Stay Informed and Stay Ahead: Market Watch, November 18th, 2024

Late-Week Wall Street Markets

Key Takeaways

- Economic & Commodity Insights: Builder confidence is rising, but affordability remains a concern. Commodity prices (crude, gold, silver, and natural gas) signal inflation risks.

- Investment Strategy & Fed Outlook: Focus on long-duration bonds and AI stocks, diversify with Russell 2000 ETFs. October CPI shows disinflation, with the Fed signaling continued easing.

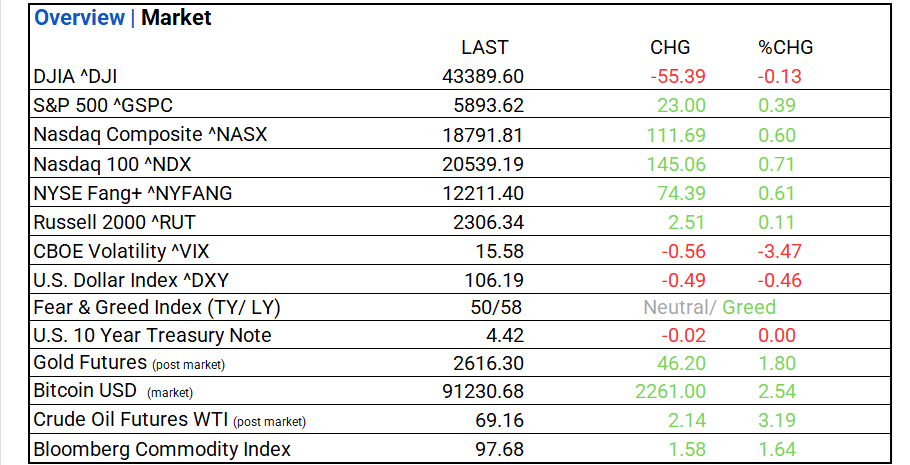

Market Overview

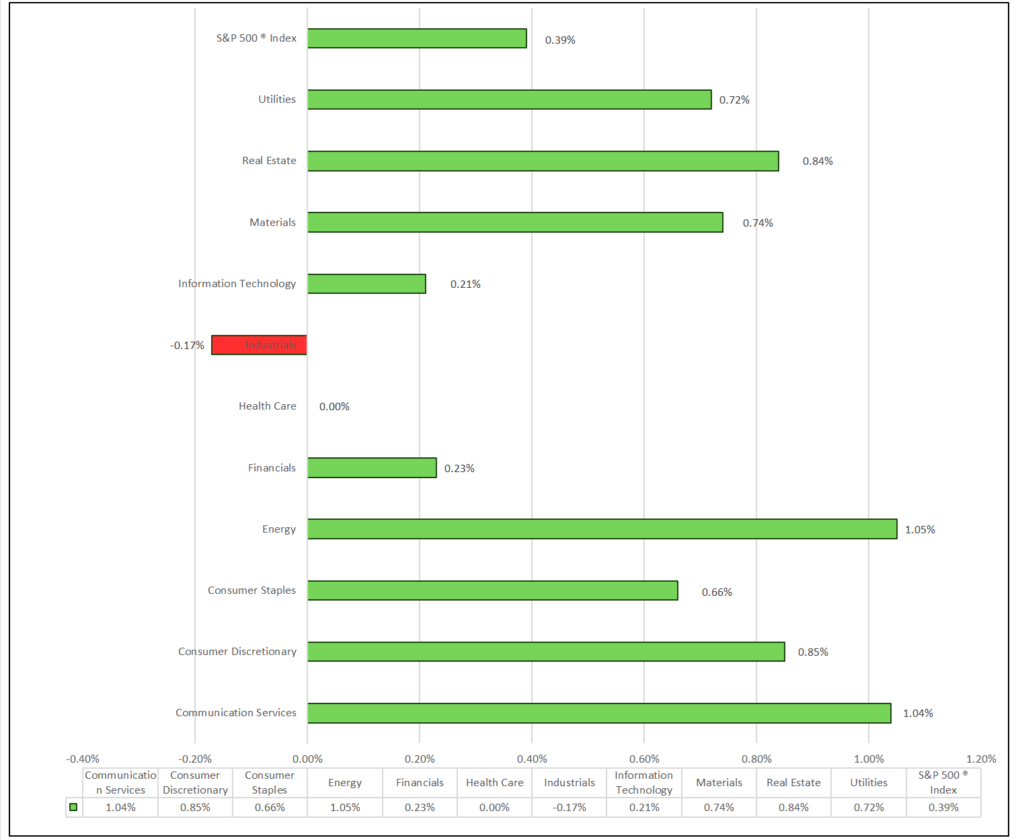

