Stay Informed and Stay Ahead: Market Watch, June 7th, 2024.

Late-Week Wall Street Market Digest

Three Key Takeaways

+ Major indices, NASDAQ, DJIA, and S&P 500 down; Tech outperforms, Utilities and Materials lag; Top Industry: Technology Hardware, Storage & Peripherals.

+Employers added 272,000 jobs, beating 182,000 forecasts. Rate cut odds for September dropped to 56% from 67%, with expectations for two cuts falling to 51% from 66%.

+Nasdaq Friday data shows a bearish sentiment with advancers to decliners at a 0.381 ratio. Natural Gas jumps and Gold Bears cash in!

Summary of Market Performance

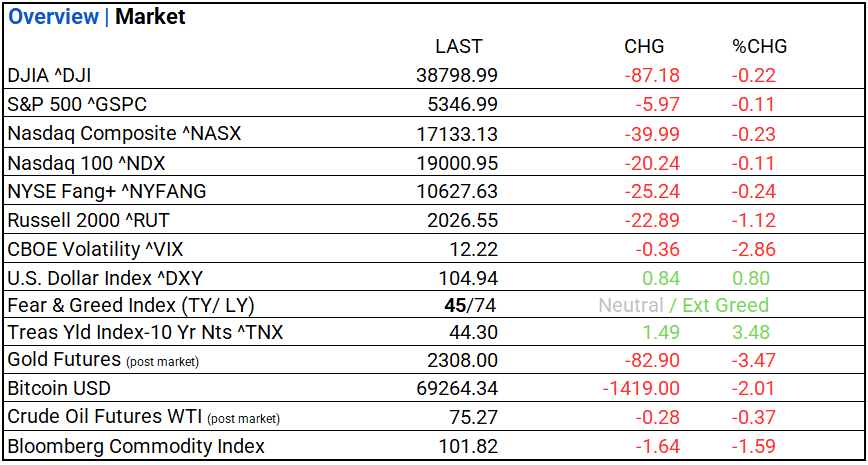

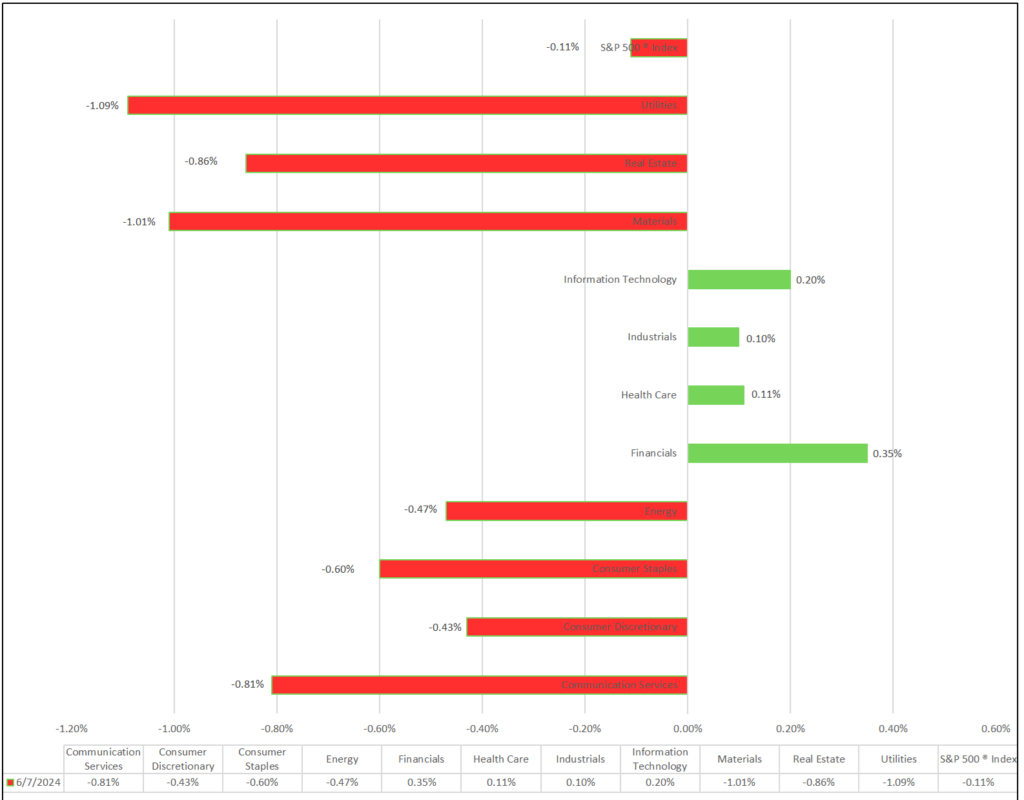

Indices & Sectors Performance:

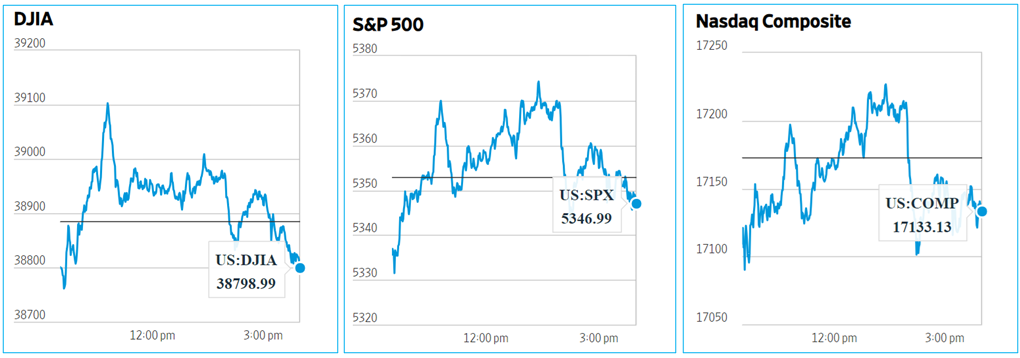

- Major indices, NASDAQ, DJIIA and S&P 500, down.

- 7 of 11 sectors declining: Financials/ Tech outperforms, Utilities/ Materials lag. Top Industries: Technology Hardware, Storage & Peripherals, Trading Companies & Distributors, Energy Equipment & Services.

