MARKETS TODAY July 27th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished mixed, Hong Kong’s Hang Seng gained 1.41%, Japan’s Nikkei 225 rose 0.68%. China’s Shanghai Composite off 0.20%

European markets finished higher, France’s CAC 40 up 2.05%, Germany’s DAX up 1.70% London’s FTSE 100 up 0.21%. S&P futures opened trading at 0.69% above fair value.

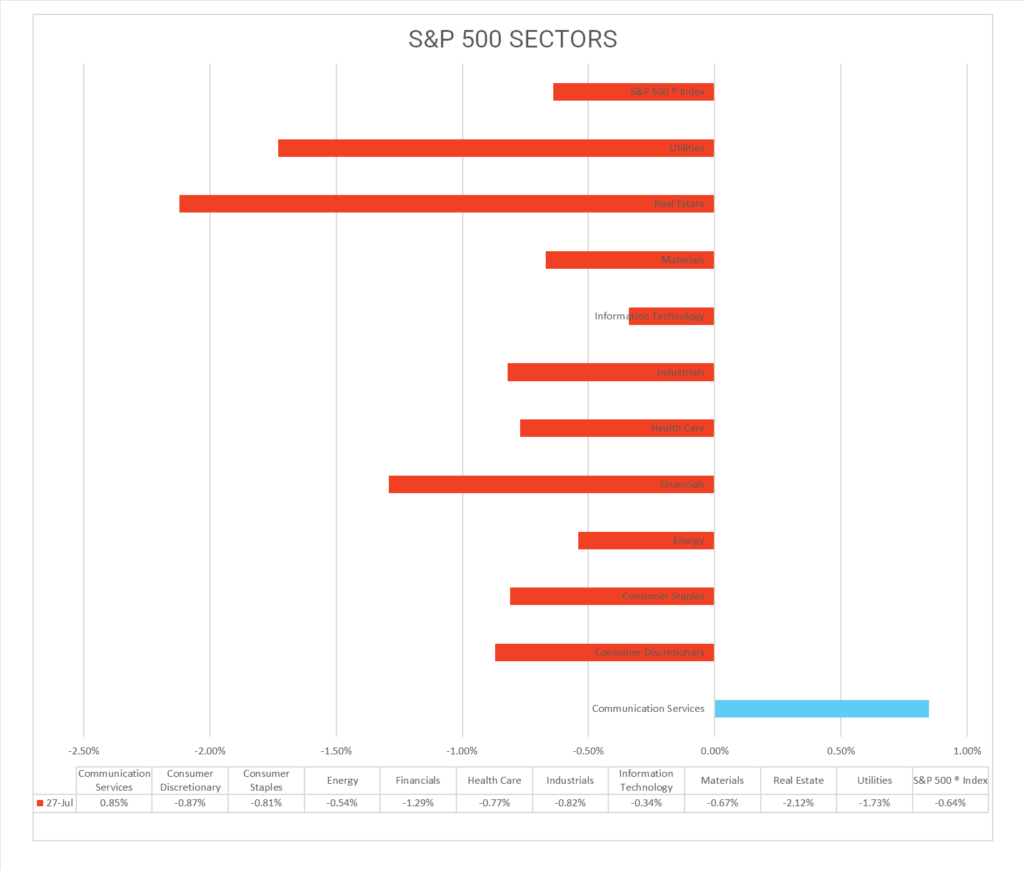

Today US Markets finished lower, the DOW down 0.67% the S&P 500 down 0.64% while the NASDAQ lost 0.55%. 10 of 11 S&P 500 sectors declining: Communication Services +0.85% outperforms/ Real Estate -2.12% lags. On the upside, Treasuries, Semiconductor ETF ^SOXX, Sector Subs, Media, Biotechnology, Building Products, Mega Cap Growth, USD Index, Oil.

In US economic news, Initial and continuing claims came in below estimates, Q2 GDP came in well ahead of expectations. PCE and core fell sharply from last quarter. Durable goods were well ahead of estimates and ex-transports tripled estimates. Capital goods orders, a proxy for business spending, increased verse negative estimates.

