Stay Informed and Stay Ahead: Market Watch, June 14th, 2024.

Late-Week Wall Street Markets

Three Key Takeaways

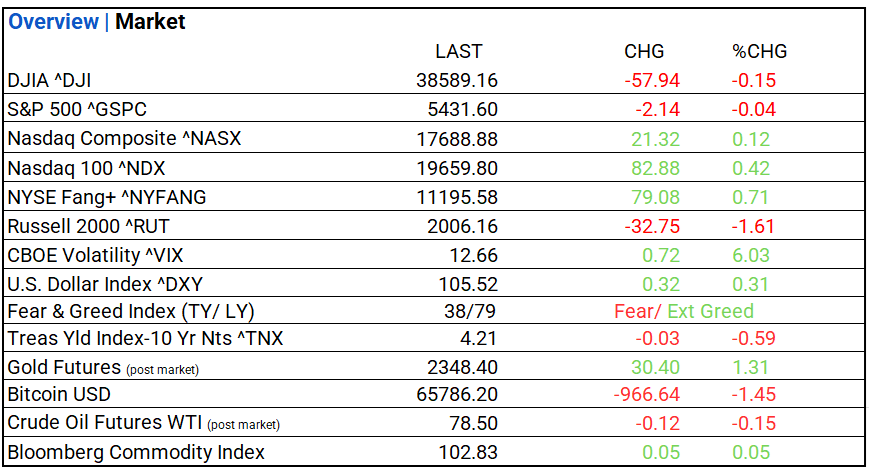

+ Major indices: NASDAQ up, S&P 500 and DJIA down. 8 sectors decline; Communication Services and Tech outperform, Materials and Energy lag. Top industries, Leisure Products and Semiconductors.

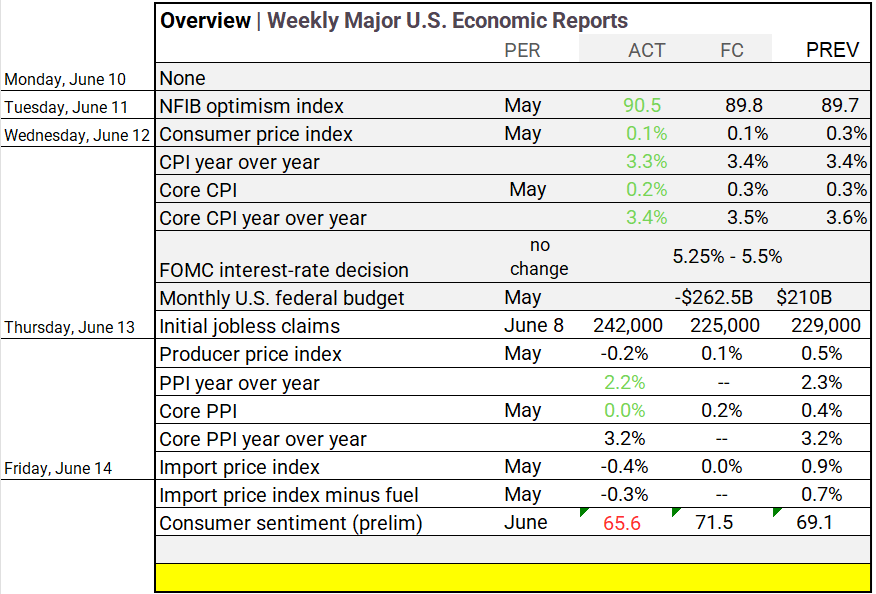

+ In the past 48 hours: Jobless claims rose to 242,000. May’s PPI fell by 0.2%, with a 2.2% year-over-year increase. Core PPI was unchanged, up 3.2% year-over-year, while June’s consumer sentiment fell.

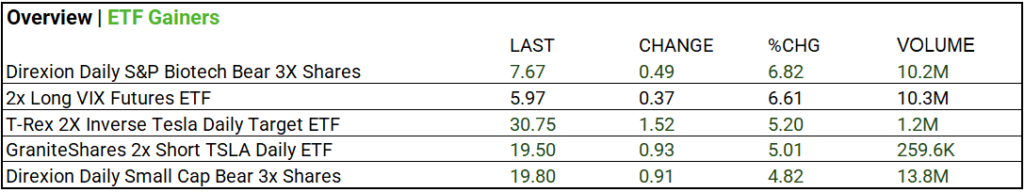

+Today’s market winners included ETFs like Direxion Daily S&P Biotech Bear, Direxion Daily Small Cap Bear 3x, and 2x Long VIX (+6.61%, 10.3M shares), betting on market volatility.