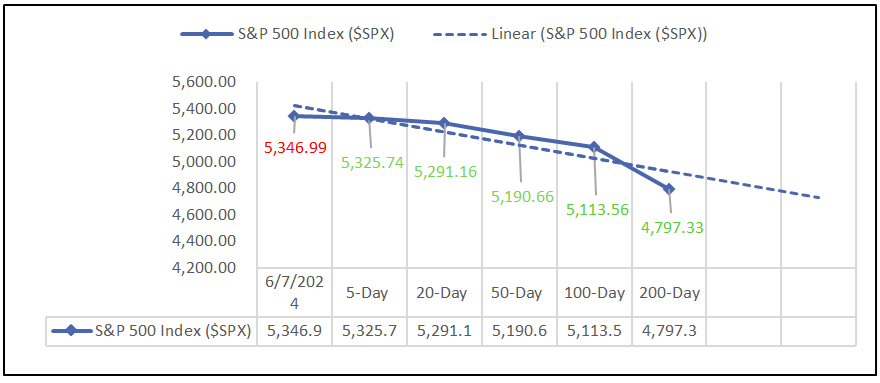

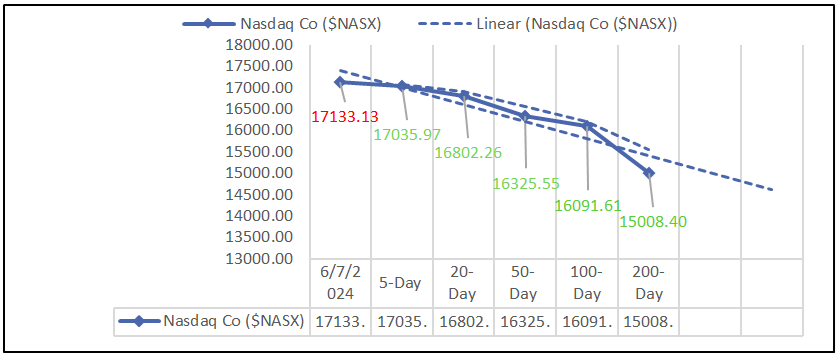

Chart: Performance of Major Indices

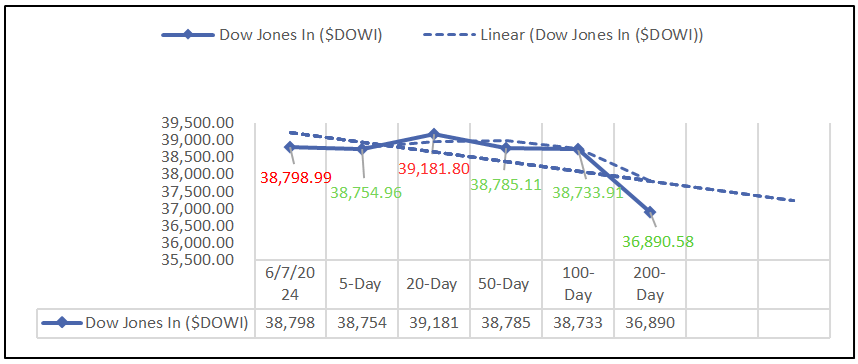

Moving Average Analysis:

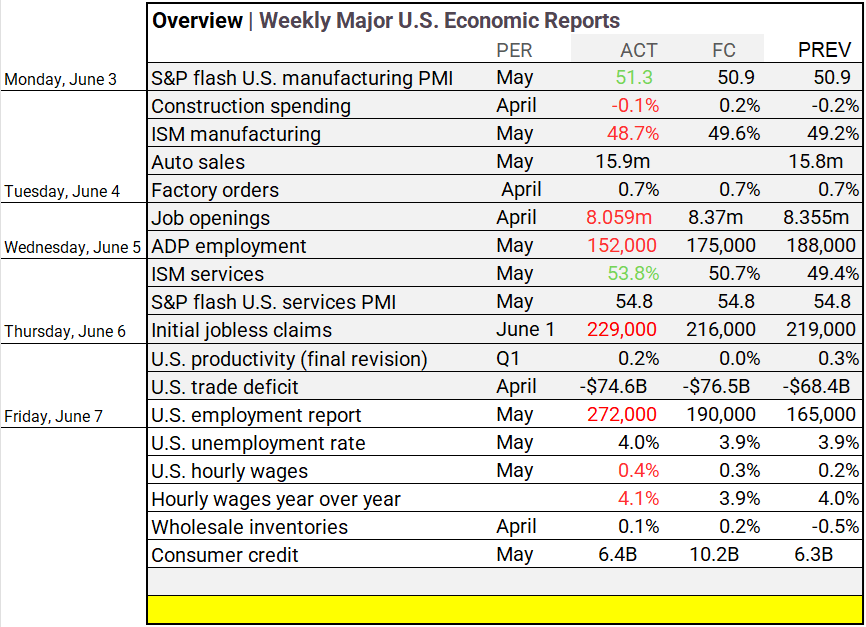

Economic Highlights:

- Employers added 272,000 jobs, surpassing the 182,000 forecasts. The unemployment rate rose to 4%, the highest in over two years. Rate cut odds for September dropped to 56% from 67%, and expectations for two cuts this year fell to 51% from 66%.

- Jobs Report detail view

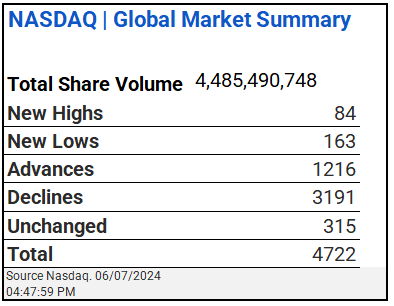

NASDAQ Global Market Update:

- Today’s Nasdaq data shows a bearish sentiment with advancers to decliners at a 0.381 ratio.

