“Empowering Your Financial Success”

Daily Market Insights: September 21st, 2023

Global Markets Summary:

Asian Markets:

- China’s Shanghai Composite: -0.77%

- Hong Kong’s Hang Seng: -1.29%

- Japan’s Nikkei 225: -1.37%

US Futures:

- S&P Futures: opened @4,452.81 (-0.63%)

European Markets:

- London’s FTSE 100: -0.66%

- Germany’s DAX: -1.33%

- France’s CAC 40: -1.59%

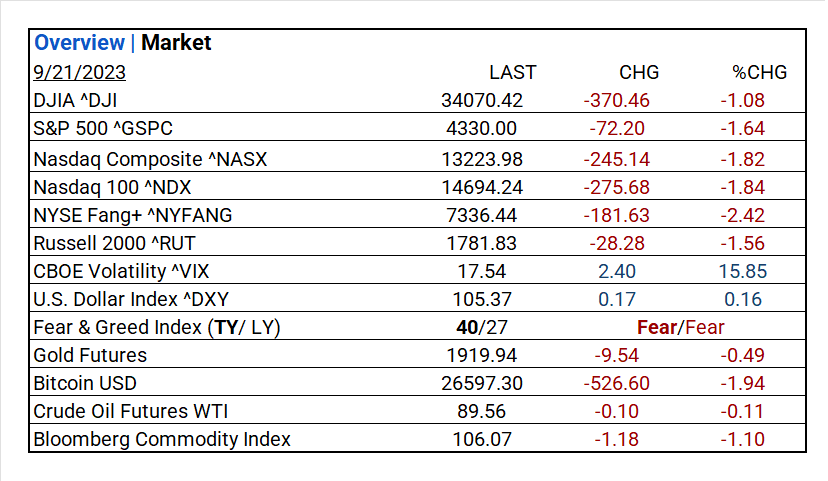

US Market Snapshot:

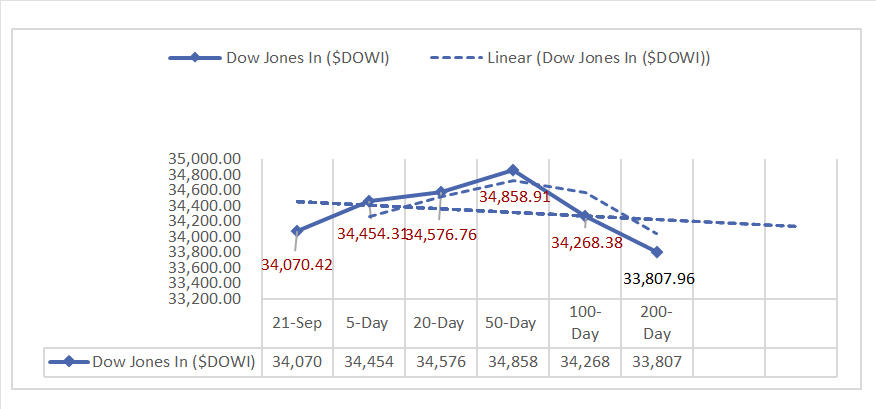

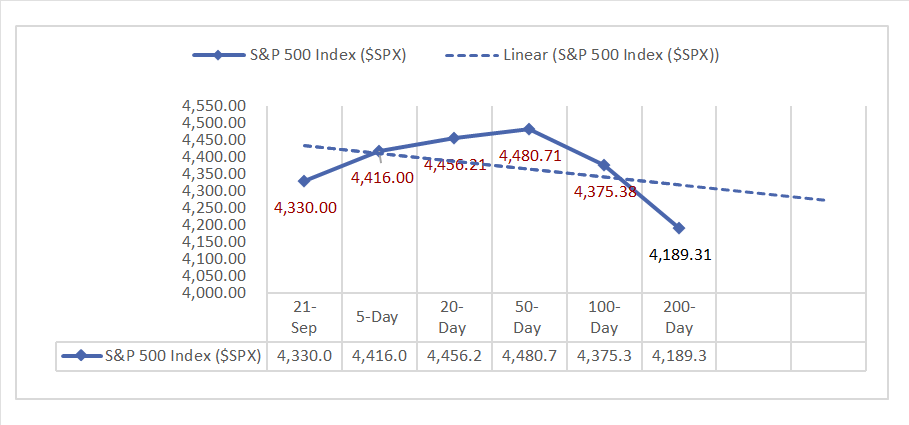

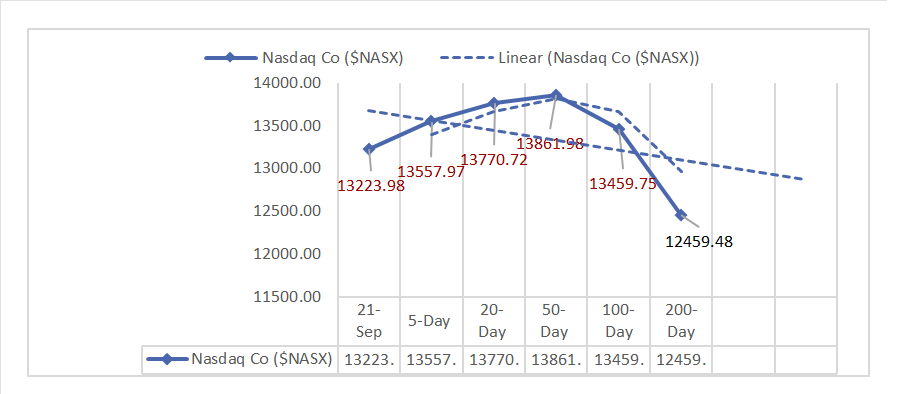

Key Stock Market Indices:

- DJIA ^DJI: 34070.42 (-370.46, -1.08%)

- S&P 500 ^GSPC: 4330.00 (-72.20, -1.64%)

- Nasdaq Composite ^NASX: 13223.98 (-245.14, -1.82%)

- Nasdaq 100 ^NDX: 14694.24 (-275.68, -1.84%)

- NYSE Fang+ ^NYFANG: 7336.44 (-181.63, -2.42%)

- Russell 2000 ^RUT: 1781.83 (-28.28, -1.56%)

