Stay Informed and Stay Ahead: Market Watch, September 19th, 2024.

ECONOMICS

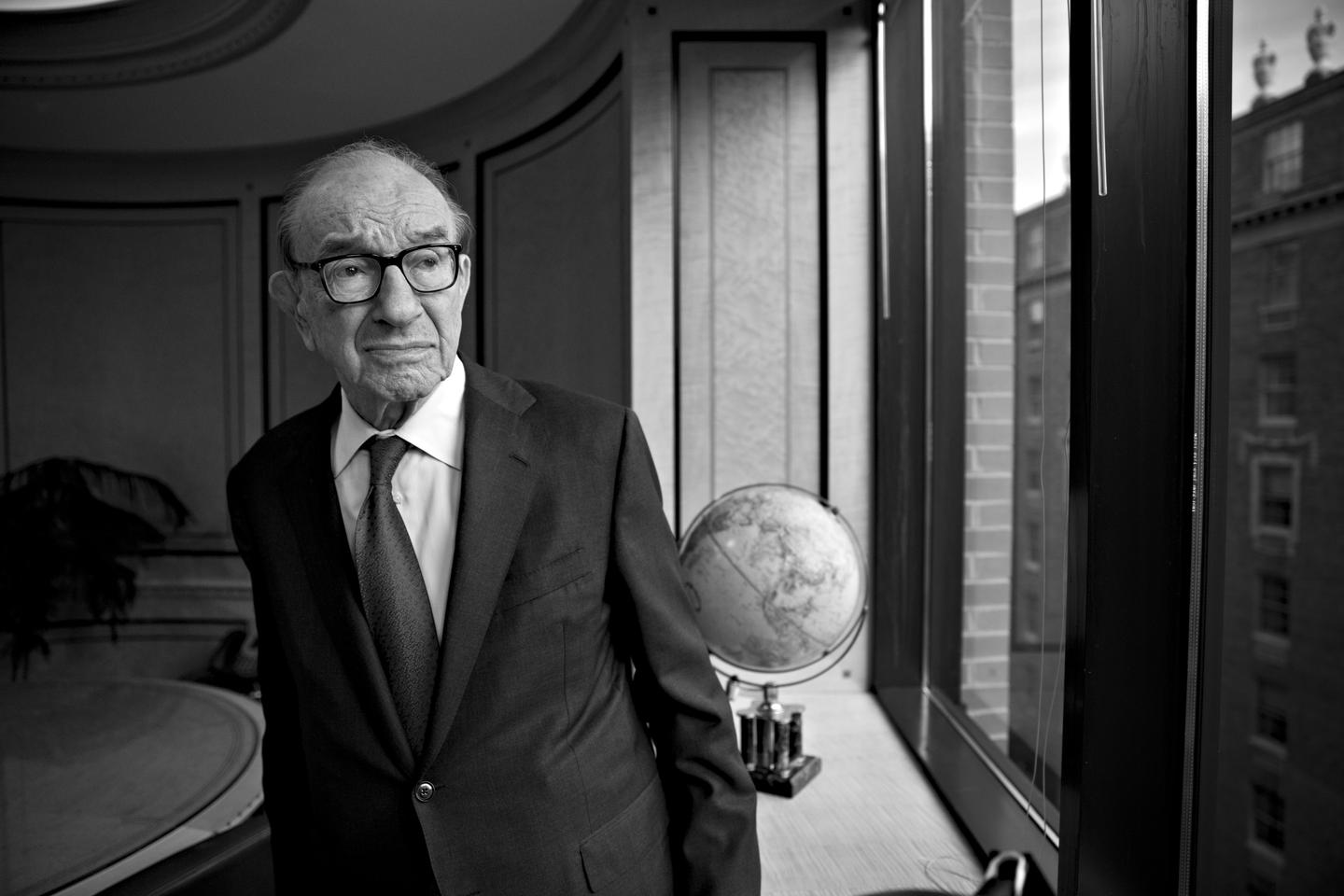

This article provides an in-depth comparison of Jerome Powell’s current monetary easing strategies with Alan Greenspan’s 1990s “soft landing,” focusing on their differing macroeconomic contexts, labor market dynamics, financial market risks, and geopolitical influences. It offers strategic insights tailored for business leaders and economists navigating today’s complex inflationary environment.

As the Federal Reserve begins easing in 2024, parallels with Alan Greenspan’s 1990s “soft landing” emerge. While both aim to balance inflation and growth, Powell faces distinct challenges, emphasizing the need for strategic agility in labor, capital, and risk management.

Key Takeaways:

- Diverging Economic Backdrops: Greenspan’s 1990s easing benefited from globalization and tech-driven productivity gains. Powell confronts inflation stemming from supply chain disruptions (e.g., semiconductor shortages), labor market tightness, and structural shifts post-pandemic. For instance, the semiconductor shortage has significantly constrained production capacity across industries, exacerbating inflationary pressures.

