MARKETS TODAY August 21st, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished mixed, Japan’s Nikkei 225 gained 0.37% while Hong Kong’s Hang Seng lost 1.82% and China’s Shanghai Composite down 1.24%. S&P futures opened trading at 0.24% above fair value.

European markets finished mixed, France’s CAC 40 gained 0.47% and Germany’s DAX up 0.19%. London’s FTSE 100 was off 0.06%.

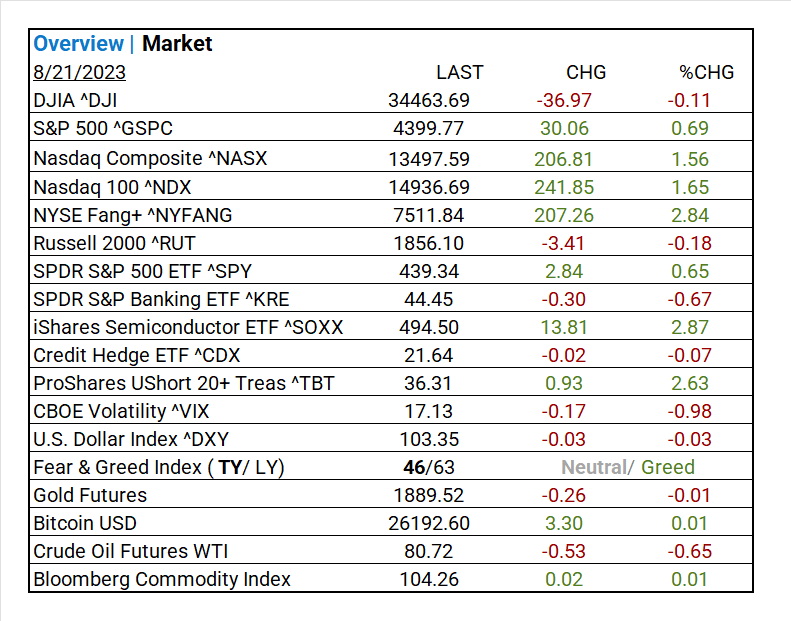

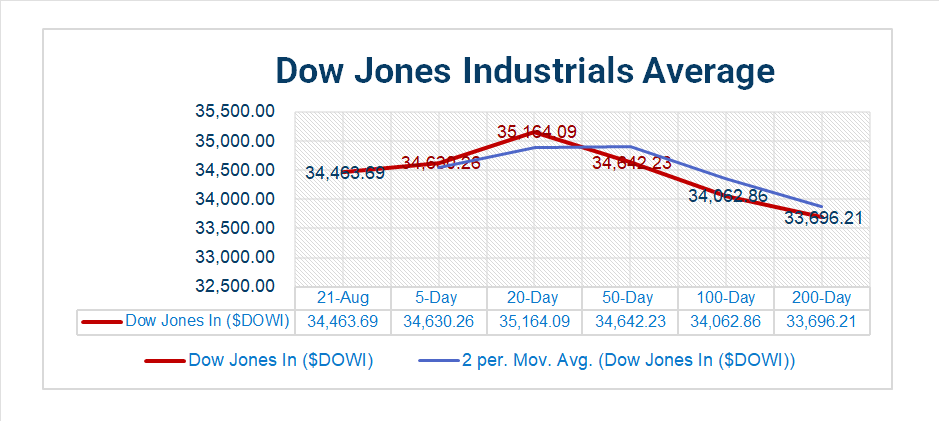

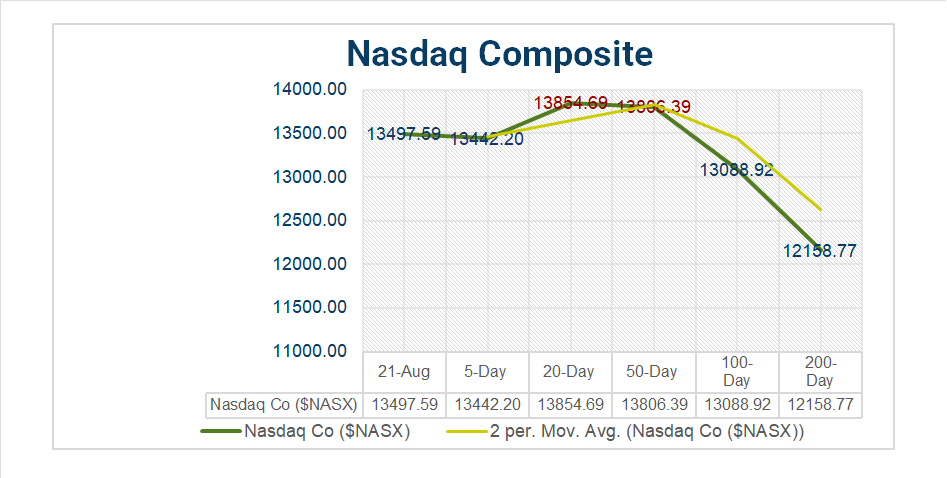

