MARKETS TODAY June 8th, 2023 (Vica Partners)

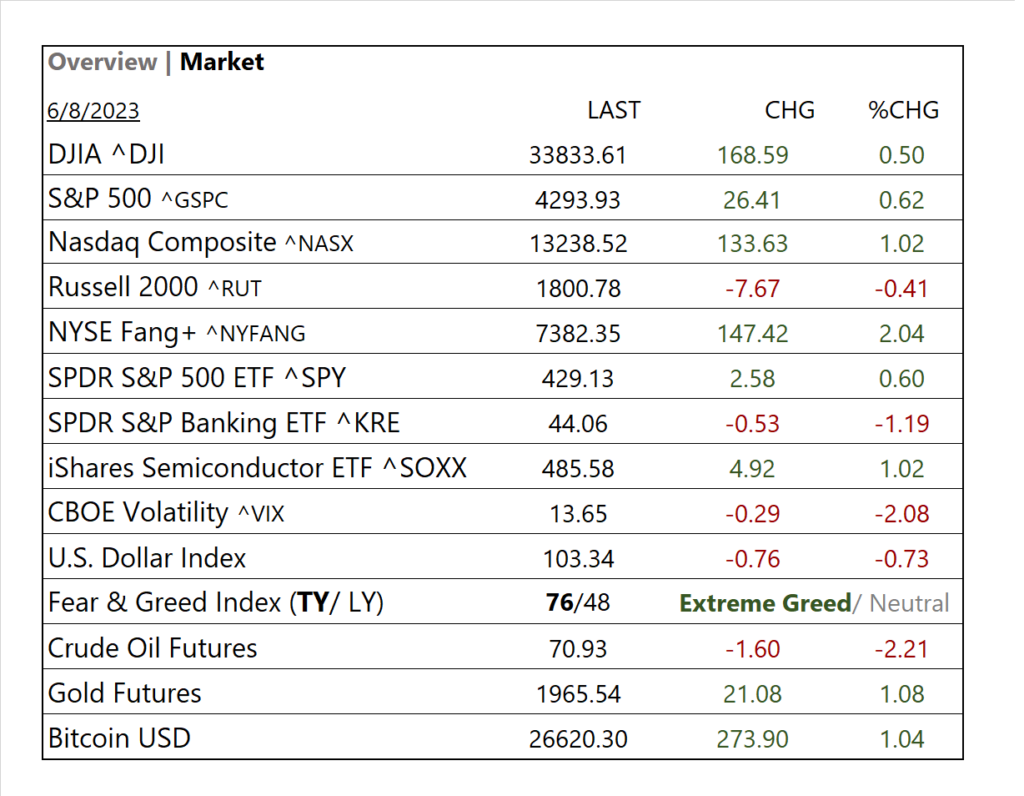

Yesterday, US markets finished mixed, S&P 500 -0.38%, DOW +0.27% and the Nasdaq-1.29%. 6 of 11 of the S&P 500 sectors lower: Energy +2.65% outperformed/ Communication Services -1.87% lagged. On the upside, Russell 2k, Treasury Yields, Brent oil and the Bloomberg Commodity Index. In economic news, trade deficit in the US narrowly missed estimates and U.S. consumer-credit growth in April moderately exceeding estimates.

Overnight/US Premarket, Asian markets finished mixed, China’s Shanghai Composite +0.49%, Hong Kong’s Hang Seng +0.25% and Japan’s Nikkei 225 -0.85%. %. US S&P futures were trading at 0.1% above fair value. European markets finished mixed, France’s CAC 40 +0.27, Germany’s DAX +0.18% and London’s FTSE 100 -0.32%.