- Market Performance: The NASDAQ and S&P 500 gained, DOW declined. Energy led, Industrials lagged, with strong performances in Automobiles and Real Estate Management.

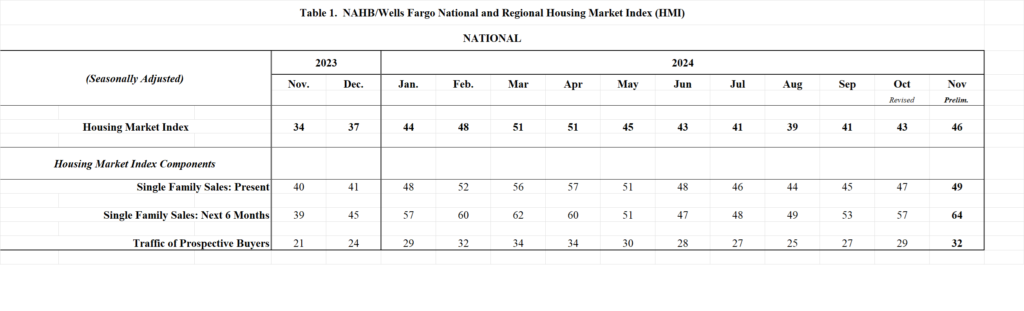

- Economic Insights: November NAHB Index shows rising builder confidence and sales expectations, but affordability concerns suggest selective investment in housing stocks.

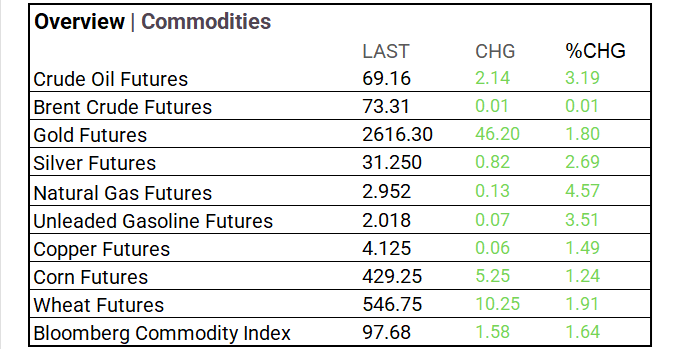

- Yields & Commodities: Recent yield movements show declining rates, with positive 10-2 Year spread indicating long-term confidence, while 10-3 Month remains inverted. Commodity prices rose w/ crude oil up 3.19%, gold 1.80%, silver 2.69%, and natural gas 4.57%, signaling inflation concerns.

