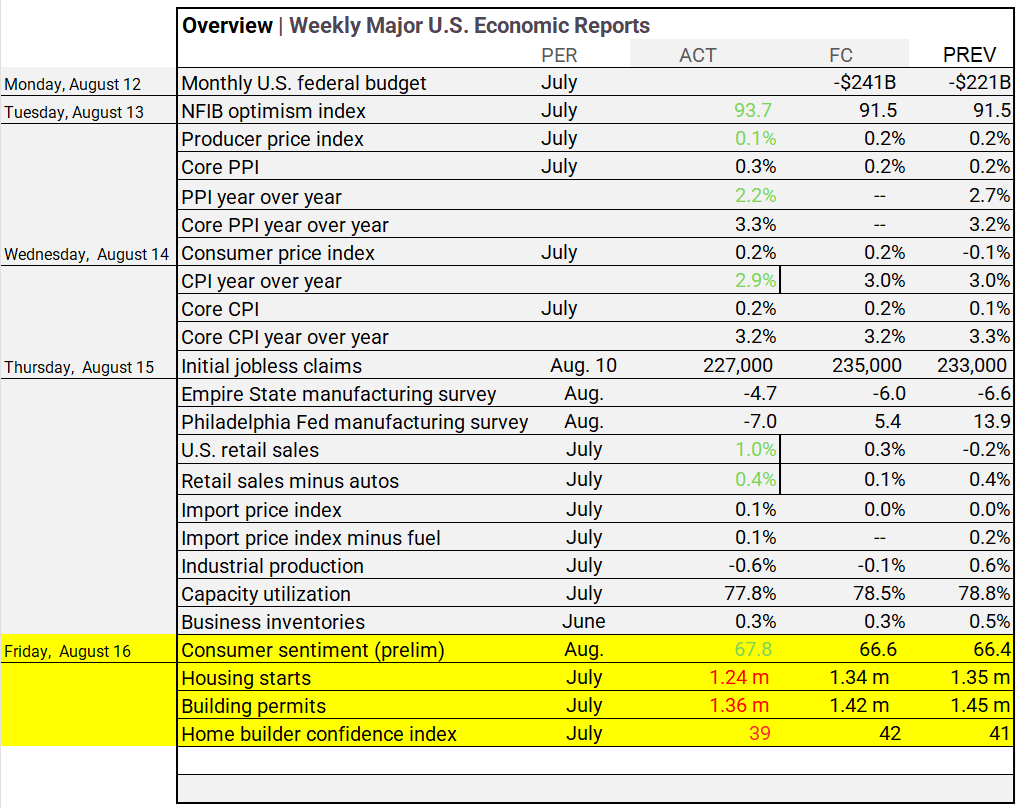

Economic Highlights:

- August consumer sentiment rose to 67.8, but housing starts, building permits, and home builder confidence all declined, indicating weaker housing market activity.

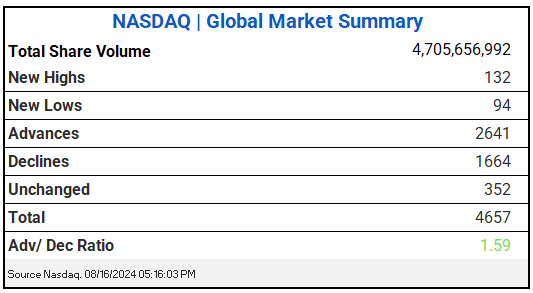

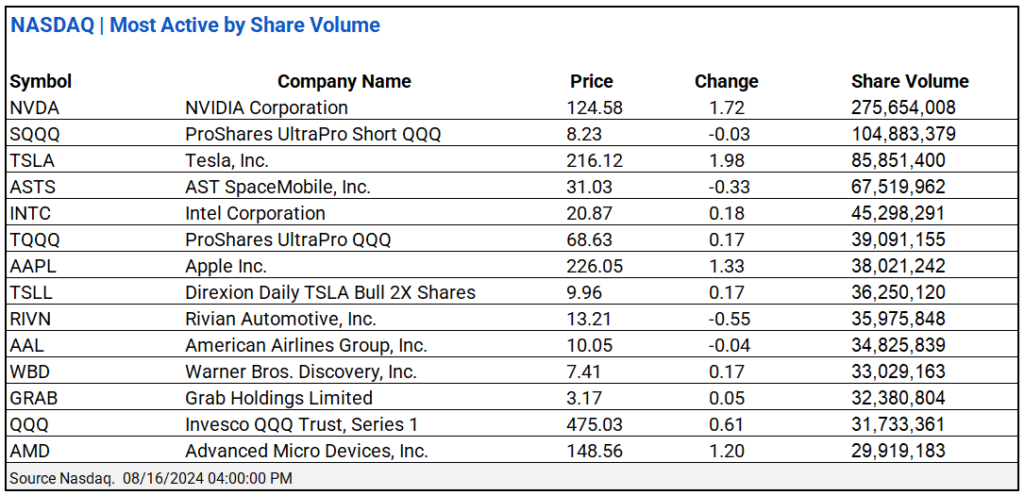

NASDAQ Global Market Update:

- NASDAQ saw 4.70B shares traded with a 1.59 advance/decline ratio. NVIDIA and ProShares UltraPro Short ^SQQQ led.

