August 4, 2025 | VICA Macro Strategy Note

By Matthew Krumholz | Source: VICA Partners

Executive Summary

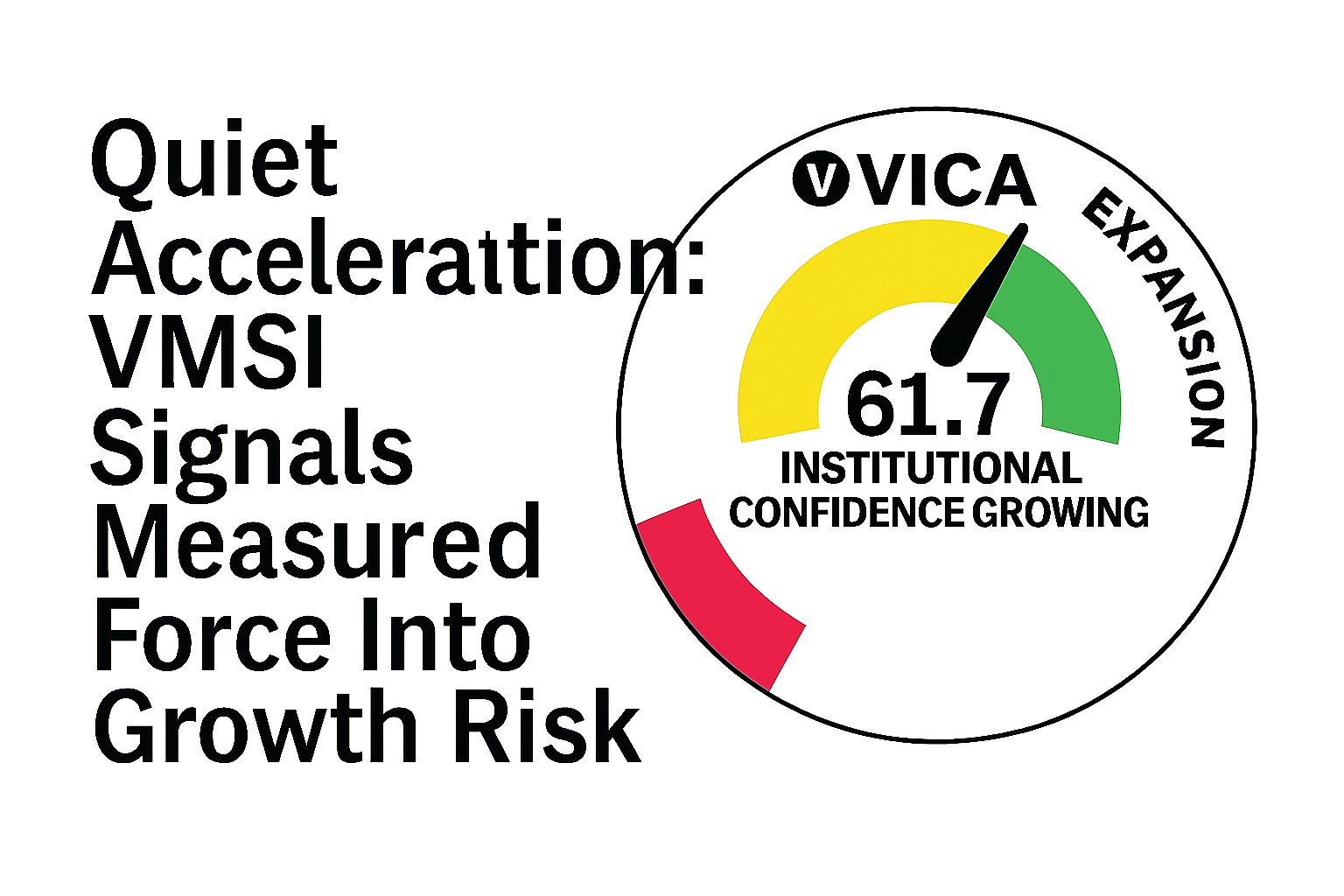

A sharp drop in July job creation triggered an aggressive repricing of Federal Reserve expectations. While short-end yields tumbled and Fed cut odds surged, institutional capital quietly rotated into risk. VMSI — VICA’s proprietary Volatility & Market Sentiment Index — confirms this is not a reactionary chase. It is a methodical, conviction-weighted build.

Rates Reprice. Institutions Rebuild.

