“Empowering Your Financial Success”

Daily Market Insights: October 23rd, 2023

Global Markets Summary:

Asian Markets:

- Hang Seng (Hong Kong): -0.72%

- Nikkei 225 (Japan): -0.83%

- Shanghai Composite (China): -1.47%

European Markets:

- CAC 40 (France): +0.50%

- DAX (Germany): +0.02%

- FTSE 100 (London): -0.37%

US Futures:

- S&P Futures: opened @ 4210.40 (-0.33%)

US Market Snapshot:

Key Stock Market Indices:

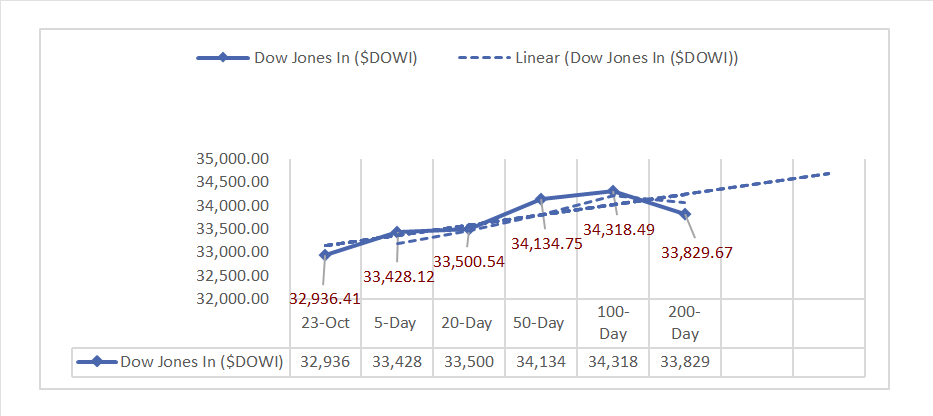

- DJIA ^DJI: 32,936.41 (-190.87, -0.58%)

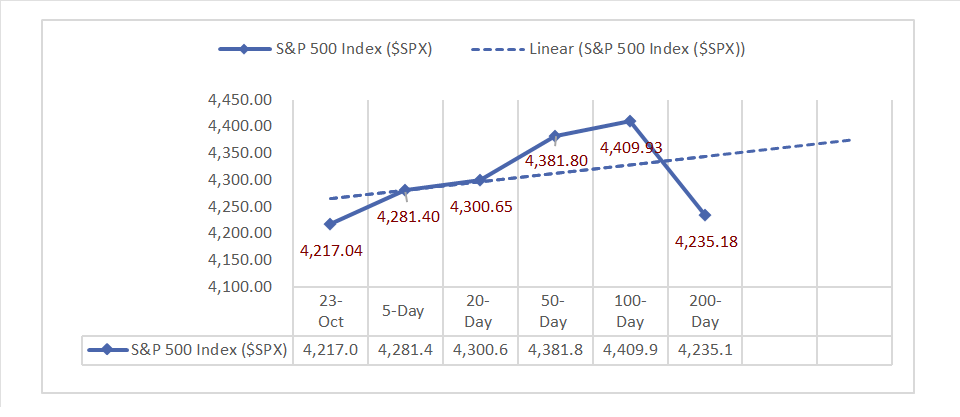

- S&P 500 ^GSPC: 4,217.04 (-1.12, -0.17%)

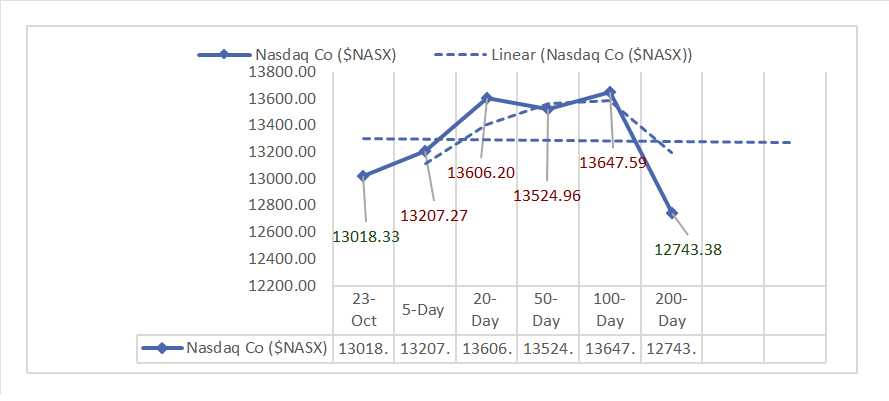

- Nasdaq Composite ^NASX: 13,018.33 (34.52, 0.27%)

- Nasdaq 100 ^NDX: 14,604.85 (43.97, 0.30%)

- NYSE Fang+ ^NYFANG: 7,419.86 (83.96, 1.14%)

- Russell 2000 ^RUT: 1,665.88 (-14.91, -0.89%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: Chicago Fed National Activity Index rose to 0.02 in September, from -0.22 in August, signaling faster economic expansion.