Summary of Market Performance

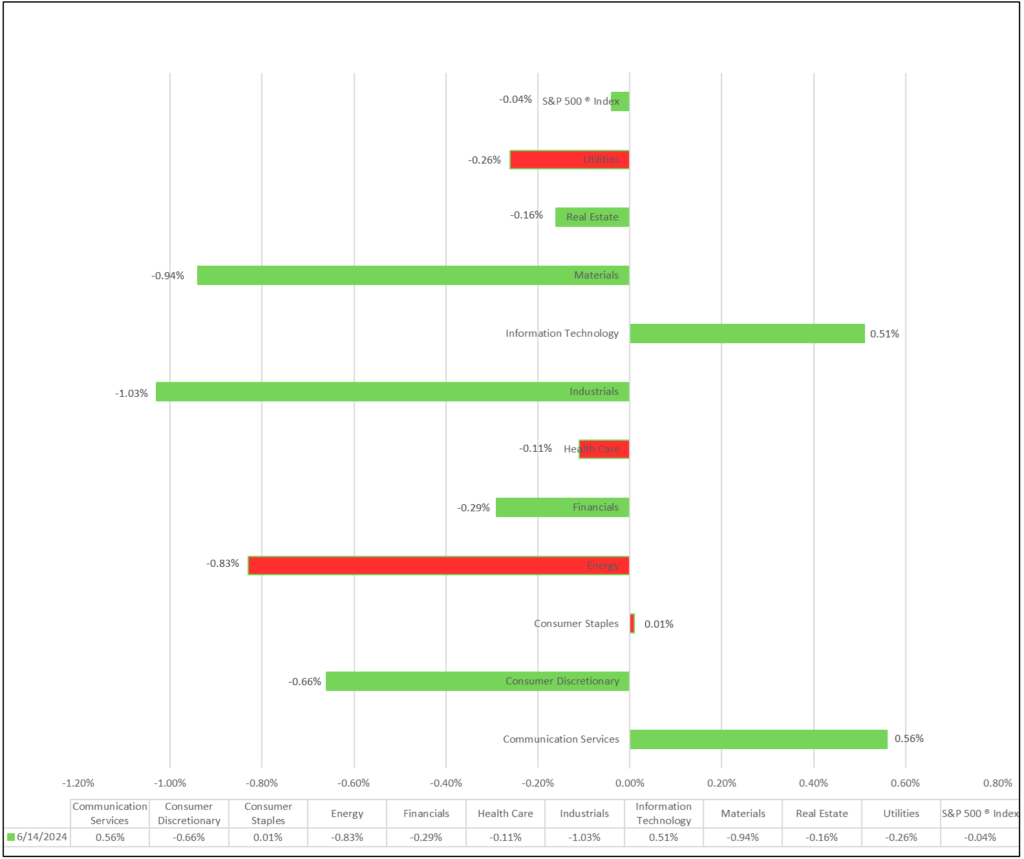

Indices & Sectors Performance:

- Major indices, NASDAQ up, S&P 500 up DJIIA down.

- 8 of 11 sectors fall: Communication Services and Tech outperform/ Materials and Energy lag. Top Industries: Leisure Products Industry (+6.01%), Entertainment Industry (+1.23%), and Semiconductor & Semiconductor Equipment Industry (+1.09%).

