Stay Informed and Stay Ahead: Report Series, June 7th, 2024

U.S. Economic Reports Series: Jobs Employment Report

Key Highlights

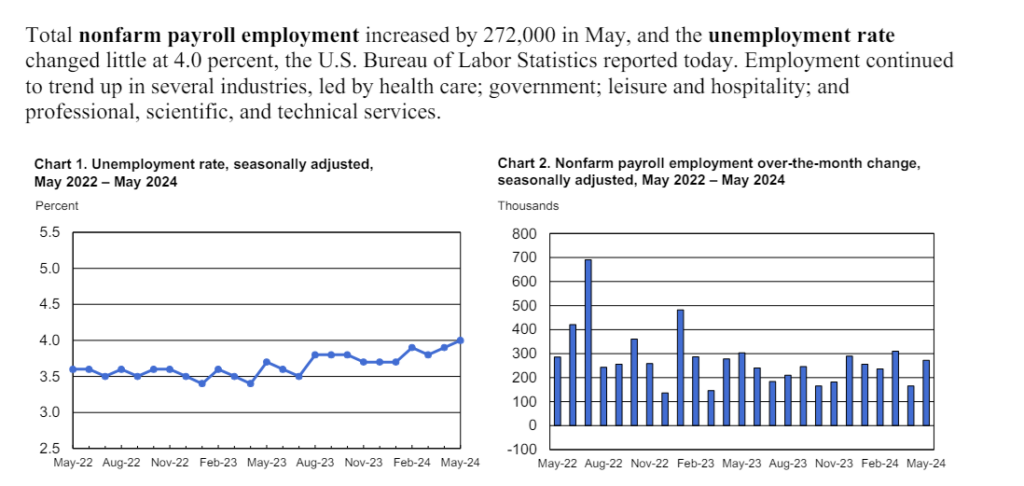

- Job Growth Exceeds Expectations: Employers added 272,000 jobs, surpassing the forecast of 182,000.

- Unemployment Rate Rises: Unemployment increased to 4%, the highest in over two years.

- Market Reaction: S&P 500 futures initially dropped but rebounded as investors considered the potential for Fed rate cuts.

Jobs Report Breakdown

The 6/07/24 jobs report shows strong job market growth in both private and public sectors.

Private Sector: Added 229,000 jobs, beating the forecast of 168,000.

- Health Care and Social Assistance: +83,500 jobs. Driven by demand from an aging population and expanded mental health, home care, and outpatient services.

- Retail: +12,600 jobs. Higher consumer confidence and spending, plus retailers expanding online, increased logistics, and customer service jobs.

- Transportation and Warehousing: +10,600 jobs. Growth in e-commerce and enhanced post-pandemic supply chain capabilities.

- Government: Added 43,000 jobs.

- Drivers: Increased funding for public infrastructure, education, and public safety services.

Notable Movers:

- Construction: +21,000 jobs. Boosted by infrastructure investments and housing demand.

- Manufacturing: +8,000 jobs. Reshoring efforts and advanced manufacturing technologies.

- Temporary Help: -14,100 jobs. Shift towards permanent roles as the labor market stabilizes.

Wage Insights and Household Survey

- Average Hourly Earnings: Increased by 0.4% in May, with a 12-month growth rate of 4.1%, surpassing the 3.9% forecast.

- Unemployment Rate: Rose to 4%, with 408,000 fewer employed and 157,000 more unemployed.

- Labor Market Participation: Showed variability, indicating potential economic shifts.

Market Implications

- Fed Rate Cut Odds: Reduced expectations for a rate cut by September (56%, down from 67%). Odds for two quarter-point cuts decreased to 51% from 66%

- Conflicting Data: Strong establishment survey vs. weak household survey results. Payroll tax data suggests strong employer data accuracy.

Conclusion

June 2024’s job growth exceeded expectations with 272,000 jobs added, underscoring a robust economy bolstered by strong consumer spending, business investments, and seasonal hiring in retail and construction. Significant contributions from the health care, retail, and construction sectors were key drivers, influenced by factors such as an aging population, e-commerce expansion, and infrastructure investments. The decline in temporary help jobs indicates a shift towards stable, permanent employment, reflecting long-term economic confidence.

Market Impact on Friday 6-07

- Bullish for USD: Higher-than-expected job growth suggests a stronger economy, potentially leading to higher interest rates.

- Market Pressure: Despite positive job numbers, concerns about growth and Fed rate cuts could add market pressure.

Value of the National Employment Report

- Timeliness: Monthly release by the BLS provides prompt employment trend insights.

- Market Indicator: Significantly influences financial markets, predicting economic trends, and impacting stock markets, bond yields, and forex rates.

- Coverage: Includes data from both the establishment and household surveys, covering payroll employment and labor force status, including unemployment rates.

Employment Report Data Sets

- Industry Breakdown: Reflects employment changes across sectors, indicating demand for goods, services, and economic activity.

Criticisms

- Accuracy and Reliability: Discrepancies compared to other reports like the ADP National Employment Report.

- Predictive Value: Not always a reliable predictor of future economic conditions due to data volatility and revisions.

- Revisions and Adjustments: Frequent revisions can cause market confusion.

- Sectoral Breakdown: While detailed, it may be less comprehensive than other data sources.

Exploring Market Insights with Options

- Volatility Adjustments: Jobs report releases often lead to increased market volatility.

- Interest Rate Expectations: Shapes expectations about future Federal Reserve actions.

- Market Sentiment: Positive employment data can boost investor confidence and bullish sentiment.

- Sector-Specific Impacts: Different sectors respond uniquely to the Jobs Report.

- Hedging Strategies: Institutional investors use options to hedge against market movements influenced by significant employment shifts.

Understanding the Jobs Report helps traders and investors anticipate market reactions and adjust strategies, leveraging report insights for informed decisions.