- Market Indices: Major US indices on the day: DJIA -0.58%, S&P 500 -0.17%, Nasdaq Composite +0.27%, Nasdaq 100 +0.30%.

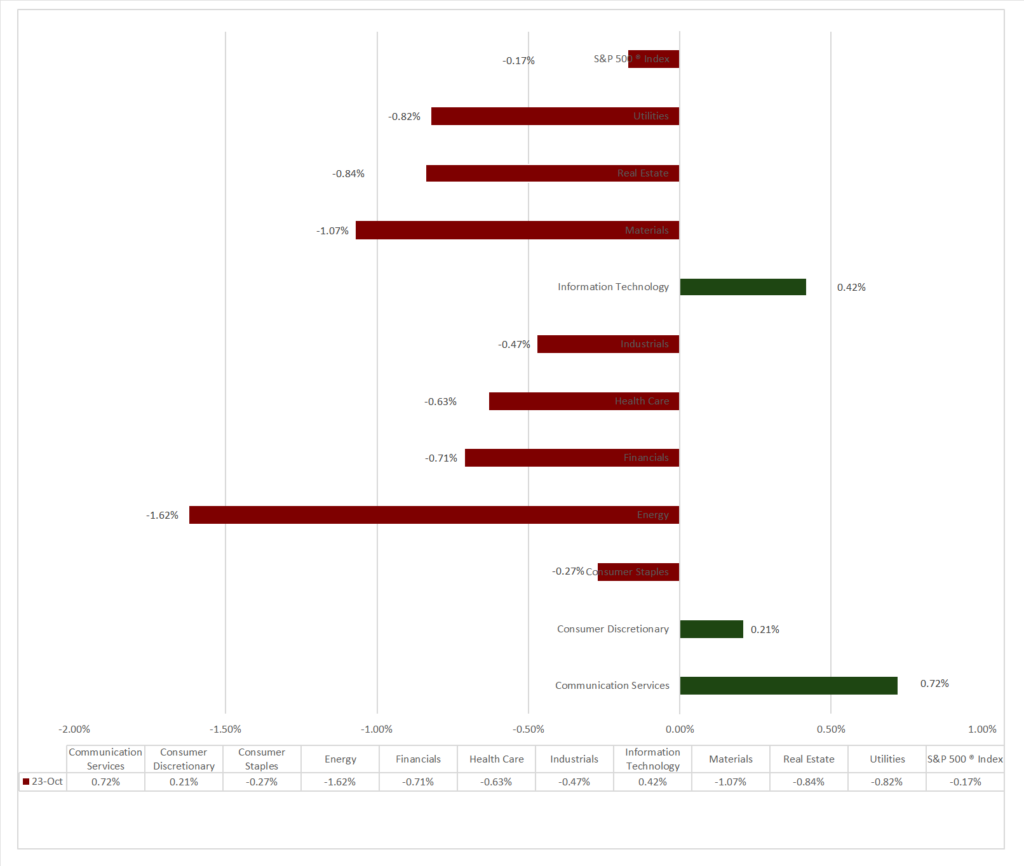

- Sector Performance: 9 of 11 sectors declined, with Communication Services (+0.72%) leading and Energy (-1.62%) lagging. Top industry: Consumer Finance (+1.32%).

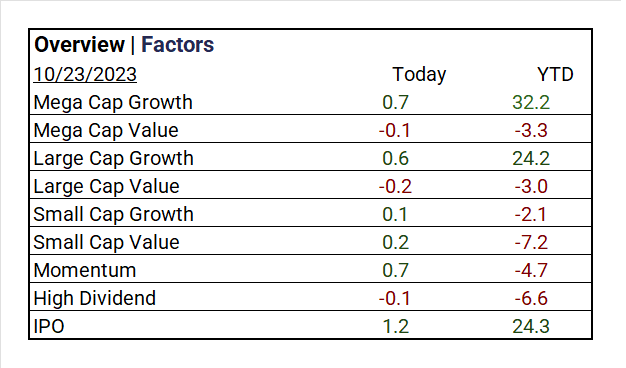

- Factors: Growth outperforms Value.

