What Venezuela Reveals About Risk, Oil, and Duration Mispricing

VICA Partners | Institutional Market Structure Commentary

Abstract

Geopolitical shocks consistently produce the same market error: duration is priced before it is confirmed. Oil markets respond immediately to political events, embedding risk premia that often imply persistence without confirmation. In most cases, those implications are not validated by market structure.

The Venezuela event is a current example. Front-month oil prices repriced quickly. Long-dated pricing did not. The forward curve remained orderly, reflecting carry economics rather than scarcity. This divergence is not incidental. It is diagnostic.

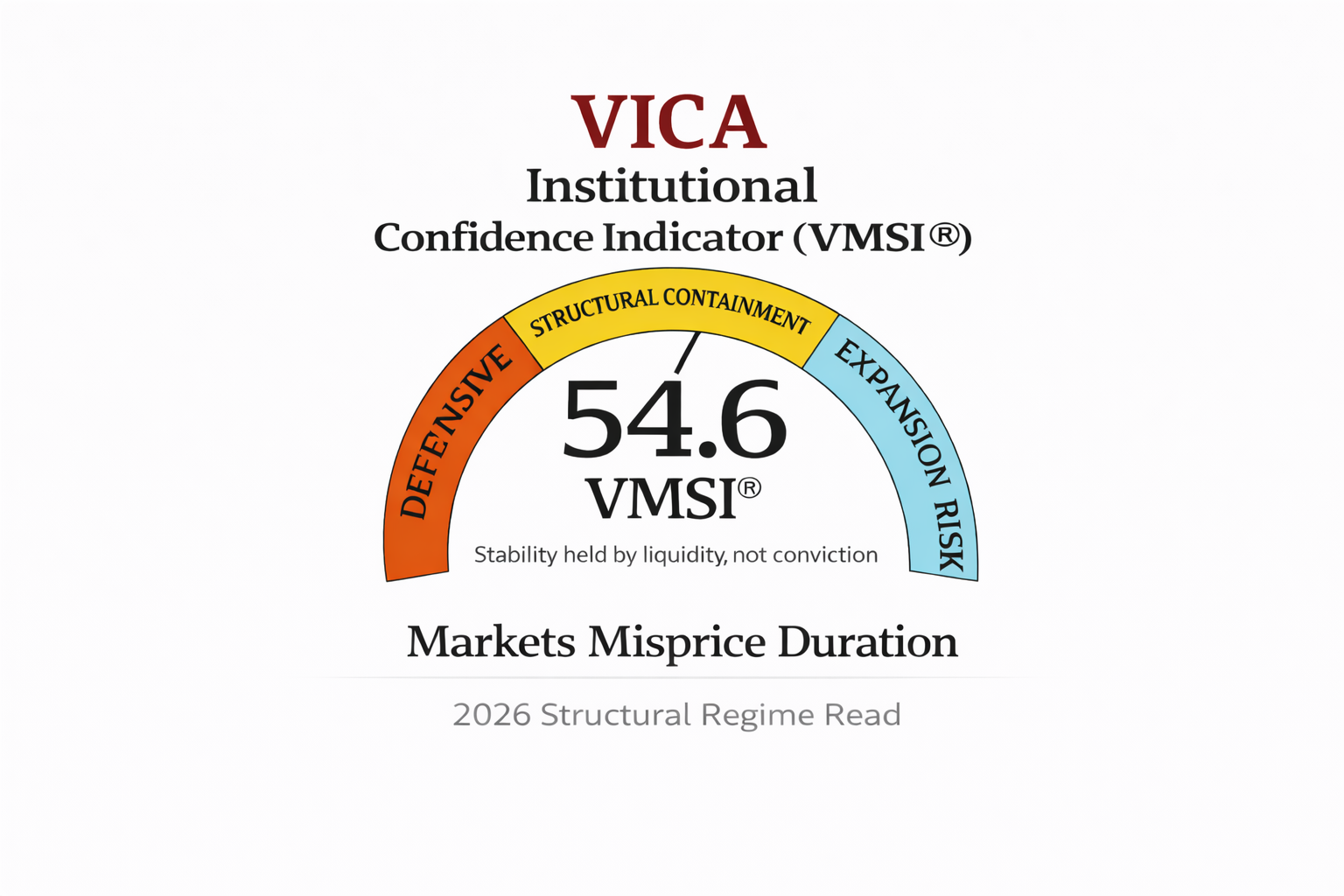

Within the VICA Market Sentiment Index (VMSI) framework, this pattern is characteristic of a containment regime: elevated event risk, rapid volatility insertion, and compressed expectations for long-duration disruption. The implication for allocators is structural, not directional.

