“Empowering Your Financial Success”

Daily Market Insights: October 4th, 2023

Global Markets Summary:

Asian Markets:

- Shanghai Composite (China): +0.10%

- Hang Seng (Hong Kong): -0.78%

- Nikkei 225 (Japan): -2.28%

US Futures:

- S&P Futures: opened @ 4233.83 (+0.10%)

European Markets:

- Germany’s DAX: +0.10%

- France’s CAC 40: 0.0%

- London’s FTSE 100: -0.81%

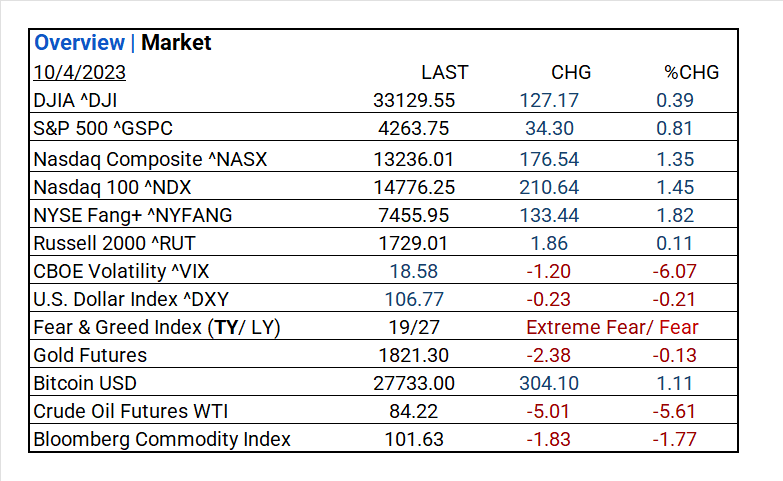

US Market Snapshot:

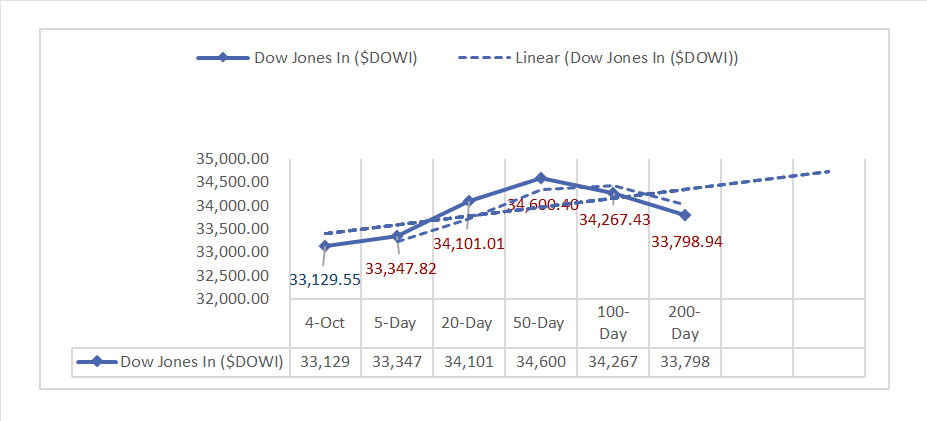

Key Stock Market Indices:

- DJIA ^DJI: 33,129.55 (+127.17, +0.39%)

