Stay Informed and Stay Ahead: Market Watch, February 8th, 2024.

Market Highlights & Analysis: Indices, Sectors, and More…

- Economic Data: Initial jobless claims fell to 218,000, below the forecasted 220,000 and prior 227,000, while December’s wholesale inventories rose 0.4%.

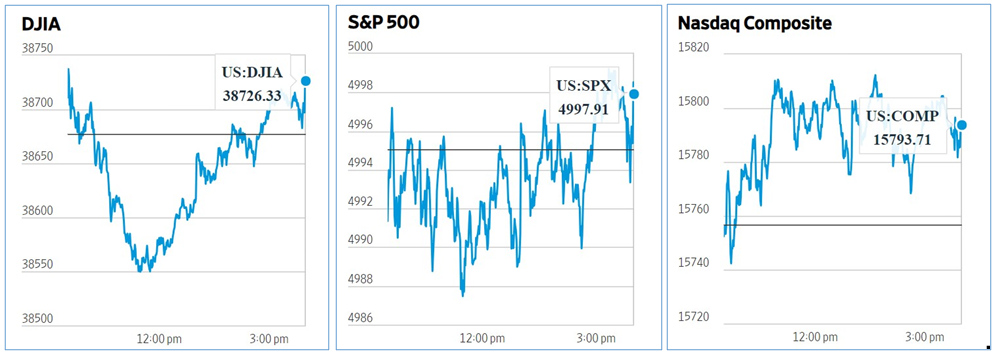

- Market Indices: DJIA (+0.13%), S&P 500 (+0.06%), Nasdaq Composite (+0.24%).

- Sector Performance: 6 of 11 sectors higher; Energy (+1.09%) leading, Utilities (-0.83%) lagging. Top industry: Entertainment (+4.09%).

- Factors: IPO’s and Small Cap Growth lead on the day.

- Treasury Markets: Yields rising for 30-year, 10-year, 7-year notes, but falling for shorter durations.

- Commodities: Gold futures dipped slightly to $2,049.70, Bitcoin rallied to $45,349.36, while crude oil rose to $76.46.

- ETFs: GraniteShares 2x Long COIN Daily ETF jumped 17.24%, leading to gains among crypto-focused ETFs on robust volume.

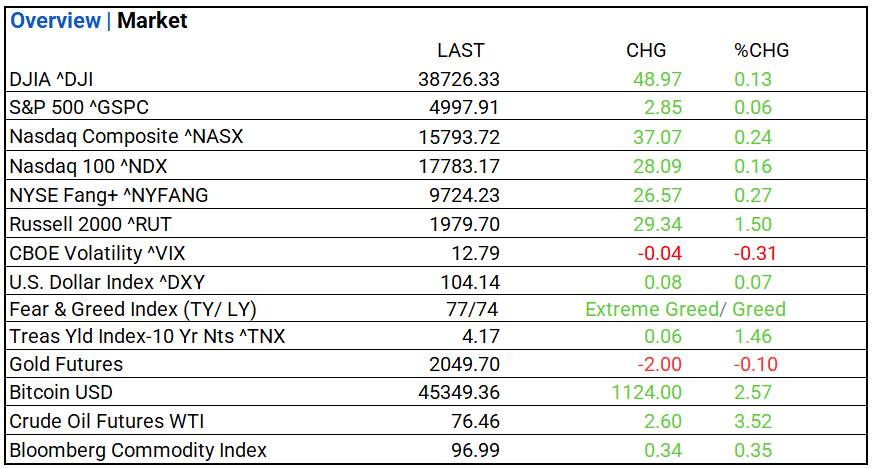

US Market Snapshot: Key Stock Market Indices:

- DJIA ^DJI: 38,726.33, 48.97, 0.13%

- S&P 500 ^GSPC: 4,997.91, 2.85, 0.06%

- Nasdaq Composite ^NASX: 15,793.72, 37.07, 0.24%

- Nasdaq 100 ^NDX: 17,783.17, 28.09, 0.16%

- NYSE Fang+ ^NYFANG: 9,724.23, 26.57, 0.27%

- Russell 2000 ^RUT: 1,979.70, 29.34, 1.50%

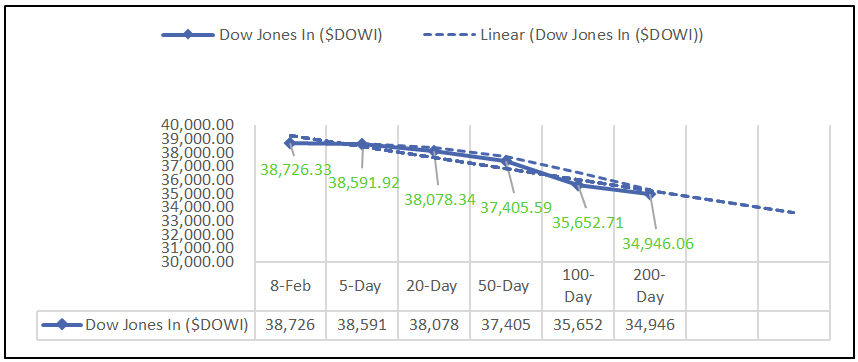

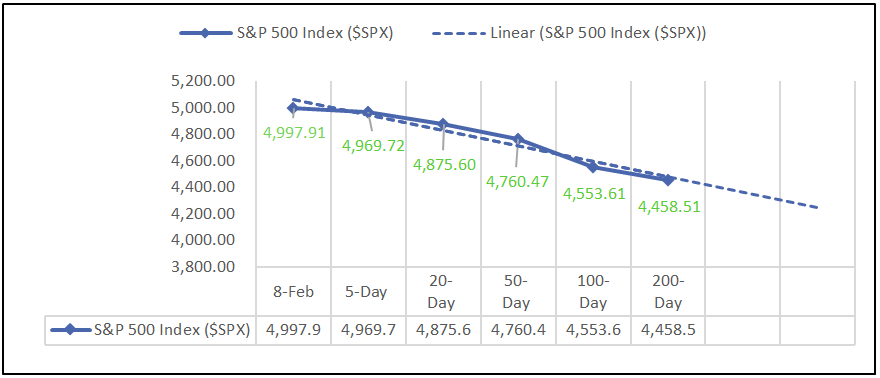

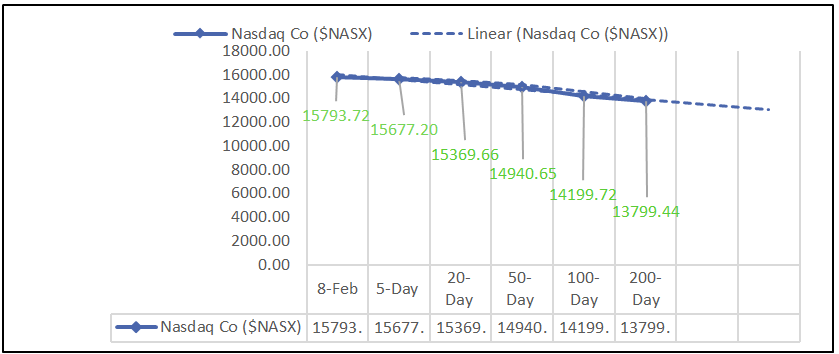

Moving Averages: DOW, S&P 500, NASDAQ:

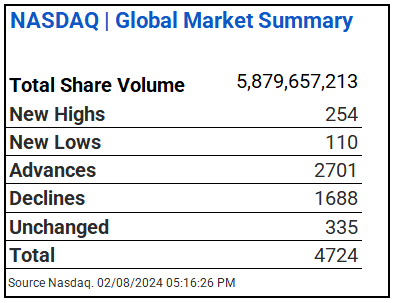

NASDAQ Global Market Summary:

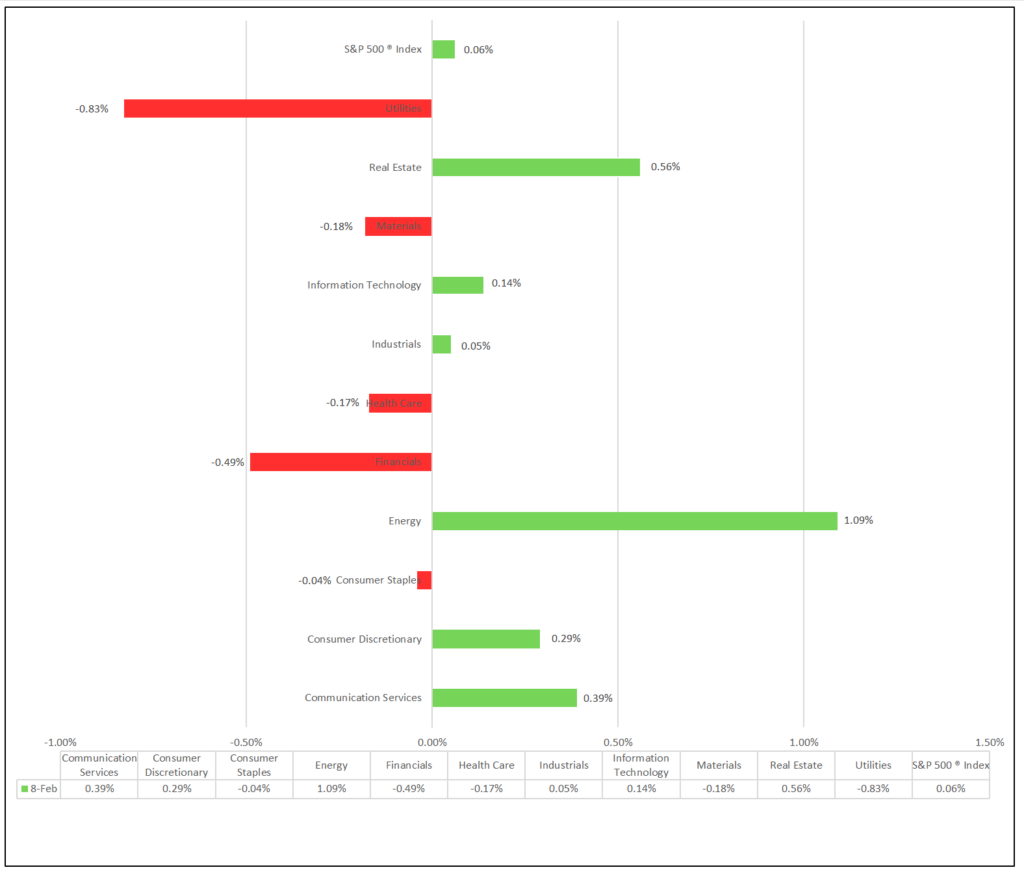

Sectors:

- 6 of 11 sectors higher; Energy (+1.09%) leading, Utilities (-0.83%) lagging. Top industries: Entertainment (+4.09%), Industrial REITs (+1.99%), Passenger Airlines (+1.74%), and Textiles, Apparel & Luxury Goods (+1.67%).

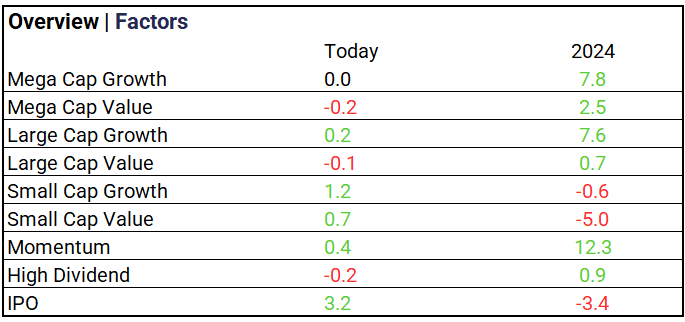

Factors:

- IPO’s and Small Cap Growth lead on the day, Momentum +12.3% YTD.

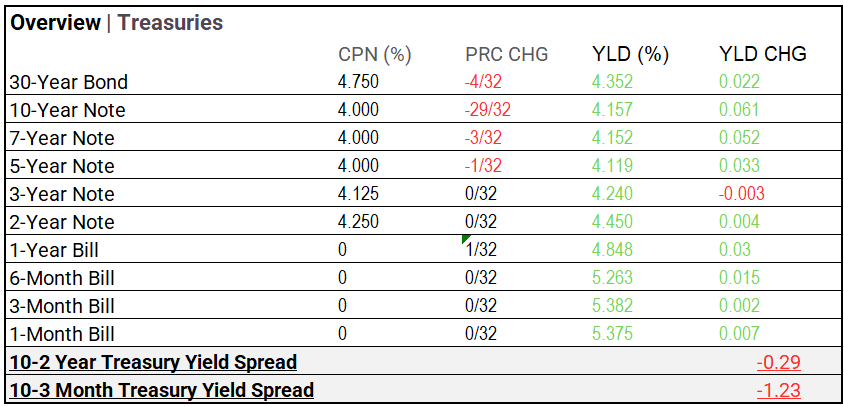

Treasury Markets:

- Yields rising for 30-year, 10-year, 7-year notes, but falling for shorter durations.

Currency and Volatility:

- U.S. Dollar Index ^DXY: 104.14 (+0.08, +0.07%)

- CBOE Volatility ^VIX: 12.79 (-0.04, -0.31%)

- Fear & Greed Index: 77/LY 74 (Extreme Greed/ Greed)

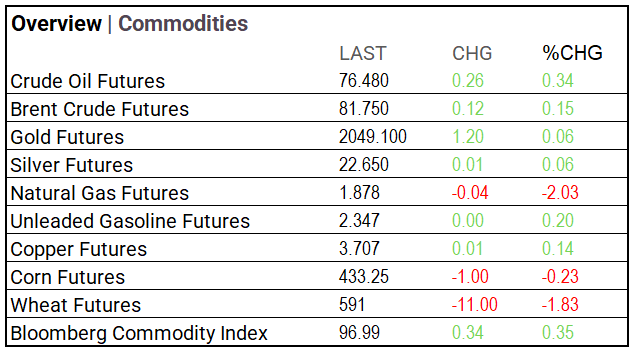

Commodity Markets:

- Gold Futures: $2,049.70, -$2.00, -0.10%

- Bitcoin USD: $45,349.36, +$1,124.00, +2.57%

- Crude Oil Futures WTI: $76.46, +$2.60, +3.52%

- Bloomberg Commodity Index: 96.99, +$0.34, +0.35%

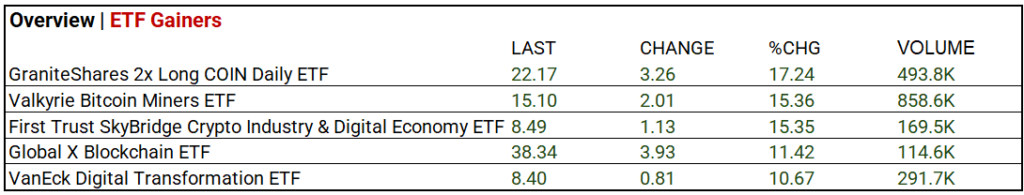

ETF’s:

- GraniteShares 2x Long COIN Daily ETF surged 17.24%, leading gains among crypto-focused ETFs on robust volume.

US Economic Data:

- Initial jobless claims for the week ending February 3 came in at 218,000, slightly below the forecast 220,000 and prior 227,000.

- Wholesale inventories for December increased by 0.4%, surpassing both the forecasted 0.3% and the previous -0.2%.

Earnings:

- Q4 Forecast: Analysts significantly lowered S&P 500 companies’ Q4 earnings per share (EPS) estimates during October and November, with a 5.0% decline in the bottom-up EPS estimate. This drop surpasses the average declines over the past 5, 10, 15, and 20 years, marking the most substantial decrease since Q1 2023. Among sectors, Health Care experienced the largest decline (-19.9%), while Information Technology saw a modest increase (+1.5%) in their Q4 2023 bottom-up EPS estimates.

Notable Earnings Today:

- BEAT: S&P Global (SPGI), Unilever ADR (UL), ICE (ICE), Transdigm (TDG), Apollo Global Management A (APO), Honda Motor ADR (HMC), Motorola (MSI), DexCom (DXCM), BCE Inc (BCE), Cloudflare (NET), Cameco (CCJ).

- MISSED: L’Oreal ADR (LRLCY), AstraZeneca ADR (AZN), Siemens ADR (SIEGY), Philip Morris (PM), ConocoPhillips (COP), Nippon ADR (NTTYY), SoftBank Group (SFTBY), Duke Energy (DUK), Hershey Co (HSY), Kenvue (KVUE), Pinterest (PINS).

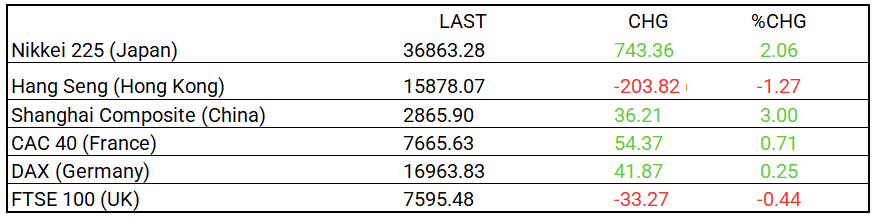

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): 36,863.28, +743.36, +2.06%

- Hang Seng (Hong Kong): 15,878.07, -203.82, -1.27%

- Shanghai Composite (China): 2,865.90, +36.21, +3.00%

- CAC 40 (France): 7,665.63, +54.37, +0.71%

- DAX (Germany): 16,963.83, +41.87, +0.25%

- FTSE 100 (UK): 7,595.48, -33.27, -0.44%

Central Banking and Monetary Policy, Noteworthy:

- In China, Deflation Tightens Its Grip – WSJ

- Risk of Big US Inflation Revision Puts Policymakers, Investors on Edge – Bloomberg

- Fed Has Time to Be Patient on Cutting Interest Rates, Barkin Says – Bloomberg

Energy:

- U.S. Oil Inventories Rose, Products Fell in Week Ended Feb. 2 – WSJ

- China’s Clean Technology Is Made of Dirty Metals – Bloomberg

- Big Oil’s Boring Quarter Was Great News for Investors – Bloomberg

China:

- Explainer | ‘Don’t be overly concerned’: 4 takeaways from China’s January inflation data – SCMP