Takeaways

- Economic data far better than consensus

- Market gave back early session gains especially Tech

- 10 of 11 S&P 500 sectors declining: Communication Services +0.85% outperforms/ Real Estate -2.12% lags

- Sector Subs/ Media+3.84%, Biotechnology +1.60%, Building Products +1.60%, Semiconductor & Semiconductor Equipment +1.51%,

- iShares Semiconductor ETF ^SOXX +1.88%

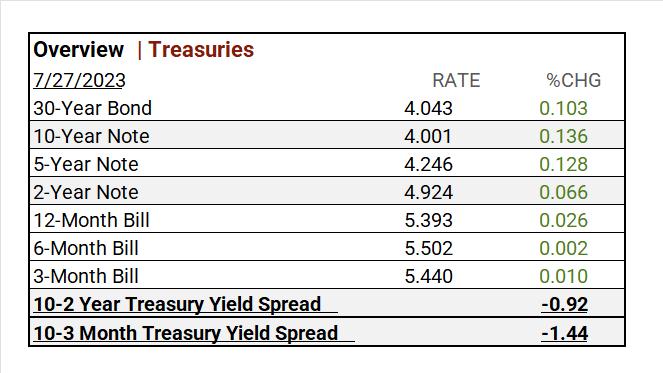

- Treasury Yields rise across the curve

- USD Index up

- Oil gains

- Mastercard (MA), McDonald’s (MCD), Comcast (CMCSA) w/ solid earnings beats

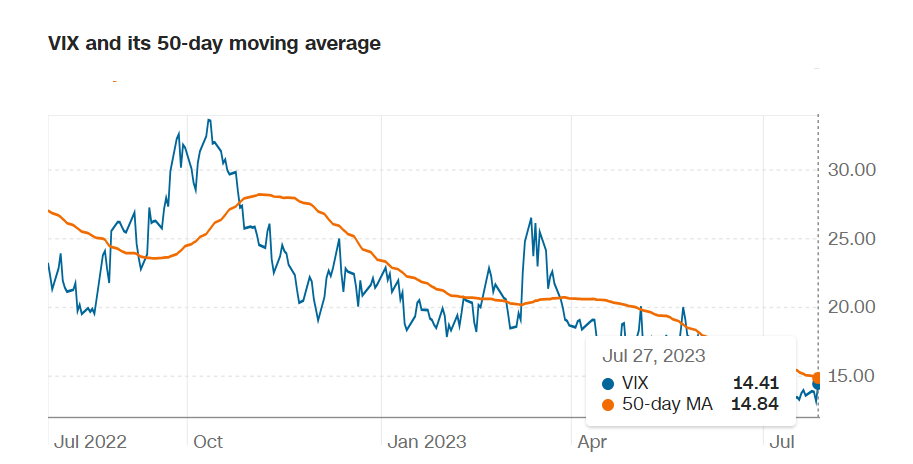

Pro Tip: The VIX measures expected price fluctuations or volatility in the S&P 500 Index options over the next 30 days. The key is to look at the VIX over time. It’s lower in bull, opportune markets.