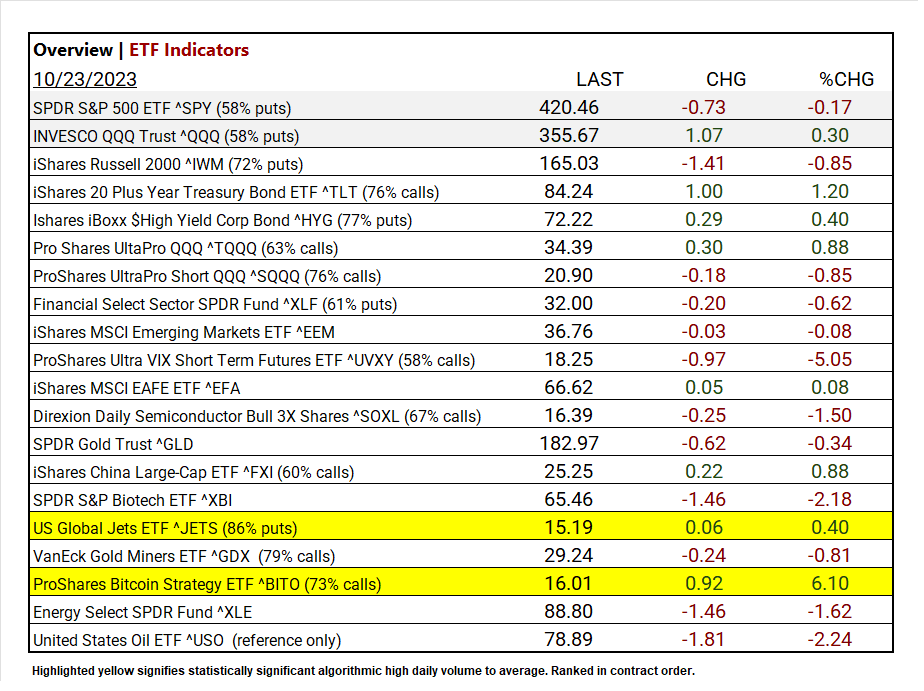

- Top ETF: ProShares Bitcoin Strategy ETF ^BITO +6.10%.

- Low ETF: ProShares Ultra VIX Short Term Futures ETF ^UVXY -5.05%.

- Treasury Markets: Shorter-term Treasury bills with maturities of 12 months or less gained while greater than 2-year Treasury notes declined.

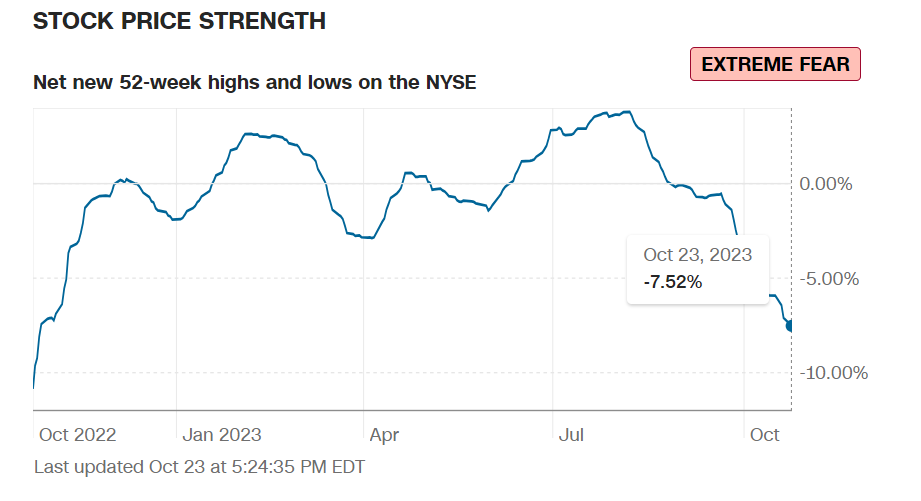

- Currency and Volatility: The U.S. Dollar Index pullsback, CBOE Volatility falls -6.17%, and the Fear & Greed reading: Fear.

- Commodity Markets: Bitcoin and Gold rise, while Oil and the Bloomberg Commodity Index decline.

- Insider Insight: Options market bet heavily on Bitcoin Strategy ETF ^BITO to gain, and US Global Jets ETF ^JETS to fail.

Sectors:

- 9 of 11 sectors declined, with Communication Services (+0.72%) leading and Energy (-1.62%) lagging. Top industries: Consumer Finance (+1.32%), Independent Power and Renewable Electricity Producers (+1.23%), and Semiconductor & Semiconductor Equipment (+1.14%).

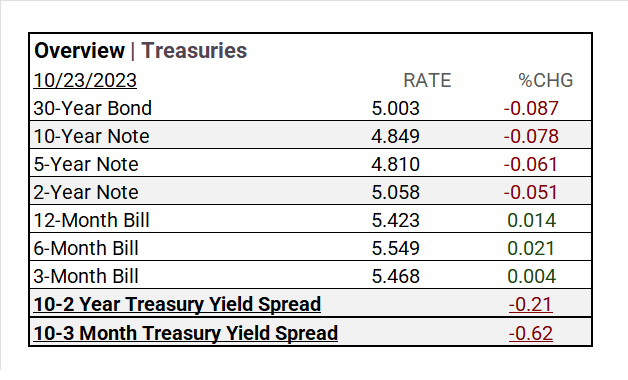

Treasury Yields and Currency:

- Shorter-term Treasury bills with maturities of 12 months or less gained while greater than 2-year Treasury notes declined, with the following yield changes: 30-Year Bond: 5.003 (-0.087), 10-Year Note: 4.849 (-0.078), 5-Year Note: 4.810 (-0.061), and 2-Year Note: 5.058 (-0.051). 10-2 Year Treasury Yield Spread: -0.21-, and 10-3-Month Treasury Yield Spread: -0.62.