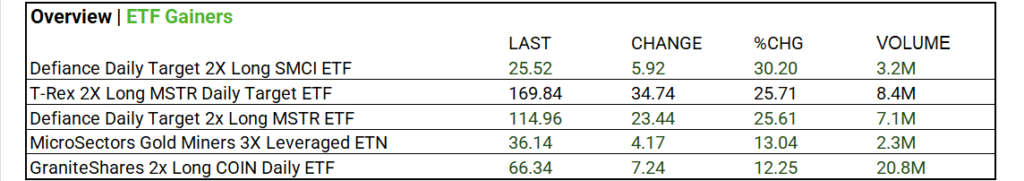

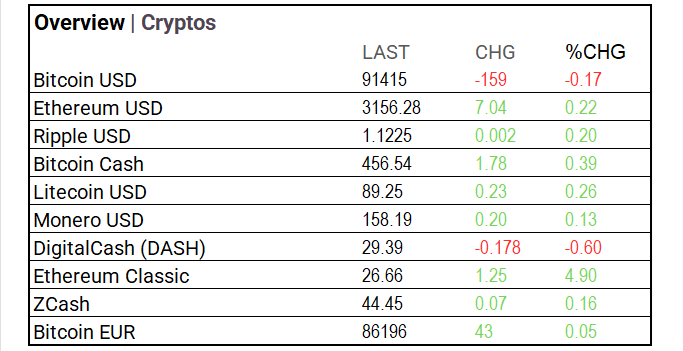

- Crypto & ETFs: Cryptocurrency markets were mixed, with Bitcoin rising 2.54% to $91,230.68, indicating growing investor confidence in digital assets. High-volume ETF movements included significant gains in tech, crypto, and mining sectors, with Defiance and T-Rex ETFs rising notably.

- Market Strategy: Maintain long-duration bonds and consider leading mortgage refinancing firms like Rocket and SOFI, anticipating Q4/Q1 ’25 rate cuts. Long positions in AI are prudent; diversify with Russell 2000 ETFs.

- Rate Cut Outlook: October CPI rose 2.6% YoY, showing disinflation. The Fed remains cautious but signals a continued easing path ahead.

Indices & Sector Performance:

- The NASDAQ and S&P 500 rose, while the DOW declined. Ten out of eleven sectors saw gains, with Energy leading and Industrials lagging. Noteworthy performances were seen in Automobiles, Independent Power & Renewable Electricity Producers, and Real Estate Management & Development.

Technical Analysis:

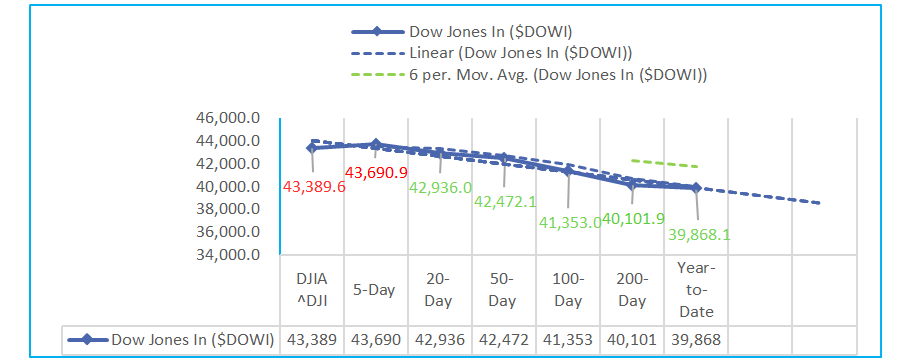

Dow Jones Industrial Average (DOWI):

- The Dow Jones Industrial Average (DOWI) maintains strong long-term momentum with a year-to-date gain of +15.12% and a 200-day average up +12.25%. Short-term dips, including a 5-day decline of -2.04%, contrast with a 20-day gain of +1.07%, signaling recovery. Overbought stochastic indicators (50-day %D at 82.64%) suggest caution, while RSI at 55.77% reflects moderate recovery potential. Short-term MACD signals bearishness (-271.07 for 9-day), but the 100-day MACD (+2,175.50) underscores robust long-term strength. Overall, the DOWI exhibits strong growth trends but near-term volatility and overbought conditions recommend cautious optimism.

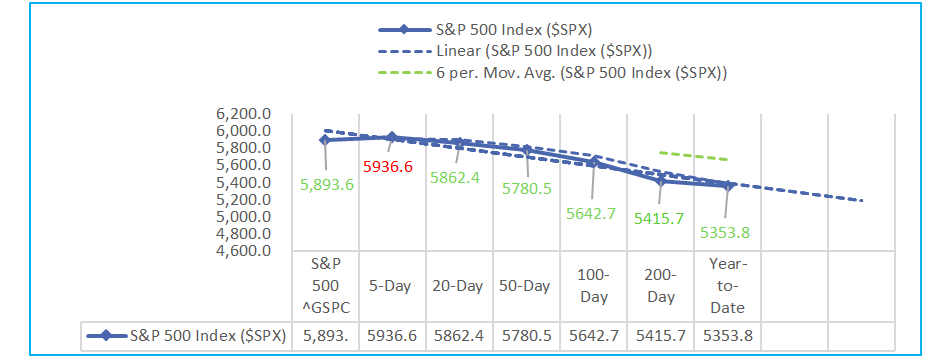

S&P 500 Index (SPX):