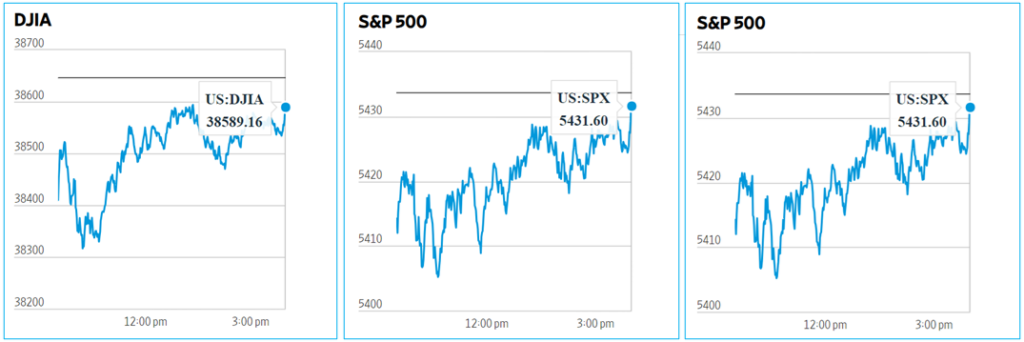

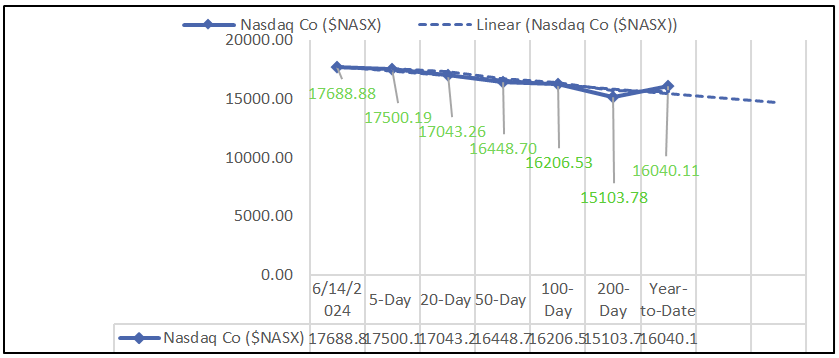

Chart: Performance of Major Indices

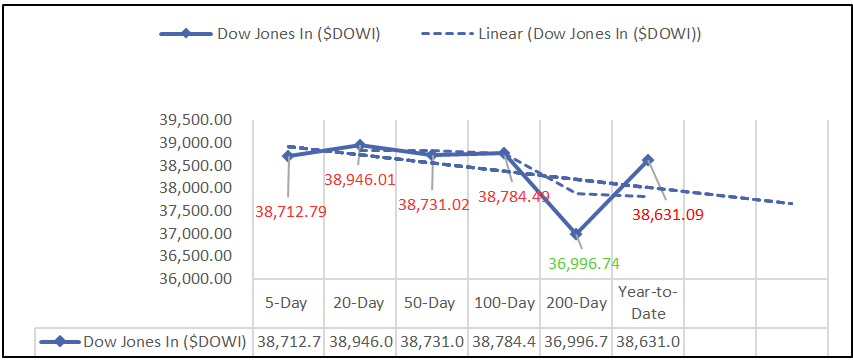

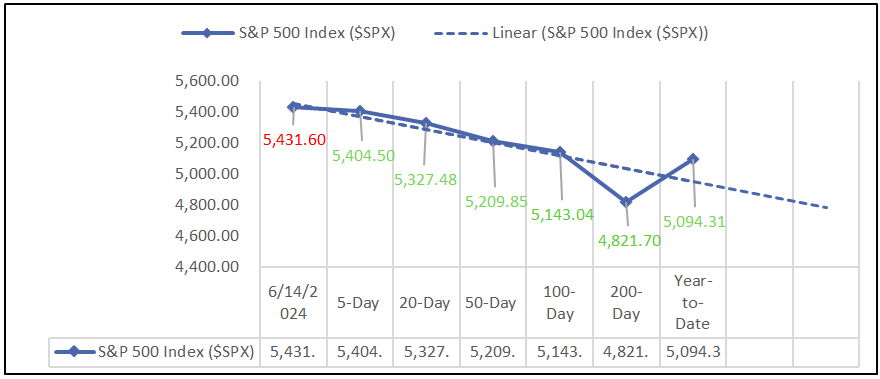

Moving Average Analysis:

Economic Highlights:

- 6/13-14: Jobless claims rose to 242,000. The Producer Price Index (PPI) fell by 0.2% in May and increased 2.2% year-over-year. Core PPI was flat in May and up 3.2% year-over-year. Preliminary consumer sentiment for June dropped to 65.6.

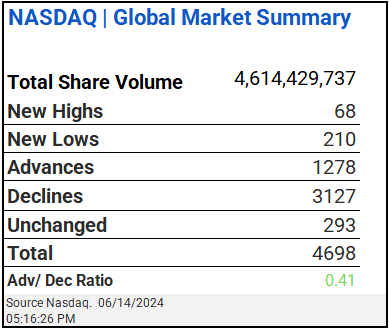

NASDAQ Global Market Update:

- Today’s Nasdaq data shows bearish sentiment with advancers to decliners at a 0.41 ratio.