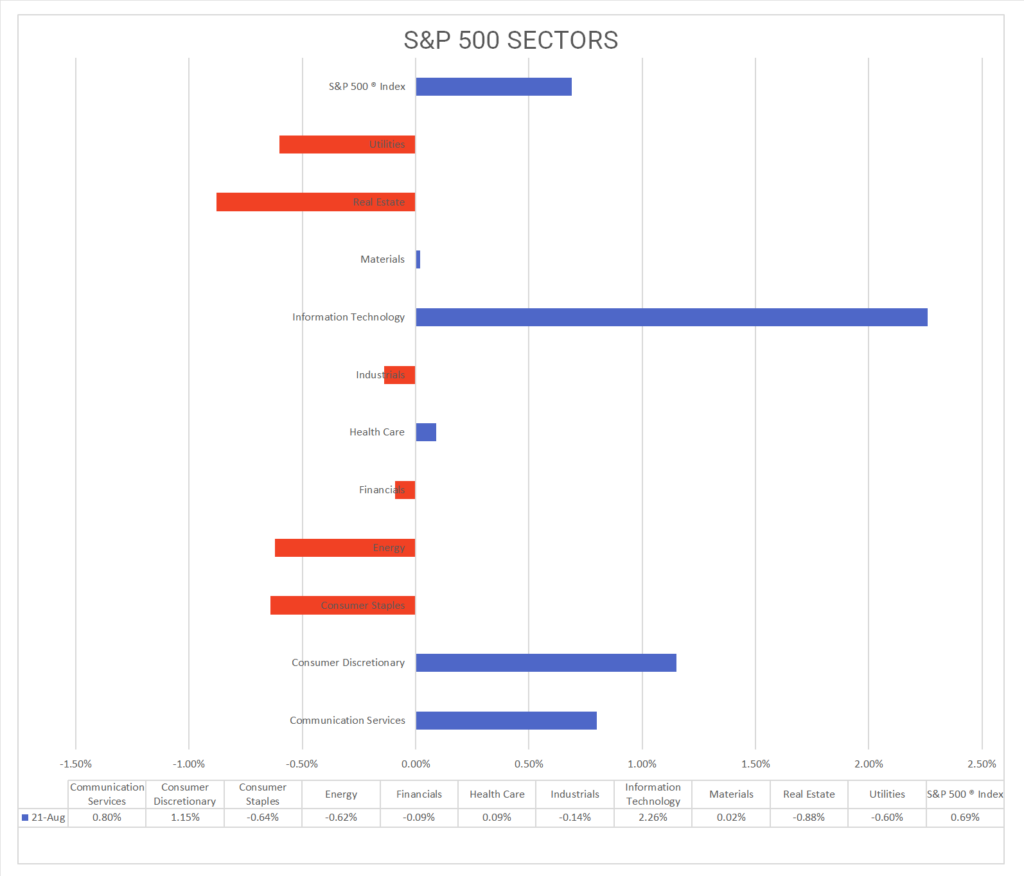

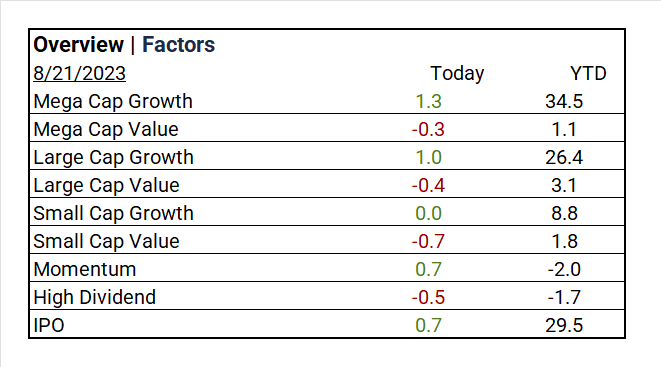

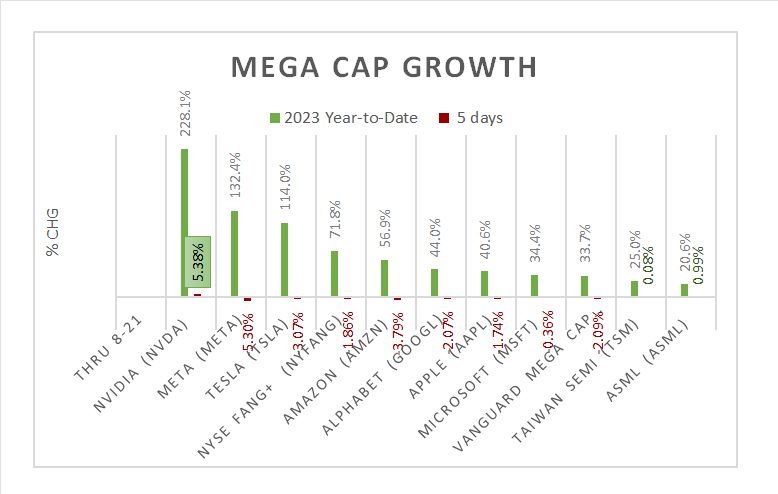

Today US Markets finished mixed, the NASDAQ gained 1.56%, S&P 500 up 0.69% while the DOW lost 0.11%. 6 of 11 S&P 500 sectors declining: Information Technology +2.26% outperforms/ Real Estate -0.88% lags. Industries: Automobiles, Semiconductor & Semiconductor Equipment, Software. On the upside, NYSE Fang+ ^NYFANG, iShares Semiconductor ETF ^SOXX, SPDR S&P 500 ETF ^SPY, Mega Cap Growth, ProShares UShort 20+ Treas ^TBT, >1 Treasury Yields.

In US economic news, no economic data came out today.

Takeaways

- Hang Seng/ Shanghai Composite both losing >1.2% overnight

- Nasdaq Composite ^NASX +1.56%

- NYSE Fang+ ^NYFANG +2.84%

- 6 of 11 S&P 500 sectors declining: Information Technology +2.26% outperforms/ Real Estate -0.88% lags

- Trending Industries: Automobiles +6.35%, Semiconductor & Semiconductor Equipment +4.86%, Software +1.88%