- The S&P 500 (SPX) shows robust long-term momentum, with a year-to-date gain of +23.56% and a 200-day average up +18.86%. Short-term pullbacks, reflected in the 5-day average (-1.80%) and overbought stochastic indicators, suggest potential for near-term consolidation. RSI at 55.83% points to moderate momentum, while the MACD reveals mixed signals: short-term bearish divergence contrasts with strong long-term momentum. Overall, the index remains solidly upward, but cautious optimism is advised amid short-term volatility and overbought conditions.

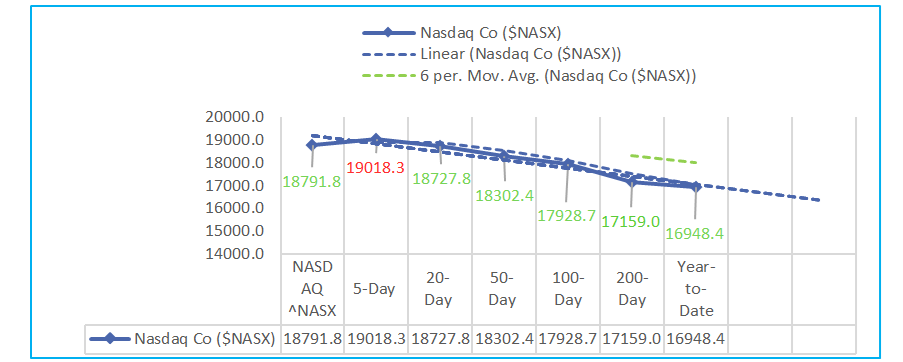

Nasdaq Composite (NASX):

- The Nasdaq Composite (NASX) demonstrates solid long-term momentum, with a year-to-date gain of +25.18% and a 200-day average up +20.24%. Short-term dips, including a 5-day pullback of -2.63%, contrast with a 20-day gain of +1.36%, signaling recovery. Overbought stochastic indicators (50-day %D at 87.11%) suggest potential near-term consolidation, while RSI at 54.80% indicates moderate momentum and growth potential. MACD readings show short-term bearishness (-243.50 for 9-day) but strong long-term momentum (+931.14 for 100-day). Overall, the index reflects robust growth, but high volatility and overbought conditions warrant caution in the short term.

Sector Performance:

- Consumer Discretionary led with an 8.95% gain, followed by Financials (+6.54%) and Communication Services (+2.76%), signaling resilience in consumer and financial sectors. Energy rose slightly (+1.21%), while Industrials slipped marginally (-0.21%). In contrast, Utilities (-1.50%), Technology (-1.62%), and Real Estate (-1.81%) faced declines, with Materials (-5.71%) and Health Care (-8.44%) performing the worst. Sector performance reflects selective growth, with strength in discretionary spending and financials amid higher rates, offset by caution in defensive and high-growth sectors.