The Structural Baseline

Venezuela has not functioned as a marginal swing supplier in global oil markets for several years. Production constraints, sanctions, infrastructure degradation, and capital scarcity have already reduced its relevance to near-term supply balance.

As a result, regime-targeted political action does not remove barrels the market is actively depending on. It alters governance uncertainty without materially impairing physical availability.

Export corridors were not structurally disrupted. No coordinated producer response followed. Inventory expectations did not reset.

The baseline remained intact. Prices reacted anyway.

The Market Error: Pricing Duration Before Confirmation

Markets are efficient at repricing risk. They are less efficient at pricing persistence.

In oil markets, this distinction is observable. Front-month contracts absorb shock premia immediately. Longer-dated contracts reveal whether participants believe that shock will translate into sustained physical constraint.

In this case, they did not.

This is not an interpretation of politics. It is a statement about how markets process uncertainty over time.

Where Oil Markets Reveal the Truth

Brent Crude: Front-Month vs 12- and 24-Month Forwards (Indexed to Event Date)

Following the Venezuela event, front-month Brent repriced sharply. The 12-month and 24-month contracts remained comparatively stable.

As of the January 2 settlement:

- Front month (March 2026): $60.75

- 12-month forward (February 2027): $60.40

- 24-month forward (February 2028): $61.49

The forward curve remained in modest contango. The spread between M12 and M24 reflected carry and storage costs rather than disruption risk.

If markets were pricing persistent supply impairment, this structure would have changed. The back end would have repriced. It did not.

Oil trades barrels. The curve rejected duration assumptions.

Global Power Behavior Under Economic Constraint

Geopolitical responses from major global actors must be interpreted through the same lens as market pricing: incentives, constraints, and cost.

China and other systemically important economies remain economically interdependent with the United States. U.S. end-demand, dollar-based settlement, and global trade infrastructure continue to anchor their growth models. That dependence has not materially changed.

Public opposition to U.S. actions serves a signaling function. It reinforces principles of sovereignty and non-interference that are relevant to domestic legitimacy and future bargaining posture. It does not imply a willingness to absorb economic disruption through trade, capital, or energy channels.

Markets distinguish between signaling and follow-through.

Just as oil curves separate shock from duration, capital markets separate rhetoric from economic action. Political visibility increases. Structural incentives constrain behavior.

Why Global Signaling Does Not Translate Into Duration Risk

Escalation that disrupts energy flows, trade, or settlement systems imposes immediate economic cost on all participants, including those issuing the strongest rhetoric. As a result, geopolitical responses are typically calibrated to preserve economic function while signaling opposition.

This produces a consistent pattern:

- Political language escalates

- Economic behavior remains constrained

- Markets price event risk, not structural rupture

Oil markets internalize this logic rapidly. Front-end volatility reflects uncertainty. Long-dated pricing reflects skepticism about persistence.

The forward curve processes constraints faster than narratives do.

The VMSI Interpretation

The VMSI is designed to measure how capital prices risk over time — not sentiment in isolation.

Containment regimes are characterized by:

- Recurrent event-driven volatility

- Limited willingness to price long-duration disruption

- Structural systems that remain operational despite elevated uncertainty

The oil curve behavior observed here aligns directly with this framework. The Venezuela event increased near-term uncertainty without altering long-horizon expectations.

Within VMSI, this configuration signals event risk, not regime risk.

Allocator Implication

This is not an oil call. It is a response framework.

When front-end prices reprice without back-end confirmation:

- Risk has already been priced

- Duration assumptions are likely overstated

- Volatility is more likely to compress than compound

Allocators should not anchor on spot moves or headlines. They should observe whether structure confirms persistence.

If structure does not follow, narratives will fade.

Conditions for Reassessment

This framework would require reassessment only under observable structural change:

- Sustained physical disruption to production or transport

- Coordinated supply withdrawal that removes spare capacity

- Persistent inventory drawdowns inconsistent with seasonality

- Back-end repricing that confirms duration

Absent these conditions, market behavior remains consistent with containment.

Conclusion

Venezuela reinforces a pattern markets repeatedly misjudge. Headlines arrive instantly. Risk premia follow. Duration is assumed rather than earned.

Oil markets provide a corrective mechanism. When long-dated pricing remains anchored, the market is signaling skepticism about persistence.

Within the VMSI framework, this is not instability. It is containment.

For allocators, the discipline is not speed. It is recognizing when risk has already been priced — and when duration has not been confirmed.

Headlines fade. Risk premia follow.

Source: VICA Partners Research © VICA Research — Proprietary Market Intelligence

Disclaimer: This commentary is for informational purposes only and does not constitute investment advice; views reflect market-structure analysis as of publication and should not be relied upon for individual investment decisions.