“Empowering Your Financial Success”

Daily Market Insights: November 17th, 2023

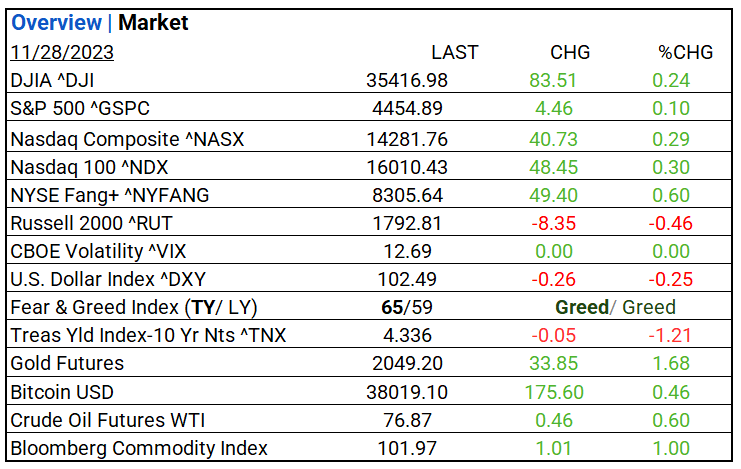

US Market Snapshot: Key Stock Market Indices:

- DJIA ^DJI: 35,416.98 (83.51, 0.24%)

- S&P 500 ^GSPC: 4,454.89 (4.46, 0.10%)

- Nasdaq Composite ^NASX: 14,281.76 (40.73, 0.29%)

- Nasdaq 100 ^NDX: 16,010.43 (48.45, 0.30%)

- NYSE Fang+ ^NYFANG: 8,305.64 (49.40, 0.60%)

- Russell 2000 ^RUT: 1,792.81 (-8.35, -0.46%)