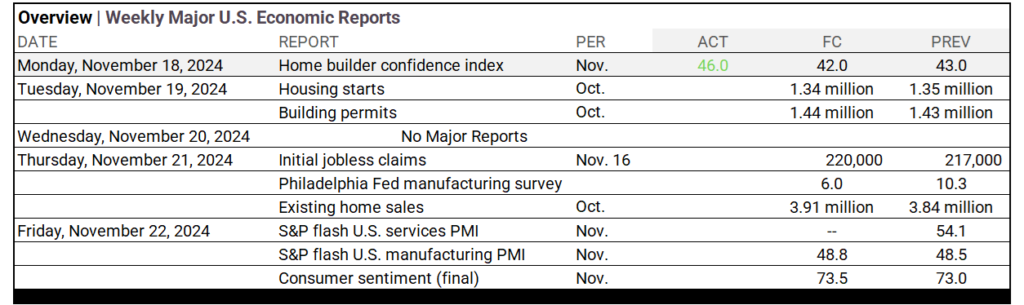

Economic Highlights

- The November 2024 NAHB Housing Market Index showed a 3-point rise in builder sentiment to 46, below neutral. Sales expectations rose to 64, with improvements in current sales and buyer traffic. Builders are addressing challenges, with 31% lowering prices by an average of 5%. For investors, rising builder confidence suggests housing sector improvement, supporting broader market stability. However, subdued buyer traffic highlights affordability concerns, suggesting selective investments in housing-related stocks.

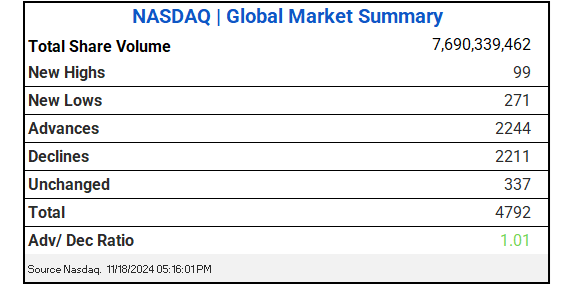

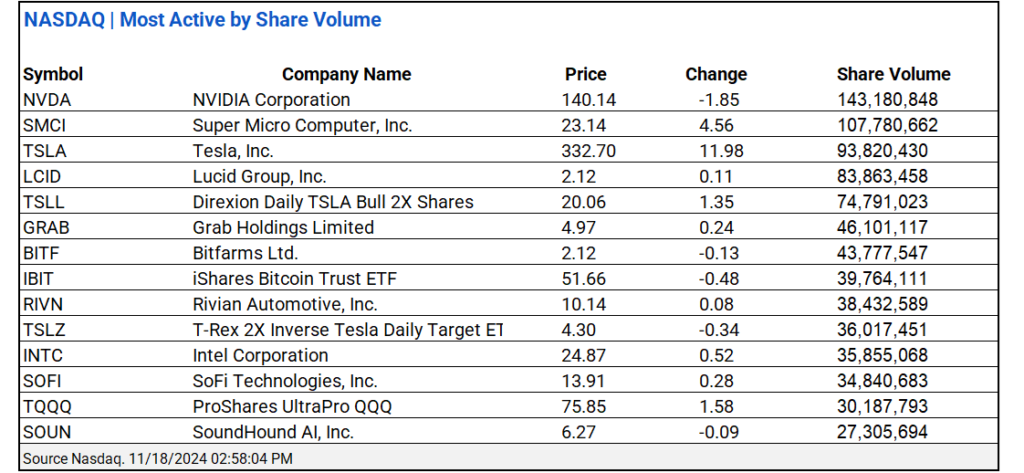

NASDAQ Global Market Update

- Trading Volume: 7.69 billion shares traded, with NVIDIA ^NVDA and Super Micro Computer, Inc ^SMCI leading in volume.