- iShares Semiconductor ETF ^SOXX +2.87%

- NVIDIA (NVDA) jumps 8.47%

- SPDR S&P 500 ETF ^SPY +0.65%

- ProShares UShort 20+ Treas ^TBT +2.63%

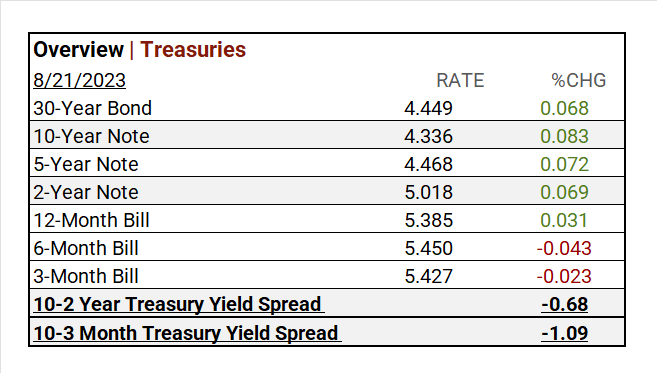

- >1 Treasury Yields rise

- Zoom Video (ZM) with aftermarket earnings beat

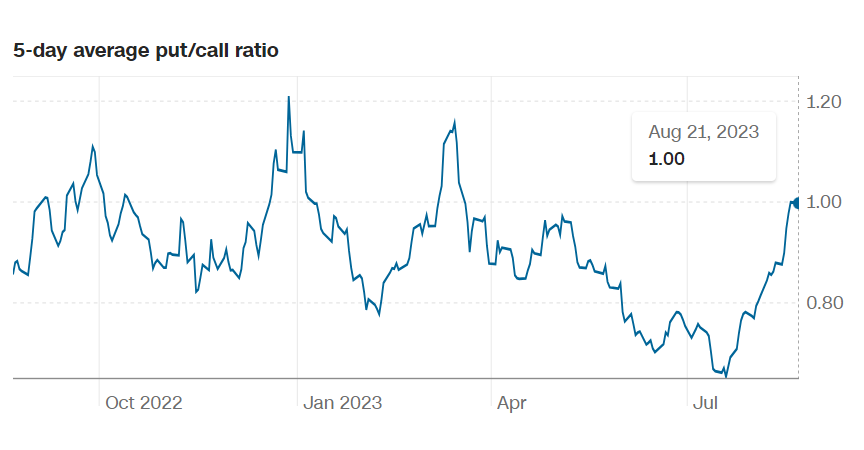

Pro Tip: The 5-day average put/call ratio indicates when the ratio of puts to calls is rising, it is a sign that investors are growing cautious. A ratio above 1 is considered pessimistic.

Sectors/ Commodities/ Treasuries

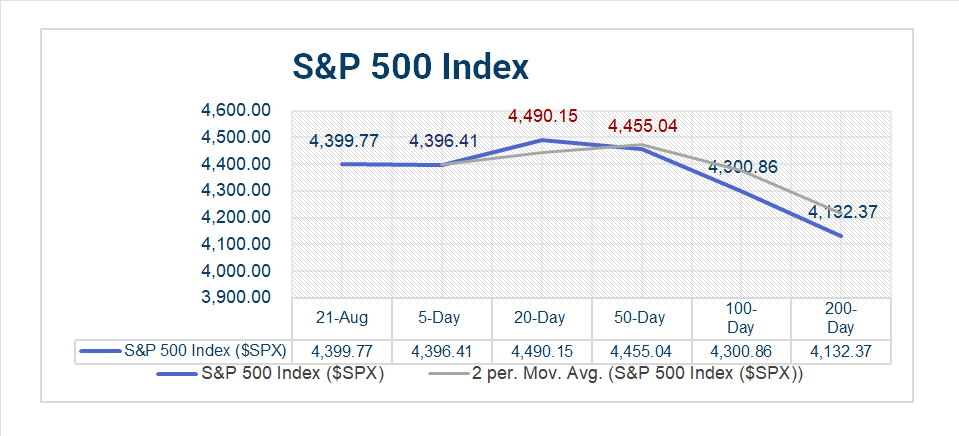

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 6 of 11 S&P 500 sectors declining: Information Technology +2.26% outperforms/ Real Estate -0.88% lags.

- Trending “on the Day”: Automobiles +6.35%, Semiconductor & Semiconductor Equipment +4.86%, Software +1.88%, Interactive Media & Services +1.19%

- *1 Month Leaders: Energy +8.54%, Health Care +1.72%, Communication Services -1.12%

- *YTD Leaders: Communication Services +37.23%, Information Technology +34.46%, Consumer Discretionary +27.67%

- *S&P 500 +13.81% *as of Aug-18-2023

Factors

US Treasuries

Earnings

Q2 ’23 Top Line Top Line

- Q1 ’23 Actual: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 Forecast: S&P 500 EPS was expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

Q2 Actual (TBA)

Notable Earnings Today

- +Beat: Zoom Video (ZM), Fabrinet (FN)

- – Miss: Singapore Telecommunications PK (SGAPY)

Economic Data

US

- No economic data came out today.

Vica Partner Guidance August ’23, (updated 8-21)