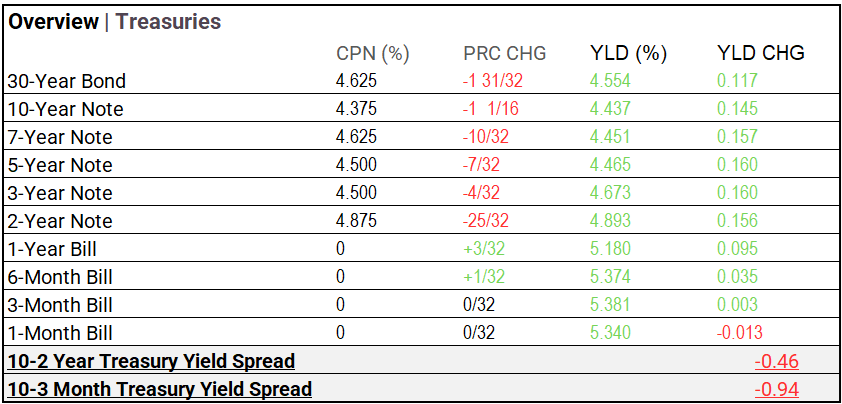

Treasury Markets:

- Treasury yields rose, with notable increases in the 5-year and 3-year notes by 0.160%. The 30-year bond yield reached 4.554%, up 0.117%.

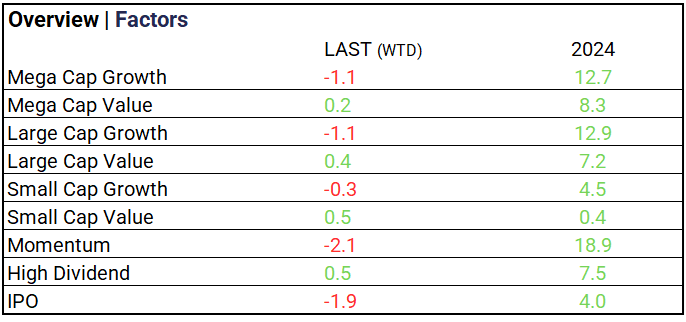

Market Trends:

- This week, Mega Cap Growth fell 1.1%, Large Cap Value rose 0.4%, Small Cap Value gained 0.5%, and Momentum dropped 2.1%.

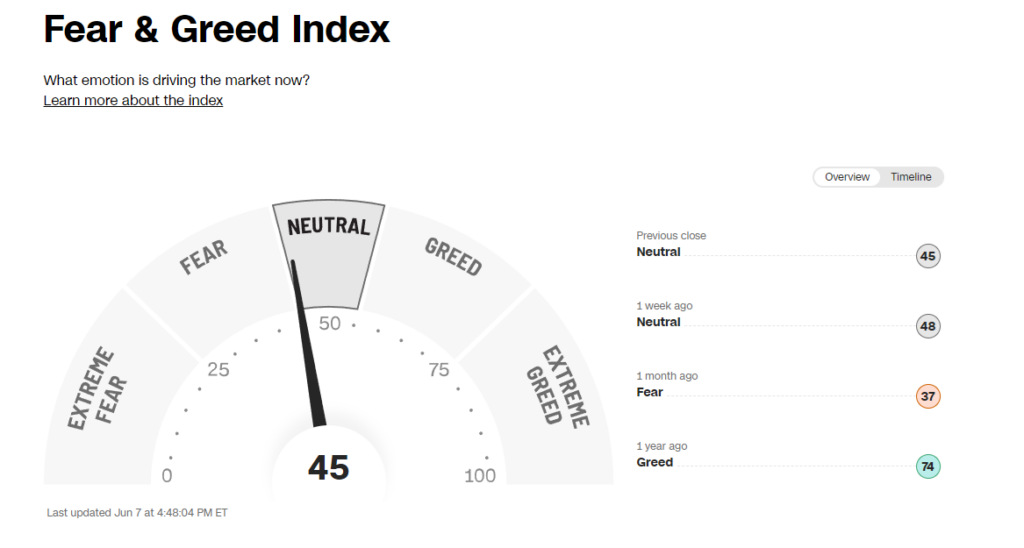

Currency & Volatility:

- The CBOE Volatility Index dropped 2.86% to 12.22, the U.S. Dollar Index rose 0.80%, and the Fear & Greed Index is neutral at 45.

