Stay Informed and Stay Ahead: Market Watch, July 11th, 2024.

Late-Week Wall Street Markets

Key Takeaways

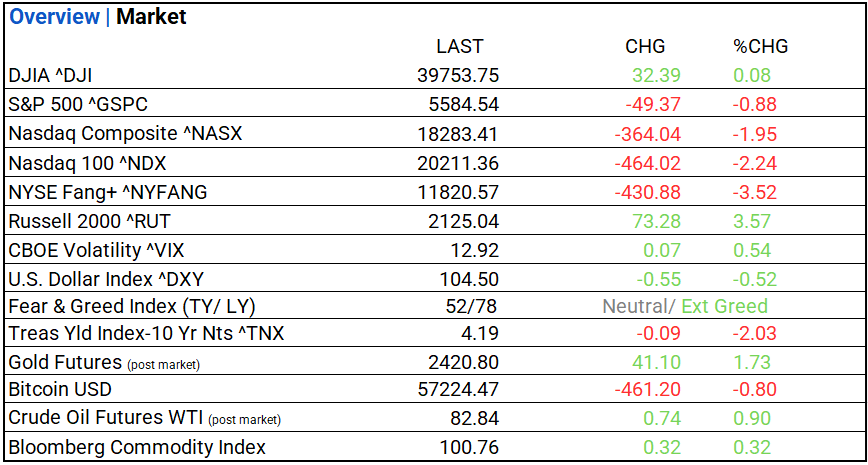

+ US stock indices: DOW rises; NASDAQ plunges, S&P 500 declines. Seven of eleven sectors gain, with Real Estate leading and Information Technology lagging. Household Durables outperforms.

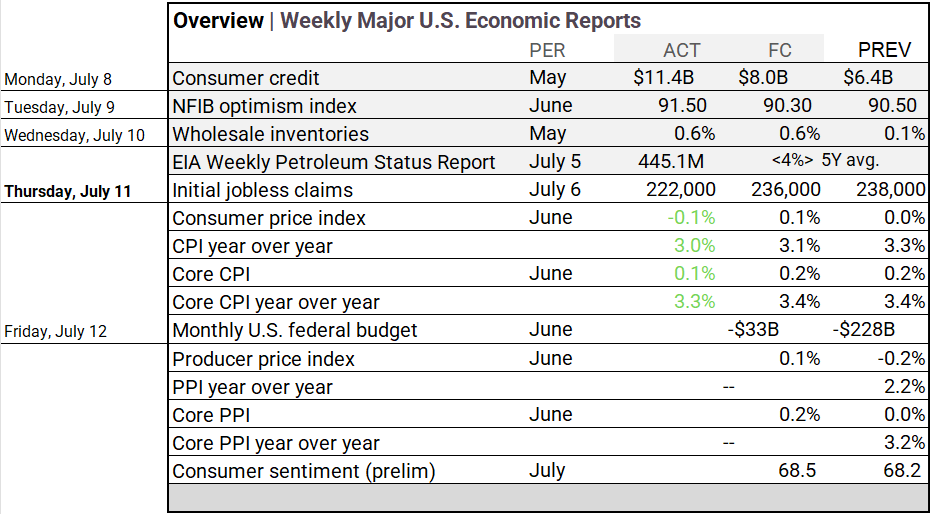

+ CPI beats consensus as June’s CPI fell to -0.1%, below forecasts, with year-over-year at 3.0%.

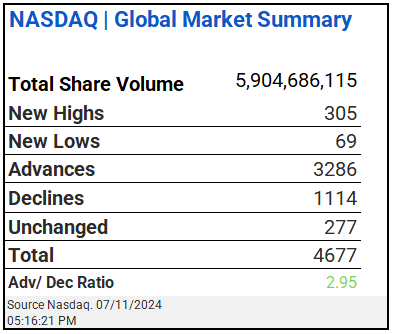

+ Treasury yields sharply lower across maturities; NASDAQ’s A/D ratio at 2.95. Russell 2000 and Value sectors outperform. Commodities mostly rise; NVIDIA leads in active trading. Tesla shorts see significant gains. PepsiCo and Delta Air Lines miss earnings expectations.