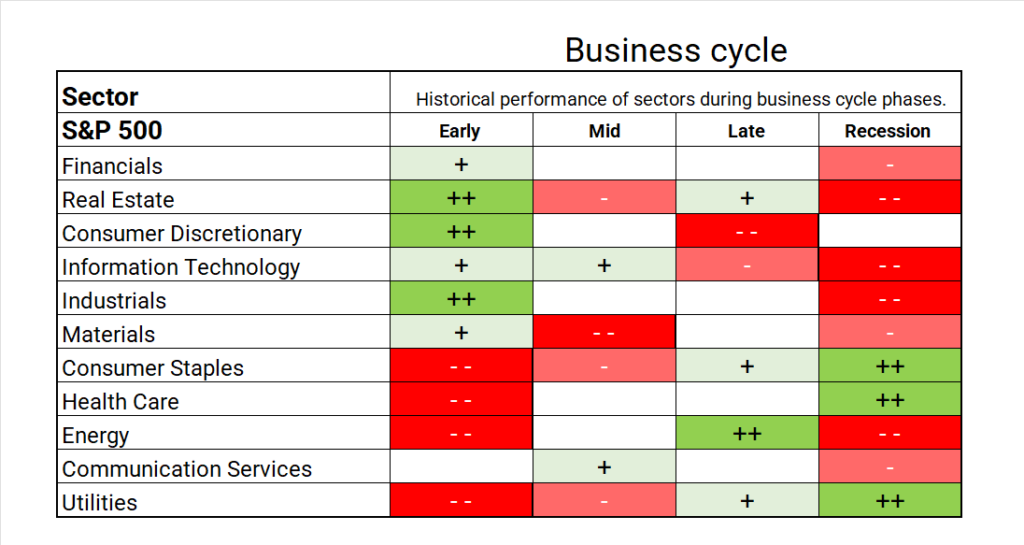

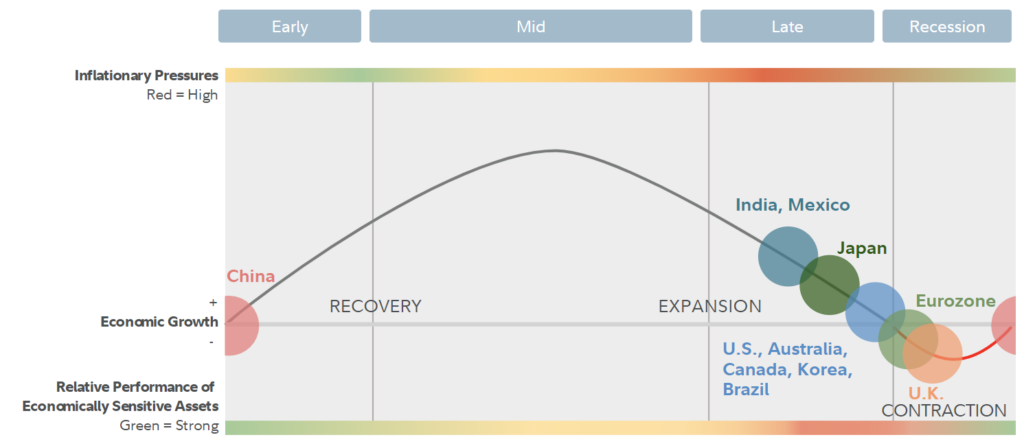

- Q3+/4: highlighting: the Energy sector which is typical in a mature/ late business cycle. Expect continued Q4 sector shifts to Defensives, Health Care and Utilities.

- Trending Industries: Communication Services/ 1. Media Consumer Discretionary/ 1. Broadline Retail 2. Specialty Retail Consumer Staples/ 1. Consumer Staples Distribution & Retail Energy/ 1. Energy Equipment & Services, 2. Oil, Gas & Consumable Fuels Financials/ 1. Insurance Health Care/ 1. Pharmaceuticals 2. Biotechnology Industrials/ 1. Construction & Engineering Information Technology/ 1. Communications Equipment Materials/ 1. Containers & Packaging Utilities/ 1. Gas Utilities

- Cautionary Industries: Consumer Discretionary/ 1. Automobiles 2. Automobile Components Consumer Staples/ 1. Personal Care Products Financials/ 1. Consumer Finance Health Care/1. Health Care Equipment & Supplies Industrials/ 1. Passenger Airlines Materials/ 1. Construction Materials Real Estate/ 1. Real Estate Management & Development 2. Specialized REITs 3. Hotel & Resort REITs Utilities/ 1. Independent Power and Renewable Electricity Producers

- General: Continued shift from Growth to Value. Materials and Real Estate remains volatile on China deflation. Credit default swap (CDS) to pick-up through Q4/Q1. >20 Year Treasuries price erosion.