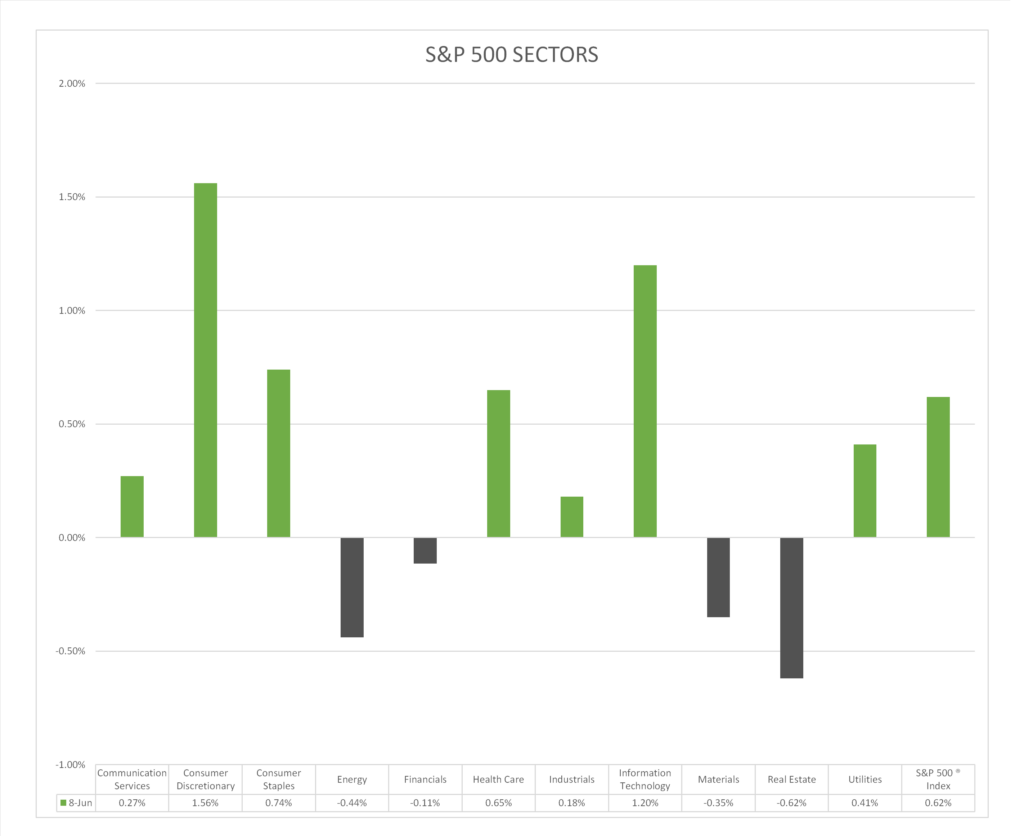

Today US Markets finished higher, S&P 500 +0.62%, DOW +0.50% and the Nasdaq +1.02%. 7 of 11 of the S&P 500 sectors advancing: Information Technology +1.20% outperforms/ Real Estate -0.62% lags. On the upside, NY FANG+, Gold, Bitcoin and the Bloomberg Commodity Index. In economic news, Initial Claims data came in higher than last week and above forecast while Continuing claims declined and below consensus. U.S. wholesale inventories came in light in April and beating estimates.

