VICA Market Sentiment Index (VMSI) Report | December 12, 2025, Condensed Structural Read.

VMSI™ FORCE-12.3 | VICA Research

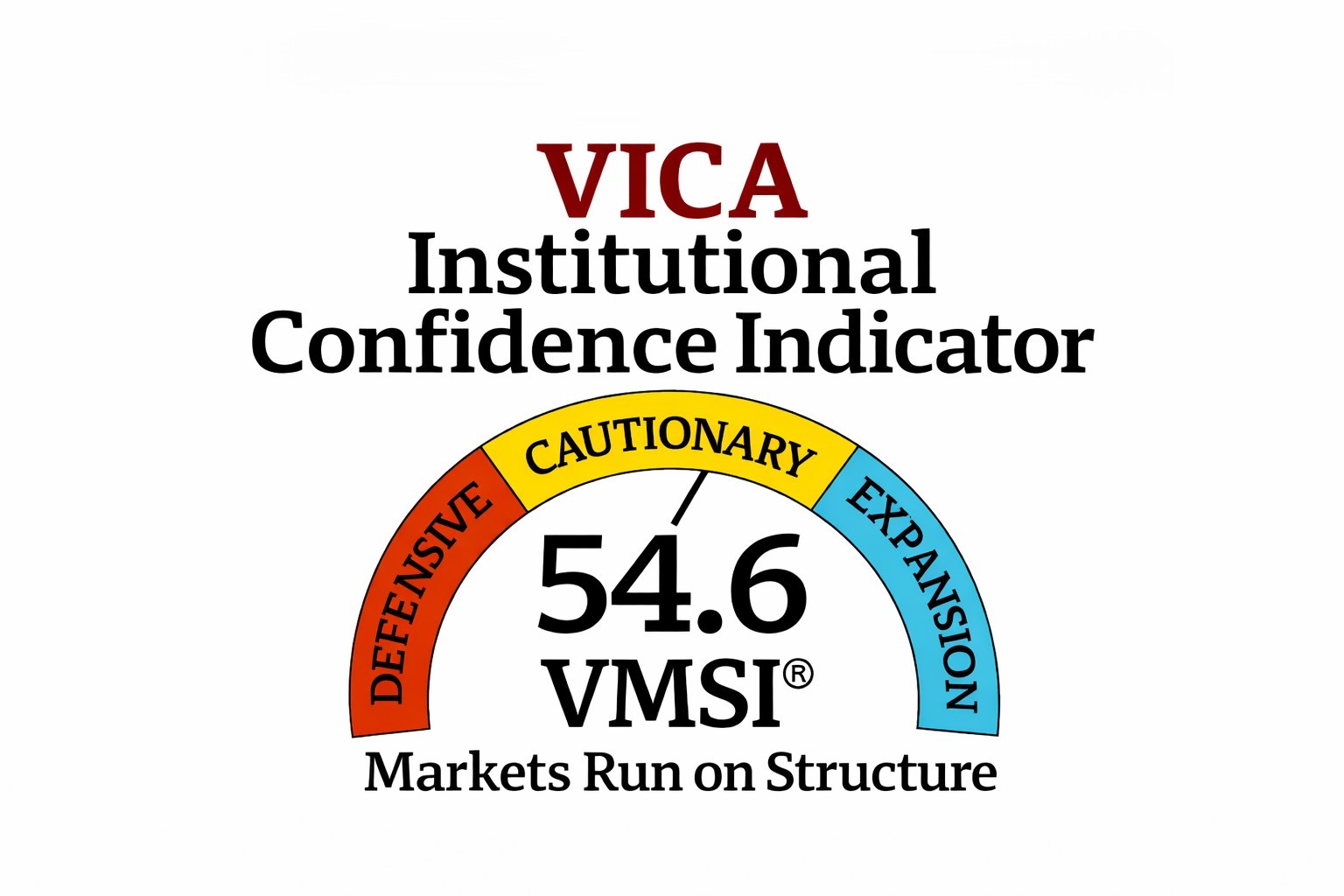

VMSI Composite: 54.6 — Cautionary Optimism

Stability holds, but the cost of maintaining equilibrium continues to rise.

Condensed Structural Read — VICA Market Sentiment Index (VMSI®)

Executive Summary

Market volatility remains deceptively calm, but structural signals tell a more complex story. Beneath steady index levels, liquidity has become increasingly concentrated, momentum has narrowed further, and duration demand continues to migrate into the 7–10 year Treasury belly — a classic signal of growth fragility rather than inflation concern.

AI leadership remains the primary structural backbone supporting equity stability, while participation outside these corridors continues to fade. This is not a breakdown regime, but it is no longer an organically expanding one. Stability persists through engineering, not conviction.

VMSI Component Breakdown

-

Momentum: 51.9

Growth torque continues to decay. Nasdaq and growth-weighted indices underperformed, while resilience shifted toward balance-sheet-driven leadership. Momentum remains selective, not directional. -

Liquidity: 54.4

Liquidity is functional but increasingly concentrated. Execution capacity remains intact, yet dispersion and participation continue to weaken. The system moves, but no longer scales. -

Volatility & Hedging: 56.8

Surface volatility remains suppressed, but internal signals reject true stability. Hedging activity has rotated into duration, credit, and corridor congestion rather than disappearing. -

Safe Haven Demand: 59.1

Defensive positioning remains elevated but rational. The persistent bid in the 7–10 year Treasury belly confirms a market hedging growth and policy risk — not systemic stress.

Structural Signals That Matter

-

Dow resilience vs. Nasdaq softness confirms late-equilibrium divergence

-

Breadth remains impaired, reinforcing corridor-only continuation

-

Credit remains inside safety boundaries, preserving stability

-

Duration demand concentrates in the belly, confirming growth fragility

Volatility is not resolved — it is being absorbed.

Sector Positioning

Overweight / Structural Corridors

-

Communication Services

-

Select Mega-Cap Technology (AI spine)

-

Industrials (quality balance sheets)

-

Health Care (defensive convexity)

-

Select Financials (credit-anchored carry)

Underweight

-

Consumer Discretionary

-

Consumer Staples

-

Materials

-

Energy

Predictive Outlook

Continuation remains possible, but only through precision and liquidity density.

-

42% — Liquidity-Led Continuation (narrow, defensive grind)

-

43% — Divergence Drift (growth torque fades, volatility pockets emerge)

-

15% — Convexity Shock (low probability, structurally rising risk)

Two conditions still define regime stability:

-

High Yield must remain contained

-

Volatility of volatility must stay suppressed

A breach in either forces repricing — not collapse, but discontinuity.

Tactical Focus

This is not a broad-beta market.

It is a corridor-only regime.

Maintain exposure only where:

-

Liquidity density is high

-

Balance sheets are strong

-

Duration support reinforces equity stability

Treat upside as conditional, not momentum-driven.

Conclusion

The VMSI at 54.6 confirms a market that remains stable — but increasingly engineered. AI concentration and belly-duration demand are doing the work that breadth and momentum no longer can.

Stability holds.

Efficiency declines.

Precision matters.

Source: VICA Partners Research

© VICA Research – Proprietary Market Intelligence

About the VICA Market Sentiment Index (VMSI)

The VMSI is VICA Research’s proprietary sentiment gauge designed to track institutional risk behavior, liquidity dynamics, volatility structure, and defensive rotation. It is engineered for tactical capital positioning — not headline emotion.

This report is for informational purposes only and does not constitute investment advice. Unauthorized reproduction or redistribution is prohibited.