Summary of Market Performance

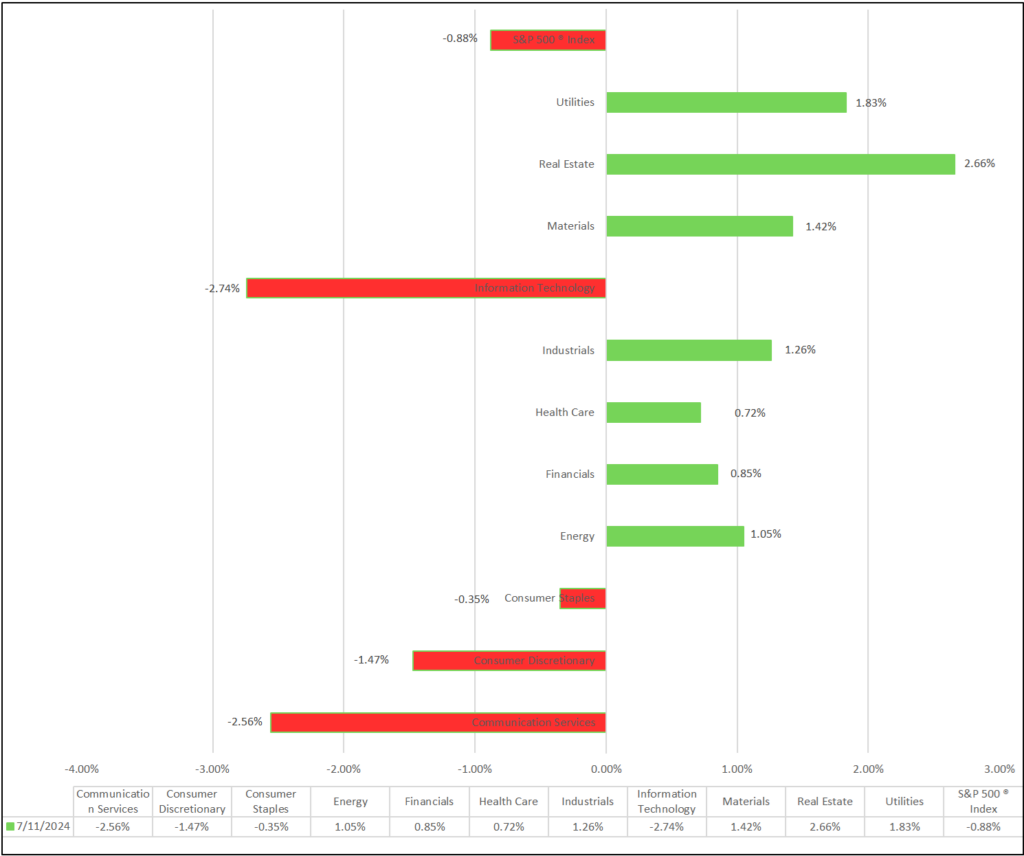

Indices & Sectors Performance:

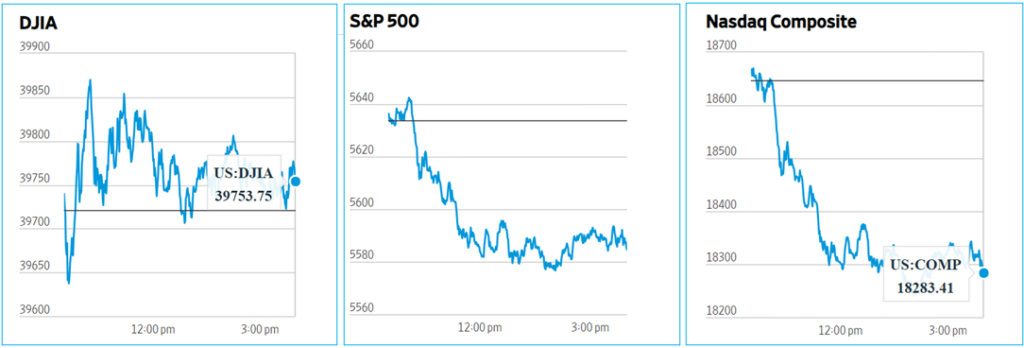

- Today, major US stock indices—DOW—up, NASDAQ, S&P 500—fall. Among eleven sectors, seven gain. Real Estate led; Information Technology and Communication Services trailed. Top industries: Household Durables Industry (+5.98%), Office REITs (+5.50%) and Real Estate Management & Development Industry Group (+04.12%).