Takeaways

- Japans Yen strengthens on GDP report beat

- Initial Claims data came in higher hinting at recession

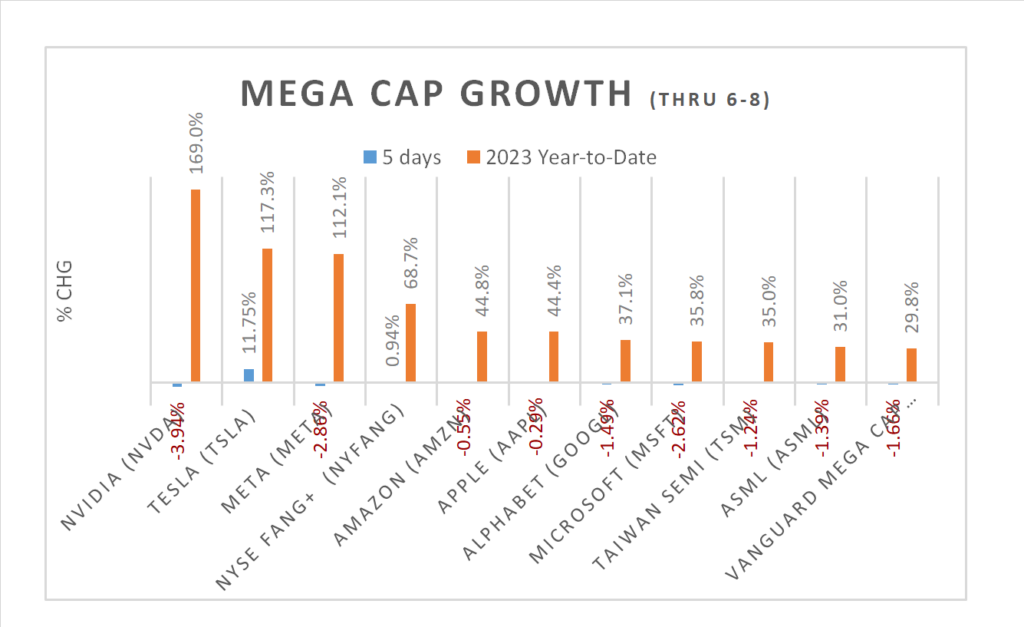

- Nasdaq, up >1% and NY FANG+, up >2% lead

- 7 of 11 of the S&P 500 sectors higher: Information Technology +1.20% outperforms/ Real Estate -0.62% lags

- iShares Semiconductor ETF (SOXX) +1.02%

- CBOE Volatility (VIX)lowest close @13.65 since 2020

- DocuSign (DOCU) beats and Vail Resorts (MTN), misses on earnings

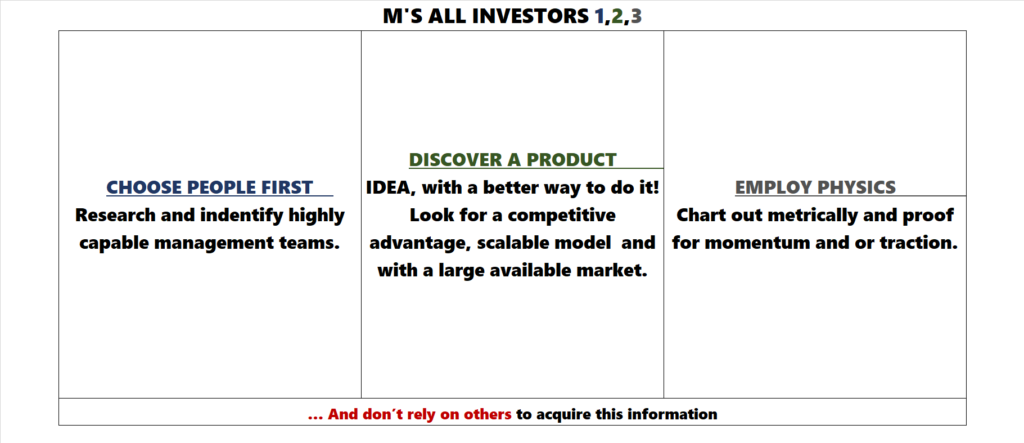

Pro Tip: Matt’s 3P’s for all Investors 1. People first, do research a find a highly capable management team 2. Product+, look for idea… a better way to do it that has a) competitive advantage b) scalable c) has large available market. 3 Physics, chart out metrically relevant momentum and or traction.

It’s time to do your homework!