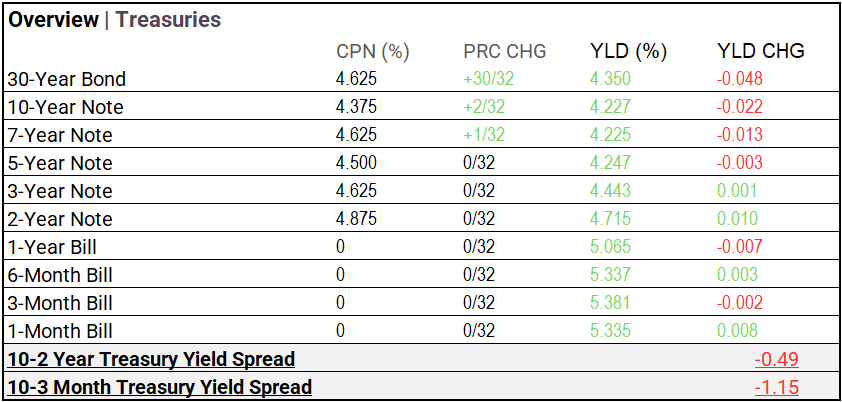

Treasury Markets:

- Bond prices mostly rose, decreasing yields. The 30-Year Bond yield fell to 4.350% with a +30/32 price change. The 10-Year Note yield dropped to 4.227% with a +2/32 price change. Shorter-term notes and bills saw minimal changes.

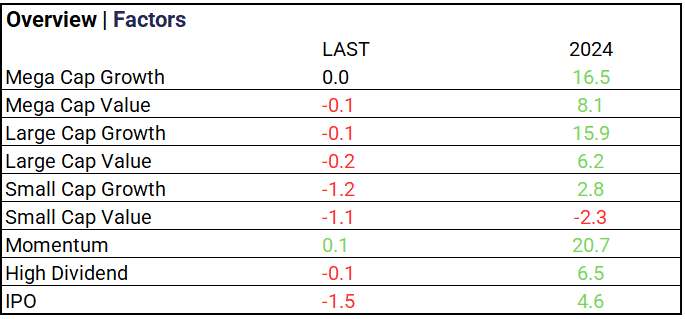

Market Trends:

- Growth stocks were mixed: Mega Cap Growth was flat at 0.0% YTD, while Momentum gained 0.1%. Value stocks were negative on the day, with Mega Cap Value declining by 0.1%.

Currency & Volatility:

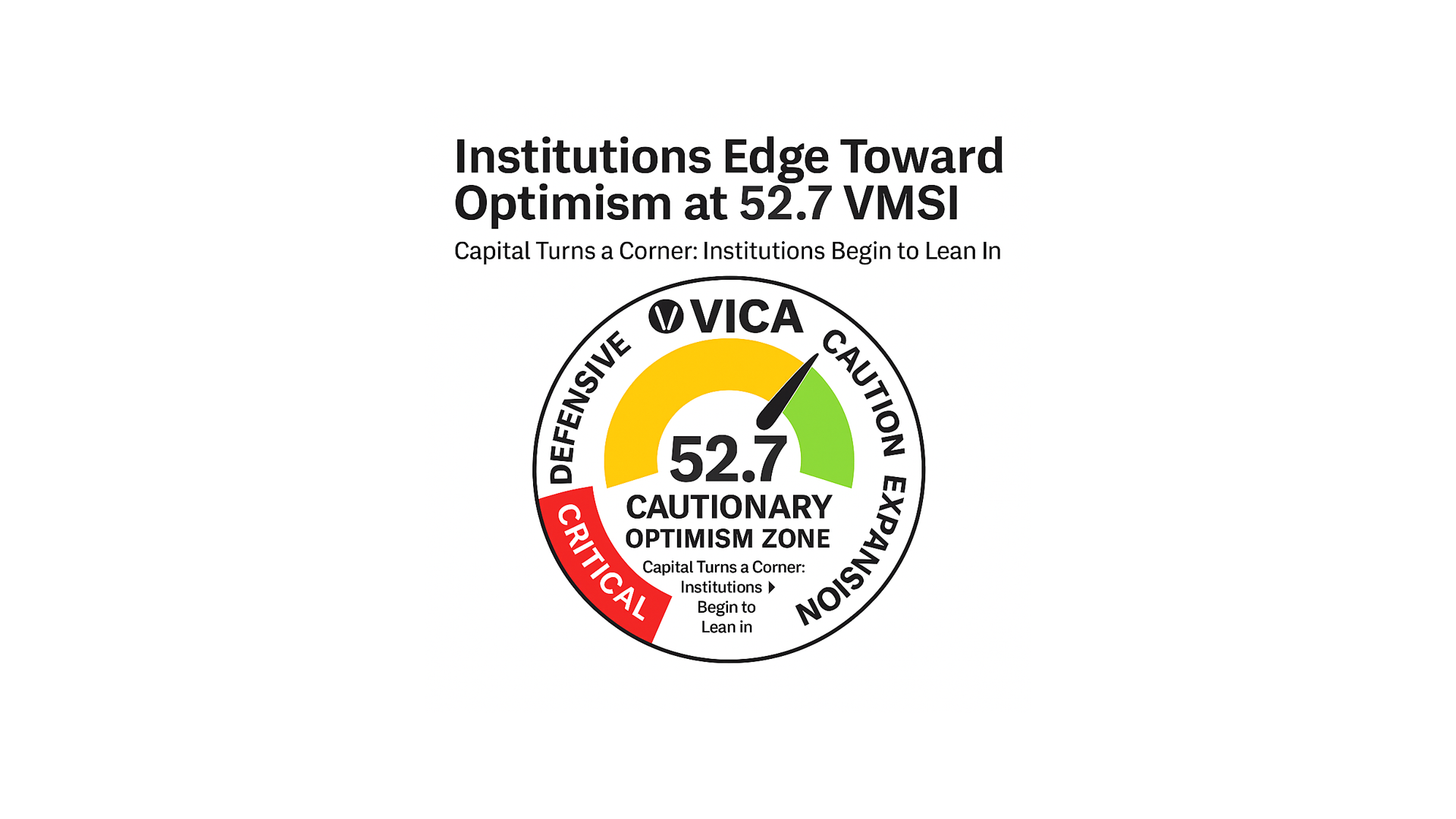

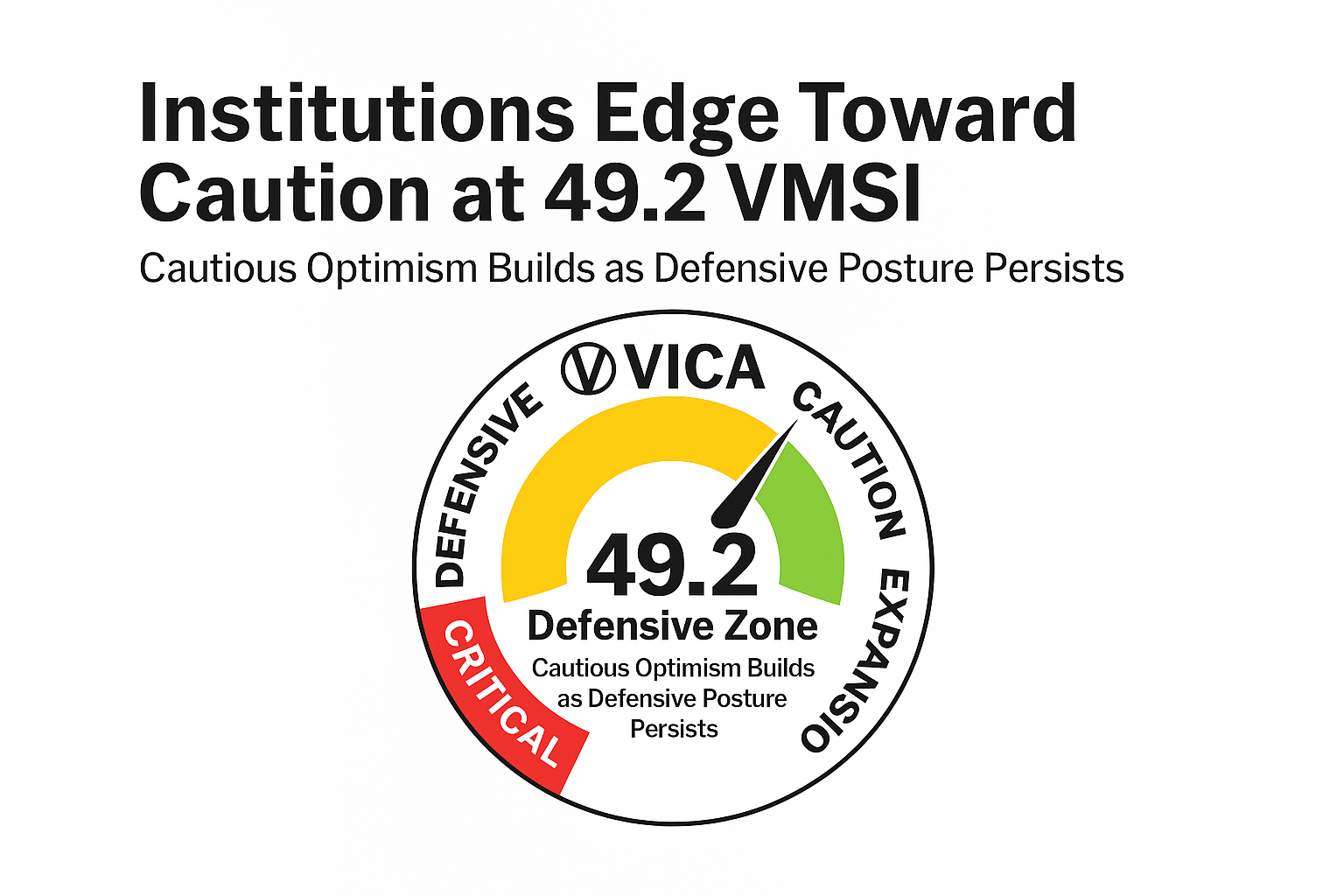

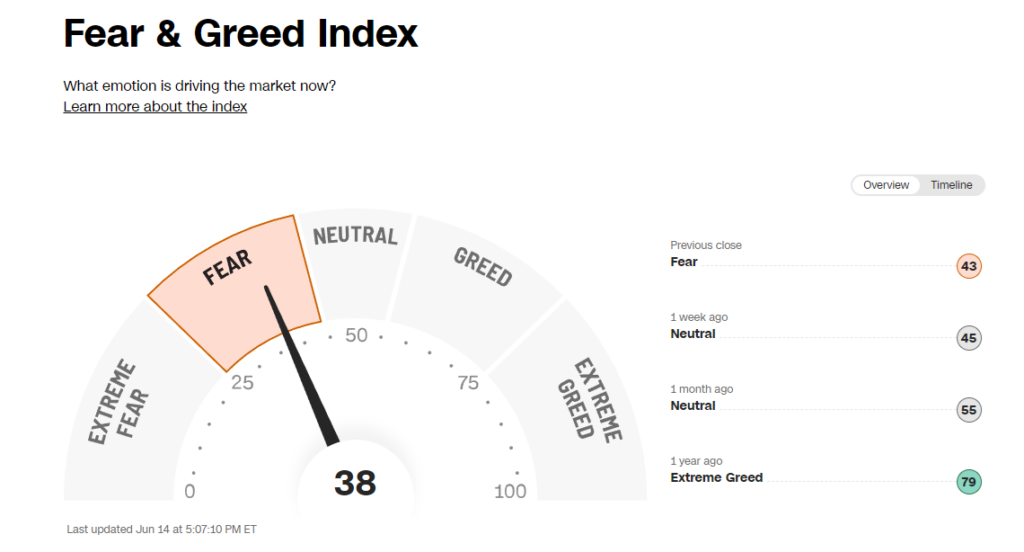

- The CBOE Volatility Index rose 6.03% to 12.66, the U.S. Dollar Index increased 0.31% to 105.52, and the Fear & Greed Index indicates fear at 38, down from extreme greed at 79 last year.