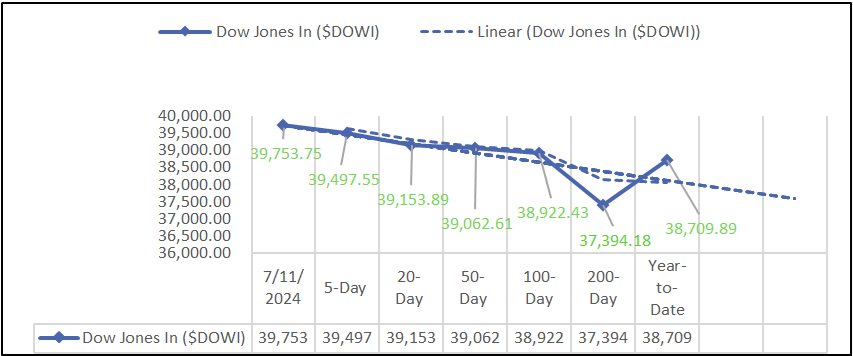

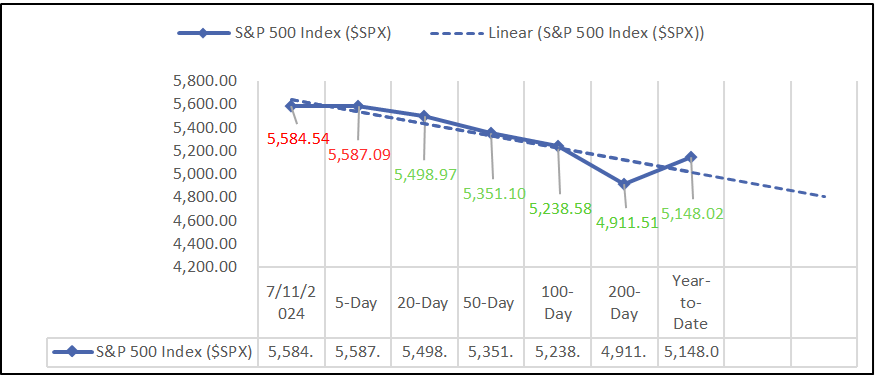

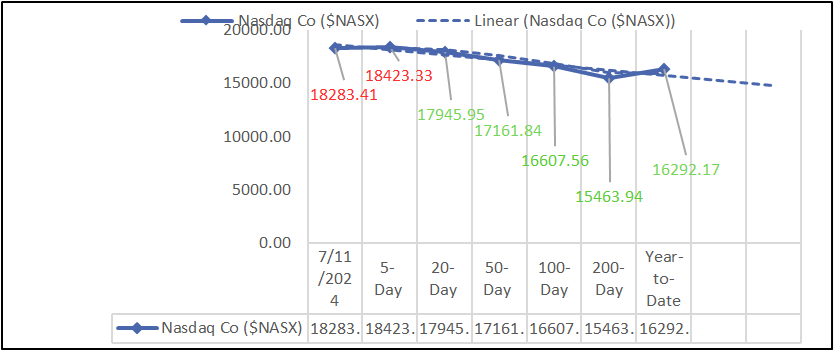

Chart: Performance of Major Indices

Moving Average Analysis:

S&P 500 Sectors:

- Among eleven sectors, seven gain. Real Estate led; Information Technology trailed.

Economic Highlights:

- June’s CPI cooled to -0.1%, below forecasts, with year-over-year at 3.0%. Core CPI rose 0.1%. The probability of a September rate cut increases to >77%.

