“Empowering Your Financial Success”

Daily Market Insights: September 19th, 2023

Global Markets Summary:

Asian Markets and US Futures:

- Hong Kong’s Hang Seng: (+0.37%)

- China’s Shanghai Composite: (-0.03%)

- Japan’s Nikkei 225: (-0.87%)

- S&P Futures: (-0.18%)

European Markets:

- London’s FTSE 100: (+0.09%)

- France’s CAC 40: (+0.08%)

- Germany’s DAX: (-0.40%)

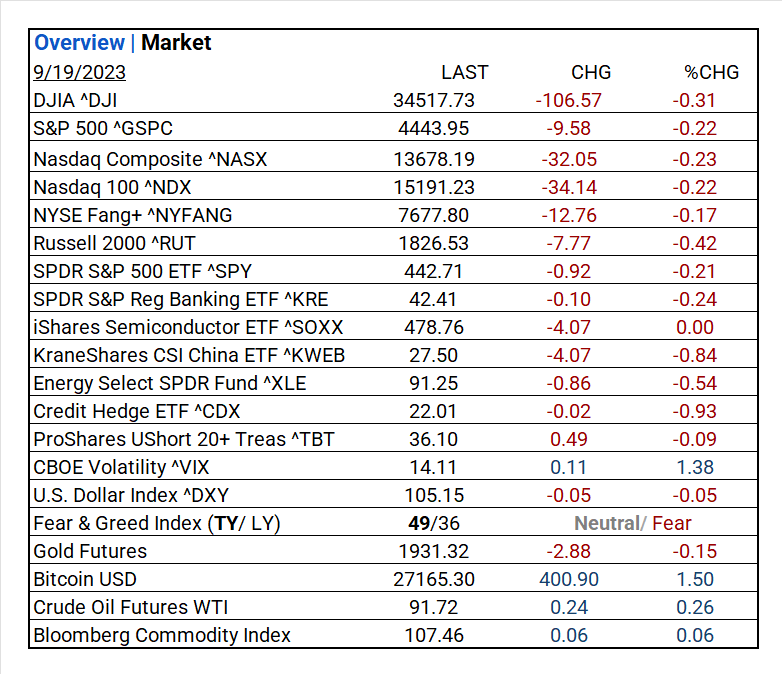

US Market Snapshot:

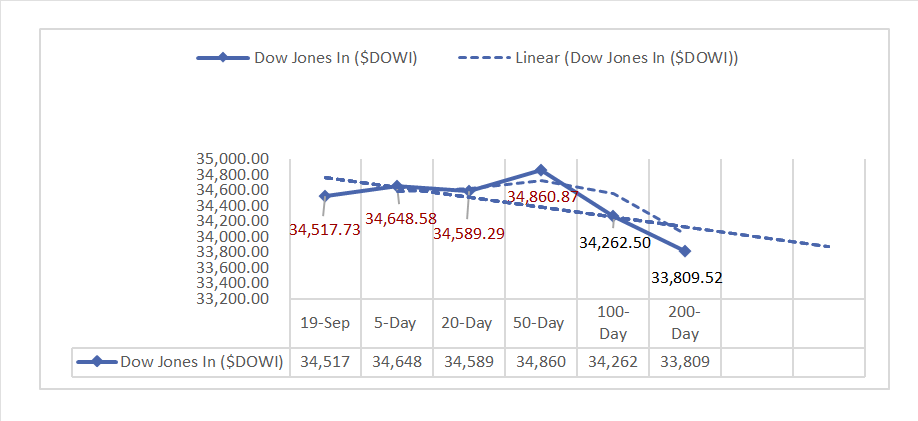

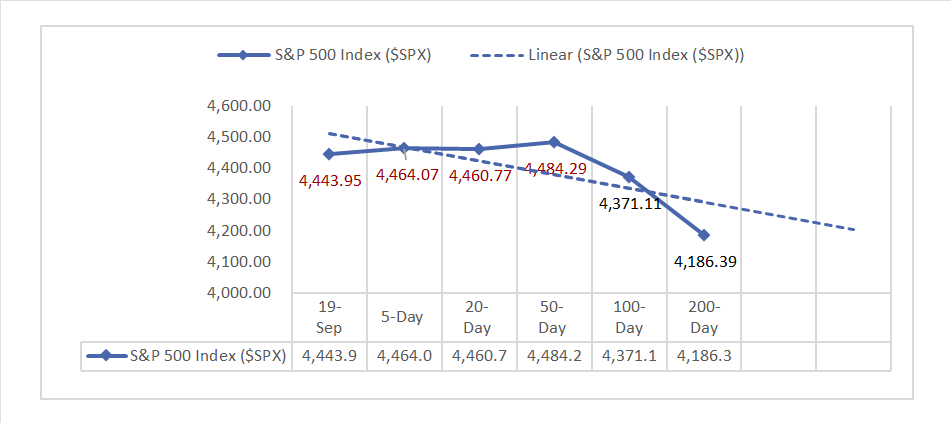

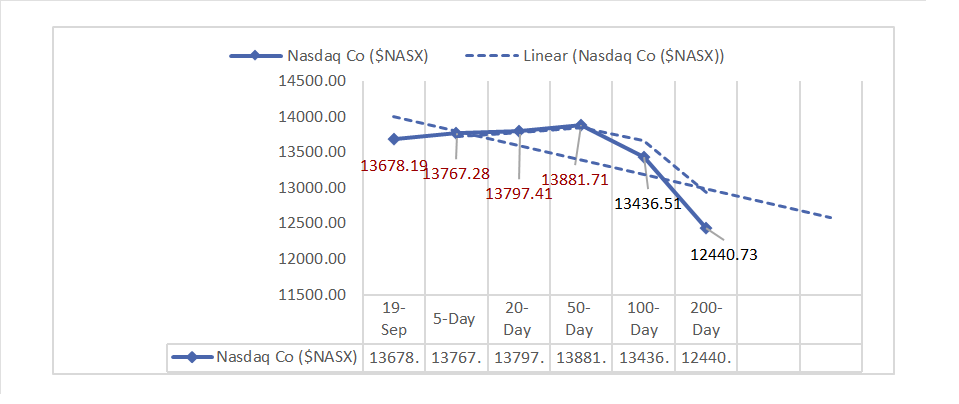

Key Stock Market Indices:

- DJIA ^DJI: 34517.73 (-0.31%)

- S&P 500 ^GSPC: 4443.95 (-0.22%)

- Nasdaq Composite ^NASX: 13678.19 (-0.23%)

- Nasdaq 100 ^NDX: 15191.23 (-0.22%)

- NYSE Fang+ ^NYFANG: 7677.80 (-0.17%)

- Russell 2000 ^RUT: 1826.53 (-0.42%)