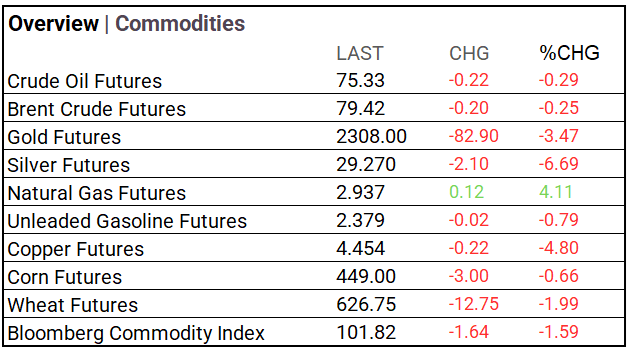

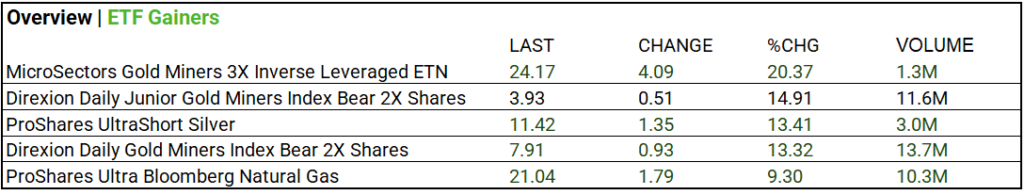

Commodities & ETFs:

- Commodities: Natural gas rose 4.11% to $2.937, while crude oil fell 0.29% to $75.33, Brent crude dropped 0.25% to $79.42, gold declined 3.47%, and silver dropped 6.69%.

- ETF’s: High-volume trading saw significant moves: Direxion Daily Gold Miners Bear 2X rose 13.32% with 13.7M shares, and ProShares Ultra Bloomberg Natural Gas gained 9.30% with 10.3M shares.