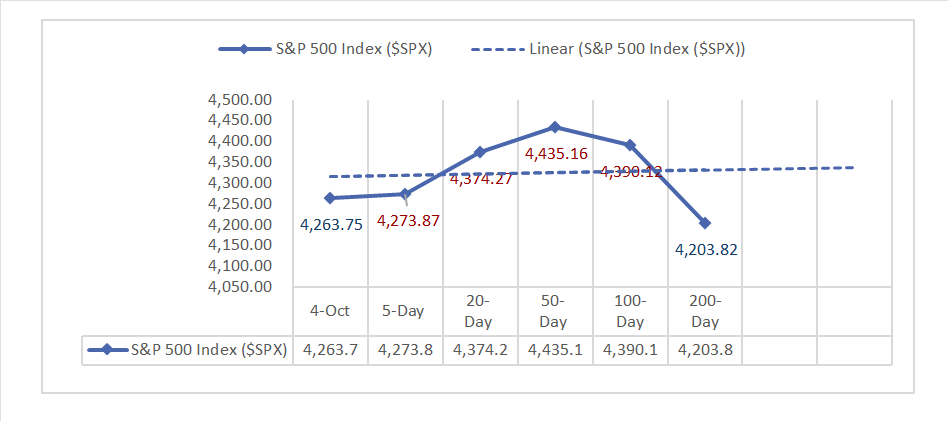

- S&P 500 ^GSPC: 4,263.75 (+34.30, +0.81%)

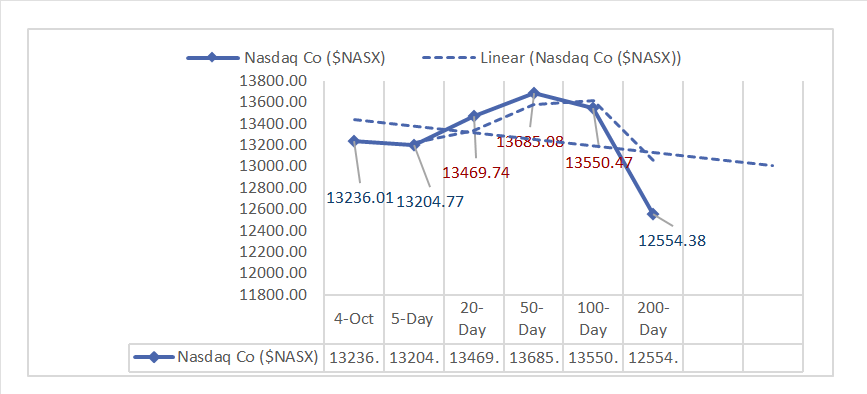

- Nasdaq Composite ^NASX: 13,236.01 (+176.54, +1.35%)

- Nasdaq 100 ^NDX: 14,776.25 (+210.64, +1.45%)

- NYSE Fang+ ^NYFANG: 7,455.95 (+133.44, +1.82%)

- Russell 2000 ^RUT: 1,729.01 (+1.86, +0.11%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: In August, factory orders rose by 1.2%, beating expectations. In September, ADP reported 177,000 job additions, slightly below the consensus, S&P services PMI decreased to 50.1, and ISM services remained at 53.6%.

- Market Indices: Major U.S. indices performed well: Nasdaq Composite and Nasdaq 100 gained 1.35% and 1.45%, S&P 500 rose by 0.81%, DJIA saw a 0.39% gain, NYSE Fang+ surged by 1.82%, while Russell 2000 had a minor uptick of 0.11%.

