MARKETS TODAY August 25th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished lower, Japan’s Nikkei 225 lost 2.05%, Hong Kong’s Hang Seng down 1.40% China’s Shanghai Composite down 0.59%. S&P futures opened trading at 0.30% above fair value.

European markets finished higher, France’s CAC 40 up 0.21%, London’s FTSE 100 up 0.07% and Germany’s DAX up 0.07%.

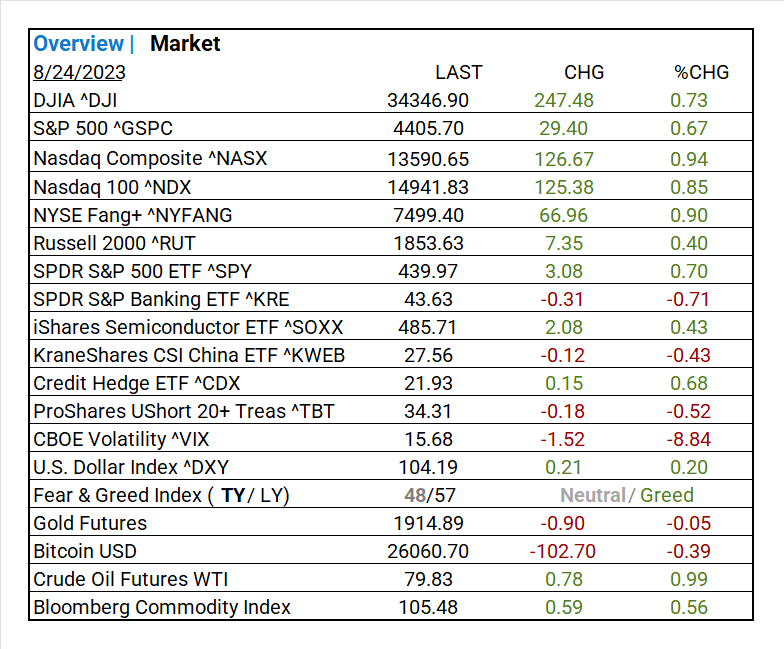

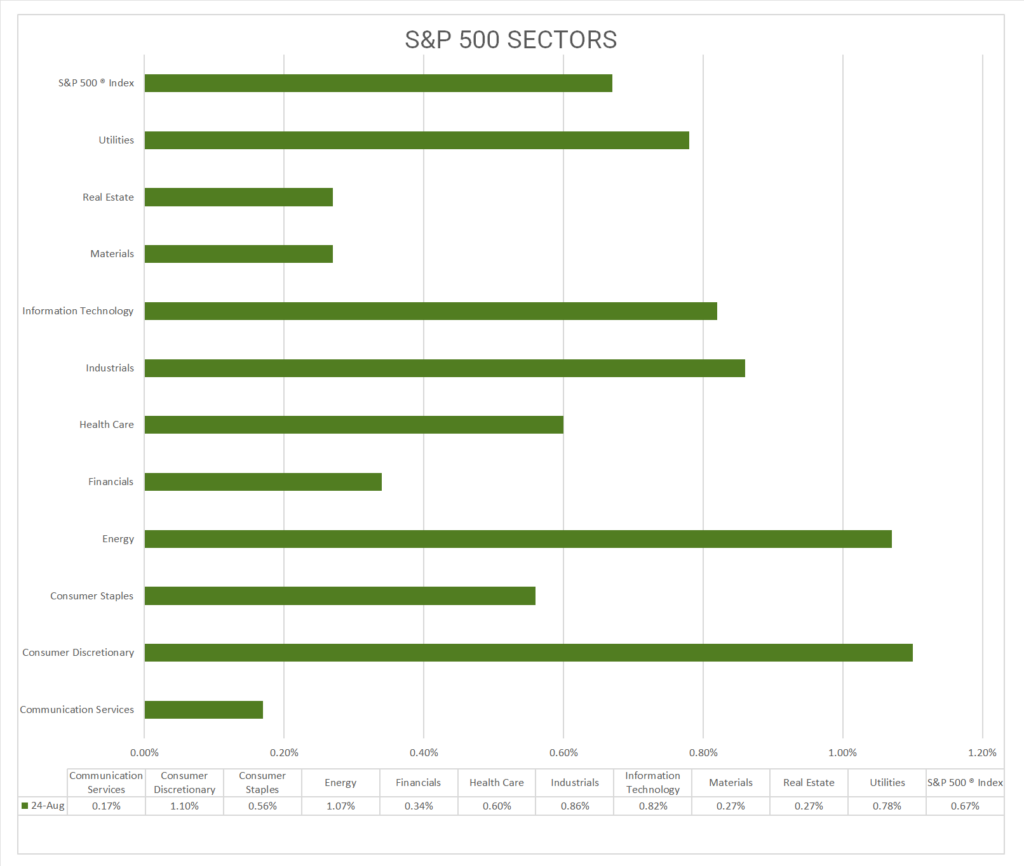

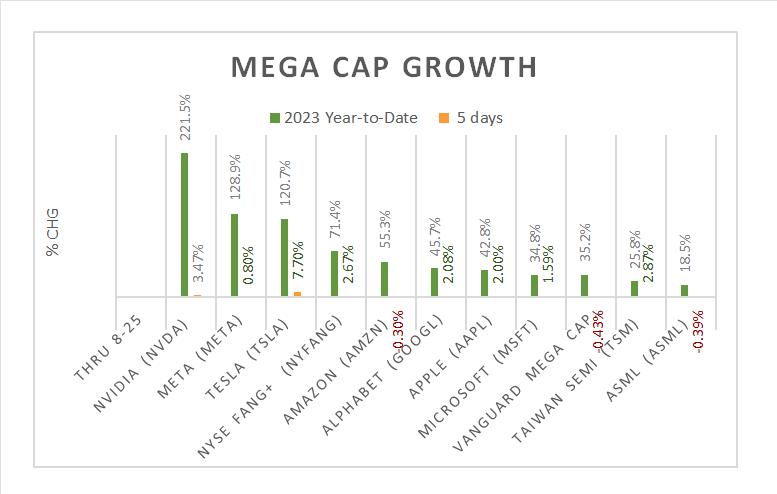

Today US Markets finished higher, the NASDAQ gained 0.94%, the DOW up 0.73%, S&P 500 up 0.67%. All 11 S&P 500 sectors advancing: Consumer Discretionary +1.10% outperforms/ Communication Services +0.17% lags. Trending Industries: Leisure Products Automobiles. On the upside, NYSE Fang+ ^NYFANG, Russell 2000 ^RUT, iShares Semiconductor ETF ^SOXX, Credit Hedge ETF ^CDX, Treasuries <5 Years, U.S. Dollar Index ^DXY, Oil Futures, Bloomberg Commodity Index.

In US economic news, the U Mich consumer sentiment came in below forecast, buying expectations improved and longer-term economic outlook worsened. Fed Chairman Jerome Powell kept his Jackson Hole speech simple, “although inflation has moved down from its peak—a welcome development—it remains too high”.

Takeaways

- Fed Chairman Jerome Powell stays on script with 2% inflation target

- NYSE Fang+ ^NYFANG up 0.90%

- All 11 S&P 500 sectors advancing: Consumer Discretionary +1.10% outperforms/ Communication Services +0.17% lags.