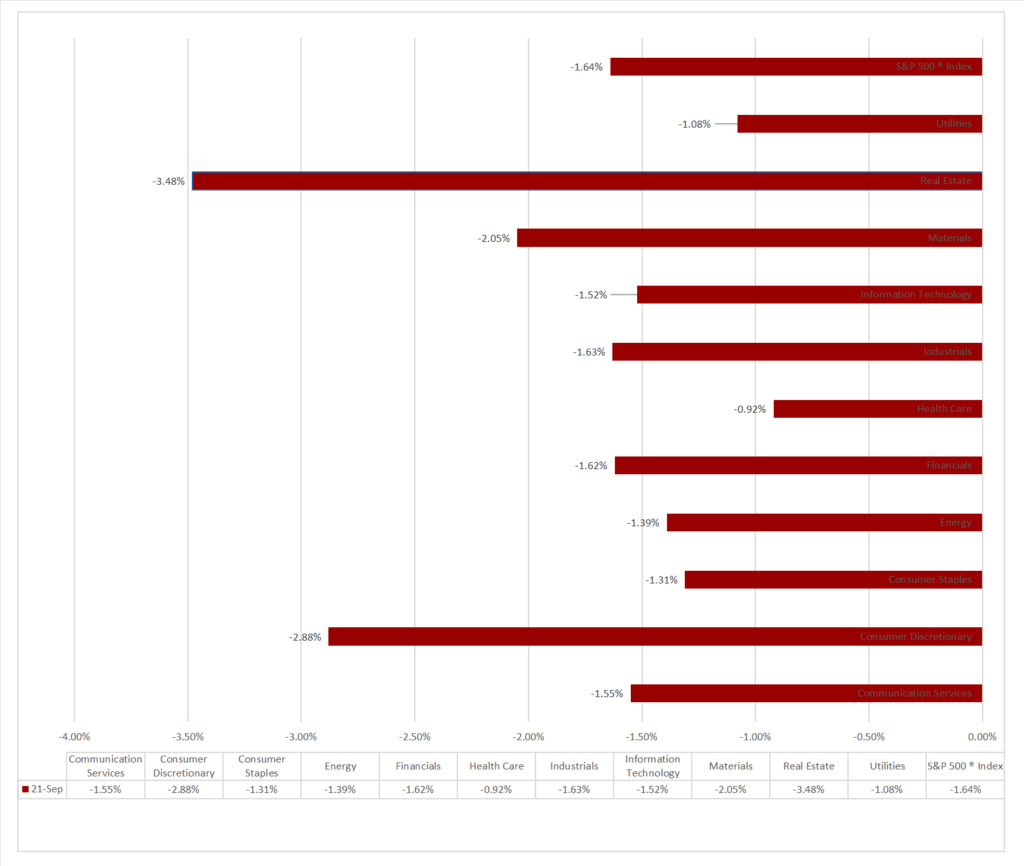

Market Insights: Performance, Sectors, and Trends:

- Economic data: Initial Claims beating expectations, Continuing Claims decreasing, and the Philly Fed Index dropping.

- Major indices dropped, including DJIA, S&P 500, Nasdaq, Nasdaq 100, NYSE Fang+, Russell 2000.

- All 11 sectors fell, with Health Care outperforming and Real Estate lagging. Notable industry performance in Health Care Providers & Services, Media, and Air Freight & Logistics.

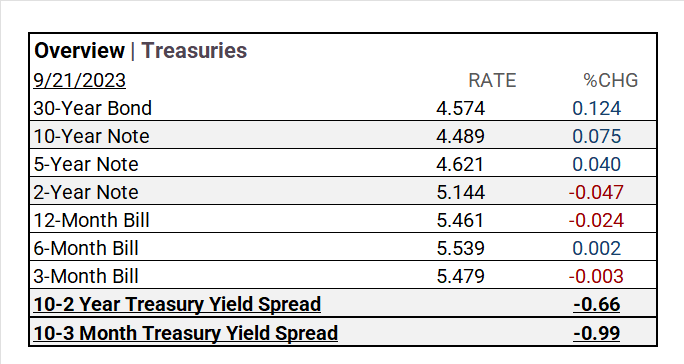

- Treasury rates fluctuated, with the 30-Year Bond and 10-Year Note rising while the 2-Year Note fell.

- U.S. Dollar Index increased, CBOE Volatility spiked, and the Fear & Greed Index indicated fear.

- Commodity markets saw declines in Gold Futures, Bitcoin USD, Crude Oil Futures WTI, and the Bloomberg Commodity Index.

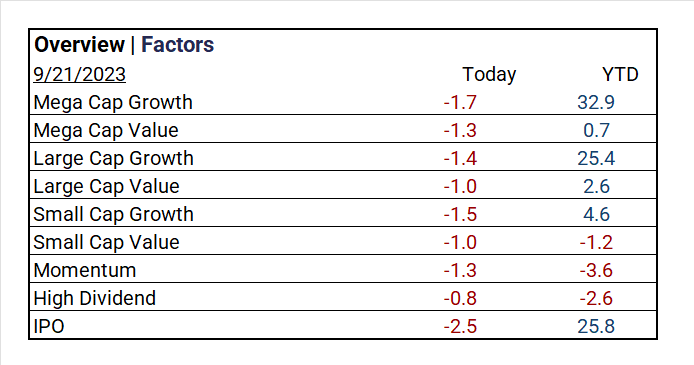

- Factors showed Mega Cap Growth and IPO underperforming, while High Dividend performed better.

- Top-performing ETFs were ProShares Ultra VIX Short Term Futures ETF ^UVXY and ProShares UltraPro Short QQQ ^SQQQ.

- Worst-performing ETFs were ProShares UltraPro Short QQQ ^SQQQ, KraneShares CSI China ETF ^KWEB, and INVESCO QQQ Trust ^QQQ.

Treasury Yields and Currency:

- In Treasury markets, 30-Year Bond and 10-Year Note rose, but 2-Year Note fell. Yield spreads were mixed.