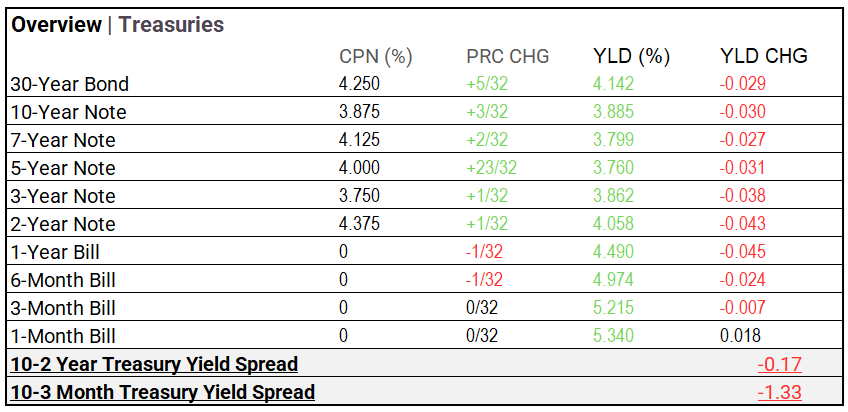

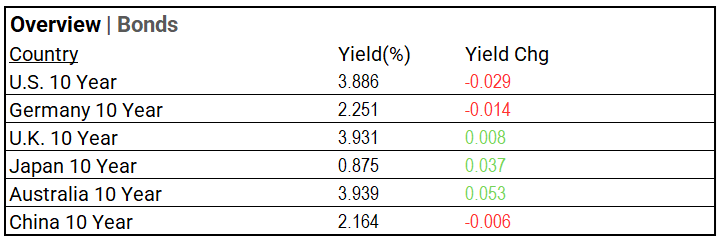

US Treasuries & Bond Markets:

- Yields fell across most maturities, with short-term notes seeing the largest declines, particularly the 3-Year Note.

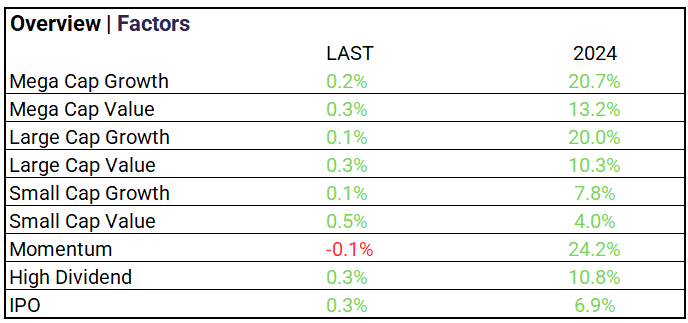

Market Factors:

- Mega Cap Value and Small Cap Value led; Momentum lagged with -0.1%.

Volatility:

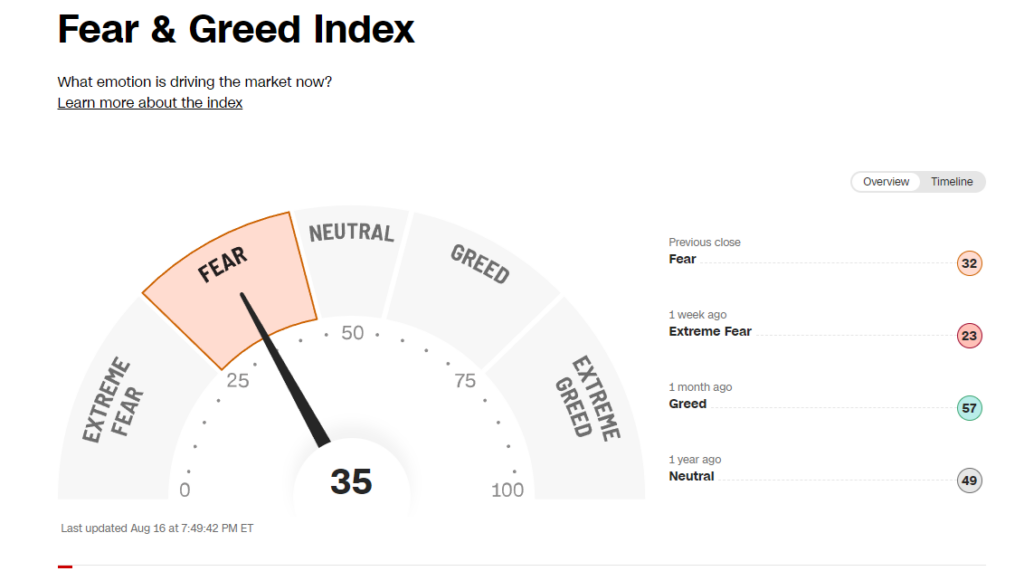

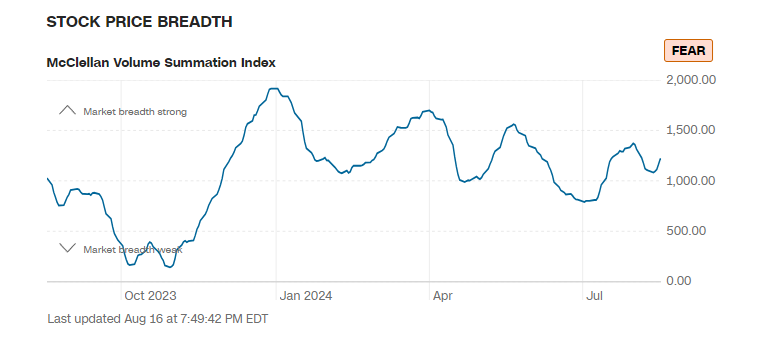

- VIX at 14.80 (-2.82%); Fear & Greed Index shifted to “Fear.”

Commodities & ETFs:

- Commodities mostly lower, except gold, silver, and wheat. Gold futures rose to 2546.20, up 53.80 (+2.16%), leading commodity gains. ETFs: 2x Bitcoin Strategy ETF rose 9.76% on 6.3M volume.

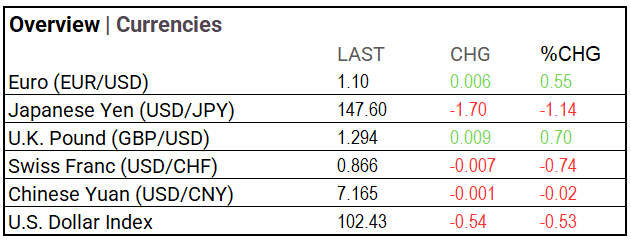

Cryptocurrency & Currency:

- In-session: Bitcoin rose $1,361 to $58,884.86. In after-hours: Bitcoin settles at $59,353. And Ethereum up $82.63 to $2612.96. Currency: Hedge Funds shift to bullish Yen stance after carry trade losses.

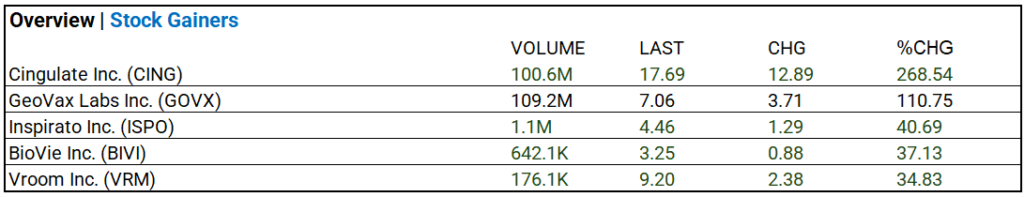

Stocks:

- Cingulate Inc. (CING) surged 268.54% with 100.6M volume.

Notable Earnings:

- Nidec (NJDCY), and Madison Square Garden Entertainment (MSGE) beat estimates. Pandora ADR (PANDY), Flowers Foods (FLO)Sea, and Torm A (TRMD) missed.

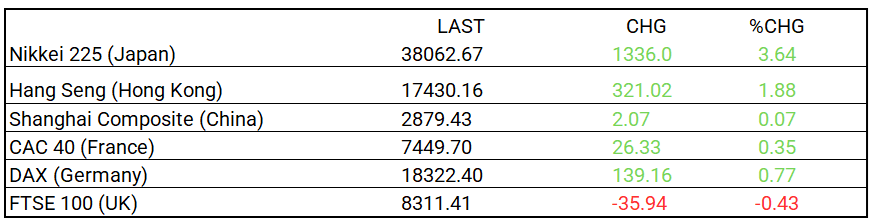

Global Markets Summary:

- Asian indices: Japan’s Nikkei 225 rallies up 3.64%, with modest gains for Hong Kong and China. European indices: CAC 40, DAX slightly up; FTSE 100 down.

Strategic Investment Adjustments:

- Focus on long-duration bonds with leveraged ETFs like ZROZ (PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF) and EDV (Vanguard Extended Duration Treasury Index ETF) to gain on potential rate cuts. Nasdaq/Tech and growth sectors show strong long-term potential. Diversify with Russell 2000 ETFs and bank index ETFs. Election years historically boost market performance.

In the NEWS:

Central Banking, Monetary Policy & Economics:

- Why Falling Mortgage Rates Aren’t a Quick Fix for Frustrated Homebuyers – WSJ

- Powell Huddles With Bank CEOs to Avoid Long Legal Fight Over Capital Plan – Bloomberg

Business:

- What Americans Get Wrong About Electric Cars – WSJ

- Hedge Funds Turn Bullish on Yen After Carry Trade Blow-Up – Bloomberg

China:

- Bridgewater steps back from China as biggest hedge fund slashes stock bets for 7th quarter – SCMP