Sectors/ Commodities/ Treasuries

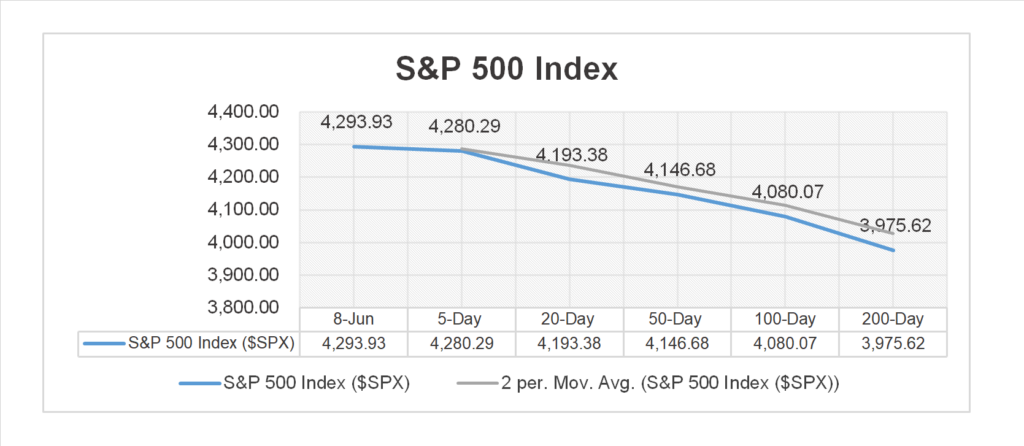

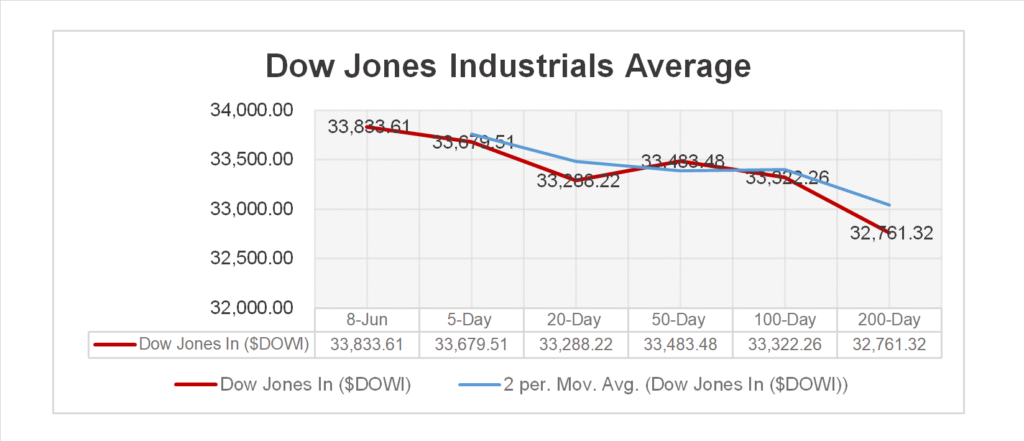

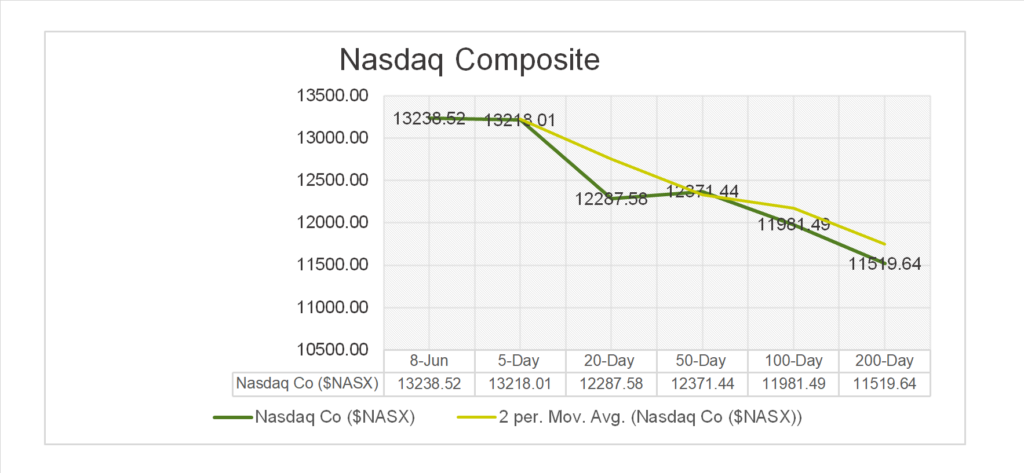

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 7 of 11 of the S&P 500 sectors higher: Information Technology +1.20%, Consumer Staples +0.74% outperform/ Real Estate -0.62%, Energy -0.44% lag.