- Tighter Labor Markets: Powell manages a labor market characterized by tighter conditions compared to the 1990s. Persistent wage growth in sectors like technology and logistics threatens to sustain inflation despite policy measures. The Beveridge curve’s outward shift indicates higher job vacancies and slower unemployment reduction, underscoring persistent labor market frictions.

- Financial Market Volatility: Unlike Greenspan’s era dominated by the dot-com bubble, today’s financial markets experience corrections across asset classes—equities, real estate, and cryptocurrencies. The S&P 500’s 20% decline in 2022 and the volatile cryptocurrency market, exemplified by Bitcoin’s fall from $69,000 to under $35,000, highlight the need for prudent capital and liquidity management.

- Geopolitical and Supply Chain Risks: Powell faces challenges from deglobalization and geopolitical tensions, such as the Ukraine war and trade tensions with China. The resultant disruptions in energy markets and supply chains—e.g., energy price spikes and semiconductor shortages—complicate monetary policy and economic stability.

- Policy Transparency vs. Flexibility: Powell’s commitment to transparent forward guidance contrasts with Greenspan’s “Greenspeak,” which allowed for more flexibility. Powell’s approach, while providing clarity, limits the Fed’s ability to react dynamically to unforeseen economic shifts. For example, the explicit communication of rate hikes in 2022 led to rapid market adjustments, constraining the Fed’s policy maneuverability.

Macroeconomic Backdrop: Managing Inflationary Pressures

- Greenspan’s 1990s: Greenspan’s rate hikes from 3% to 6% in 1994, followed by cuts to 4.75% post-1995, were strategically timed to manage inflation amidst a productivity surge from technological advancements (e.g., early internet infrastructure and semiconductor improvements). This period saw productivity gains and favorable demographics contributing to moderated inflation, despite economic growth.

- Powell’s 2024: Powell contends with elevated inflation driven by supply chain disruptions and post-pandemic fiscal policies. For example, the Fed’s current rate of 5.25% aims to address multi-decade high inflation but risks over-tightening, potentially stalling economic growth and exacerbating labor shortages. The interplay between supply chain constraints and fiscal stimulus requires careful calibration of monetary policy to avoid stifling recovery.

Strategic Impact on Business Leaders:

Business leaders should anticipate moderating but persistent inflation risks. Supply chain vulnerabilities, such as semiconductor shortages and energy price instability, continue to impact cost structures. Powell’s potential easing may reduce borrowing costs, but businesses must adapt through increased automation, diversified supply chains, and cautious capital investment. The risk of reigniting inflation—particularly if wage growth remains strong—requires vigilance.

Financial Markets: Asset Valuations and Volatility

- The 1990s Bubble: Greenspan’s management of the dot-com bubble included rate cuts following the Russian default and LTCM’s collapse in 1998. These measures, while stabilizing the economy, also extended speculative excesses, culminating in the market crash of 2000.

- Today’s Market Landscape: Powell’s era features diverse asset corrections, including equities, real estate, and digital currencies. The significant drop in cryptocurrencies and housing market adjustments necessitate careful liquidity and capital management. For example, the correction in Bitcoin and other digital assets illustrates the need to manage speculative risks in today’s financial environment.

Global Context: Navigating a Fragmented World Economy

- Greenspan’s Globalization: The 1990s benefited from robust globalization, with the WTO’s establishment and China’s industrialization driving down production costs and keeping inflation in check. This environment allowed Greenspan to pursue accommodative policies without igniting inflation.

- Powell’s De-globalization: Today’s geopolitical fragmentation—highlighted by trade wars and energy market disruptions—introduces complexities into economic policy. Powell’s challenge is to navigate these disruptions, such as the semiconductor supply chain issues, while addressing inflationary pressures within a more fragmented global context.

Monetary Policy Communication: Managing Expectations

- Greenspan’s Era: Greenspan’s “Greenspeak” provided policy flexibility through indirect language, allowing for responsive adjustments without causing market panic. For instance, his handling of the LTCM crisis through subtle policy shifts demonstrated his ability to manage market expectations without overt intervention.

- Powell’s Transparency: Powell’s clear forward guidance involves explicit communication of policy intentions, such as rate expectations and inflation targets. While this approach helps manage market expectations, it also limits the Fed’s flexibility. For example, the rapid market reaction to perceived policy pivots underscores the challenge of maintaining policy efficacy in a transparent framework.

Conclusion

As the Federal Reserve transitions into a new phase of monetary easing in 2024, comparing Powell’s approach with Greenspan’s 1990s “soft landing” reveals both similarities and significant differences. Greenspan’s era, characterized by strategic rate adjustments and favorable global conditions, contrasts with Powell’s current challenges of high inflation, supply chain disruptions, and geopolitical risks. Powell’s strategy must address these ongoing inflationary pressures while navigating a fragmented global economy. For business leaders and economists, understanding these technical distinctions is crucial for developing resilient strategies and adapting to the evolving economic landscape.