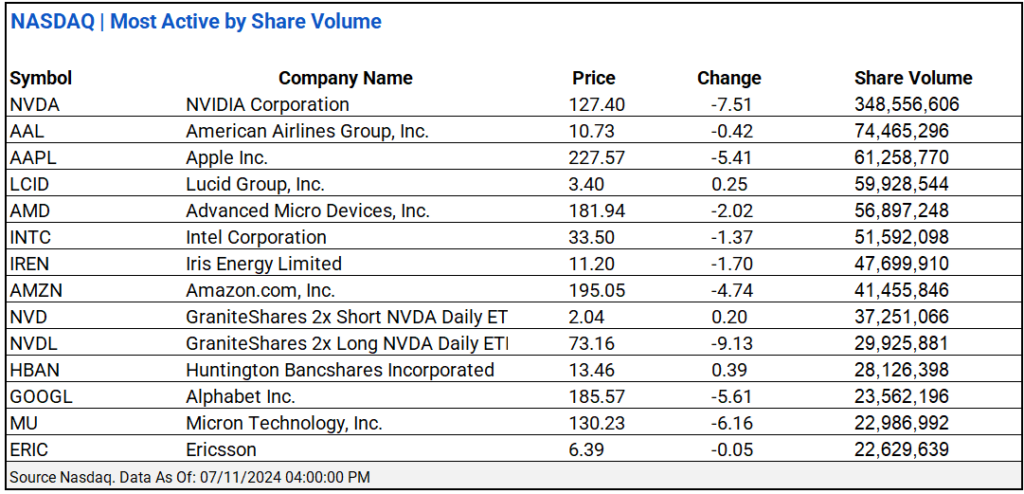

NASDAQ Global Market Update:

- NASDAQ showed positive sentiment with a total share volume of 5.90 billion, 305 new highs, 69 new lows, and an advance/decline ratio of 2.95/ NVIDIA Corporation led in active trading, followed by American Airlines Group.

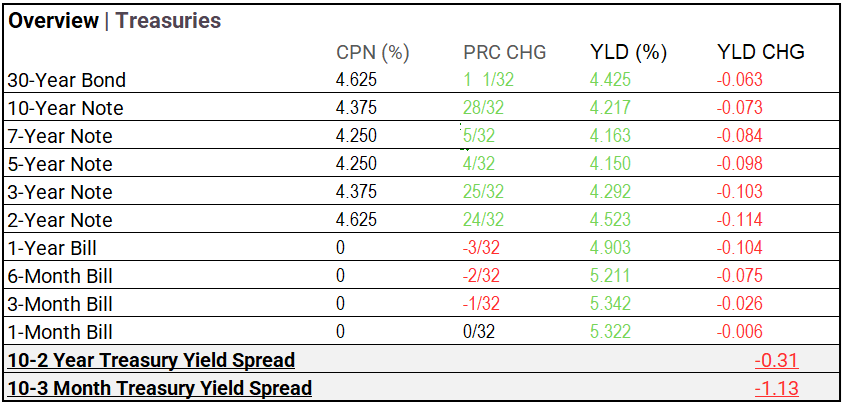

Treasury Markets:

- Yields for U.S. Treasury securities fell, with the 30-year bond at 4.425%, the 10-year note at 4.217%, and the 2-year note at 4.523%, with decreased yield changes across maturities.

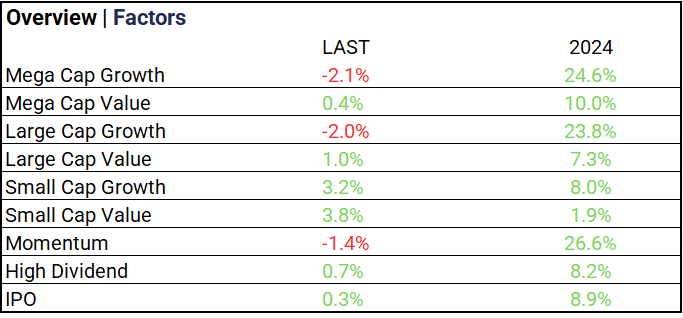

Market Factors:

- Small-cap value stocks rose 3.8%, while mega-cap growth segments experienced sharp declines.

Currency & Volatility:

- The VIX moderately rose to 12.92, while the Fear & Greed Index dropped from 78 (Extreme Greed) last year to 52 (Neutral).

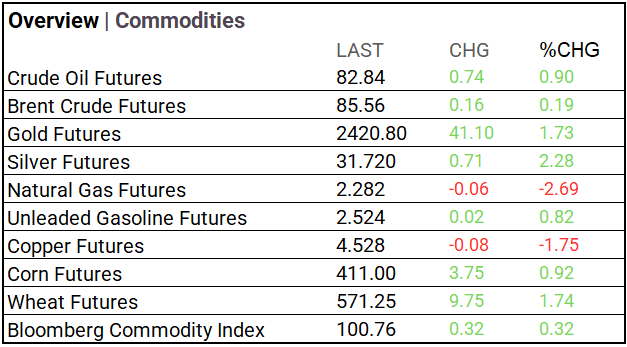

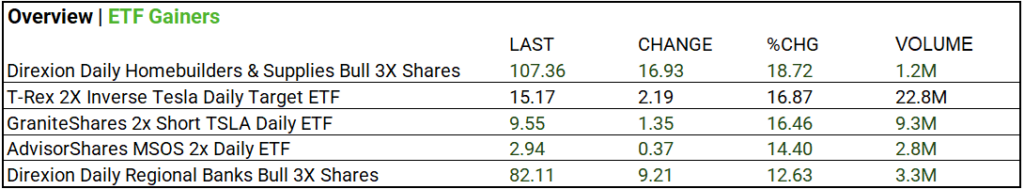

Commodities & ETFs:

- Commodity markets: Crude oil, Brent crude, gold, and silver up, with copper and natural gas down, while corn and wheat rose.

- ETFs: T-Rex 2X Inverse Tesla Daily Target ETF up 16.87%, Direxion Daily Regional Banks Bull 3X Shares up 12.63%; noteworthy as Tesla shorts and Banks bulls win.

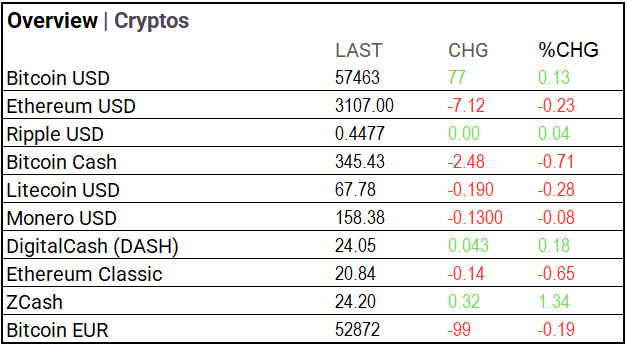

Cryptocurrency Update:

- Bitcoin rose by 0.13%, Ethereum fell by 0.23%, and ZCash jumps +1.34%.

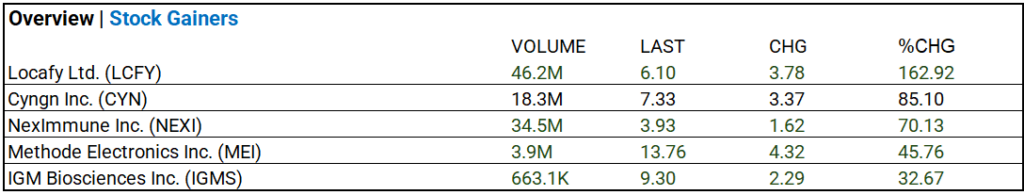

Stocks:

- Locafy Ltd. (LCFY) saw a significant volume of 46.2 million shares traded, closing at $6.10 with a notable increase of $3.78, or 162.92%. NexImmune Inc. (NEXI) traded 34.5 million shares, closing at $3.93, up $1.62, or 70.13%.

Notable Earnings:

- PepsiCo (PEP), Seven i ADR (SVNDY), Delta Air Lines (DAL) and Conagra Brands (CAG) miss. Fast Retailing ADR (FRCOY) beats. Big Banks up tomorrow!

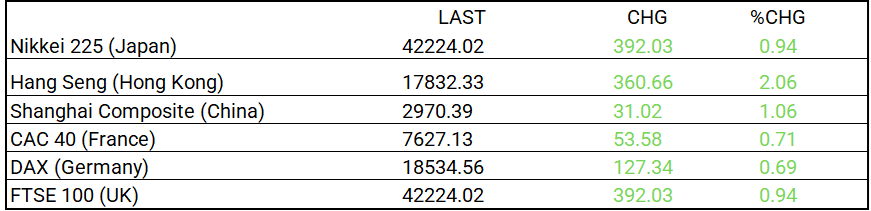

Global Markets Summary:

- Both Asia and Europe were up; Hang Seng led gainers +2.06%.

In the NEWS:

Central Banking, Monetary Policy & Economics:

- Milder Inflation Opens Door Wider to September Rate Cut – WSJ

- Japan Currency Chief Keeps Traders in Dark Over Yen Intervention – Bloomberg

Business:

- Delta’s Sagging Profit Signals Trouble for Airlines This Summer – WSJ

- PepsiCo Sales Disappoint as US Consumers Cut Back on Snacks – Bloomberg

China:

- Exclusive | Why this China analyst thinks ‘full decoupling’ is unlikely, and what gets missed in talk of reforms – SCMP