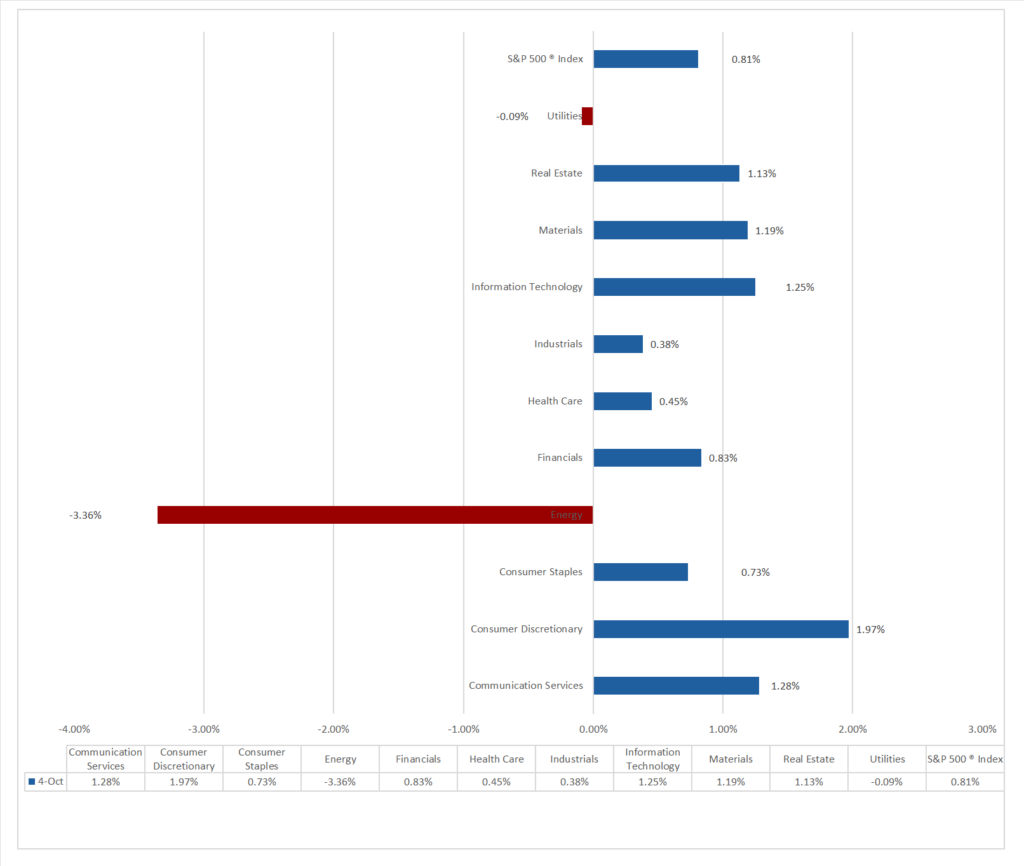

- Sector Performance: 9 of 11 sectors advanced, Consumer Discretionary outperformed (+1.97%), while Energy (-3.36%) lagged. Top Industries: Automobiles (+5.14%) and Construction Materials (+3.05%).

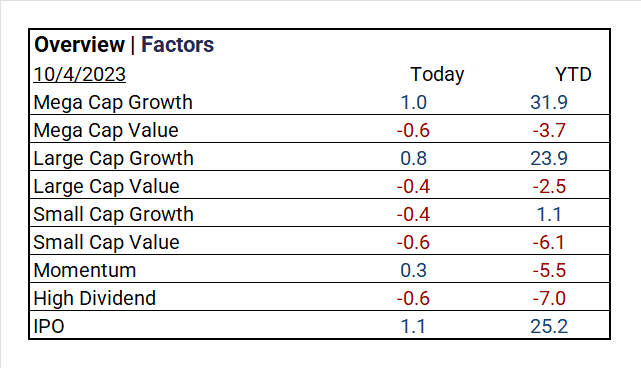

- Factors: Growth trumps Value. IPO’s and Mega Cap Growth outperform.

- Top ETF: Direxion Daily Semiconductor Bull 3X Shares ^SOXL +4.19%.

- Worst ETF: ProShares Ultra VIX Short Term Futures ETF ^UVXY -7.61%.

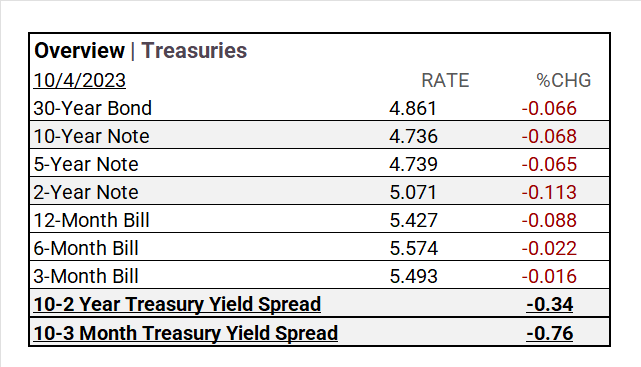

- Treasury Markets: Yields fell across various Treasury terms, with the 30-Year Bond at 4.861% and shorter maturities decreasing. Yields signaled a flattening yield curve.