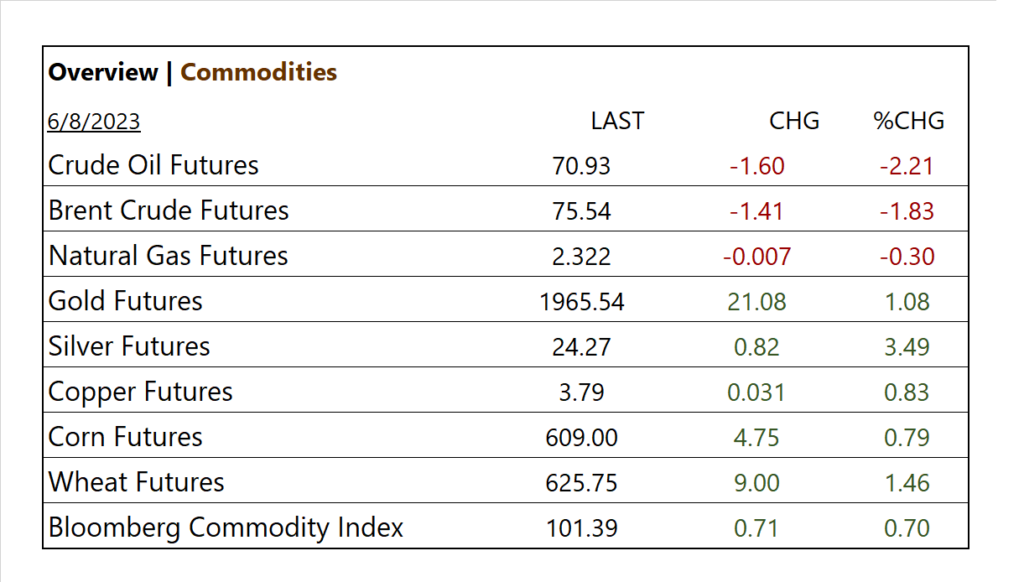

Commodities

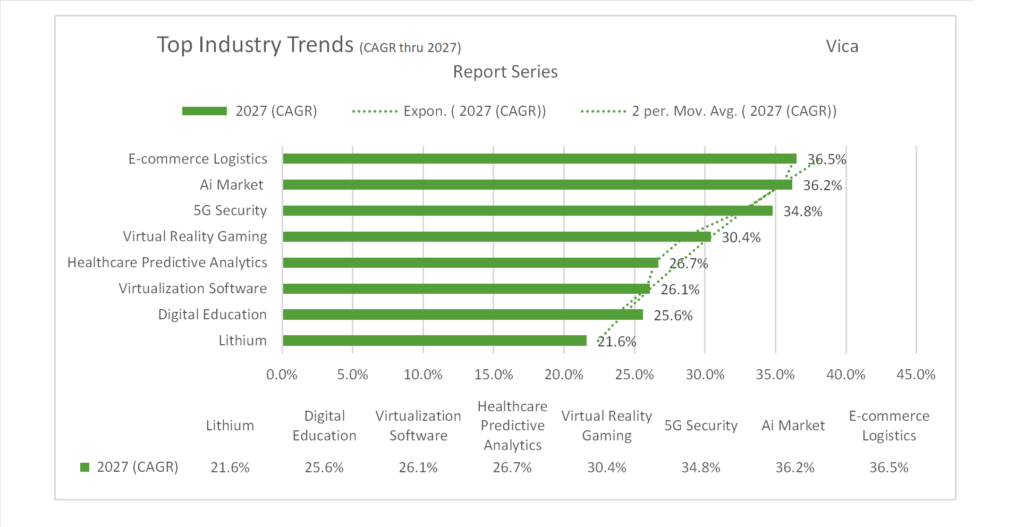

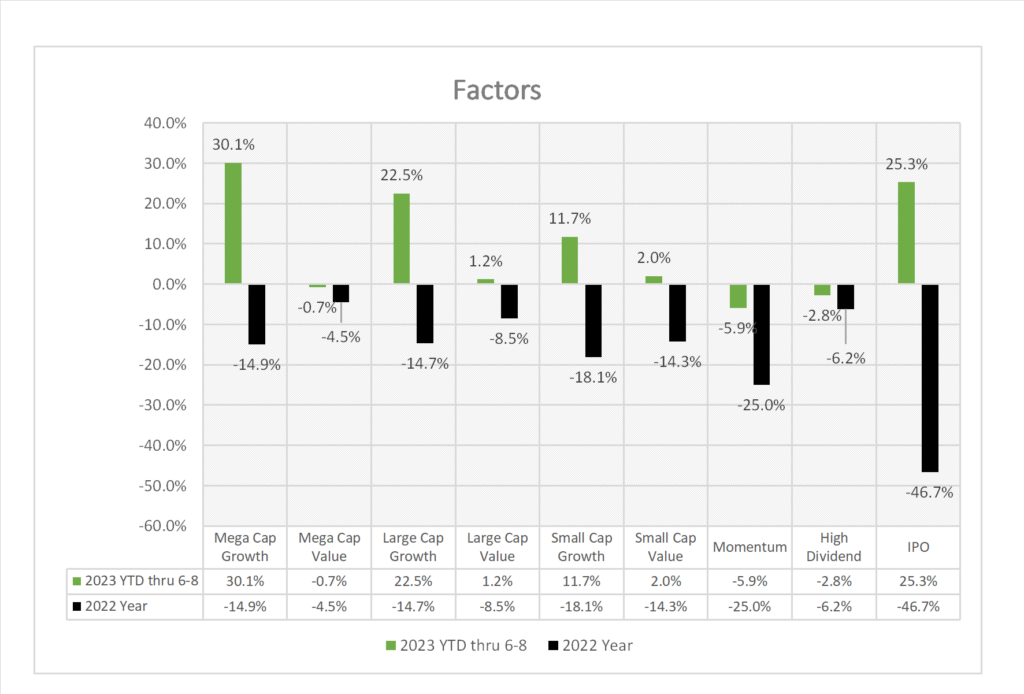

Factor/ Mega Cap Growth Chart (YTD)

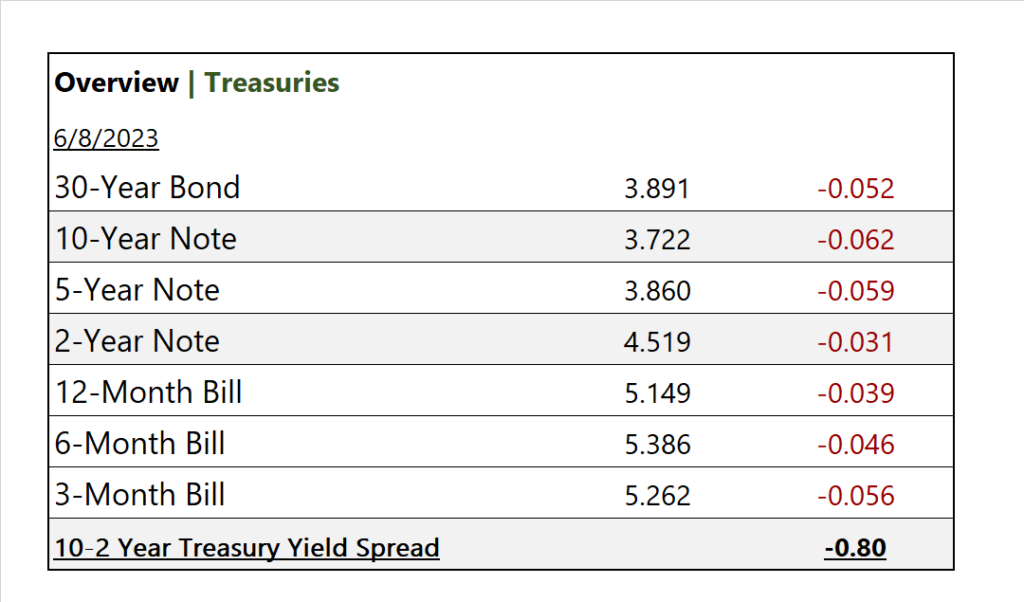

US Treasuries

Notable Earnings Today

- +Beat: DocuSign (DOCU), Braze (BRZE), Signet Jewelers (SIG), Duckhorn Portfolio (NAPA)

- – Miss: Sekisui House ADR (SKHSY), Vail Resorts (MTN), Toro (TTC), Planet Labs PBC (PL)

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), UI Path (PATH)

Economic Data

US

- Initial jobless claims; period June 3, act 261,000, fc 236,000, prior 233,000

- Continuing claims; act 757m, fc 1.81m, prior 1.795m

- Wholesale inventories; period April, act -0.1%, fc -0.2%, prior 0.0%

News

Company News

- Google to Launch Long-Delayed News Showcase Product in U.S. This Summer – WSJ

- Don’t Squeeze the Shorts – Bloomberg

- Coinbase CEO Says He’ll Challenge the SEC for ‘Clarity’ on Crypto – WSJ video

Energy/ Materials

- Construction Boom Fuels Surge in Excavator Sales – WSJ

- Renewable Diesel Bubble Begins to Burst as Costs Spark Pullback – Bloomberg

Central Banks/Inflation/Labor Market

- Delinquent Office Loans at Five-Year High Trouble Commercial Mortgage Bond Market – Bloomberg

- Bidenomics and Its Contradictions – WSJ

China

- China’s biggest state banks cut deposit rates – Reuters