MARKETS THIS WEEK April 7th, 2023 (Vica Partners)

Good Friday Afternoon,

Concerns this week over recession “may” have been greatly exaggerated with jobless claims topping estimates however housing and rental components of inflation still remain high. The SPDR Regional Bank ETF KRE was trending slightly above its 52-week lows as banking deposit flows appear to be stabilizing according to Fed officials.

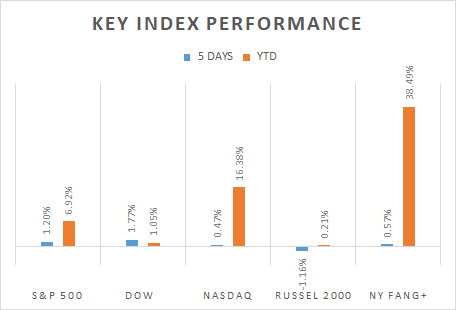

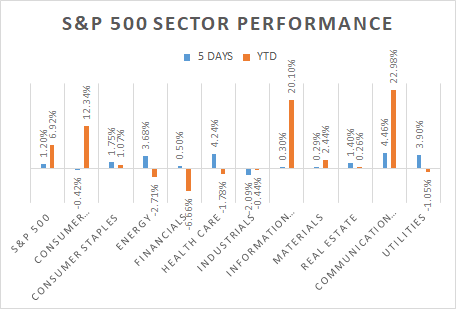

For the Week (3/31- 4/06), the S&P 500 was up 1.20%, rising for the third consecutive week. “Beaten down” Defensives/ Health Care +4.24% and Utilities +3.90% outperformed while Consumer Discretionary and Information Technology lagged.

- Treasury Yields continue to decline for the fourth consecutive week

- Oil Futures were up 6% while Gold price passed $2K an ounce

- Materials had a tough week on recessionary concerns (attractive entry opportunity)

- The USD Index was trading below its 20d ma against a strong Euro and BP.

Year to Date, FANG+, Mega Caps stocks are up 38.4% and 18.3% respectively. The Communication Services +22.98% and Information Technology +20.1% sectors outperform.

- Bitcoin is up 68%

- Gold is up 11%

- 2/10 Yield inversion curve continues to moderate

Pro- tip, the Q1 ’23 earning cycle starts next Friday. Look for earning cuts/ revisions as these calls will influence the tone for Market for the next Quarter.

News