- Trending Industries: Leisure Products +5.65%, Automobiles +3.34%,

- SPDR S&P 500 ETF ^SPY +0.70%

- Credit Hedge ETF ^CDX +0.68

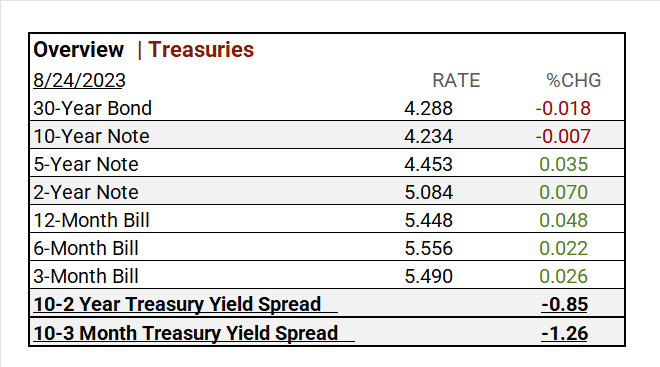

- Treasuries <5 Years and US. Dollar Index ^DXY rise

- Oil Futures, Bloomberg Commodity up

- Nothing newsworthy to report on earnings

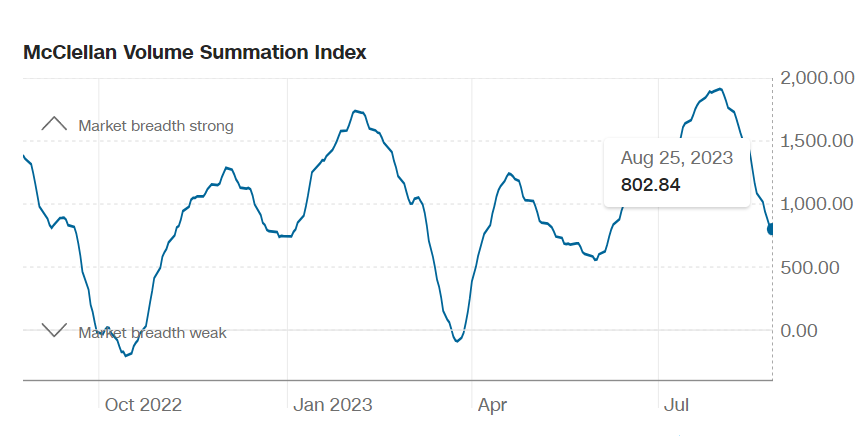

Pro Tip: McClellan Volume Summation Index measure volume of shares on the NYSE that are advancing compared to the number of shares that are declining.

Sectors/ Commodities/ Treasuries

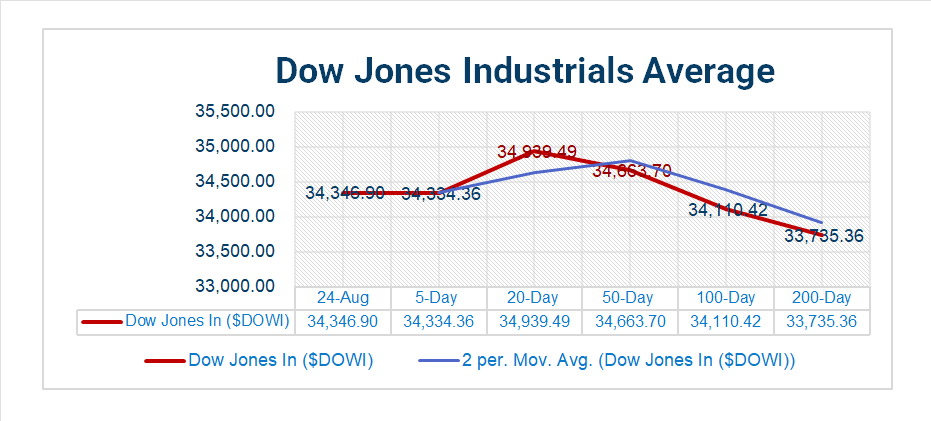

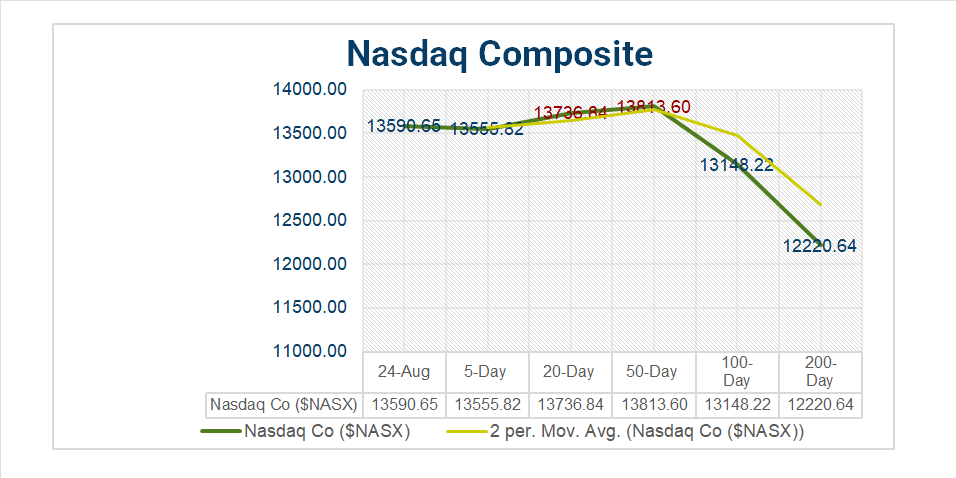

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- All 11 S&P 500 sectors advancing: Consumer Discretionary +1.10% outperforms/ Communication Services +0.17% lags.