- The U.S. Dollar Index ^DXY: 105.61(-0.55, -0.52%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 20.37 (-1.34, -6.17%)

- Fear & Greed Index (TY/LY): 27/43 (Fear/ Fear).

source: CNN Fear and Greed Index

Commodities:

- Gold Futures: 1,972.85 (+1.72, +0.09%)

- Bitcoin USD: 31,652.80 (+1,648.70, +5.49%)

- Crude Oil Futures WTI: 85.49 (-2.59, -2.94%)

- Bloomberg Commodity Index: 104.86 (-0.95, -0.90%)

Factors:

- Growth outperforms Value; IPO’s lead (+1.2%)

ETF Performance:

Top 3 Best Performers:

- ProShares Bitcoin Strategy ETF ^BITO +6.10%

- iShares 20 Plus Year Treasury Bond ETF ^TLT +1.20%

- Pro Shares UltaPro QQQ ^TQQQ +0.88%

Top 3 Lowest Performers:

- ProShares Ultra VIX Short Term Futures ETF ^UVXY -5.05%

- SPDR S&P Biotech ETF ^XBI -2.18%

- Energy Select SPDR Fund ^XLE -1.62%

US Major Economic Data

- The Chicago Fed National Activity Index increased to 0.02 in September, up from a revised -0.22 in August, indicating slightly faster-than-average economic expansion.

- The Federal Reserve Financial Stability Report, emphasizing the continued stability of the banking sector.

Earnings:

- Q1 ’23: 79% of companies beat analyst estimates.

- Q2 Forecast/Actual: Predicted <7.2%> FY 2023 S&P 500 EPS decline; FY 2023 EPS flat YoY. By 7-28, 51% reported Q2 2023, results; 80% beat EPS estimates, above 5-year (77%) and 10-year (73%) averages. Earnings exceeded estimates by 5.9%, slightly below the 5-year (8.4%) and 10-year (6.4%) averages.

- Q3 Forecast: 116 companies in the index have issued EPS guidance for Q3 2023, Of these 116 companies, 74 have issued negative EPS guidance and 42 have issued positive EPS guidance. The percentage of S&P 500 companies issuing negative EPS guidance for Q3 2023 is 64% (74 out of 116), which is above the 5-year average of 59% but equal to the 10-year average of 64%. Eight of the eleven sectors are expected to see year-over-year earnings growth, with Communication Services and Consumer Discretionary leading the way. Conversely, three sectors, mainly Energy and Materials, are expected to experience earnings declines.

Notable Earnings Today:

- BEAT: Cadence Design (CDNS), Nucor (NUE), Brown&Brown (BRO), Cleveland-Cliffs (CLF), Medpace Holdings (MEDP), Simpson Manufacturing (SSD), Calix (CALX), WSFS (WSFS), Bank of Hawaii (BOH), Agilysys (AGYS), Park National (PRK).

- MISSED: Nidec (NJDCY), Sandvik AB ADR (SDVKY), Koninklijke Philips ADR (PHG), Alexandria RE (ARE), WR Berkley (WRB), Packaging America (PKG), TFI Intl (TFII), Crown (CCK), RLI (RLI), Hexcel (HXL), Crane (CR), Inter Parfums (IPAR), Herc Holdings (HRI), Cathay (CATY).

Resources:

News

Investment and Growth News

- Chevron to Buy Hess for $53 Billion – WSJ

- Tim Cook Can’t Make iPhones Without This Chinese Company and Its CEO – WSJ

- Middle East Conflict Is Impacting Regional Travel, Virgin Atlantic CEO Says – Bloomberg

Infrastructure and Energy

- Biofuel Boom to Push US Soy Meal Exports to Record High – Bloomberg

Real Estate

- America’s Downtowns Are Empty. Fixing Them Will Be Expensive – WSJ

Central Banking and Monetary Policy

- The Economy Was Supposed to Slow by Now. Instead It’s Revving Up. – WSJ

- Fresh Growth Numbers Are Set to Show US Remains Economic Powerhouse – Bloomberg

International Market Analysis (China)

- Shanghai’s economy, under pressure from weak property and stock markets at home, banks on external demand drivers in 2024 – SCMP