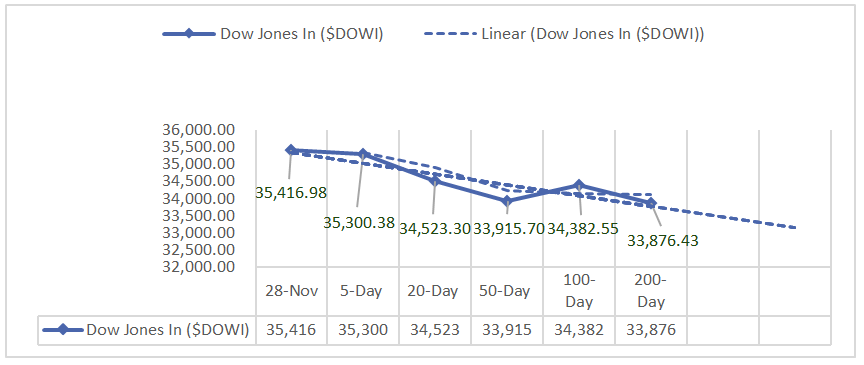

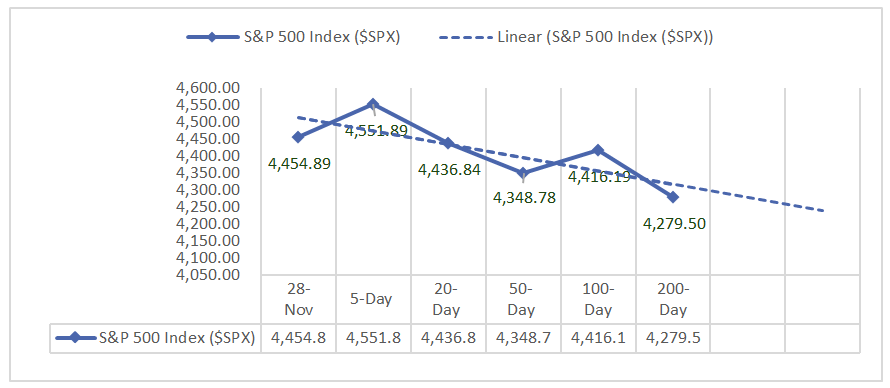

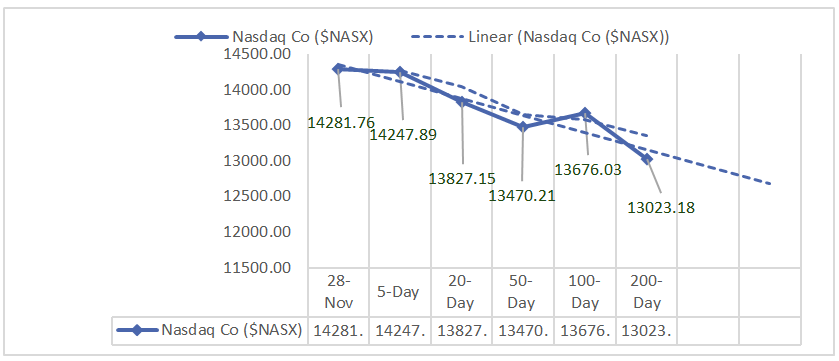

Moving Averages: DOW, S&P 500, NASDAQ:

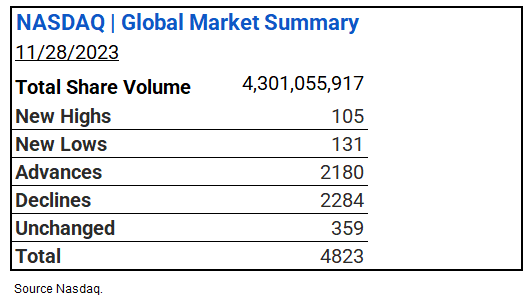

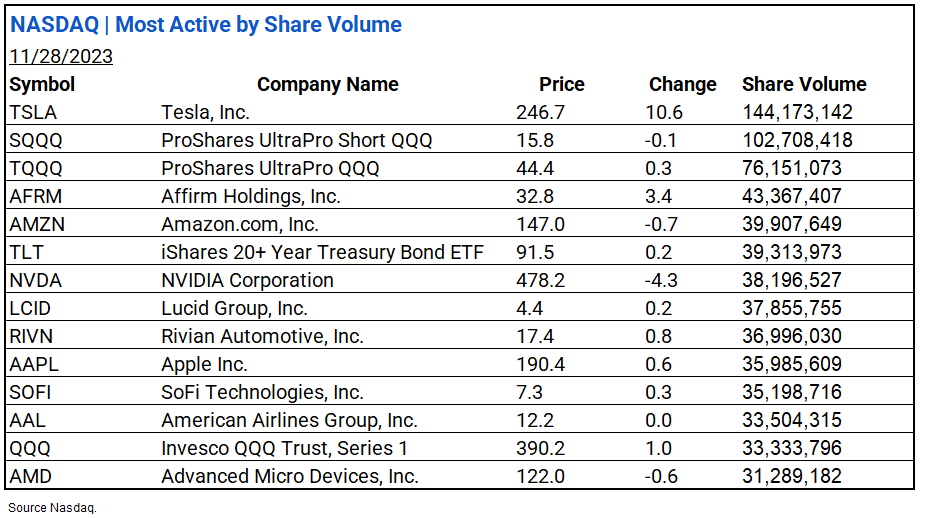

NASDAQ Global Market Summary:

Market Insights: Performance, Sectors, and Trends:

- Economic Data: S&P Case-Shiller Home Price Index in Sept. @3.9% beats forecast: 2.5%, Consumer Confidence up for Nov @102.0 and beats forecast of 99.1.

- Market Indices: DJIA (+0.24%), S&P 500 (+0.10%), Nasdaq Composite (+0.29).