- Trending “on the Day” Leisure Products +5.65%, Automobiles +3.34%, Independent Power and Renewable Electricity Producers +1.92%, Construction & Engineering +1.84%, Water Utilities +1.57%, Software +1.44%%

- *1 Month Leaders: Energy +2.19%, Communication Services +2.11%

- *YTD Leaders: Communication Services +38.34%, Information Technology +36.80%, Consumer Discretionary +27.71%

- *S&P 500 +13.98% *as of Aug-24-2023

Factors

US Treasuries

Earnings

Q2 ’23 Top Line Top Line

- Q1 ’23 Actual: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 Forecast: S&P 500 EPS was expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

Q2 Seasonal Actual (TBA)

Notable Earnings Today

- +Beat: n/a

- – Miss: Bank of Communications ADR (BCMXY), Ubiquiti (UI)

Economic Data

US

- U Mich consumer sentiment (final) Aug: act 69.5, fc 71.2, prior 71.2

- Fed Chairman Jerome Powell kept his Jackson Hole speech simple, “although inflation has moved down from its peak—a welcome development—it remains too high”.

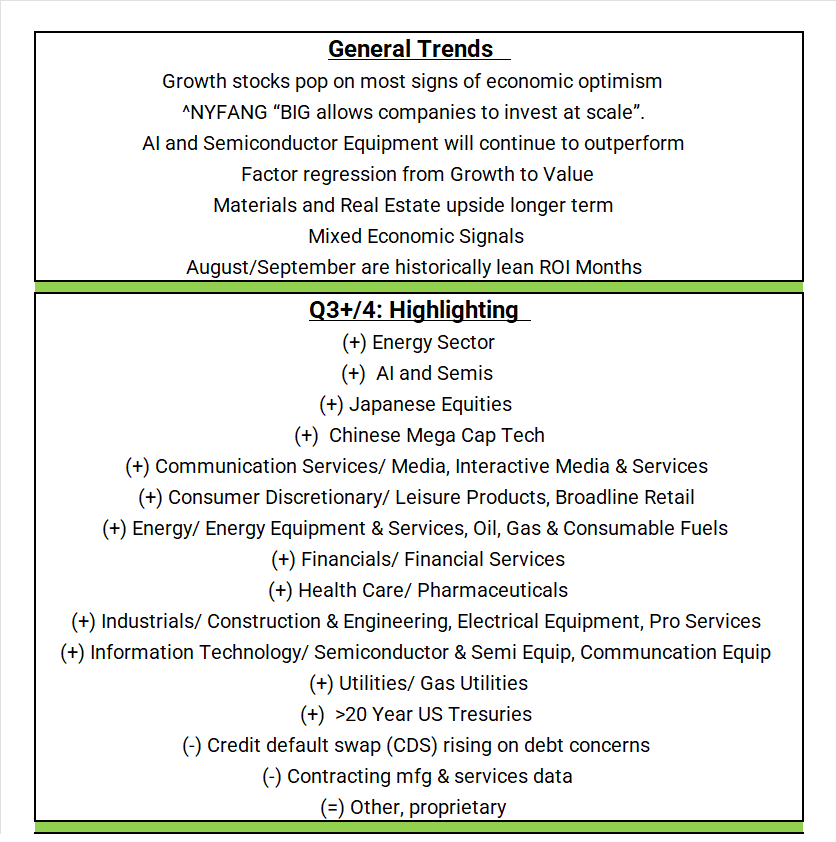

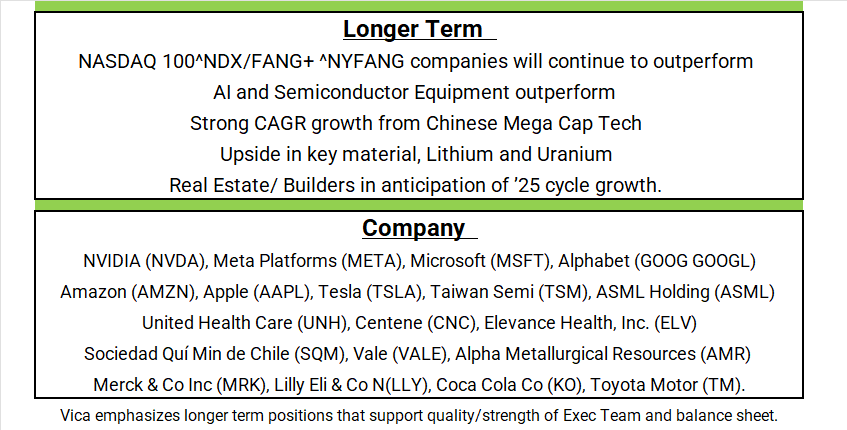

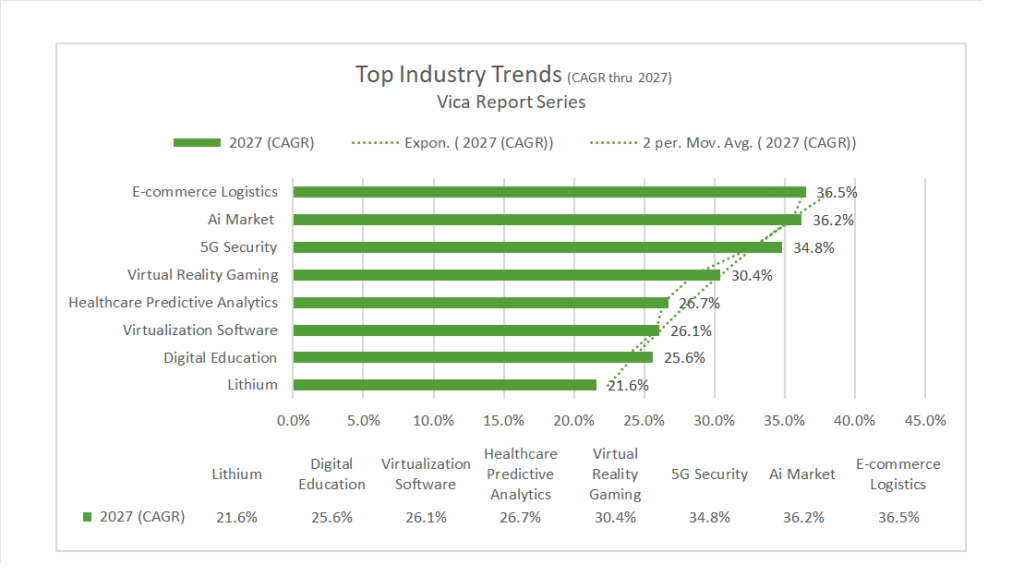

Vica Partners Guidance

Vica Partners Economic Forecast

The Federal Reserve as of August 2023 was no longer predicting Recession; to quote Investor Jeremy Grantham “the Federal Reserve record on predicting recessionary cycles is guaranteed to be wrong! Pundits can all agree that the Fed has never called any recession in-kind.