Sectors/ Commodities/ Treasuries

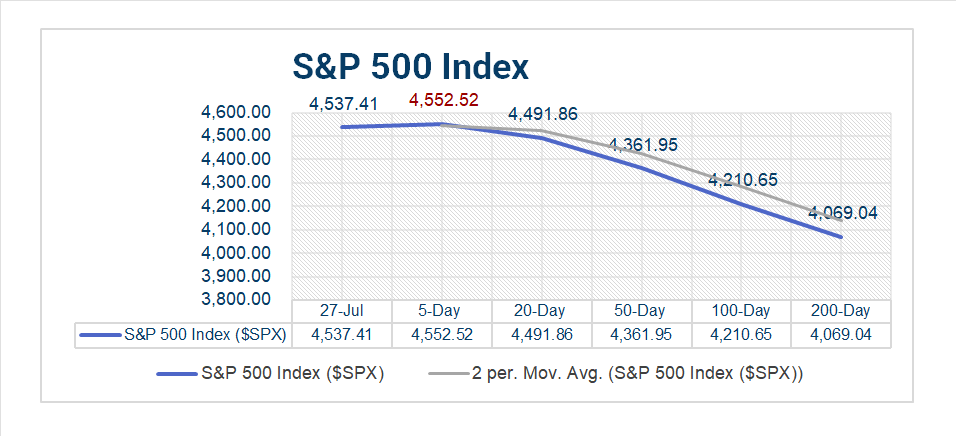

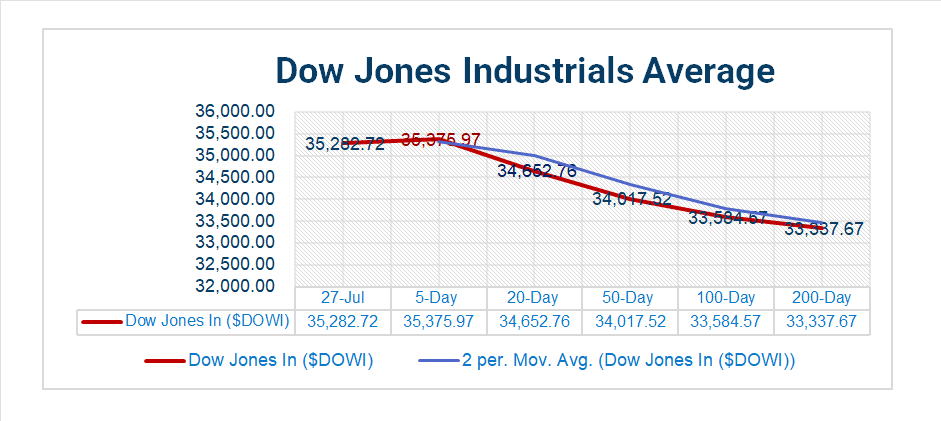

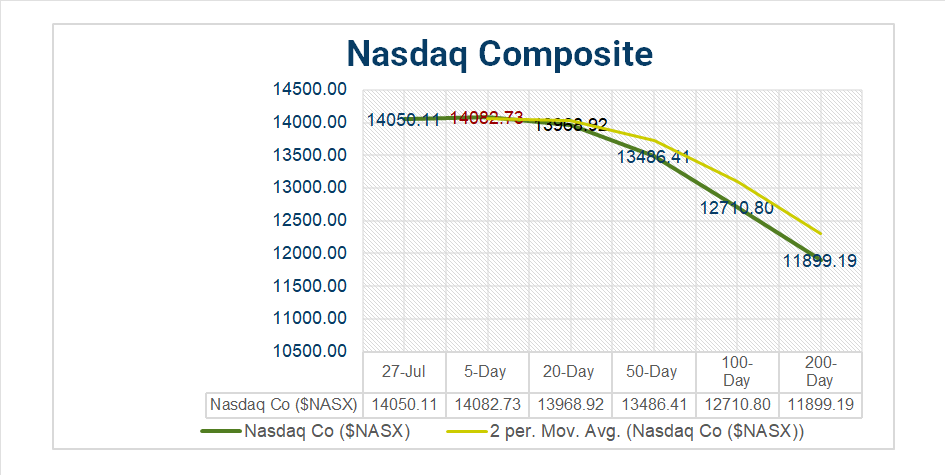

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 10 of 11 S&P 500 sectors declining: Communication Services +0.85% outperforms/ Real Estate -2.12% lags.

- Media +3.84%, Biotechnology +1.60%, Building Products +1.60%, Semiconductor & Semiconductor Equipment +1.51%, Interactive Media & Services +1.46%