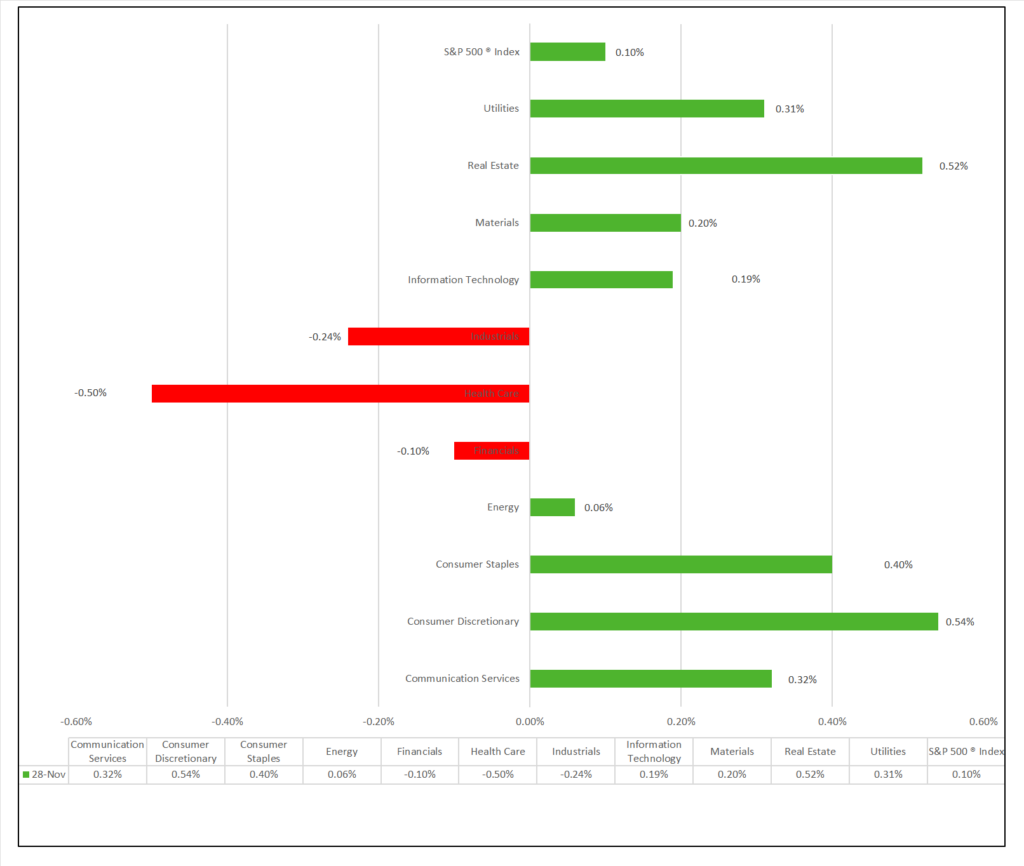

- Sector Performance: 8 of 11 sectors higher; Consumer Discretionary (+0.54%) leading, Health Care (-0.50%) lagging. Top industry: Automobiles (+4.10%).

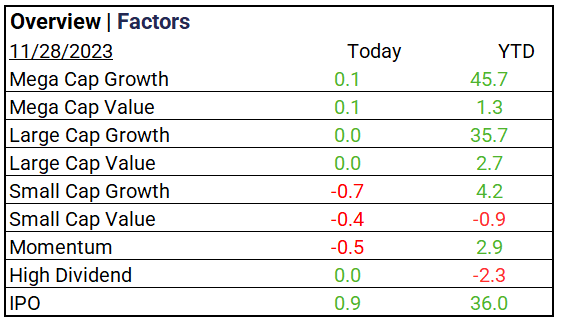

- Factors: IPOs outperform, Small Caps lag.

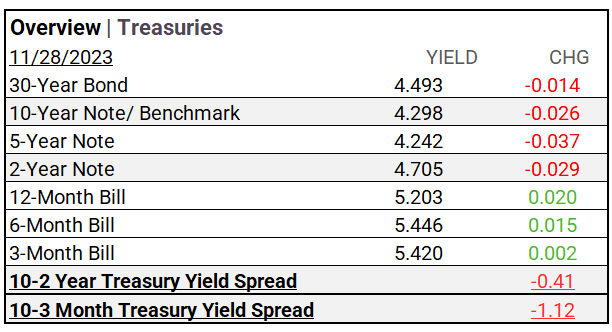

- Treasury Markets: 10-Year Note down 0.026, 2-Year Note down -0.029; Short-term Bills rose.

- Commodities: Gold futures posted robust gains, while Bitcoin, Crude Oil futures and the Bloomberg Commodity Index also advanced.

Sectors:

- 8 of 11 sectors higher; Consumer Discretionary (+0.54%) leading, Health Care (-0.50%) lagging. Top industries: Automobiles (+4.10%), Office REITs (+2.83%), and Metals & Mining (+2.25%).

Factors:

- IPO’s (+0.9%) outperform, Small Caps lag.

Treasury Markets:

- 10-Year Note down 0.026, 2-Year Note down -0.029; Short-term Bills rose.

Currency and Volatility:

- U.S. Dollar Index declined, CBOE Volatility unchanged, Fear & Greed indicates Greed.