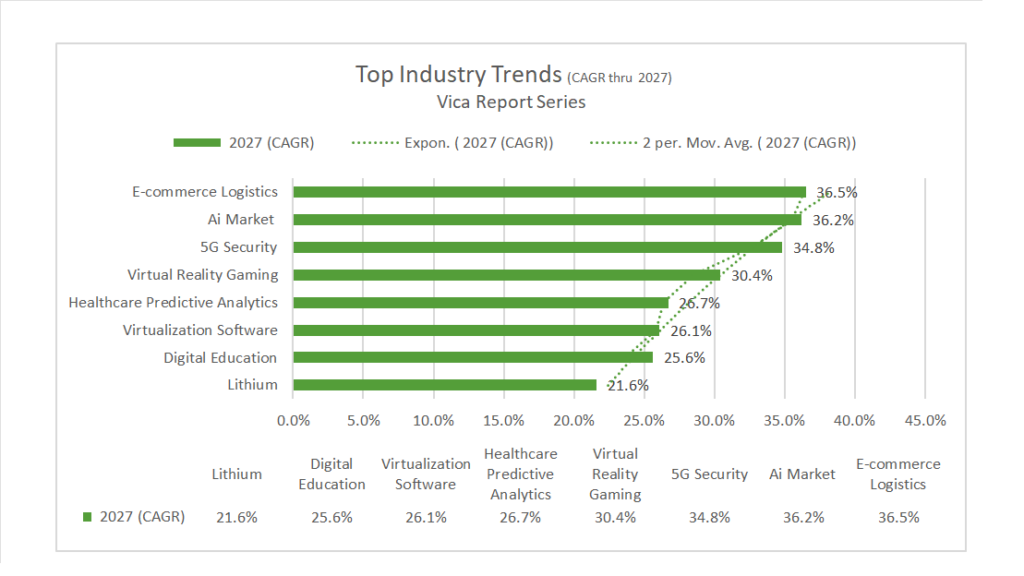

- Longer Term: NASDAQ 100^NDX/FANG+ ^NYFANG companies will continue to outperform “BIG allows you to invest at scale”. TOP Sector outperform includes AI and Semiconductor Equipment, Key materials like Lithium and Uranium. Larger funds have started investing in Real Estate with focus on builders in anticipation of ’25 cycle growth. Forward looking ’27 CAGR growth below.

- Company: we continue to emphasize longer term positions *quality and strength of balance sheet for all investments. * Strong Mega Cap longer support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML). **Select Value – United Health Care (UNH), Centene (CNC), Elevance Health, Inc. (ELV), Sociedad Quí Min de Chile (SQM), Vale (VALE), Merck & Co Inc (MRK), Lilly Eli & Co N(LLY), Coca Cola Co (KO).

The Federal Reserve as of August 2023 was no longer predicting Recession: To quote Investor Jeremy Grantham “the Federal Reserve record on predicting recessionary cycles is guaranteed to be wrong!

So why don’t we support the soft-landing scenario…

- Vica forecasts that the US will have a Recession, starting as early as Q4 ’23 and deep into ’24: the combination to date of Fed tightening, surging oil prices, stock market overvaluations and a strong dollar will shortly give us our bottom.

- Market bottoms are made on bad news and with deflationary signals: economic reports are currently mixed and arguably too much focus placed on product prices and weekly jobs. Our biggest concern is rising interest rates and the depressing slow-moving effect it has on the Real Estate market. In addition consumer debt is rising to historical highs.

- Current S&P 500 Sector Metrics support contraction: strong trends in the Energy sector indicate the US is in a late business cycle (see chart below).

- A correction in excessive market asset valuations: the current shift from Growth to Value stocks and the Information Technology sector pullback are both underway.

Pundits can all agree that the Fed has never called any recession in-kind.

Realignment is needed …

- The Federal Reserve has limited power in controlling inflation: applying old school economic principles is ineffective in a highly automated and expanding global economy. By simply raising rates to counter jobs (1.6 jobs available for every job seeker) will NOT moderate on demands.

- A 2% inflation target is not realistic today: perhaps a >3% base rate could help fund a) appropriated wages for skilled workers and training b) an executable and efficient energy transition c) improving operational efficiencies across the economy d) and most importantly (look at China today) protection from deflation!

News

Company News/ Other

- SoftBank Chip Unit Arm Files for an IPO Likely to Be 2023’s Biggest – WSJ

- American Air Pilots Approve Record Contract With Higher Pay – Bloomberg

Energy/ Materials

- China’s Abandoned, Obsolete Electric Cars Are Piling Up in Cities – Bloomberg

Real Estate

- China Evergrande Group Files Chapter 15 Bankruptcy in New York – Bloomberg

Central Banks/Inflation/Labor Market

- No Signs of Soft Landing on Bloomberg’s Trade Tracker – Bloomberg

- Why the Era of Historically Low Interest Rates Could Be Over – WSJ

- Why Child-Care Prices Are Rising at Nearly Twice the Overall Inflation Rate – WSJ

Asia/ China

- China puts onus on computing power as US tech war shows no sign of abating – South China Morning Post