- MTD Leaders: Energy +10.70%, Financials +8.55%, Real Estate +8.07%

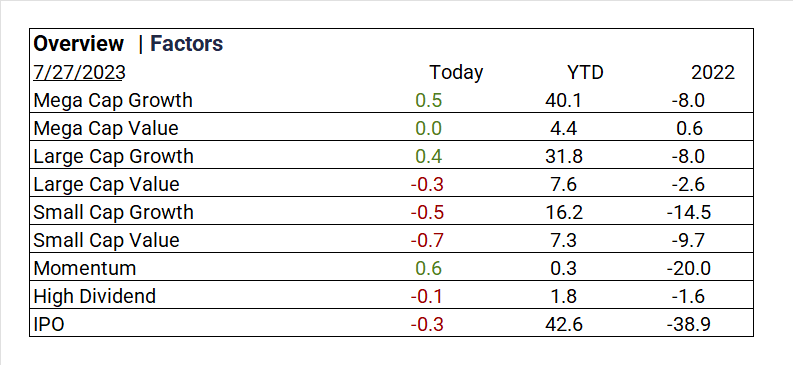

Factors

US Treasuries

Q2 ’23 Top Line Earnings Preview

- In Q1 ’23: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 S&P 500 EPS expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

- Expect lower Q1 revenues

- Call topics: economic uncertainty, aggregate demand, inventories, costs, roi

This Week ending 7/28

- >17% of S&P 500 names have reported, 40% more will release earnings this week.

- To date BIG picture, credit resilience, deposit stabilization, travel demand

- Technology sector, mega caps reporting META, MSFT, GOOGL

Notable Earnings Today

- +Beat: Mastercard (MA), AbbVie (ABBV), McDonald’s (MCD), Comcast (CMCSA), American Tower (AMT), BNP Paribas ADR (BNPQY), Boston Scientific (BSX), HCA (HCA), Northrop Grumman (NOC), Takeda Pharma ADR (TAK), Keurig Dr Pepper (KDP), Carrier Global (CARR), Cenovus Energy Inc (CVE), Royal Caribbean Cruises (RCL), DTE Energy (DTE), Westinghouse Air Brake (WAB)

- – Miss: Roche Holding ADR (RHHBY), Shell ADR (SHEL), Linde PLC (LIN), TotalEnergies SE ADR (TTE), Honeywell (HON), Bristol-Myers Squibb (BMY), Air Liquide ADR (AIQUY), Mercedes Benz Group (MBGAF), Volkswagen 1/10 ADR (VWAGY), Iberdrola SA (IBDRY), Norfolk Southern (NSC), Hershey Co (HSY), STMicroelectronics ADR (STM), Valero Energy (VLO), WW Grainger (GWW), PG E (PCG), Barclays ADR (BCS), Baxter (BAX)

Economic Data

US

- Initial jobless claims: period July 22, act 221,000, fc 235,000, prior 228,000

- Durable goods orders: period June, act 4.7%. fc 1.5%, prior 2.0%

- Durable goods minus transportation: period June, act 0.6%, prior 0.7%

- GDP (advanced report): period Q2, act 2.4%, fc 2.0%. prior 2.0%

- Advanced U.S. trade balance in goods: period June, act -$87.8B, prior $-91.9B

- Advanced retail inventories: period June, act 0.7%, prior 0.8%

- Advanced wholesale inventories: period June, act -0.3%. prior 0.0%

- Pending home sales: period June, act 0.3%, fc -0.5%, prior -2.7%

Vica Partner Guidance July ’23, (updated 7-20)

- Q3/4 highlighting Energy Equipment & Services, Banks, Passenger Airlines, Metals & Mining. Real Estate Management & Development, Specialized REITs. Defensives Health Care Providers & Services and Gas Utilities also have upside. Undervaluation for Chinese Mega Cap Tech. Japan equities still a better value than US.

- Cautionary, current valuations in question as Mega and Large Cap Growth moderating, Banks shortly may be overpricing. Current indicators are recessionary. Credit default swap (CDS) to pick-up through Q4/Q1.