- The U.S. Dollar Index ^DXY: 105.37 (+0.17, +0.16%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 17.54 (+2.40, +15.85%)

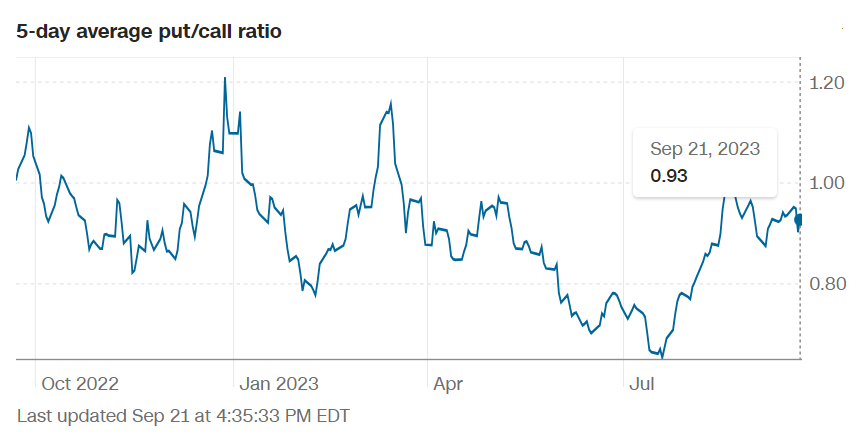

- Fear & Greed Index: 40/27 (TY/LY) – Indicates Fear, 5-Day Average Put/Call Ratio: 0.93 (Bearish)

source: cnn fear-and-greed index

Commodities:

- Gold Futures: 1919.94 (-9.54, -0.49%)

- Bitcoin USD: 26597.30 (-526.60, -1.94%)

- Crude Oil Futures WTI: 89.56 (-0.10, -0.11%)

- Bloomberg Commodity Index: 106.07 (-1.18, -1.10%)

Factors:

- Mega Cap Growth (-1.7%) and IPO (-2.5%) experienced the poorest performance, while High Dividend (-0.8%) had the best showing.

ETF Performance:

Top Performers:

- ProShares Ultra VIX Short Term Futures ETF ^UVXY: +11.91%

- ProShares UltraPro Short QQQ ^SQQQ: +5.79%

Worst Performers:

- ProShares UltraPro Short QQQ ^SQQQ: -5.70%

- KraneShares CSI China ETF ^KWEB: -2.07%

- INVESCO QQQ Trust ^QQQ: -1.83%

US Economic Data

- Initial Claims: 201k (vs. 225k consensus, prior 220k)

- Continuing Claims: 1.662 million (vs. 1.692 million consensus, prior 1.688 million)

- Philly Fed: -13.5 (vs. -1 consensus, prior 12)

- Existing Home Sales: 4.04 million (vs. 4.1 million consensus, prior 4.07 million)

- Leading Indicators: -0.4% (vs. -0.4% consensus, prior -0.3%)

Earnings:

Q1 Insights:

- Q1 ’23: 79% of companies beat analyst estimates.

Q2 Insights:

- Q2 Forecast: Predicted decline of <7.2%> in S&P 500 EPS , Fiscal year 2023 EPS remained flat YoY.

Notable Earnings Today:

- Beat: Darden Restaurants (DRI),

- Miss: FactSet Research (FDS)

Resources:

News

Investment and Growth News

- Cisco to Buy Cybersecurity Company Splunk in $28 Billion Cash Deal – WSJ

- Intel sees massive demand for AI chips designed for China amid LLM boom and US export curbs, report says – SCMP

- Blackstone, Permira Explore Bid for eBay-Backed Adevinta – Bloomberg

Infrastructure and Energy

- The Hidden Threat to US Energy Security – Bloomberg

- Ex-Goldman Bankers Make a Fortune With Controversial Bet on Coal – Bloomberg

Real Estate Market Updates

- Flood-Insurance Program Faces a Backlash—and a Deadline – WSJ

Central Banking and Monetary Policy

- August Home Sales Declined to Slowest Pace Since January – WSJ

- Fed Signals Higher-for-Longer Rates With Hikes Almost Finished – Bloomberg

- Oil Nearing $100 Is Red Flag for Central Banks’ Inflation Fight – Bloomberg

International Market Analysis (China)