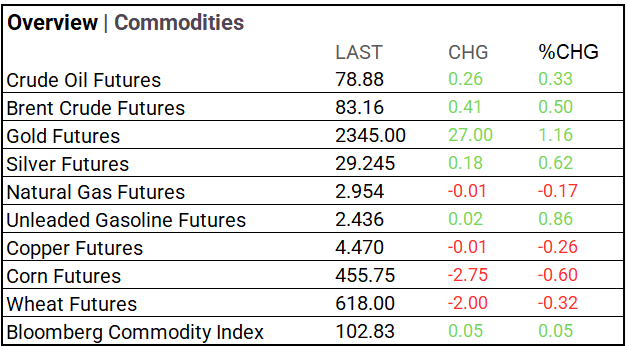

Commodities & ETFs:

- Commodities: Overall, commodities saw mixed movement: Crude oil futures rose 0.33% to $78.88, and Brent crude increased 0.50% to $83.16. Gold futures jumped 1.16% to $2345.00, and silver gained 0.62% to $29.245. Natural gas fell 0.17% to $2.954. The Bloomberg Commodity Index increased modestly by 0.05% to 102.83.

- ETFs: Direxion Daily S&P Biotech Bear 3X Shares rose 6.82% with high volume at 10.2M shares. The 2x Long VIX Futures ETF increased 6.61% on 10.3M shares. Direxion Daily Small Cap Bear 3x Shares gained 4.82%, trading 13.8M shares.

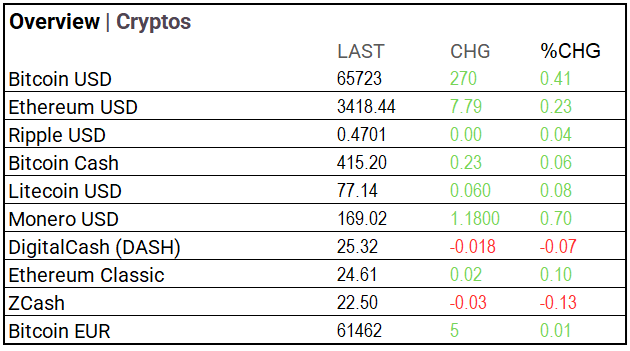

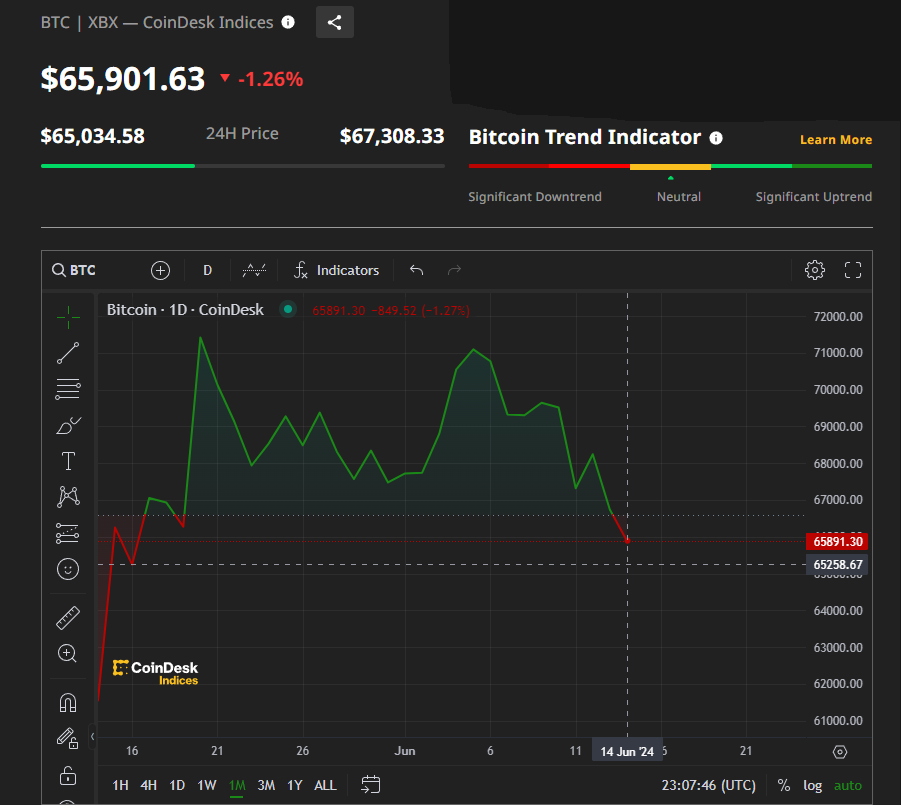

Cryptocurrency Update:

- Bitcoin closed at $65,723, up $270 (0.41%). Ethereum finished at $3,418.44, rising $7.79 (0.23%). Ripple traded at $0.4701, showing no change (0.04%).