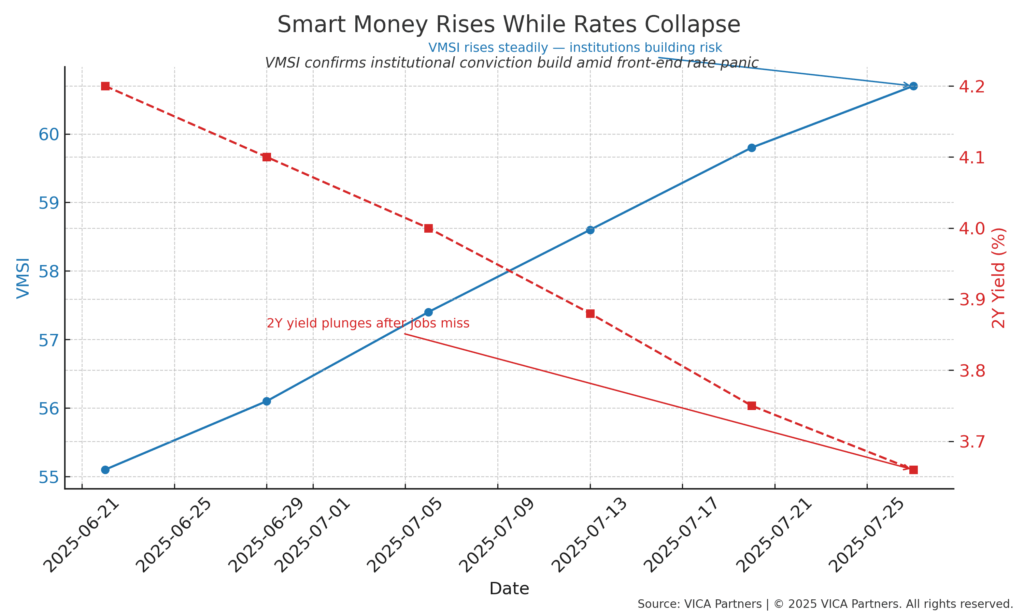

July nonfarm payrolls came in at just 63,000, with downward revisions totaling 178,000 for May and June. Markets now assign an 86% probability of a rate cut in September. The 2-Year Treasury yield fell to 3.666%.

At the same time, VMSI rose to 59.8 — its fourth straight weekly gain. The signal is clear: institutions are not retreating. They’re reallocating deliberately, particularly toward mid-cap growth, cyclicals, and semiconductors.

VMSI confirms institutional conviction build amid front-end rate panic.

What’s Driving the Signal

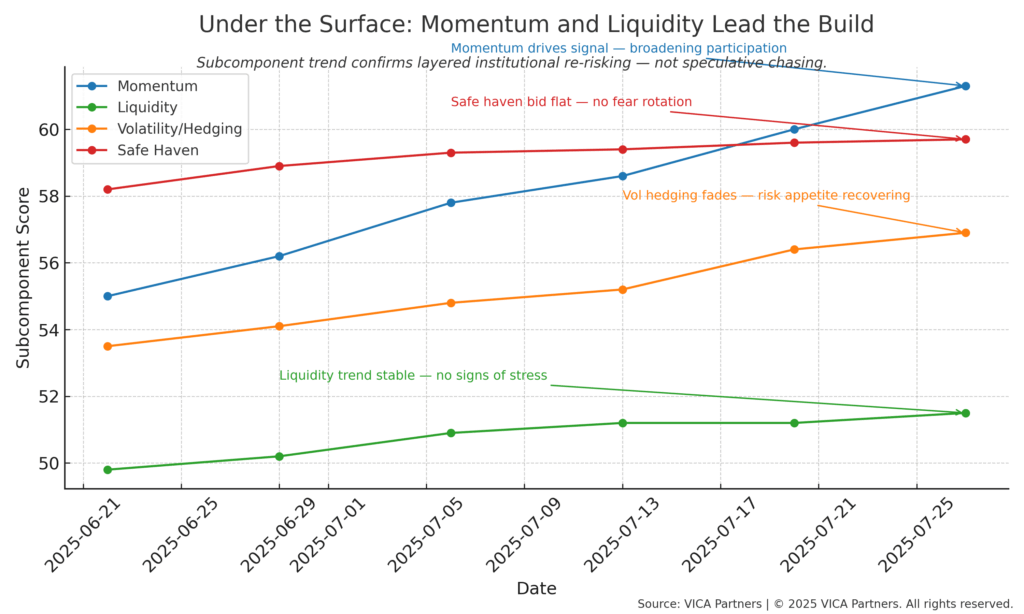

VMSI strength is not a technical anomaly — it’s broad-based and intentional:

- Momentum: 61.3 — leadership is broadening beyond megacaps

- Liquidity: 51.5 — credit conditions remain supportive

- Volatility/Hedging: 56.9 — overlays continue to thin

- Safe Haven: 59.7 — no increase in defensive positioning

This is structured risk-taking, built with discipline — not reaction.

Subcomponent trend confirms layered institutional allocation — not speculative chasing.

Political Noise, Capital Clarity

President Trump’s dismissal of the BLS Commissioner raised concerns about data credibility. But the market told a different story: no safe haven spike, no credit spread widening, and no volatility blowout. Institutions saw through the noise and kept building.

Strategy Implications

| Positioning Theme | Tactical Allocation Signal |

| Duration | Build long exposure in EDZ5/EDF5 to capitalize on front-end mispricing. |

| Equities | Rotate into mid-cap growth while trimming small-cap value exposure. |

| Volatility | Initiate long volatility around CPI and FOMC; favor TY gamma structures. |

| Sector Rotation | Overweight semiconductors and industrials; underweight staples. |

Summary Takeaway

Skip the headlines — the data tells the real story.

- Markets are pricing a Fed pivot.

- Institutions have already positioned.

- The front end has moved.

- Capital rotation is active and deliberate.

This isn’t flight to safety.

It’s structured conviction — building quietly beneath the noise.

Source: VMSI™ is a proprietary indicator of VICA Partners.

© 2025 VICA Partners. All rights reserved. Reproduction without permission is prohibited.