MARKETS TODAY June 1st, 2023 (Vica Partners)

Yesterday, US Markets finished lower, S&P 500 -0.61%, DOW -0.41% and the Nasdaq -0.63%. 7 of 11 of the S&P 500 sectors lower: Energy -1.88% underperformed/ Utilities +0.96% outperformed. Defensive Sectors and Gold gained. In economic news, Chicago PMI fell more than expected but JOLTS job openings unexpectedly beat estimates.

Overnight/US Premarket, Asian markets finished mixed, Japan’s Nikkei 225 +0.84%, Hong Kong’s Hang Seng -0.10% and China’s Shanghai Composite unchanged. US S&P futures were trading at 0.4% above fair value. European markets finished higher, Germany’s DAX +1.21%, London’s FTSE 100 +0.59% and France’s CAC 40 +0.55%.

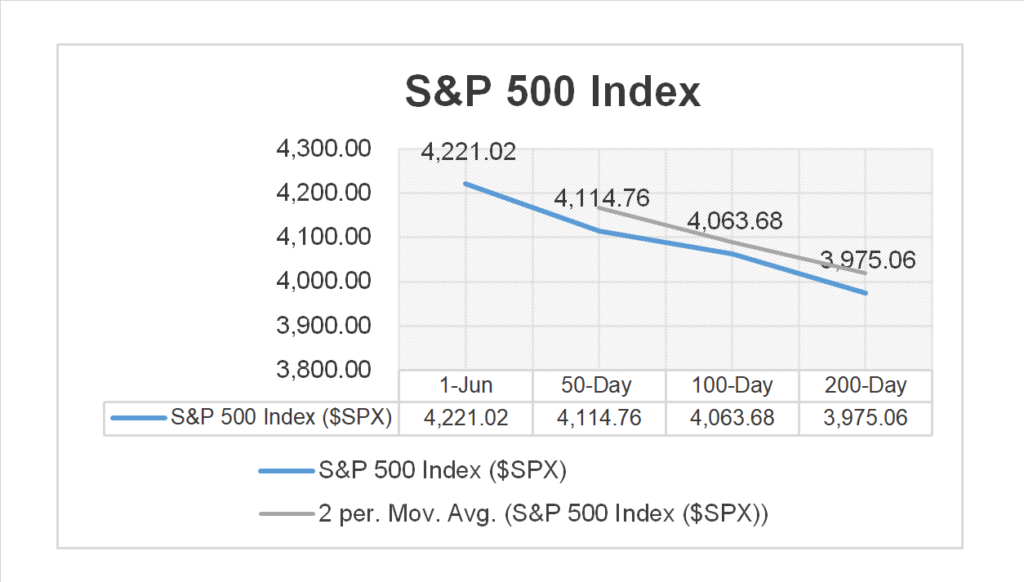

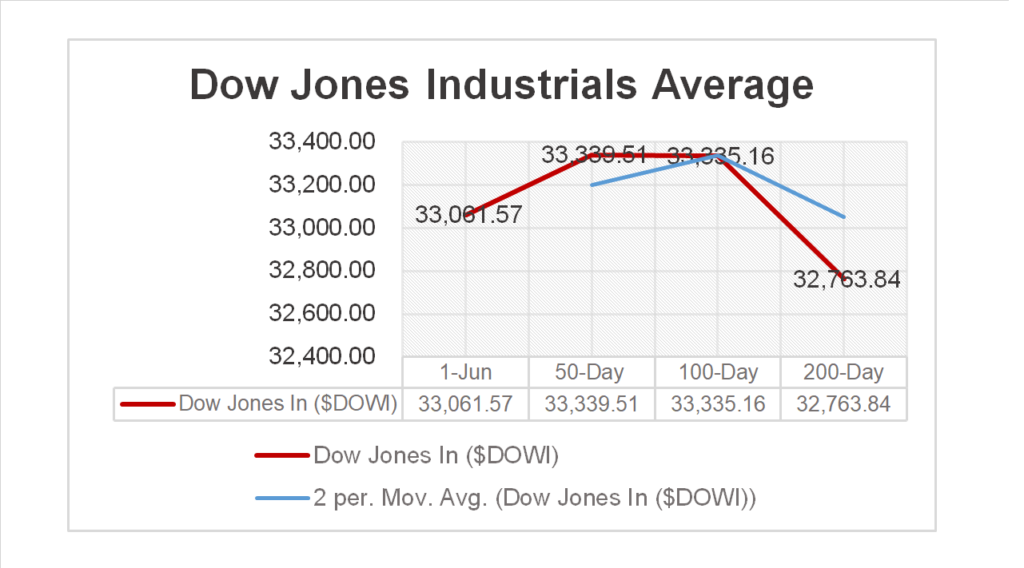

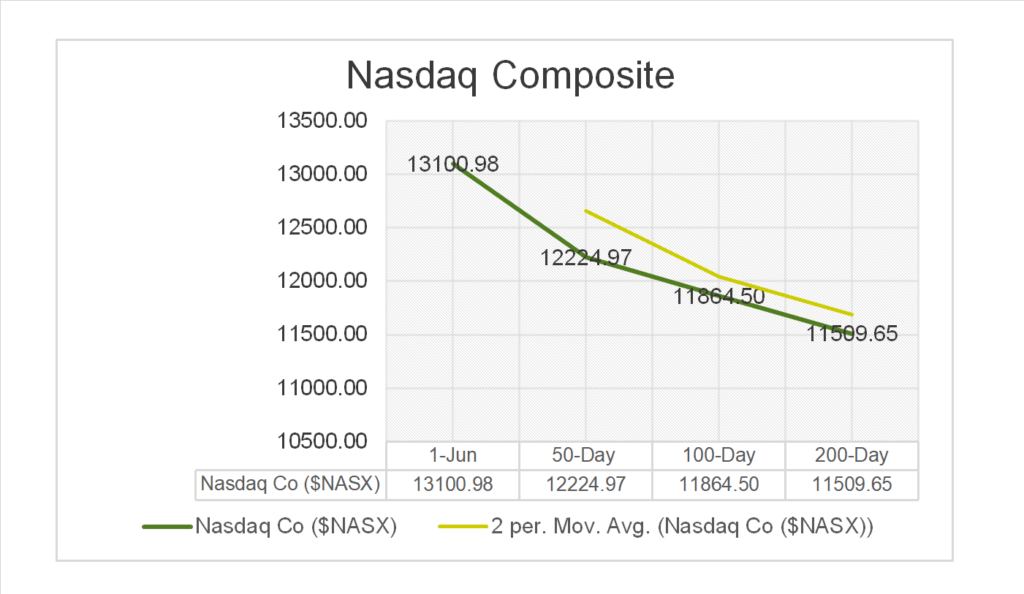

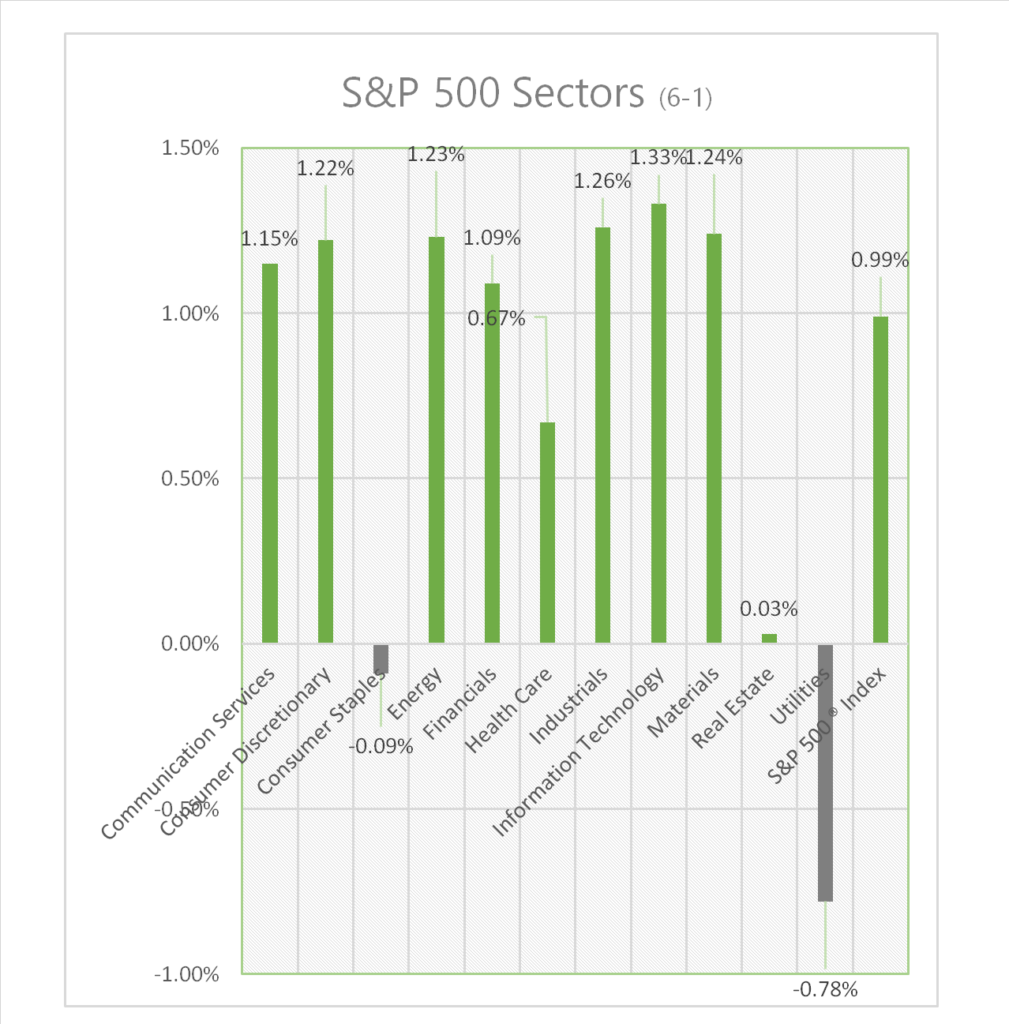

Today US Markets finished higher, S&P 500 +0.99%, DOW +0.47% and the Nasdaq +1.28%. 9 of 11 of the S&P 500 sectors higher: Information Technology +1.33% outperforms/ Utilities -0.78% lags. On the upside, NY FANG+, Gold, Oil and the Bloomberg Commodity Index. In economic news, the ADP job survey well ahead of estimates, claims data was in line with estimates, Manufacturing PMI and ISM manufacturing survey were just below estimates.