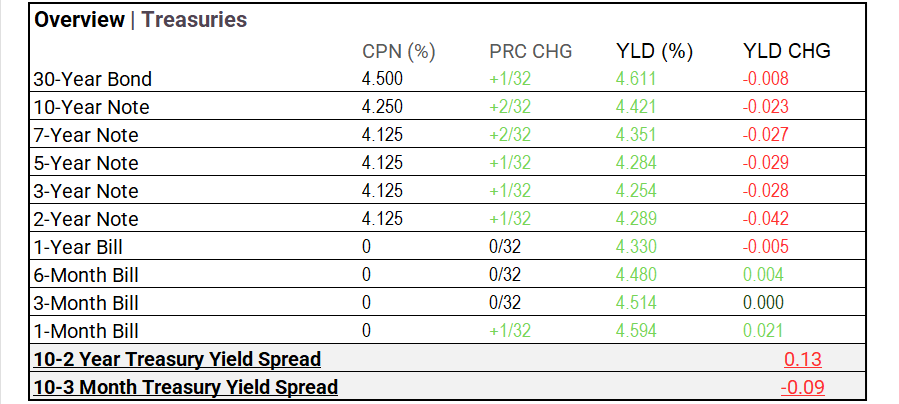

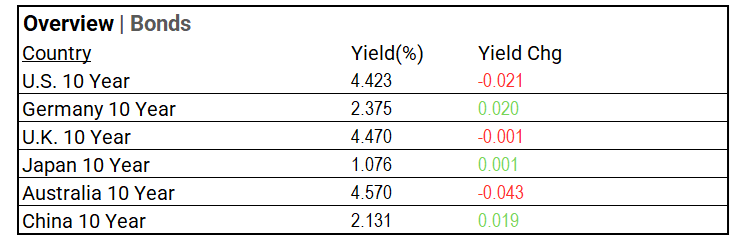

US Treasuries & Bond Markets

- Yield Movements: Recent yield movements reflect market caution, with yields generally declining across the curve, particularly for the 2-Year and 5-Year Notes. The 10-2 Year Treasury yield spread is positive at 0.13, suggesting confidence in the longer-term outlook, while the 10-3 Month spread remains inverted at -0.09, signaling concern over near-term economic risks. This mixed yield behavior indicates uncertainty, with market participants pricing in both long-term optimism and short-term caution.

- Bonds: The U.S. 10-Year bond yield decreased slightly to 4.423%, reflecting a modest pullback in rate expectations. In contrast, Germany and China saw slight increases in yields, with Germany rising to 2.375% and China at 2.131%, signaling market adjustments. U.K. and Australia experienced minor declines, with U.K. at 4.470% and Australia at 4.570%, amid ongoing inflation concerns. Japan saw a minimal rise in its 10-Year yield to 1.076%, maintaining its low-interest-rate stance.

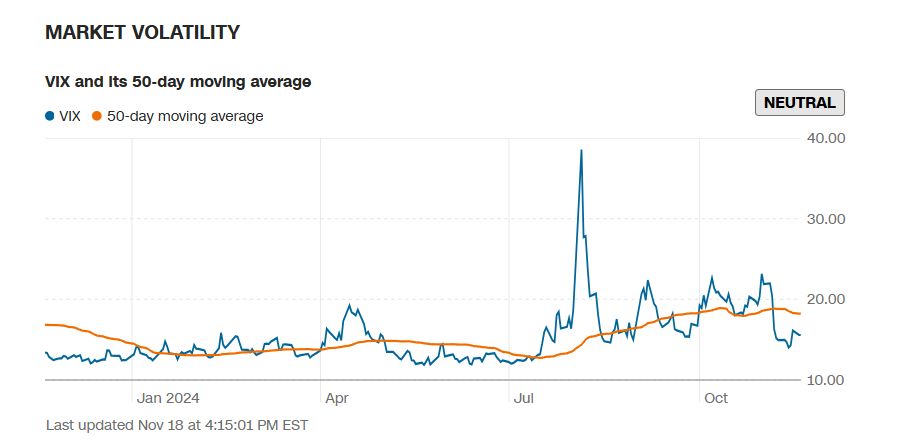

Volatility Overview

- The current VIX level of 15.58 reflects lower market volatility compared to recent spikes, suggesting reduced uncertainty in the short term. Over the past 20 days, the VIX has dropped by 15.19%, indicating a decline in market fear. However, the VIX’s 100-day and year-to-date increases of 27.29% and 25.14%, respectively, highlight heightened volatility and concerns in the broader market.