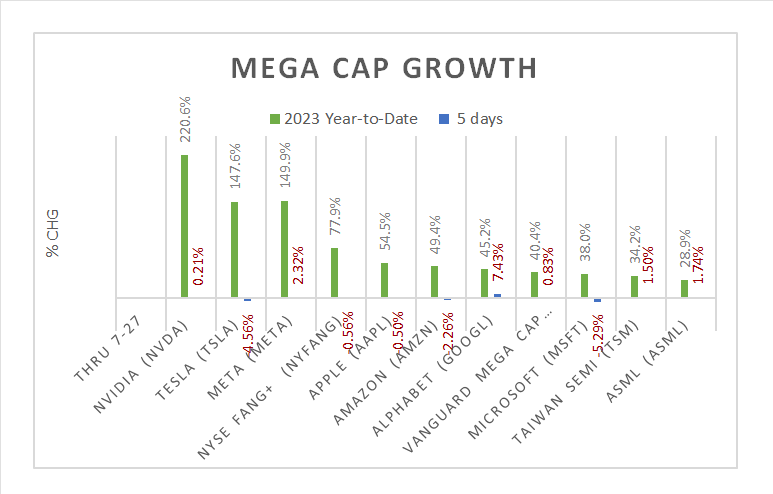

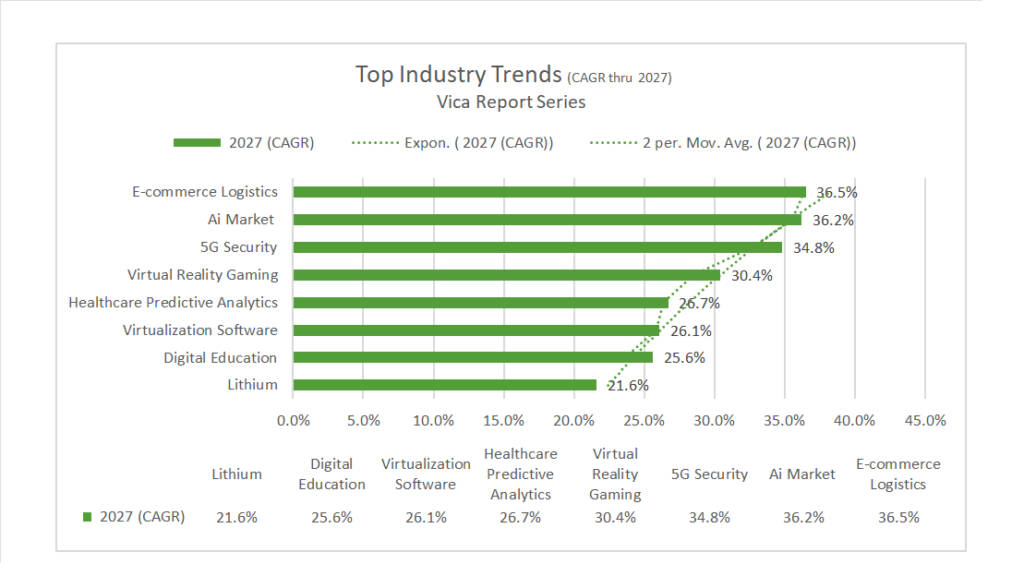

- Longer Term, NASDAQ 100^NDX/FANG+ ^NYFANG companies will continue to outperform “BIG allows you to invest at scale”. TOP Sector outperform includes AI and Semiconductor Equipment. Forward looking CAGR growth below.

- We continue to emphasize business *quality and strength of balance sheet for all investments. * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom (AVGO).

News

Company News/ Other

- US Rail Profits Pinched by Rising Labor Costs, Declining Cargo – Bloomberg

- Why Elon Musk’s Plan for a Super App Won’t Be Easy in America – WSJ

- SoftBank-Backed Delivery App Rappi to Offer Loans to Restaurants – Bloomberg

- Airlines Adjust to the New Reality of Business Travel: It’s Not Coming Back – WSJ

Energy/ Materials

- Supreme Court Lets Work Resume on Gas Pipeline Backed by Manchin – Bloomberg

- Why Chile’s New Approach to Lithium Matters Globally – Bloomberg

Central Banks/Inflation/Labor Market

- US. Economic Growth Accelerates, Defying Slowdown Expectations – WSJ

- Bank of Japan Move Could Fuel U.S. Bond Rout – WSJ

Asia/ China

- Hong Kong’s banks raise rates as funding cost soars to 16-year high – South China Morning Post

- China’s smartphone market narrows decline in second quarter, with Huawei back in the country’s top 5 vendor ranking – South China Morning Post