Takeaways

- ADP jobs survey strong, economic data today “kindly” revealed wages slowing

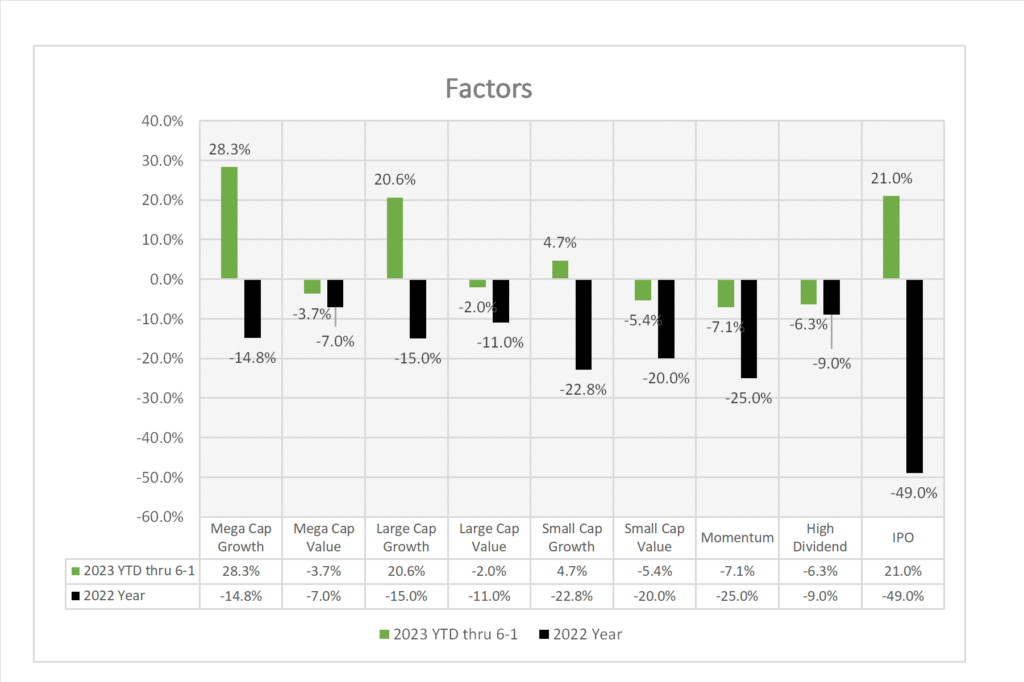

- Investors moving money from value stocks into AI at record pace

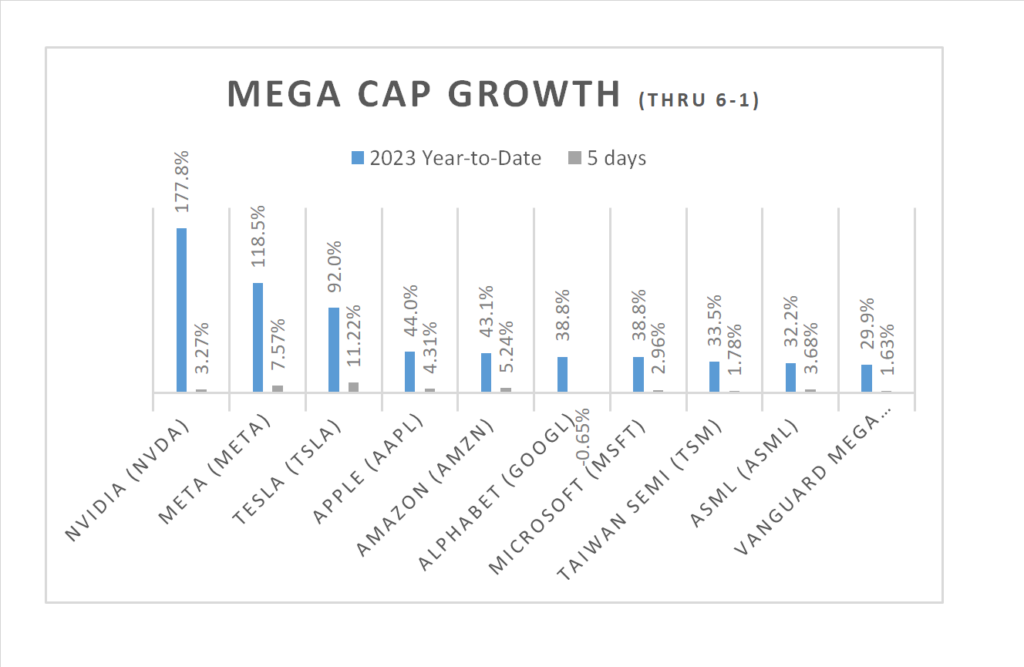

- NYFANG+ up >2% mega cap tech continues higher

- 9 of 11 of the S&P 500 sectors higher: Information Technology +1.33% outperforms/ Utilities -0.78% lags