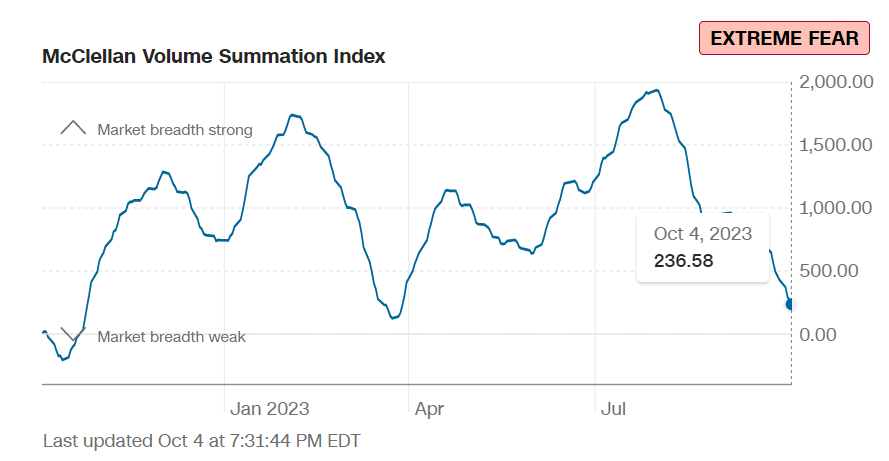

- Currency and Volatility: The U.S. Dollar Index declined, CBOE Volatility fell 6.07%, and the Fear & Greed continues indicating extreme fear.

- Commodity Markets: Gold, Crude Oil Futures WTI and the Bloomberg Commodity Index fell while Bitcoin gained.

Sectors:

- 9 of 11 sectors advanced, Consumer Discretionary outperformed (+1.97%), while Energy (-3.36%) lagged. Top Industry: Automobiles (+5.14%), Construction Materials (+3.05%), Hotel & Resort REITs (+2.65%) and Health Care REITs (+2.26%).

Treasury Yields and Currency:

- In Treasury markets, yields fell across different terms. The 30-Year Bond dropped to 4.861%, the 10-Year and 5-Year Notes to 4.736% and 4.739%, and shorter-term yields also decreased. The 2-Year Note was at 5.071%, 12-Month Bill at 5.427%, 6-Month Bill at 5.574%, and 3-Month Bill at 5.493%. Yield spreads between 10-Year and 2-Year Treasuries contracted by -0.34, while the 10-Year and 3-Month Treasury spread contracted by -0.76, signaling a flattening yield curve.

- The U.S. Dollar Index ^DXY: 106.77 (-0.23, -0.21%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 18.58 (-1.20, -6.07%)

- Fear & Greed Index (TY/LY): 19/27 (Extreme Fear/Fear).

source: CNN Fear and Greed Index

Commodities:

- Gold Futures: 1821.30 (-2.38, -0.13%)

- Bitcoin USD: 27733.00 (+304.10, +1.11%)

- Crude Oil Futures WTI: 84.22 (-5.01, -5.61%)

- Bloomberg Commodity Index: 101.63 (-1.83, -1.77%)

Factors:

- Growth tops Value, IPO’s (+1.1%), Mega Cap Growth (+1.0) outperformed.