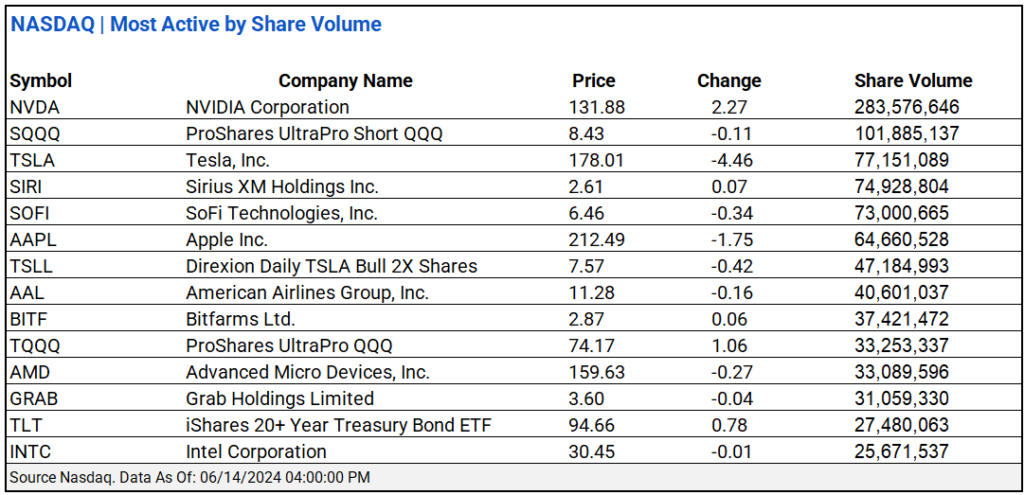

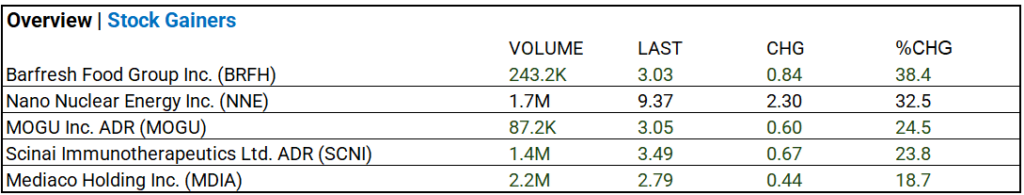

Stocks:

- Nano Nuclear Energy Inc. (NNE) traded 1.7M shares at $9.37, up 2.30 (32.5%). Scinai Immunotherapeutics Ltd. ADR (SCNI) traded 1.4M shares at $3.49, up 0.67 (23.8%). Mediaco Holding Inc. (MDIA) traded 2.2M shares at $2.79, up 0.44 (18.7%).

Notable Earnings:

- None

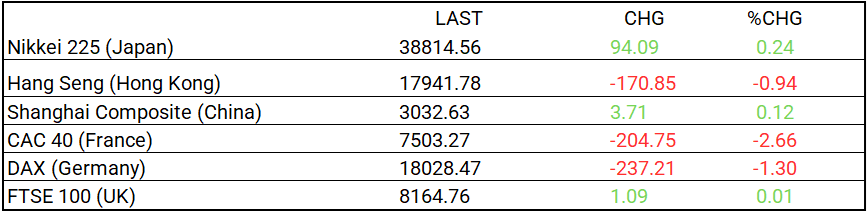

Global Markets Summary:

- CAC 40 (France) led declines, dropping 2.66%, while Hang Seng (Hong Kong) fell 0.94%. Nikkei 225 (Japan) topped gains, rising 0.24%.

In the NEWS:

Central Banking and Monetary Policy:

- Bank of Japan Plans to Reduce Bond Buying, Yen Weakens – Wall Street Journal

- Fed Diverges From Global Peers in New Era of Higher for Longer – Bloomberg

Business:

- Tesla Can’t Be All About Elon Musk – Wall Street Journal

- Cava Is Worth $33 Million Per Restaurant After Blistering Debut – Bloomberg

China:

- China unveils new fair-competition regulations in ongoing push to unify domestic market – South China Morning Post