- SPDR S&P Banking ETF (KRE) +>2%

- iShares Semiconductor ETF (SOXX) +1.7%

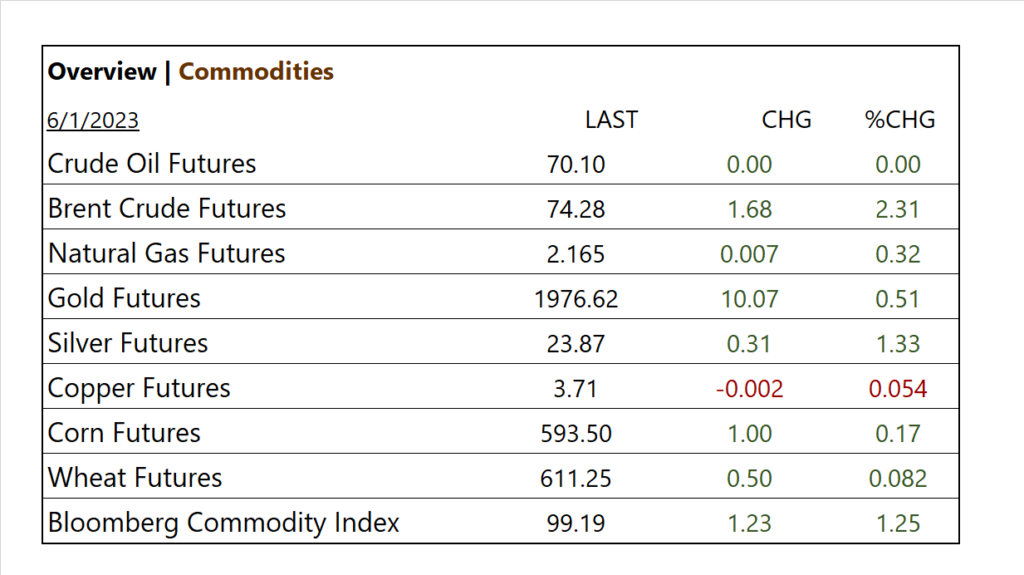

- Commodities rise

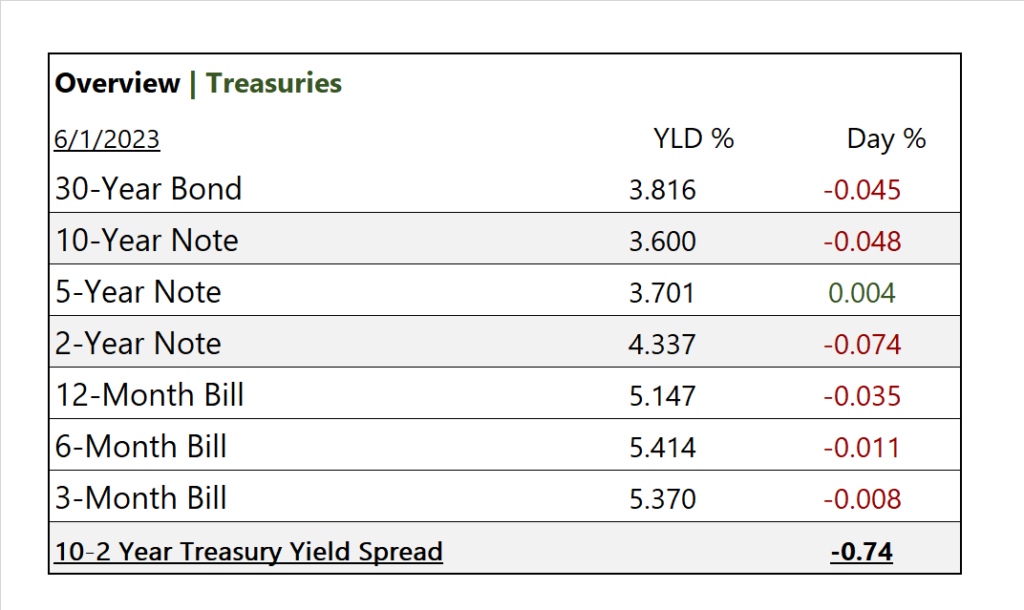

- Yields decline

- Broadcom (AVGO) and Lululemon Athletica (LULU) earning beats

- Probability of a June Fed hike <20%

Pro Tip: The first trading day of the month effect yields significantly better returns than any other day of the month.

Back to the market headline story …

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 9 of 11 of the S&P 500 sectors higher: Information Technology +1.33%, Industrials +1.26% outperform/ Utilities -0.78% underperforms.

Commodities

Factors (YTD)

US Treasuries

Notable Earnings Today

- +Beat: Broadcom (AVGO), Lululemon Athletica (LULU), Dell Tech (DELL), MongoDB (MDB), Zscaler (ZS), Cooper (COO), Samsara (IOT), Asana (ASAN)

- – Miss: VMware (VMW), Dollar General (DG), Hormel Foods (HRL), Five Below (FIVE), Guidewire (GWRE), Macy’s Inc (M)

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), UI Path (PATH)

Economic Data

US

- ADP employment; period May, act 278,000, fc 180,000, prev. 291,000