So why don’t we support the soft-landing scenario…

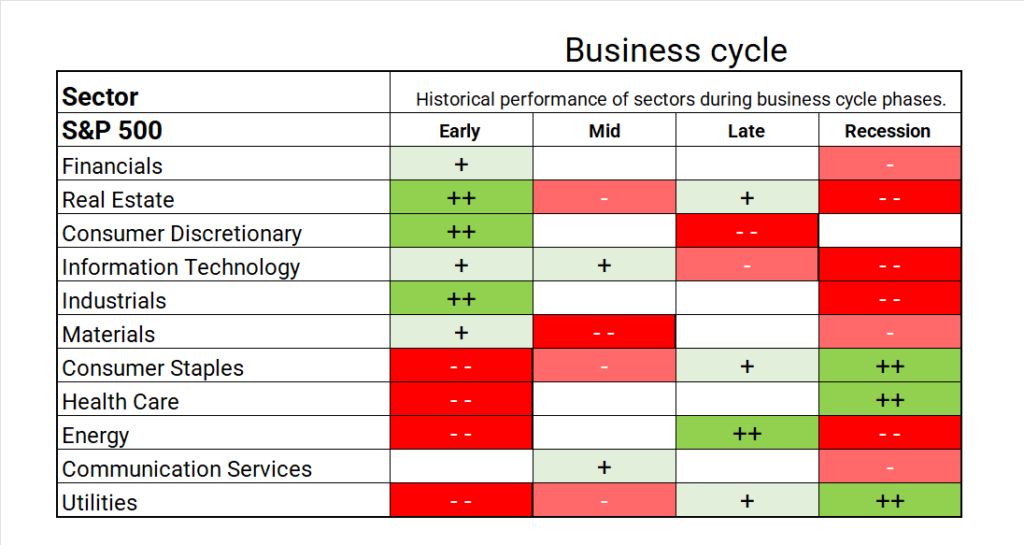

- Vica forecasts that the US will have a Recession, starting as early as Q4 ’23 and deep into ’24: the combination to date of Fed tightening, surging oil prices, stock market overvaluations and a strong dollar will shortly give us our bottom.

- Market bottoms are made on bad news and with deflationary signals: economic reports are currently mixed and arguably too much focus placed on product prices and weekly jobs. Our biggest concern is rising interest rates and the depressing slow-moving effect it has on the Real Estate market. And… all with Consumer debt rising to historical highs.

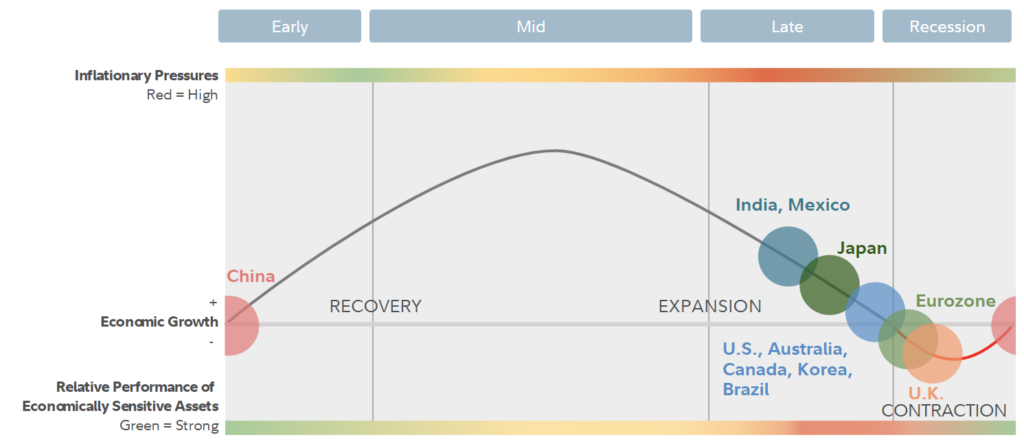

- Current S&P 500 Sector Metrics support contraction: strong trends in the Energy sector indicate the US is in a late business cycle (see chart below).

- A correction in excessive market asset valuations: the current shift from Growth to Value stocks and the Information Technology sector pullback are both underway.

And why…

- The Federal Reserve has limited power in controlling inflation: applying old school economic principles is ineffective in a highly automated and expanding global economy. By simply raising rates to counter jobs (1.6 jobs available for every job seeker) will NOT moderate on demands.

- A 2% inflation target is not realistic today: perhaps a >3% base rate could help fund a) appropriated wages for skilled workers and training b) an executable and efficient energy transition c) improving operational efficiencies across the economy d) and most importantly (look at China today) protection from deflation!

News

Company News/ Other

- Rite Aid Prepares Chapter 11 Bankruptcy to Restructure Debts – Bloomberg

- Taiwan’s semiconductor sector faces offshore production dilemma as island struggles for water, power, people – SCMP

- Pro Take: Corporate Venture Capital Provides Path for Long-Term Tech Strategy – WSJ

Energy/ Materials

- Fossil Fuel Subsidies Hit $1.3 Trillion Despite Government Pledges to End Them – Bloomberg

Real Estate

- Rising Insurance Costs Start to Hit Home Sales – WSJ

- Evergrande Seeks to Resume Trading After Shares Were Halted in March 2022 – Bloomberg

Central Banks/Inflation/Labor Market

- Powell Says Fed Will ‘Proceed Carefully’ on Further Rate Rises – WSJ

- US Budget Deficits Are Exploding Like Never Before – Bloomberg

- Fed Officials See Rates Close to Peak, Differ on How Close – Bloomberg

Asia/ China

- US, China to cover ‘expansive’ range of topics during Gina Raimondo visit, but no immediate solutions expected – SCMP