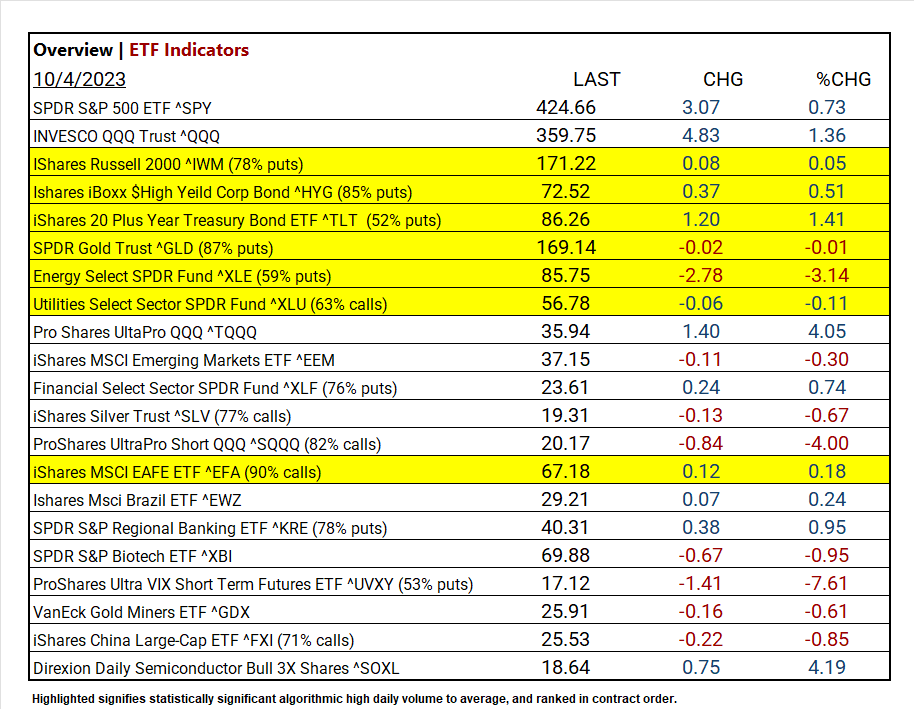

ETF Performance:

Top 3 Best Performers:

- Direxion Daily Semiconductor Bull 3X Shares ^SOXL +4.19%

- Pro Shares UltaPro QQQ ^TQQQ +4.05%

- iShares 20 Plus Year Treasury Bond ETF ^TLT +1.41%

Top 3 Worst Performers:

- ProShares Ultra VIX Short Term Futures ETF ^UVXY -7.61%

- ProShares UltraPro Short QQQ ^SQQQ -4.00%

- Energy Select SPDR Fund ^XLE -3.14%

US Economic Data

August

- Factory orders: 1.2% (Consensus 0.3%, Previous -2.1%)

September

- ADP employment: 177,000 (Consensus 150,000, Previous 180,000)

- S&P final U.S. services PMI: 50.1 (Consensus N/A, Previous 50.2)

- ISM services: 53.6% (Consensus 53.6%, Previous 54.5%)

Earnings:

- Q1 ’23: 79% of companies beat analyst estimates.

- Q2 Forecast/Actual: Predicted <7.2%> FY 2023 S&P 500 EPS decline; FY 2023 EPS flat YoY. By 7-28, 51% reported Q2 2023, results; 80% beat EPS estimates, above 5-year (77%) and 10-year (73%) averages. Earnings exceeded estimates by 5.9%, slightly below the 5-year (8.4%) and 10-year (6.4%) averages.

- Q3 Forecast: 116 companies in the index have issued EPS guidance for Q3 2023, Of these 116 companies, 74 have issued negative EPS guidance and 42 have issued positive EPS guidance. The percentage of S&P 500 companies issuing negative EPS guidance for Q3 2023 is 64% (74 out of 116), which is above the 5-year average of 59% but equal to the 10-year average of 64%. Eight of the eleven sectors are expected to see year-over-year earnings growth, with Communication Services and Consumer Discretionary leading the way. Conversely, three sectors, mainly Energy and Materials, are anticipated to experience earnings declines.

Notable Earnings Today:

- Beat: RPM (RPM), Helen of Troy Ltd (HELE)

- Miss: Acuity Brands (AYI), Tilray (TLRY)

Resources:

- What’s Expected in October (10-6 update TBD)

- Vica Partners Economics Forecast

News

Investment and Growth News

- Ford’s Hybrids Take Off, Pushing Third-Quarter Sales Up 7.7% – WSJ

- How China’s BYD Became Tesla’s Biggest Threat – WSJ

- AT&T Exploring Options for DirecTV as Pay-TV Subscriptions Continue Decline – Bloomberg

Infrastructure and Energy

- Dominion Energy Sets Ambitions on Second Massive US Offshore Wind Farm – Bloomberg

Real Estate Market Updates

- Gucci, Chanel and Other Luxury Retailers Splurge on American Real Estate – WSJ

Central Banking and Monetary Policy

- US Services Activity Moderates as Orders Growth Slides – Bloomberg

- Bond Selloff Threatens Hopes for Economy’s Soft Landing – WSJ

International Market Analysis (China)

- IMF likely overestimating China’s economic growth prospects, US analyst says – SCMP