- Initial jobless claims; act 232,000, fc 235,000, prev. 230,000

- US. productivity; period Q1 (rev.), act -2.1%, fc -2.7%, prev. -2.7%

- S&P U.S. manufacturing PMI; period May, act 48.4, fc 48.5. prev. 48.5

- ISM manufacturing; period May, act 46.9%, fc 47.0%, prev. 47.1%

- Construction spending; period April, act 1.2%, fc 0.1%, prev. 0.3%

News

Company News

- Broadcom forecasts third-quarter revenue above estimates – Reuters

- Nvidia CEO feels safe relying on Taiwan for chips – Reuters

- Investors Are Dumping Value Funds to Shovel Money Into AI Bets – Bloomberg

- Business Is Slowing. So Companies Are Juicing Profits. – WSJ

Energy/ Materials

- Move Over, Scotland. U.S. Oil Enters World’s Most Important Benchmark. – WSJ

Central Banks/Inflation/Labor Market

- A Debt-Ceiling Deal That Doesn’t Deal With Debt – WSJ

- US Senate set to pass debt limit suspension bill Thursday night – Reuters

China

- Elon Musk’s Warm Welcome in China Reflects Tesla’s Role in Building Top EV Market – WSJ

- Investors Zero In on China Local Debt Blowup as Top Risk in Asia – Bloomberg