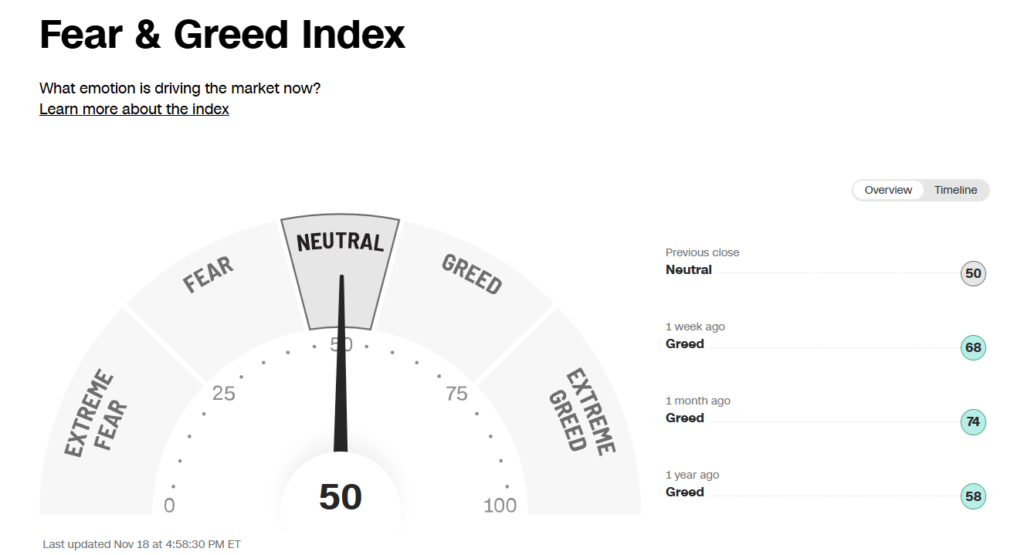

- The Fear & Greed Index currently registers “Neutral,” while the Volatility Index remains “Neutral.”

Commodities & ETFs

- Commodity prices showed significant movements recently, with crude oil increasing by 3.19%, indicating potential tightening in supply or growing demand. Gold and silver saw gains of 1.80% and 2.69%, respectively, reflecting rising investor interest in safe-haven assets amid market uncertainty. Natural gas prices also rose 4.57%, while agricultural commodities like corn and wheat gained 1.24% and 1.91%, respectively. For investors, these shifts suggest a mixed outlook: rising oil and natural gas prices could signal inflationary pressures or geopolitical risks, while precious metals and agricultural commodities may indicate demand for stability or inflation hedges. The overall increase in the Bloomberg Commodity Index (+1.64%) reflects broader market optimism.

- Notable high-volume ETF movements included the Defiance Daily Target 2X Long SMCI ETF, which gained 30.20% on 3.2M shares traded, and the T-Rex 2X Long MSTR Daily Target ETF, which rose 25.71% with 8.4M shares traded. Other significant movers included the Defiance Daily Target 2X Long MSTR ETF (up 25.61% on 7.1M volume) and the GraniteShares 2X Long COIN Daily ETF, which gained 12.25% with 20.8M shares traded. These movements highlight strong investor interest in sectors like tech, cryptocurrency, and mining.

Crypto’s & Currency Markets

- Cryptocurrency markets showed mixed movements, with Bitcoin seeing a strong rise of 2.54%, reaching $91,230.68, suggesting growing investor interest and confidence in the leading cryptocurrency. The rise in Bitcoin suggests confidence in the digital asset space.

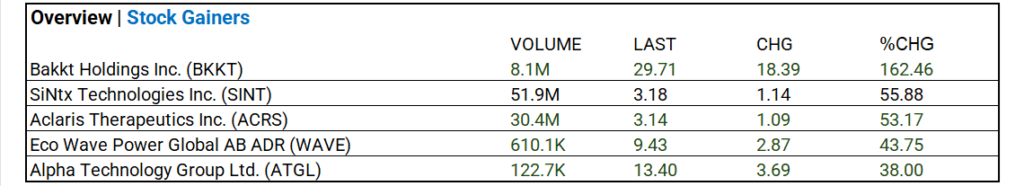

Stocks to Watch

- Stock movements today saw SiNtx Technologies Inc. (SINT) leading with 51.9M shares traded and a 55.88% increase in its stock price. Additionally, Aclaris Therapeutics Inc. (ACRS) saw 30.4M shares traded, with a gain of 53.17%.

Earnings

- As of mid-November 2024, the S&P 500 has reported moderate earnings growth despite challenges. For the third quarter, year-over-year earnings growth stands at about 3.4%, which is the lowest since Q2 2023, reflecting a slowdown in the pace of corporate profits. However, this marks the fifth consecutive quarter of positive earnings growth for the index. The most significant contributors to this growth came from the Information Technology and Communication Services sectors. On the flip side, sectors like Energy, Healthcare, and Industrials showed signs of weaker performance, with downward revisions to earnings expectations.