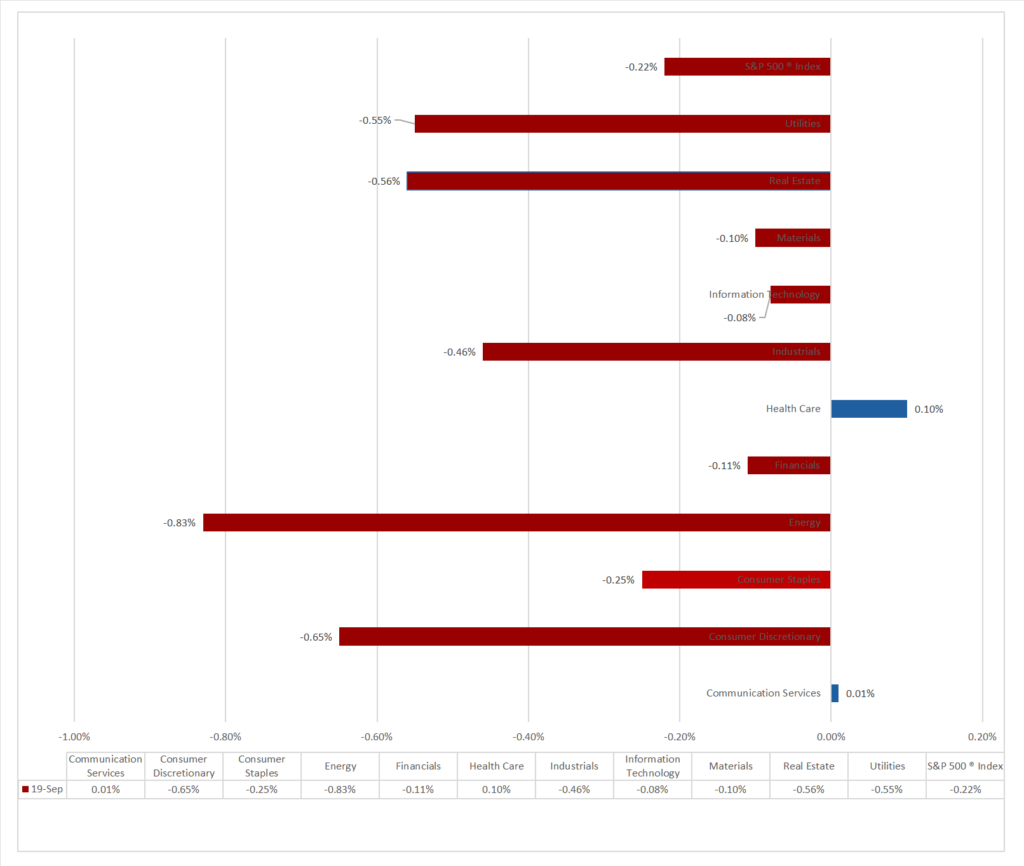

Market Insights: Performance, Sectors, and Trends:

- Major indices (DJIA, S&P 500, Nasdaq, Nasdaq 100, NYSE Fang+, Russell 2000) declined.

- Nine sectors weakened: Health Care up +0.10%, Energy down -0.83%.

- Notable gains in Automobile Components (+1.07%), Passenger Airlines (+0.76%), and Insurance (+0.69%).

- ProShares UltraPro Short QQQ ^SQQQ rose +0.75% on options market pullback bets.

- Fear & Greed Index shows neutral to slightly fearful sentiment.

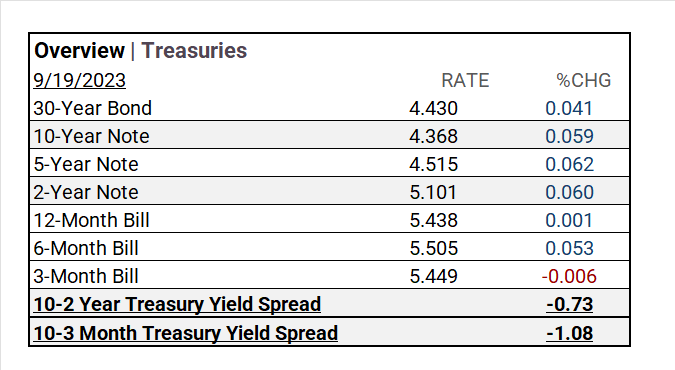

- Treasury securities mostly advanced, notably the 10-Year Note.

- US. Dollar Index slightly dipped.

- IPOs faced significant losses.

- ProShares UShort 20+ Treas led gains; other ETFs and indices declined.

- Building Permits exceeded expectations, while Housing Starts slumped in August.

Treasury Yields and Currency:

- Treasury yields rose, led by the 10-Year Note (+0.059%), while the 3-Month Bill dipped slightly. Yield spreads: -0.73% (10-Year vs. 2-Year), -1.08% (10-Year vs. 3-Month).

- US. Dollar Index (^DXY): 105.15 (-0.05%).

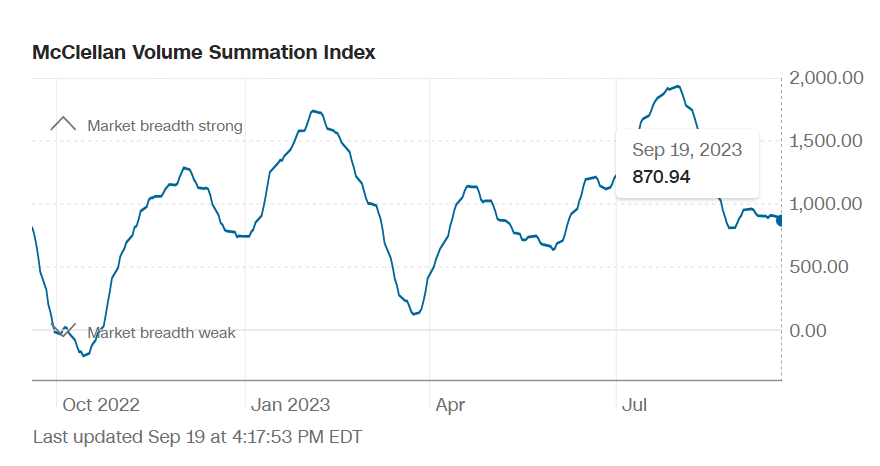

Market Volatility and Sentiment:

- CBOE Volatility Index (^VIX): 14.11 (+1.38%).

- Fear & Greed Index (TY/LY): 49/36 (Neutral/Slightly Fearful).

- McClellan Volume Summation Index: 870.94 (-2.77%).

Commodities:

- Gold Futures: 1931.32 (-0.15%).

- Bitcoin USD: 27165.30 (+1.50%).

- Crude Oil Futures WTI: 91.72 (+0.26%).

- Bloomberg Commodity Index: 107.46 (+0.06%).

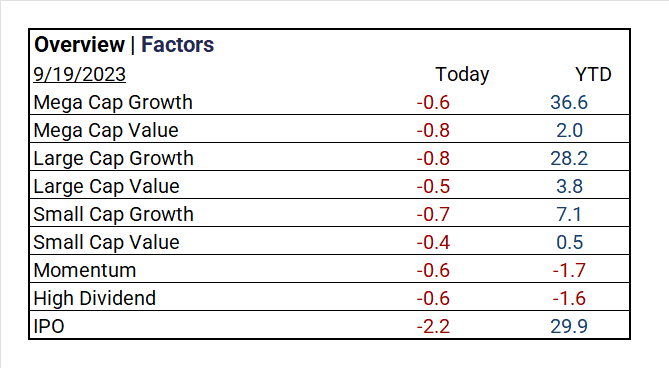

Factors:

- Losers: IPO (-2.2%), Large Cap Growth, Mega Cap Value, Momentum, High Dividend, all down by -0.8%, Mega Cap Growth and Small Cap Growth both down by -0.6%, and Small Cap Value down by -0.4%.

ETF Performance:

- Top Gainers: ProShares UShort 20+ Treas ^TBT (+1.36%), ProShares UltraPro Short QQQ ^SQQQ (+0.75%)

- Top Losers: KraneShares CSI China ETF ^KWEB (-0.84%), Credit Hedge ETF ^CDX (-0.93%), SPDR S&P Reg Banking ETF ^KRE (-0.24%), Energy Select SPDR Fund ^XLE (-0.54%)

US Economic Data

- In August, Building Permits came in at 1.543 million, surpassing the consensus estimate of 1.443 million and exceeding the previous figure of 1.443 million. However, Housing Starts experienced a significant month-on-month decline of -11.3% in August, following a 2% increase in the prior month.

Earnings:

Q1 Insights:

- Q1 ’23: 79% of companies beat analyst estimates.

Q2 Insights:

- Q2 Forecast: Predicted decline of <7.2%> in S&P 500 EPS , Fiscal year 2023 EPS remained flat YoY.

Notable Earnings Today:

- Beat: AutoZone (AZO), Endava (DAVA), Steelcase (SCS)

- Miss: Apogee (APOG)

Resources:

News

Company News/ Other

- Disney to Invest $60 Billion in Theme Parks, Cruises Over Next Decade – WSJ

- Synthetic Biology Moves From the Lab to the Marketplace – WSJ

- Google Says Digital Ad Budgets Are Shifting to Amazon – Bloomberg

Energy/ Materials

- California Needs a $370 Billion Grid Investment, Edison Says – Bloomberg

Real Estate

- Marathon Is Bidding on Signature’s Commercial Real Estate Portfolio, CEO Says – Bloomberg

- San Francisco Office Market Shows Signs of Life – WSJ

Central Banks/Inflation/Labor Market

- Fed Set to Pause Rate Hikes, But Don’t Count Out Another Increase – Bloomberg

- BOJ Speculation Shifts to Negative Rate Policy From Yield Cap – Bloomberg

Asia/ China