- CBOE Volatility ^VIX: 12.69 (0.00, 0.00%)

- Fear & Greed Index: 65/59 (Greed/ Greed).

Commodity Markets:

- Gold futures posted robust gains, while Bitcoin, Crude Oil futures and the Bloomberg Commodity Index also advanced.

- Gold Futures: 2,049.20 (33.85, 1.68%)

- Bitcoin USD: 38,019.10 (175.60, 0.46%)

- Crude Oil Futures WTI: 76.87 (0.46, 0.60%)

- Bloomberg Commodity Index: 101.97 (1.01, 1.00%)

US Economic Data:

- S&P Case-Shiller Home Price Index (20 cities, Sept.): 3.9% (Previous: 3.9%, Forecast: 2.5%)

- Consumer Confidence (Nov): 102.0 (Previous: 101, Forecast: 99.1)

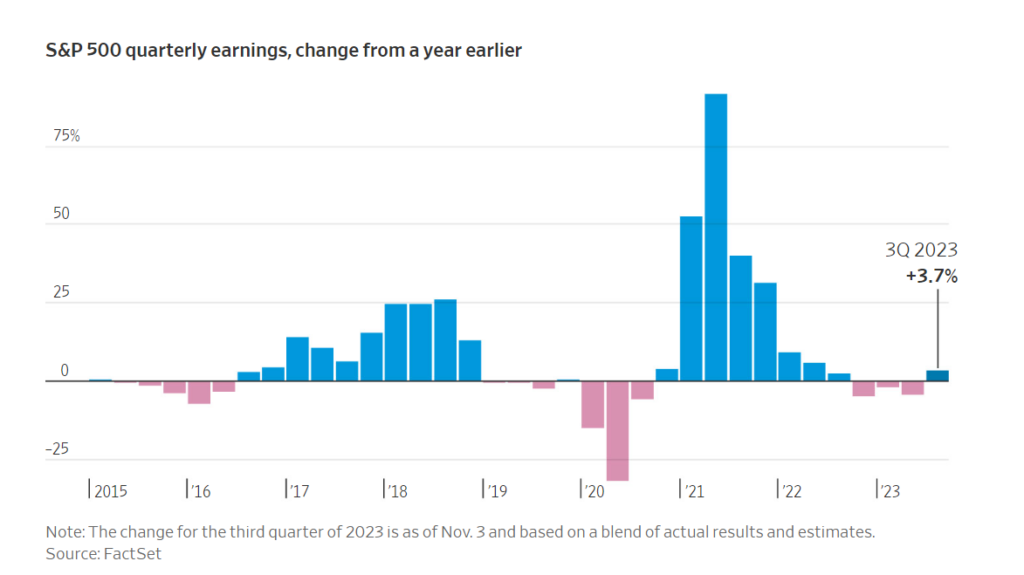

Earnings:

-

- Q3 Forecast: 64% of S&P 500 companies issue negative EPS guidance for Q3 2023. Communication Services and Consumer Discretionary lead in expected YoY earnings growth.

- Q3 Forecast: 64% of S&P 500 companies issue negative EPS guidance for Q3 2023. Communication Services and Consumer Discretionary lead in expected YoY earnings growth.

Notable Earnings Today:

- BEAT: PDD Holdings DRC (PDD), Intuit (INTU), Meituan (MPNGY), Workday (WDAY), CrowdStrike Holdings (CRWD), NetApp (NTAP)

- MISSED: Splunk (SPLK)

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): -0.09%

- Hang Seng (Hong Kong): -0.89%

- Shanghai Composite (China): -0.20%

- CAC 40 (France): -0.15%

- DAX (Germany): -0.23%

- FTSE 100 (UK): 0.00%

News

Central Banking and Monetary Policy:

- Home Prices Hit Fresh Record in September, – WSJ

- Hot Healthcare Hiring Bolsters Cooling U.S. Labor Market – WSJ

- Gold Hits Six-Month High as Fed’s Rate-Cut Momentum Swells – Bloomberg

Energy:

- Fertilizer Companies Are Betting on Ammonia as a Low-Carbon Fuel – WSJ

- Global ESG Market Shrinks After Sizable Drop in US – Bloomberg

China:

- China’s AI aspirations will fuel economy, drive investment into the trillions of dollars: McKinsey – SCMP