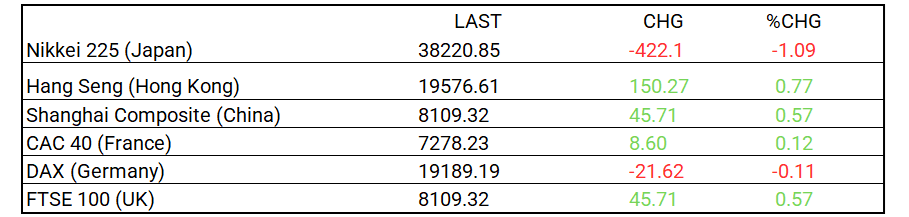

Global Markets Summary

- Asia: The Nikkei 225 declined by 1.09%, while the Hang Seng Index rose by 0.77%, and the Shanghai Composite increased by 0.57%, reflecting mixed performance.

- The CAC 40 saw a modest gain of 0.12%, while the DAX slipped by 0.11%, and the FTSE 100 rose by 0.57%, showing varied performance across European markets.

- Today’s report shows mixed signals from global markets, suggesting investor caution.

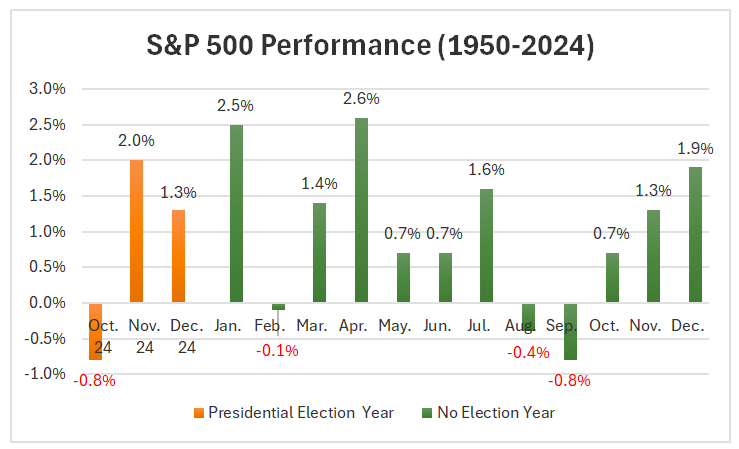

Historical Patterns and Market Impact

- Historically, November has been one of the strongest months for the S&P 500, with positive returns in 11 of the past 12 years. In election years, gains tend to be amplified, with median returns often exceeding 5%. This aligns with expectations for the current year, which has seen a 20% increase in the index. The market could potentially reach new highs by year-end, with some analysts forecasting the S&P 500 could reach up to 6,000 points. The outlook remains positive for the remainder of 2024.

Strategic Investment Adjustments

- Focus on long-duration bonds using leveraged ETFs like ZROZ (PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF) and EDV (Vanguard Extended Duration Treasury Index ETF) to capitalize on continued rate cuts through 2025.

- Strong long-term potential in Nasdaq, tech, AI, and semiconductors. Consider diversification with Russell 2000 ETFs and bank index ETFs; the year following election years with increased stimulus typically enhance market performance.

- Strategic Investment Approaches

- US Treasury Long Bond Opportunity

- Small Cap Opportunities Fall 2024

- Top 10 Fastest-Growing Technology Sectors Through 2028

In the News

Central Banking, Monetary Policy & Economics

- BOJ Governor Sticks to Stance on More Rate Hikes Despite U.S. Uncertainty – WSJ

- Rent Inflation Won’t Ebb Until 2026, Cleveland Fed Model Shows – Bloomberg

Business

- Oil Edges Higher on Supply Outage Concerns, Geopolitical Risks – WSJ

- DOJ Will Push Google to Sell Chrome to Break Search Monopoly – Bloomberg

China

- China’s consumption key to future growth as Trump tariff threat looms, economist says – SCMP