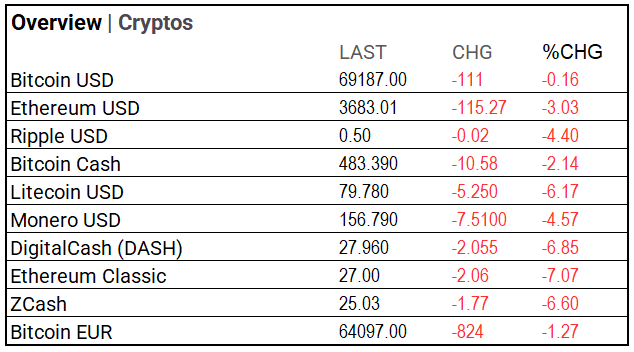

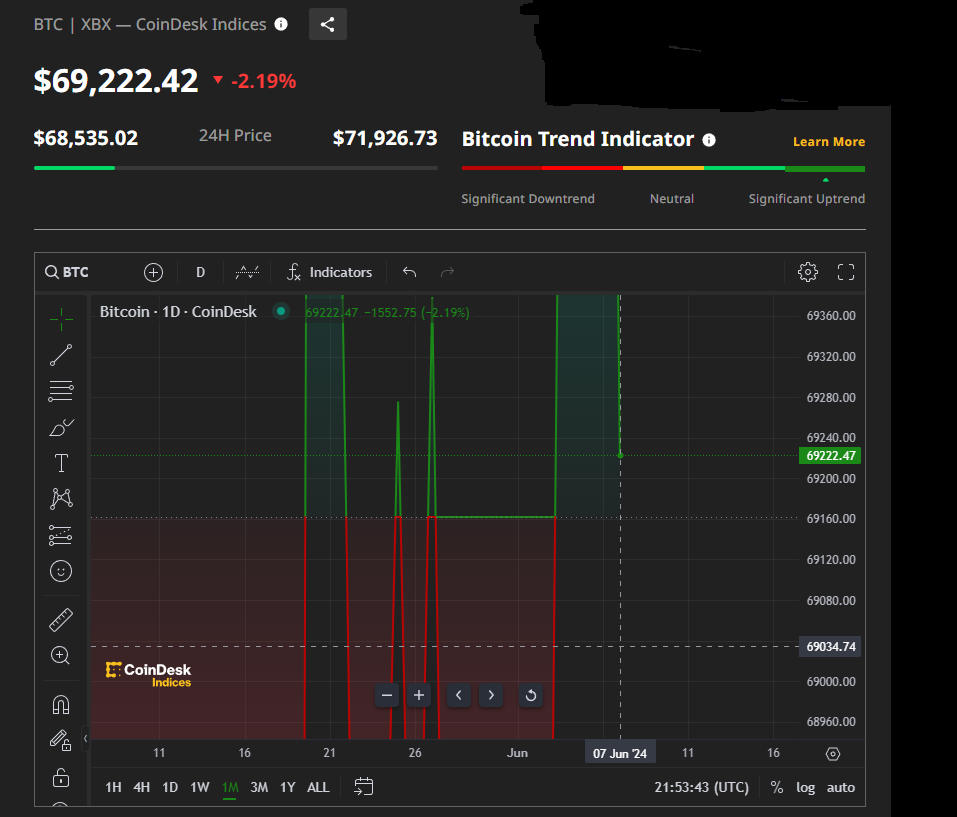

Cryptocurrency Update:

- Bitcoin closed at $69,187, down $111 or 0.16%. Ethereum fell 3.03%, Ripple dropped 4.40%, and all other cryptocurrencies saw declines.

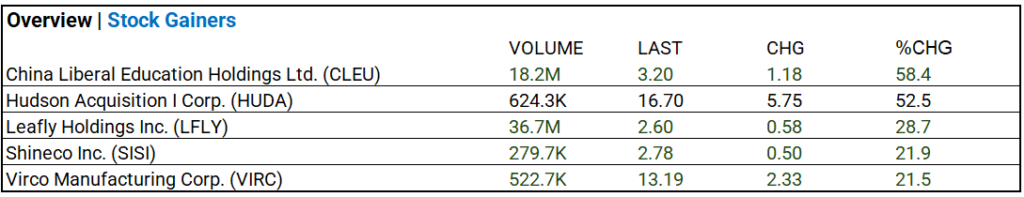

Stocks:

- China Liberal Education Holdings Ltd. (CLEU) surged 58.4% with 18.2M shares, while Leafly Holdings Inc. (LFLY) rose 28.7% on high volume of 36.7M shares.

Notable Earnings:

- Inactive day, GameStop Corp (GME) falls due to earnings disappointment, prompting meme traders to pull back.

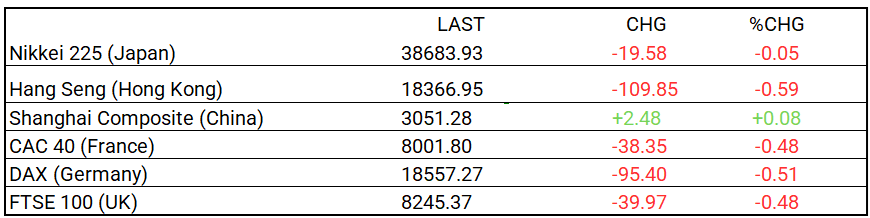

Global Markets Summary:

- Shanghai Composite edged up 0.08%, while Nikkei 225 fell marginally by 0.05%. Hang Seng dropped 0.59%, with Europe down.

In the NEWS:

Central Banking and Monetary Policy:

- Hiring and Wages are Up, Reinforcing the Economy’s Resilience – Wall Street Journal

- ECB Rate Cut Was Logical After Inflation Retreat, Nagel Says – Bloomberg

Business:

- GameStop Drops Surprise Earnings Report Into Renewed Hubbub Around Its Stock – Wall Street Journal

- Moody’s May Cut Six US Banks on Commercial Real Estate Exposure – Bloomberg

China:

- Explainer | China’s exports set to ‘defy’ tariffs: 5 takeaways from May trade data as shipments rose – South China Morning Post